Burial Insurance For People With Sleep Apnea | We Discuss How To Apply, Plan Options, And Cost

Updated: April 12, 2024 at 9:39 am

Do you have sleep apnea and need burial insurance?

Yes, John. I applied with my agent, but her company declined me because I use a CPAP machine.

Unfortunately, that is a true outcome with many carriers.

However, we can get you burial insurance no problem and have helped many people with sleep apnea obtain burial insurance.

Additionally, nearly all of the time, we can get you burial insurance with immediate, first-day coverage.

Here’s what we will discuss:

- Introduction To Burial Insurance

- Burial Insurance Underwriting

- Types Of Burial Insurance Available

- Premium Cost Of Burial Insurance

- How To Apply

- Now You Know You Can Obtain Burial Insurance

Let’s start off with an introduction to burial insurance. It’s important you understand what this is. We will then discuss how carriers underwrite your sleep apnea.

Introduction To Burial Insurance

Here’s a secret.

Burial insurance is actually life insurance.

I know people and the industry like to call it “burial insurance”.

However, burial insurance is a whole life insurance policy with a small or low death benefit like $25,000.

It is designed to help pay for funeral expenses and burial needs.

Consequently, you may hear burial insurance called other names like:

- Final expense insurance

- Funeral insurance

- End-of-life insurance

- Cremation insurance

And on and on…

They all mean the same thing. The industry calls it burial insurance because that’s what it is intended to do.

Geez, John. Why don’t I just work with a funeral home directly, then?

Good question. You completely can.

However, burial insurance (i.e. the whole life policy with a small death benefit) completes your funeral and burial needs in about 30 minutes (more on that later).

You see, you can go to a funeral home and set up a plan. You pay into their plan. But, what if you die and you still have an outstanding balance?

Then, yes, your loved ones will have to pay the rest.

Additionally, most people don’t wake up and say “Honey, it’s such a nice day out. Let’s go to the funeral home to set up our funerals.”

And then spend a few hours at the funeral home.

Alternatively, burial insurance essentially establishes this funding.

You can then set up your funeral on your own time.

Moreover, burial insurance is easy to qualify for. Let’s talk about the qualifications next in our underwriting section.

Burial Insurance Underwriting For Sleep Apnea

Before we get into burial insurance for people with sleep apnea, let’s talk about underwriting.

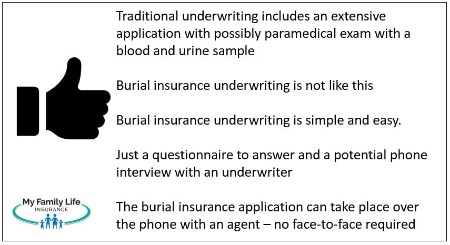

Underwriting for burial insurance is much different than that for traditional life insurance.

The underwriting departments for traditional life insurance are going to want to know the severity of your sleep apnea. They will want to know if you have had a sleep study and regularly use your CPAP machine. If you don’t, carriers will want to know why. They may even require you to complete a sleep study. Additionally, they may require a paramedical exam with a blood and urine sample.

Additionally, they will want to know if you have any other underlying health issues, including hypertension, obesity, and depression. (If you have sleep apnea and need term life insurance, whole life, or an IUL, contact us, and we will discuss the steps and process with you.)

With burial insurance, underwriting is different. The carrier doesn’t care about all of the fine details. They don’t want you to go through a sleep study or any of the other stuff.

The health questions are all “yes or no”. They just want to know if you have sleep apnea or not. The question could be as simple as, “in the past 2 years have you been diagnosed or treated for sleep apnea?” Or, the question could vary, such as, “do you currently require oxygen?”

Here is the interesting point. Some carriers don’t even ask the question about sleep apnea. That is right. They don’t care. So, if you have sleep apnea, and you have no other significant underlying health conditions, who do you think we will use? That is right – the carrier that doesn’t ask the question about sleep apnea.

Just Yes Or No Questions On The Application

As we mentioned, burial insurance underwriting is a simple “yes/no” application. Some carriers then follow the application with a phone interview. We prefer the ones that don’t when possible. Carriers will also look up your medical claim history through the MIB and your prescription drug history.

As we mentioned, burial insurance underwriting is a simple “yes/no” application. Some carriers then follow the application with a phone interview. We prefer the ones that don’t when possible. Carriers will also look up your medical claim history through the MIB and your prescription drug history.

If all checks out, the carrier approves your application, and you have burial insurance!

If it sounds easy, it is.

Again, if the carrier doesn’t ask the question regarding sleep apnea, likely they ignore it (along with the prescription drug history). To give you an idea, here are 4 questions on real burial insurance applications that ask about sleep apnea:

(1) do you currently require oxygen use?

(2) are you currently using oxygen equipment to assist with breathing?

(3) has the proposed insured been treated with oxygen during the last 12 months?

(4) is the proposed insured currently requiring oxygen equipment to assist with breathing (excluding use for sleep apnea)?

If you have sleep apnea, the first 3 questions are “yes”. The carrier declines your application.

However, on question 4, truthfully your answer is “no”.

So, who then would we use for your burial insurance? That is right; the carrier who doesn’t ask the question about your sleep apnea (or, in this case, excludes it)!

That sounds, great, John, you say. But, I am sure the carrier in question 4 will charge me a lot because I have sleep apnea, right?

Well, probably not. For a male, age 65, looking for $15,000 of burial insurance, the carrier in question #4 charges $82 per month for level benefits. That is one of the lowest premiums available. So, to answer your question, likely not, assuming you don’t have other significant health conditions. More on that next.

More On Burial Insurance Underwriting For People With Sleep Apnea

As mentioned, carriers will run your background through a few different databases to make sure what you say on the application matches to your records. One database is the MIB. The MIB looks at your insurance application history and medical claim history. It can see when you applied for insurance in the last few years. If you applied to several life insurance carriers, the carrier will want to know why. It will also raise any red flags if what you said on your application does not match to any previously released information, through your application history.

databases to make sure what you say on the application matches to your records. One database is the MIB. The MIB looks at your insurance application history and medical claim history. It can see when you applied for insurance in the last few years. If you applied to several life insurance carriers, the carrier will want to know why. It will also raise any red flags if what you said on your application does not match to any previously released information, through your application history.

They will also look at your prescription drug history. Carriers can see all of that. (Even the ones I take.) If an answer to an application question does not match a prescription drug you take, that will be a red flag. For example, if you take an inhaler for emphysema, but say no to the question, “in the last 2 years, have you been diagnosed or treated for emphysema?”, the carrier questions your truthfulness.

Additionally, there are potentially underlying causes of sleep apnea. Common causes include:

- Obesity/Overweight

- Heart problems

- Diabetes

If you have another health condition in addition to sleep apnea, then you could have fewer burial insurance options. For example, if you have bipolar disorder, then we have to find a carrier that accepts both your sleep apnea AND your bipolar disorder. So, you can see the options minimize.

Now is a good time to discuss the types of burial insurance options available to people with sleep apnea.

(Note: if you are overweight or obese, and your only other health condition is sleep apnea, we can get you burial insurance easily. More on that next.)

Types of Burial Insurance For People With Sleep Apnea

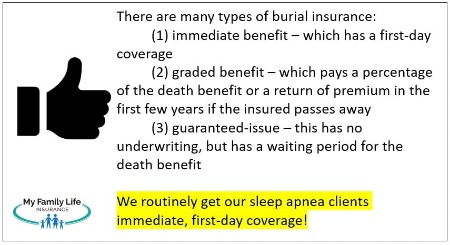

There are a few types of burial insurance for people with sleep apnea. We will help you make sense of them.

Immediate / Level Benefit

The first one is called level or immediate benefit. This means the death benefit has “day 1” coverage. Level /immediate benefit coverage is what we want. It is also, generally, the least expensive burial insurance option. Let’s say Jim applies for $20,000 burial insurance. The carrier approves him with level benefit coverage. Six months later, Jim, unfortunately, dies suddenly. Jim’s beneficiary will receive the $20,000 to help pay for Jim’s funeral costs.

The great news here is that we have helped many people with sleep apnea obtain level/immediate burial insurance! Even in cases where they had secondary health conditions like obesity, diabetes, heart conditions, etc.

Graded Benefit Burial Insurance

The second one is called graded benefit. Think of this as a “staircase” for the death benefit coverage. For example, the carrier might pay 25% of the death benefit if you pass away in year 1 of the policy’s start date and 60% of the death benefit in year 2.

In year 3 and beyond, the carrier pays the death benefit at 100%

In year 3 and beyond, the carrier pays the death benefit at 100%

An example will make this clear. Let’s use the same example, except the carrier approves Jim for graded benefit coverage. His burial insurance is $25,000. The graded death benefit is 2 years. Should Jim die of natural or sickness within the 2-year year timeframe, the carrier will pay his beneficiary 10% of the death benefit in year 1 and 70% in year 2. If Jim dies in year 3 and after, the carrier pays the full death benefit (100%) to his beneficiary.

Unfortunately, Jim unexpectedly dies of sickness 6 months later. His beneficiary receives 10% of the death benefit or $2,500.

People with many health complications usually end up with graded benefit coverage. It is, by no means, bad. However, we aim to find level benefit coverage when possible. Level benefit coverage usually means the lowest cost for you.

Other Types Of Burial Insurance For People With Sleep Apnea

There are a couple more types of burial insurance available for people with sleep apnea.

If you can’t obtain level benefit or graded benefit, there is guaranteed-issue whole life insurance available. This means just as it sounds: you automatically receive coverage. Just fill out an application and answer a few non-health questions. The carrier does not run your background through the MIB or prescription drug history.

It’s easy.

We work with many guaranteed-issue life insurance carriers, even some available for people less than age 40. We also work with some very inexpensive guaranteed-issue life insurance carriers.

In addition, we are one of the few who can offer guaranteed issue term life insurance. That is right. Unlike that of guaranteed issue whole insurance, guaranteed issue term’s premiums increase every 5 years as you enter new age bands.

You can apply on your own here. You just need to enter your zip code to see if the plan is available in your state and then have a credit or debit card ready.

Applying is easy.

Guaranteed-issue coverage contains a “waiting period”, usually 2 years. We work with several guaranteed-issue carriers, so we have plenty of options.

Sometimes, the cost of the guaranteed-issue insurance coverage is less than that of a traditional graded benefit policy. If that’s the case, it makes sense to apply for the guaranteed-issue coverage and not waste your time with a traditional graded benefit policy.

Premium Cost Of Burial Insurance For People With Sleep Apnea

Now that you know the types of burial insurance available to you, which type do you think we will choose?

That’s right. The one with the lowest cost and that best fits your situation.

As mentioned, people with sleep apnea can obtain level death benefit coverage. As we said earlier, sleep apnea by itself is not an uninsurable condition. However, there may be other health conditions that affect your approval. If you are overweight, have diabetes or cancer, or have some other significant health condition in addition to sleep apnea, the chances of a level death benefit coverage are lower.

That is where we come in. We have helped people with sleep apnea AND some other health conditions obtain proper coverage, usually at level death benefit coverage.

There is no reason that you have to pay an arm and a leg for burial insurance if you have sleep apnea. Even if you have additional health complications, we can likely find a policy that will meet your needs and budget.

Check out rates on your own using the quoter below. Note that there are some carriers here that won’t insure people with sleep apnea, but at least you will get a sense of the cost.

In the health class window, be honest about your health. If you are in good health, select “excellent”. That will bring up available level burial insurance carriers. “Decent” health brings up the graded benefit options. “Poor” health brings up guaranteed issue plans.

It’s important to note we work with many carriers outside the quoter, too. We can definitely help you obtain the burial insurance you need.

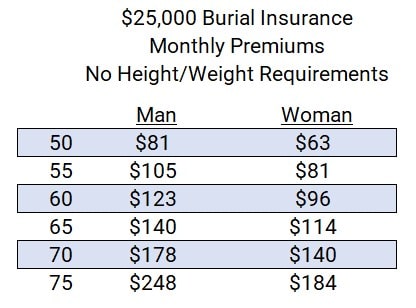

Example Of Burial Insurance Cost For Someone Overweight And Has Sleep Apnea

Obesity is a common, underlying cause of sleep apnea. Here is one carrier, and the corresponding rates, that we use for those people who are overweight and have sleep apnea. The carrier doesn’t utilize a height and weight chart.

Additionally, if you qualify, it takes only 30 minutes to get you through the application process. It’s quick.

Premiums are subject to change.

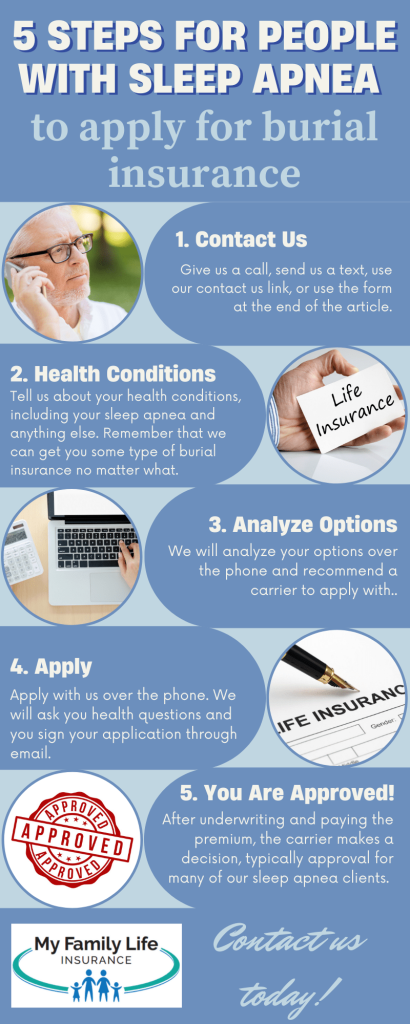

How To Apply?

Applying for burial insurance is easy. Here are the steps:

- Give us a call, use the form the below, or the contact us link

- Tell us you’d like to apply for burial insurance, and that you have sleep apnea

- Tell us other health conditions you have, if any, including tobacco use and weight

- We will analyze your options over the phone

- We select a carrier. You apply over the phone with us

Depending on your situation, you could have burial insurance in 30 minutes

It is very easy.

One question we get is if you have an implant instead of using oxygen/CPAP machine. How does that change your options?

Again, you just want to answer the questions as they read on the application. An implant isn’t oxygen. If you truly don’t use oxygen for your sleep apnea, then you’ll potentially have more burial insurance options.

Now You Know How People With Sleep Apnea Obtain Burial Insurance

We hope you found this article informative. You can obtain burial insurance if you have sleep apnea.

Are you ready to find out what you are eligible for? Feel free to contact us or use the form below.

We work with many carriers in the burial insurance area and know we can find the right coverage for you. Nearly all the time, we help our sleep apnea clients obtain immediate burial insurance coverage!

As with everything we do, we always work in your best interests. That means if there is a better option for you than what we can provide, we will help put you in touch with someone who can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".