3 Life Insurance Options Available And Approved for Heart Attack Survivors | Protect Your Loved Ones

Updated: September 12, 2024 at 9:18 am

Recently, I received a phone call from a gentleman. He told me that he had a heart attack 6 months prior to his phone call and needed life insurance.

Recently, I received a phone call from a gentleman. He told me that he had a heart attack 6 months prior to his phone call and needed life insurance.

If you or a loved one are in a similar situation, we can help.

Yes, people who have had a heart attack can obtain life insurance.

In this article, we will discuss how people who survived a heart attack obtain life insurance. We also discuss 3 life insurance options available and approved for them, depending on their heart attack and lifestyle situation.

We’ve helped many people obtain the best and most affordable rates available to them, and I am sure we can help you, too.

Additionally, I know other websites tend to gloss over the specifics. We don’t. This is a complete and transparent guide about your chances of getting approved for life insurance after a heart attack. We also discuss underwriting and potential costs in detail.

Here’s what we will discuss:

- Can You Get Life Insurance After A Heart Attack?

- Life Insurance And Underwriting After A Heart Attack

- 3 Life Insurance Options Available And Approved For Heart Attack Survivors

- FAQs About Life Insurance And Heart Attacks

- Final Thoughts

Let’s jump in and discuss if a person can get life insurance after a heart attack.

Can You Get Life Insurance After A Heart Attack?

Yes, many heart attack survivors can obtain life insurance after a heart attack. Moreover, many life insurance options exist.

However, the life insurance options available to you really depend on when the heart attack occurred, the severity of the heart attack and heart damage (if any), and other health and lifestyle situations.

What are these factors? We address them in our underwriting section next.

Life Insurance And Underwriting After A Heart Attack

Underwriting is the foundation of life insurance approval or decline. What is underwriting? It is simply the process of assessing a risk for insurability. If a carrier deems the insured too high of a risk, then they will decline life insurance coverage.

It is no secret that heart attacks (technically called a myocardial infarction) are a leading cause of death here in the United States. They are a serious heart condition, caused by a blood clot that limits blood flow and supply to the heart. After the heart attack, typically doctors administer some type of surgery such as bypass surgery, coronary angioplasty, or stenting.

The Statistics Don’t Lie…

As we stated, and described, a heart attack is a serious medical condition. Life insurance companies know this. They also know that your life expectancy drops about 10% after having a heart attack. So, if a healthy person has a life expectancy of 90, that same person with a heart attack has a life expectancy of 81 (10% drop).

So, right off the bat, underwriters are going to look at your situation unfavorably.

What, John? I had one heart attack, and I am completely healthy!

I hear this all the time. In fact, this is what the gentleman said to me when I told him about his chances of approval. Unfortunately, he had a heart attack, has heart damage, and now has a reduced life expectancy (per the statistics).

As I mentioned, heart attacks are extremely serious medical conditions. Life insurance companies know this, and they will assess you as a higher risk. It is just a fact.

However, life insurance is still available. Moreover, we can help you get the best and lowest rates available to you based on your specific situation. However, the rates and life insurance options really depend on specific underwriting factors. We discuss these factors next.

What Do Life Insurance Companies Look At With Someone With A Heart Attack?

Underwriters will look want to know the following if someone has a heart attack in their medical history.

- Date of the heart attack or heart attack(s)

- Have you had any of the following medical tests, situations, or surgeries?

- Echocardiogram

- Coronary catheterization

- Coronary angioplasty

- Bypass surgery

- Heart failure

- Coronary arterial disease

- Arrhythmia

- What medication do you take for your heart attack?

- Results of stress ECG test

- Do any of the following apply to you?

- High blood pressure

- Coronary artery disease

- High cholesterol levels / high lipids

- Family history of heart disease

- Overweight

- Irregular heartbeat

- Diabetes

- Peripheral vascular disease

- Carotid or cerebrovascular disease

- Have you smoked cigarettes or used any nicotine in the last 12 months?

- Do you have any other health issues or serious health conditions?

Then, the underwriter will want to know some other information:

- Your height / weight

- Marijuana use

- Any substance abuse

- Any bankruptcies or bad driving history

- Other medical issues or prescription medication not disclosed

Here’s the thing you need to understand. You will likely pay higher rates for life insurance compared to someone who has the same actuarial profile as you, but who never had a heart attack.

Life Insurance Table Ratings And Heart Attacks

Comparatively higher rates are called “table ratings”. Underwriters apply table ratings when your situation is a higher risk. I discussed this earlier in the article. By having a heart attack, you are a higher insurance risk.

To offset this higher risk, carriers charge you higher premiums through a table rating. Additionally, if your risk is too high, they will decline your life insurance application altogether.

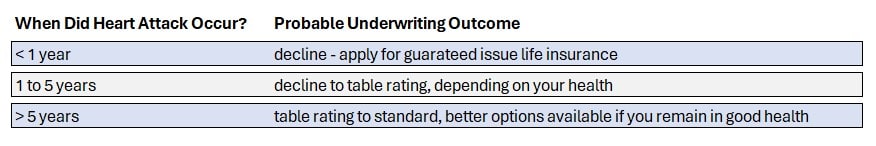

In my experience, if you’ve had a heart attack in the last year, expect a decline. If it has been between 1 and 5 years since your heart attack, you may receive a table rating. You may receive standard rates if your heart attack occurred over 5 years, with demonstrated good health.

Standard rates mean typical health/lifestyle situations. Your best rate available, as a heart attack survivor, is standard rates.

Standard rates mean typical health/lifestyle situations. Your best rate available, as a heart attack survivor, is standard rates.

John. I was reading another article and it said I could get a preferred rating!

I am aware of those articles. Preferred rating, which means very healthy, or anything like that just isn’t possible. The best rate available is a standard rating, and even then, obtaining that rate will be hard.

So, if you have had a heart attack, expect a table rating on your life insurance policy.

Life Insurance Application Process For Heart Attack Survivors

There is an application process if you want a life insurance policy with a large death benefit of $100,000 or more.

The first thing, if you work with us, is that we obtain all that underwriting information beforehand. It is called “prequalification”. We obtain that information from you and send it on to the life insurance companies. They review it and come back with an estimated rate.

That way, we know what kind of premiums we are looking at, subject to full underwriting. What is full underwriting? The carriers will want the following information from you or will access the following:

- your MIB

- prescription drug history

- a medical exam (called a paramedical exam) likely

- your primary doctor’s medical records for your overall health

- your cardiology records showing the severity of your heart attack, the current status of your heart (ECG), and any remaining heart issues

- follow up / reports from any heart surgeries, stent placement, etc.

- anything else pertinent and material to your application: driving records, bankruptcies, etc.

Once we receive all the estimates back, we decide on a carrier and have you apply. As long as what you told us matches what is contained in your medical records, health history, and background then the final premium offered by the carrier should be close to their initial estimate.

It’s important that you are truthful and transparent about your overall health and the severity of your heart attack. While we have helped many people with heart attacks obtain life insurance, we have had others who have been declined.

Now is a good time to discuss why people get declined.

Why People Get Declined…

While we have helped many people with heart attacks obtain life insurance, sometimes, however, some people get declined. Based on my analysis, the carrier declines the application because the person:

- misjudged his heart attack diagnosis – for example, maybe he felt he had a mild heart attack when he, supported by the medical records, had a severe heart attack with major damage

- did not disclose other factors – we had one prospect who did not disclose his drug abuse history to us.

During the prequalification process, it is important to be truthful and transparent so we can understand the best life insurance options available to you. If you outright lie on the life insurance application, expect a decline.

We always can get you some type and amount of life insurance coverage (as I note below), so just be honest and transparent.

Simplified Underwriting Process For Heart Attack Survivors

One final thought in this section before we introduce the 3 life insurance options available to heart attack survivors. Simplified underwriting does exist. Simplified underwriting means the carrier has removed elements of the traditional underwriting process (described above). Typically, the carrier removes the:

One final thought in this section before we introduce the 3 life insurance options available to heart attack survivors. Simplified underwriting does exist. Simplified underwriting means the carrier has removed elements of the traditional underwriting process (described above). Typically, the carrier removes the:

- paramedical exam

- medical records (sometimes)

The removal of these elements does speed up the underwriting process and decision time (sometimes as quick as a day). However, carriers that do offer simplified underwriting limit the life insurance in a couple of ways:

- a lower death benefit available and/or

- comparatively higher premiums because the easier underwriting

If you are looking for life insurance with a death benefit of less than $100,000, then the simplified underwriting process might be best for you.

Let’s discuss the 3 life insurance options available for people who have had a heart attack.

3 Life Insurance Options Available And Approved For Heart Attack Survivors

Before we get into the 3 life insurance options, let’s recap with a summary.

- People who have had a heart attack can obtain life insurance.

- Good “prequalification” information is key to understanding your life insurance options and premium.

- Underwriting determines if you are approved or declined and the final premium rate.

- Expect an in-depth underwriting process if you want a life insurance death benefit of $100,000 or more.

- Also, expect to pay a comparatively higher premium than someone who has never had a heart attack.

Let’s discuss the 3 life insurance options available. We have helped many heart attack survivors obtain these 3 life insurance options.

Fully Underwritten Term Life Insurance And Permanent Life Insurance

Carriers offer both term life insurance and permanent life insurance (like whole life insurance) to heart attack survivors.

As I said before, expect a full underwriting process if you want $100,000 or more in death benefit.

Also, expect to likely pay more than someone who never had a heart attack. How much more you will pay depends on the severity of your heart attack (and everything else we discussed).

As I mentioned, if you just had a heart attack in the last year, then this fully underwritten option likely isn’t available.

If you are between 1 and 5 years from your heart attack, some carriers will accept a life insurance application. Moreover, expect a table rating. If you had a mild heart attack, some carriers may consider an application between 1 to 2 years from your heart attack. However, most carriers will take a life insurance application between 3 and 5 years from your heart attack.

Most carriers will take an application if your heart attack occurred more than 5 years ago, as long as you have recovered and are in good health. In these cases, you should still expect a table rating. A standard rating may be possible.

If you would like a term life insurance quote, feel free to run the quoter below. Note, that this is an estimate only and your rate will likely be higher. How much higher depends on everything we discussed in the underwriting section.

Contact us if you have any questions.

Simplified Issue Life Insurance / Burial Insurance For Heart Attack Survivors

John, I don’t need $100,000. I just need $50,000 for my funeral and burial needs.

If this is your situation, simplified issue life insurance policies exist.

As discussed in the underwriting section, simplified issue policies remove many time-consuming elements from the traditional life insurance underwriting process. These elements include, but are not limited to:

- paramedical exam with blood and urine sample

- doctor records / medical records

- phone interview with an underwriter

With most simplified issue life insurance plans, you just fill out an application that includes a health questionnaire. Then, the carrier looks up your health background through the MIB and prescription drug database. If all checks out, you are then approved.

It is easy and simple, hence the name.

Most simplified issue life insurance plans are called “burial insurance”. They are called this because the insured primarily uses the death benefit to fund funeral and burial costs upon his or her death.

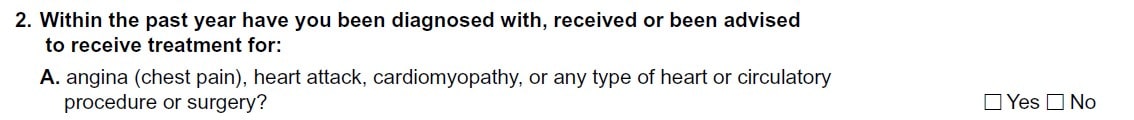

Most burial insurance applications have questions about heart attacks like this one. You just answer yes or no. We at My Family Life Insurance choose the right carrier for your situation:

Burial insurance plans offer a low death benefit, like $30,000. Feel free to research burial insurance plan costs below:

Simplified term life insurance exists as well, although underwriting could be more stringent with the lack of medical underwriting and/or doctor records.

Contact us if you have any questions.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance exists for people who have had recent heart attacks (within the last year) or have serious medical conditions.

Typically, guaranteed issue life insurance is a whole life policy. Guaranteed is just how it sounds. The carrier guarantees acceptance and approval. You just apply and you have life insurance.

While this sounds great, a few points:

- rates are higher compared to similar types of policies

- the carrier places a 2-year waiting period on the death benefit

- a limited death benefit, usually $25,000 maximum

Because the carrier doesn’t underwrite, it doesn’t know the health status of applicants. So, it places a 2-year waiting period on the death. All this means is if the insured passes away from any illness or natural cause in the first 2 years of the policy’s start date, the beneficiaries receive the premiums paid back + interest.

The carrier always covers accidental death at 100%, even during the waiting period.

Feel free to review the guaranteed issue options below. Just select “poor health” to see the guaranteed issue options.

Note: we offer additional guaranteed issue plans not on the quoter, so contact us if you have any questions.

Frequently Asked Questions About Life Insurance And Heart Attacks

We discuss and answer some commonly asked questions about life insurance and heart attacks.

Can I Get Life Insurance After Having A Heart Attack?

Yes, people who have had a heart attack can obtain life insurance. The type of life insurance and availability depends on the severity of the heart attack, when it occurred, your overall health, and other risk factors.

The good news is that we have helped many heart attack survivors obtain some type of life insurance. Contact us to learn more.

What Life Insurance Covers A Heart Attack?

All types of life insurance will pay a death benefit if you pass away from a heart attack, even if you already had a previous heart attack.

Guaranteed issue life insurance is the only type of life insurance that has some death benefit limitation. Remember, this type of life insurance has a 2-year waiting period on the death benefit. If you pass away from any type of illness or natural cause in the first 2 years of the policy, then the carrier pays your beneficiary the premiums you paid + interest.

After 2 years, the policy pays the death benefit in full. Additionally, the carriers always cover accidental death 100%, even in the first 2 years.

Can You Get Life Insurance With A Heart Stent?

Yes, you can get life insurance with a heart stent. Heart stents, angioplasty, etc. are all common surgeries after a heart attack. Depending on the type of life insurance you apply for, underwriters will want to know more details about the surgery, etc.

We have helped people with heart stents, balloon procedures, etc. obtain life insurance after a heart attack, and we can help you, too. Contact us to learn more.

Can I Get Term Life Insurance After Heart Surgery?

Yes, you can obtain term life insurance after heart surgery. As we mentioned throughout the article, your premiums depend on

- the type of heart surgery,

- how long ago it was completed,

- your overall health status now, and

- your prognosis among other factors.

Expect a table rating if you are approved for term life insurance after heart surgery.

The Carrier Declined My Life Insurance Application. What Can I Do Now?

Declines happen. Usually, the reason you’ve been declined life insurance is due to:

- applying on your own without a knowledgeable insurance broker

- using a broker, but not a knowledgeable insurance broker

- not being completely truthful on the application (say that you only had a mild heart attack when it was a severe heart attack)

- forgetting about other health conditions and risk factors (driving records, etc. or prior substance abuse)

- just completely lying

If you’ve been declined, the carrier mails you a letter containing the reason. Most of the time, these letters are generic and only touch the surface of the reason for your decline.

However, in this letter, usually, the carrier contains a phone number or email where you can obtain the specific reasons behind your decline. I recommend that you contact the reason why the carrier declined you.

Then, you can reach out to an insurance broker like My Family Life Insurance. We work with different companies and have the experience to help you obtain life insurance, even if you’ve been declined before.

If you work with us, we will prequalify you with many carriers and see what options you have along with the corresponding, estimated premium.

How Can I Improve My Chances For Approval?

The easiest and best way to improve your chances for approval is to focus on improving your health. That means exercising, losing weight, etc. You may also need to make serious lifestyle changes. For example, if you use nicotine (even vaping, you’ll have to quit that if you want a better life insurance decision outcome.

This all doesn’t happen overnight. It takes time. So, you’ll likely get declined within a year or 2 of your heart attack (unless it was a mild heart attack, and you are in good health). You’ll have to wait, and it is during this timeframe that you can focus on getting your health better.

As we alluded to earlier, another way to improve your chances of approval is to use a knowledgeable insurance broker. We have helped many people with a heart attack obtain life insurance, even when they were declined elsewhere. If you work with us, we will prequalify you with the favorable carriers we work with. They will let us know if they will accept an application from you and provide a preliminary rate.

Should I Purchase Critical Illness Insurance?

People have asked me this, and I have seen this stated on other websites. Critical illness insurance isn’t life insurance. It is a pseudo-type health/disability insurance plan.

However, to answer your question: no, if you’ve already had a heart attack. Here is the reason: critical illness insurance pays a lump sum benefit (usually) when you are diagnosed with a heart attack, stroke, or cancer. That is a nice option because you can use that lump sum, let’s say $30,000, for your needs and care. Moreover, the lump sum is an income tax-free benefit.

However, you need to qualify for critical illness insurance. If you’ve had a heart attack, all carriers will decline your application. There is no way to get around that unless you want a guaranteed issue critical illness insurance plan (we have those).

Now, if you are reading this article to help a loved one or a friend, I definitely would recommend a critical illness insurance plan for yourself. Today’s plans are relatively inexpensive, full of options, and contain additional illness coverage. I also recommend a plan that lasts your lifetime and contains a return of premium benefit.

Contact us if you would like to learn more.

Will My Medication Cause A Decline?

Sometimes. A decline will depend on the type of insurance.

With fully underwritten term life or permanent insurance, the type of medication is secondary (in my opinion). The reason why is that underwriters are looking at your medical records, paramedical exams, etc. Moreover, we prequalify all of this, including your medication, before you apply. If a carrier won’t accept an application on you, it’s because of the severity of your heart attack, health history, prognosis, etc. Your medication doesn’t necessarily drive the decision.

Conversely, simplified issue plans can decline based on a type of medication. Why? Because, as we discussed in our underwriting section, the underwriting is simple. The carrier has removed major elements of the traditional underwriting process, namely medical records and paramedical exams. So, it has to base its decisions on other factors. That is why many simplified issue life insurance plans use a “knockout” drug list. In other words, if your drug is on this list, the carrier “knocks out” or declines your application.

Take a look at this real example from a simplified issue underwriting guide. The commonly prescribed clopidogrel after a heart attack is a decline for life insurance.

![]()

No worries, though. Let us know your medication and situation, and we will find a plan that works for you.

I’ve Had Multiple Heart Attacks. Can I Get Life Insurance?

Yes, but your life insurance options are likely more limited. You may only be eligible for burial insurance or a guaranteed issue life insurance plan.

Now You Know People Can Obtain Life Insurance After A Heart Attack

I hope you learned in this article that heart attack survivors can obtain life insurance. Three types of life insurance available and approved include:

- fully underwritten term life insurance and permanent life insurance

- simplified issue life insurance

- guaranteed issue life insurance

The type of insurance available to you really depends on the severity of your heart attack, how long ago it occurred, the current state of your heart, and your prognosis, among other risk factors.

However, no matter your situation, we can help you obtain the lowest and most affordable rates.

Do you have any questions or want to get started working with us? Contact us or use the form below.

There is no risk of contacting us. We won’t call you 1,000 times each day, and we only work in your best interests. That means we work for your needs and are not beholden to any particular life insurance carrier. If we can’t help you, we will point you in the right direction as best we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".