The Right Way To Buy Burial Insurance For Parents Approved Today! | It’s An Easy Process If You Follow The Right Steps

Updated: April 12, 2024 at 9:39 am

It’s a fact that one day, we all pass away. This fact includes our parents, and burial insurance helps pay for their funeral and final expenses.

It’s a fact that one day, we all pass away. This fact includes our parents, and burial insurance helps pay for their funeral and final expenses.

It also gives you, as the child, peace of mind knowing that this situation is covered.

Did you know that you can buy burial insurance for your parents? You can. We have helped many children do so for their parents.

However, like anything, there is a right way of going about something and a wrong way.

We speak to many children (and parents, too) who went about this the wrong way.

The good news is that there is a right way, and time to fix it if you may have messed things up along the way.

Here’s what we will discuss:

- A Brief Overview Of Burial Insurance

- Why You Should Purchase Burial Insurance?

- The Wrong Way To Go About Buying Burial Insurance

- The Right Way To Buy Burial Insurance

- Other Options Instead Of Burial Insurance

- What If Your Parents Have A Disability Or Are On Medicaid?

- Frequently Asked Questions About Buying Burial Insurance

- Final Thoughts About Buying Burial Insurance

Let’s jump right in and discuss what is burial insurance.

What Is Burial Insurance?

Burial insurance is simply a whole life insurance policy with a small death benefit, like $25,000.

That’s it. I know the life insurance industry likes to make it more complicated, but it is not.

Burial insurance is nothing fancy. It is a whole life insurance policy with a small death benefit.

Here’s the kicker. The insurance calls burial insurance different things. If you hear:

- funeral insurance

- burial expense insurance

- final expense insurance

- end-of-life insurance

It all means the same thing. These are just small, whole life insurance policies designed to pay for your burial and funeral expenses, and then any other extraneous costs. Or, to leave some money to loved ones.

Upon the passing of your parents, you receive the death benefit (more on that in a minute). You can use this payout to organize your parent’s funeral and burial. Some carriers allow you to assign the death benefit to the funeral home. I generally don’t recommend that as I prefer my clients to be more in control of the death benefit.

In any case, the main benefit of burial insurance is control. You can certainly walk into a funeral home and start paying a monthly payment plan to a funeral home. I generally don’t recommend that, though. These types of plans typically “lock” you in with the funeral home. A burial insurance policy allows flexibility. A second advantage is that the death benefit is income-tax free. More on that later.

Underwriting Of Burial Insurance

Underwriting Of Burial Insurance

Anyone applying for burial insurance must go through an underwriting process. The process is simply:

- Answering a carrier’s health questionnaire,

- MIB and prescription drug look-up, and

- Possibly a phone interview with an underwriter

There are no medical or health exams. Nowadays, agents don’t need to come into your home, either. We take care of this right over the phone.

Once you submit the application, the carrier makes the decision rather instantaneously. Sometimes, decisions take a day or 2. Regardless, you will have a decision on your application within a few days.

Types Of Burial Insurance

The types of burial insurance available can be the most confusing part of the whole process. I think this is where many people get messed up.

The types available really depend on your parent’s health situation. Moreover, as we said before, “burial insurance” is just life insurance. So, existing whole life insurance policies can be used as “burial insurance”. (See my “Other Options…” section below for more information.)

Here are the types available:

Immediate or level benefit: means the carrier pays the death benefit day 1. For example, if your mom has burial insurance today and passes away unexpectedly 2 months later, the carrier pays the death benefit. This is the kind you want if parents qualify for it.

Graded benefit: this means if your parents pass away in the first couple years of the policy’s start date, then you receive some percentage of the death benefit. For example, if your mom passes away unexpectedly 2 months later from the start date, you may receive 10% of the death benefit.

Guaranteed issue: this means the application has no underwriting. You just fill out the application, and then your parents have life insurance. How great is that?

Well, because there’s no underwriting, the carrier places a 2-year waiting period on the death benefit for illness/natural causes. After 2 years, the carrier pays the death benefit in full. The carrier covers accidental death 100% anytime.

We use guaranteed issue life insurance for those people who have moderate to severe health conditions and do not qualify for an immediate benefit policy.

You may have heard that guaranteed issue whole life insurance is expensive. However, we work with affordable plans that fit your budget.

Why You Should Purchase Burial Insurance For Your Parents?

Here’s the main reason you should buy burial insurance for your parents.

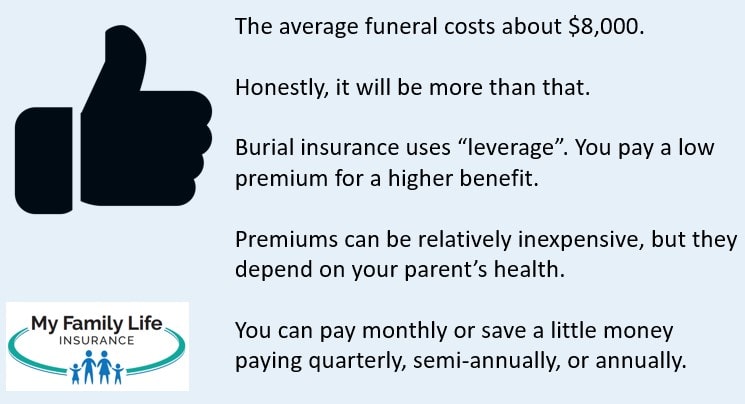

Funerals are expensive. The latest statistics show the average funeral costs about $8,000. Of course, this cost can be higher or lower depending on your situation.

Moreover, many families have other extraneous costs upon the death of a loved one such as hospital bills.

The fact is if your parents haven’t planned for this, then the funding likely comes from you.

Do you have $15,000 to $25,000 earmarked for one parent?

No? Well, not many do. So, burial insurance uses leverage (what I call it). You can pay a low premium for a larger payout. If you’d like to search rate for your parents, feel free to enter their information in our quoter. Please note our disclaimer that we will contact you to say hello either by phone, email, and/or text.

Here are some example monthly premiums for $10,000 of burial insurance:

Man, age 50: $31

Woman, age 50: $25

Man, age 60: $44

Woman, age 60: $33

Man, age 70: $70

Woman, age 70: $53

So, these rates aren’t bad, right?

Knowing these rates ties nicely into our next section.

The Wrong Way To Buy Burial Insurance On Your Parents

As we said earlier, there’s a wrong way to go about buying burial insurance for your parents.

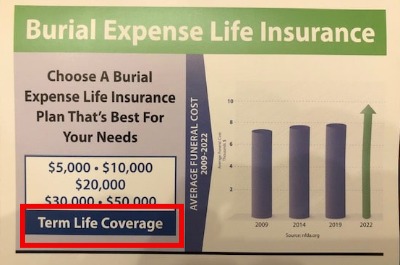

Here’s a wrong way. Look at what I received in the mail:

There are a couple of things wrong with this:

There are a couple of things wrong with this:

- It’s a mailing

- It’s misleading

Too many people receive these applications in the mail (or TV commercials) and say, “why not?”. They fill it out and then they may get approved or not.

If they’ve been approved, how do you know it was the right one for you? You don’t.

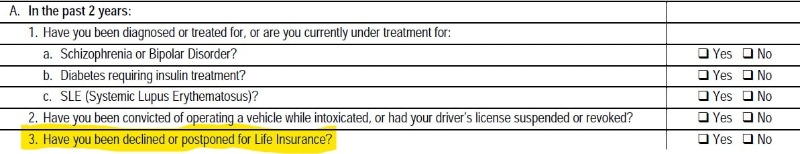

Moreover, if you’ve been declined, that goes on your MIB and potentially limits you from getting a policy that you qualify for. See this excerpt from a popular carrier we use:

Additionally, did you see what the carrier calls this?

Additionally, did you see what the carrier calls this?

Term insurance isn’t burial insurance.

You don’t want to blindly apply for burial insurance on your parents. This includes the “$9.95” plan you see on TV.

You may spend way more than you have to. Moreover, you may end up putting your parents in the wrong plan.

Then, when you make a claim, you may not receive what you expected.

So, let’s discuss the right way to buy burial insurance for your parents.

Here’s The Right Way To Buy Burial Insurance On Your Parents

There’s a right way to buy burial insurance for your parents.

First, before you can even apply, you need 2 things you need before you can even apply for burial insurance.

- Insurable interest

- Consent to review medical history

Insurable interest is a standard regulation in the insurance industry. Essentially, it means you must suffer a financial loss should the insured pass away. Obviously, in this case, as the son or daughter, you do have an insurable interest.

Additionally, your parents must offer consent to the carrier (during the underwriting process) for a review of their health history. This follows HIPAA – the Health Information Portability And Accountability Act. The carrier will review your parent’s MIB, prescription drug history, and other records.

Without insurable interest and your parent’s consent, you can’t buy burial insurance on your parents.

Assuming you do have these 2 requirements in place, let’s discuss the steps to purchasing burial insurance for your parents.

5 Steps To Purchasing Burial Insurance On Your Parents

5 simple steps to purchasing burial insurance.

#1 How much coverage do you want? Most carriers allow up to $25,000 for purchase. Depending on your parent’s health, some carriers allow more.

#2 Find out more about your parent’s health history. This information is important as it determines the type and cost of life insurance available. Some questions you want to ask your parents include, but are not limited to:

- What are your height and weight?

- What medication do you take?

- Have you been hospitalized in the last 12 months?

- What health conditions were you diagnosed and treated in the last 5 years?

#3 Contact us. Knowing the information in step 2, contact us. We can then go over the information and give you a preliminary quote. In this step, we may need your help securing additional information.

#4 Apply! Knowing the information in steps 2 and 3, we would select the best burial insurance option for your parents. We would then apply. Typically, you, your parents, and us simply need to be on a 3-way call. Easy.

#5 Upon approval, set up payment. Upon approval, you’ll need to set up your checking account for payment. Some carriers, but very few of them, offer credit card payments.

It’s usually a simple process. However, I can’t underscore the importance of knowing your parent’s health history. That will drive the availability and cost.

Other Options Instead Of Burial Insurance

Do your parents need burial insurance?

If they have money saved already or some type of permanent insurance plan, then they probably don’t.

How do you find out? You just need to start the conversation. We all pass away someday. Just ask, “Mom and Dad. Have you thought about your funeral yet?”

someday. Just ask, “Mom and Dad. Have you thought about your funeral yet?”

If they don’t give a good answer, just ask them if they passed away yesterday, how would they pay for their funeral today?

If they haven’t planned or can’t, then they need burial insurance. However, other options exist as we discuss here. Additionally, these are usually affordable types of burial insurance, especially if your parents are healthy.

Guaranteed Universal Life Insurance

Guaranteed universal life insurance (GUL) is a type of universal life insurance. If your parents are in decent health, this is a great option. Why? Because GULs have more stringent underwriting. Moreover, their premiums are usually less than a comparable whole life plan.

GULs don’t have the cash value growth like whole life. As the name suggests, the carrier guarantees the death benefit. (The death benefit on traditional universal life is not.)

Compare $25,000 for a 65-year-old healthy woman. With a traditional burial insurance carrier, she would pay about $100 per month.

With a GUL, she would pay around $75 per month for $25,000.

Again, the GUL is “burial insurance”. It’s all in the name. Upon your parent’s passing, the GUL pays the death benefit to you. You, in turn, use the death benefit on your parent’s funeral and burial.

Fraternal Life Insurance

Like the many different structures of businesses, the same holds true for life insurance carriers. Many of the “big name” carriers you know are for-profit carriers. They exist to make money for their shareholders. Prudential and Pacific Life are good examples. They are household names because of the advertising they do.

However, did you know that not-for-profit carriers exist? That is right. They exist for the benefit of members (not shareholders). The Knights of Columbus is one of the largest fraternal benefit carriers. They exist to support Catholic causes and charities.

However, many fraternal carriers nowadays don’t require you to be of a certain ethnicity or religion.

We’ve helped many people obtain burial insurance with fraternal carriers. We work with many of them. And, for good reason, because their rates are more reasonable.

Let’s look at that 65 year-old-woman again. With a fraternal carrier we use (but, other agencies do not), the comparable cost is $83 per month.

Some agents say fraternal life insurance isn’t “real” life insurance and won’t pay a benefit, lol. I don’t know why they would say this, other than to discredit. Many of these fraternal carriers have been in existence for 125 to 150 years. Isn’t that a great indicator of longevity and solvency? If they didn’t manage their finances well or pay their death benefits, they would not exist today.

Funeral Trust & Estate Planning Trust

Let’s say your parents have enough money for their funeral from a funding standpoint. If the money is in stocks, bonds, a 401K account, cash in the bank…that all can be held up by probate and taxed upon death. Depending on the situation, it could be taxed to you.

A funeral trust helps in this situation. Depending on the state where you live, you can protect up to $15,000 in a funeral trust. The $15,000 is shielded from creditors, probate…you name it. When your parents pass away, the $15,000 goes right to the funeral home.

The $15,000 is protected and can’t be touched by anyone. Protection is immediate. Yes, even if your parents are in a nursing home. By law, it bypasses the 5-year lookback rule for nursing home care. Moreover, it takes the burden and pressure off you.

John, my parents need more than $15,000.

That’s where an Estate Planning Trust comes in. You can transfer up to $100,000 into an Estate Planning Trust. Upon your parent’s passing, the trust sends the money to the funeral home. Any balance left over goes to the trust beneficiaries, likely you and/or any siblings or family members.

A key difference between the Funeral Trust and the Estate Planning Trust is the 5-year lookback requirements. The Funeral Trust legally bypasses this rule, so you can use it on parents who need protection now. However, the Estate Planning Trust follows this 5-year lookback rule.

What If Your Parents Are Disabled Or On Medicaid?

You shouldn’t worry. Burial insurance is still available for your parents if they are disabled. We’ve helped many parents who are disabled one way or another obtain burial insurance.

You shouldn’t worry. Burial insurance is still available for your parents if they are disabled. We’ve helped many parents who are disabled one way or another obtain burial insurance.

Additionally, burial insurance is available if they receive Medicaid.

You may have heard elsewhere that people on Medicaid can’t have burial insurance.

That is not true at all.

Yes, with Medicaid, you generally have to approach carefully, but it is not impossible. Numerous ways exist for people to purchase life insurance while on Medicaid. One way is for you, as the son or daughter, to be the owner and the beneficiary, provided you yourself are not on Medicaid.

You see, being on Medicaid and being an insured on a burial insurance policy is not a disqualifying factor.

As long as your parents are not the owner of the policy, their Medicaid benefits should stay intact.

Since we are not lawyers, please seek out an elder-law attorney in your state as state laws differ before applying for a policy.

Frequently Asked Questions About Burial Insurance On Your Parents

Here are some frequently asked questions about burial insurance on your parents. We continually update this section.

When Does The Policy Take Effect?

The policy takes effect when you pay the first premium.

Can I Get Burial Insurance On My Parents Without Their Knowing?

You really can’t. Your parents will need to consent to their health history.

There is one situation where you can. The only time you can is if you have a POA or guardianship on your parents. You can then sign the application on their behalf.

My Parents Live In Another State. Can I Buy Burial Insurance On Them?

Yes. That is not a problem.

Who Should Be The Owner And Beneficiary?

You as the son or daughter should be the owner and beneficiary. You will have control of the policy and then receive the death benefit. Having this structure won’t impact the death benefit, either. If three different people are the insured, owner, and beneficiary, that could cause gift tax problems for the owner. This situation is really outside the scope of our article. Contact us if you have any questions.

Now You Know How To Purchase Burial Insurance For Your Parents

Now you know how to buy burial insurance for your parents. First, you need to have an insurable interest, which you do, being their child. Then, your parents consent to review of their health history.

Once those requirements are met, then you just need to figure out a death benefit. As we said, your parent’s health determines the burial insurance options.

Next, contact us or use the form below. We would then speak to you and go over some preliminary options.

You can then bring in your parents anytime. As we said in our article, we would then have a three-way conversation and have your parents apply.

Do you have any questions? We only work in your best interests. It’s the only way we know how to help our clients. If we can’t help you, no worries. We will point you in the right direction as best we can and part as friends. You can always reach back out to us anytime.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".