3 Solid Non-smoker Life Insurance Options For Vaping | Yes, You Can Obtain Non-Smoker Rates

Updated: April 12, 2024 at 9:38 am

You don’t smoke cigarettes. All you do is vape, e-cigarettes, or vaping, and all the life insurance carriers categorize you as a tobacco user.

That sends your life insurance rates to the moon and makes you mad.

Am I right?

Yes, that is right, John. I only vape a few times per day and carriers put me at tobacco rates!

Well, I am here to tell you that you can obtain life insurance at non-smoker rates if you vape or are vaping.

Yes, that is right!

Get out of here, John. All these other websites say I can’t!

I am here to tell you that you can.

However, in some cases, just paying tobacco rates might be the best option for you.

We will discuss that later in the article. Nevertheless, you can obtain life insurance at no-smoker, no-tobacco rates if you vape, use e-cigarettes, or are vaping.

Here’s what we will discuss.

- Vaping And Underwriting

- 3 Life Insurance Options At Non-Smoker, Non-Tobacco Rates

- FAQs About Vaping And E-Cigarettes

- Cost Comparison – Are Tobacco Rates Better?

- Now You Know You Can Get Non-Smoker Life Insurance Rates

Let’s jump in and discuss vaping and life insurance underwriting. We generally discuss underwriting first because it is the foundation for setting the right expectations and getting the life insurance policy you want.

Vaping And Life Insurance Underwriting

Using e-cigarettes and vaping is a discrete way of consuming nicotine. Many people transitioned away from traditional cigarette smoking to vaping, thinking it is safer.

Technically, although it is healthier than smoking, vaping is still not safe.

Life insurance carriers know this. You still are inhaling nicotine and other containments (although fewer than traditional smoking). Moreover, many serious lung diseases have been connected to vaping.

Life insurance carriers know this. You still are inhaling nicotine and other containments (although fewer than traditional smoking). Moreover, many serious lung diseases have been connected to vaping.

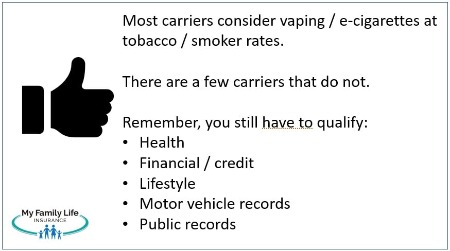

Therefore, most carriers still consider e-cigarette use and vaping at tobacco life insurance rates. You’ll pay more, sometimes up to 3 times more compared to a non-tobacco user.

The operative word is “most”.

There are a handful of carriers that will consider vaping and e-cigarette use at non-smoker life insurance rates.

Yes, that is true.

We discuss these options in a minute.

Remember that underwriting generally consists of the carrier reviewing your:

- Health

- Lifestyle

- Motor vehicle records

- Financial/credit

- Public Records

So, even though you vape, you have to qualify for life insurance in other ways.

Carriers may also require a blood and urine sample from you.

Some carriers have a simplified underwriting process that eliminates some of the aspects above.

We discuss your life insurance options next.

3 Life Insurance Options For Vaping And E-Cigarette Use

3 life insurance options exist for vaping and e-cigarette usage.

Underwriting is always changing, so the below information could change.

Always contact us to find out the latest information. We will update this section accordingly.

Term Life Insurance For Vaping

Two life insurance carriers offer high death benefit term life insurance (i.e. more than $100,000) if you vape or use e-cigarettes.

Both carriers allow the best classification at standard rating.

Standard rating is simply, typical, normal health.

You have to disclose your vaping use on the application and be fully underwritten per the carriers’ requirements. That means carriers will, at their discretion, look at your:

- Health

- Motor vehicle records

- Lifestyle

- Financial / credit

- Paramedical exam, blood/urine sample

- EKG

- Anything else

One carrier allows for the non-smoker rates as long as you don’t have more than 24 cumulative tobacco occurrences in the last 12 months. In other words, if you vape fewer than 24 times in a 12-month period, you’d qualify for non-smoker rates. You also need to show a negative nicotine/cotinine marker on a urine sample. So, likely, the carrier will require a paramedical exam with blood and urine samples.

So, if you vape once in a while, this is a good option.

Then, the other carrier only considers cigarette use as tobacco use. Anything else is considered non-tobacco.

So, if you vape more than 24 times a year, then this option is the best option.

This carrier has non-medical underwriting, which means it won’t require a paramedical exam with blood and urine. While that sounds great, non-medical policies are comparatively higher in premiums because of no lab requirements.

Moreover, they still will look at your motor vehicle records and order your doctor’s records if needed.

Also, they limit the maximum death benefit to $500,000 (lower if you are a substandard risk).

Nevertheless, you do have a couple of term life insurance options if vaping and these are way better than paying smoker rates (comparison below).

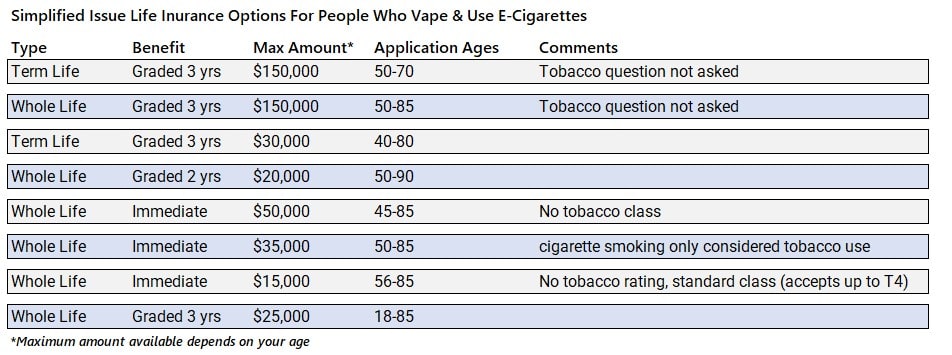

Simplified Issue Life Insurance

Simplified issue life insurance is available as well.

These are predominantly whole life policies, although there are a couple of term policies available.

The word “simplified” here refers to simplified underwriting.

The carrier doesn’t proceed with most of the underwriting tasks we described above. Usually, the carrier limits underwriting to:

- Health

- Phone interview – possible

With simplified underwriting, all you do is answer a health questionnaire. The carrier confirms your health status through the MIB and prescription drug history check.

Sometimes, they will require a phone interview with an underwriter, although this step is becoming rare as the simplified underwriting process becomes more automated.

Many carriers offer simplified issue life insurance; however, only a handful offers it without regard to vaping.

In other words, only a handful of carriers disregard your vaping status. They don’t care if you do it or not.

John, but my rates are sky-high then!

Not really. But, we will get into cost in a minute.

One drawback of simplified issue life is the death benefit. Usually, carriers offering simplified issue life insurance only offer up to $25,000 or $50,000.

Although these are small amounts, you are insured at a non-smoker rate.

Here are some simplified issue life insurance options if you are vaping. Contact us if you have questions.

We discussed the benefit type in our types of burial insurance article. Additionally, most of these carriers allow a minimum application age of 40.

We discussed the benefit type in our types of burial insurance article. Additionally, most of these carriers allow a minimum application age of 40.

If you want to check out estimated rates, feel free to do so here on our quoter.

Guaranteed Issue Life Insurance

We also have some guaranteed issue life insurance plans for people who enjoy vaping and use e-cigarettes.

With guaranteed issue life insurance, carriers do not consider tobacco use.

John, does that mean my rates are higher?

Generally speaking, yes. Therefore, I recommend you enroll in either the term or simplified issue plans first before enrolling in guaranteed issue (except for one, noted below).

Any guaranteed issue plans are going to be higher in premiums because the carrier doesn’t underwrite. So, they don’t know the health status of applicants.

Applicants can have stage 4 cancer, but the carrier doesn’t know.

Because they don’t know the health status of applicants, they place a waiting period on the death benefit. Typically, this waiting period is 2 years, but for some carriers, it is 3.

If you pass away from an illness or natural cause in the waiting period, your beneficiary receives the premiums you paid + interest.

We work with many guaranteed issue carriers, so I am sure we can find you some level of coverage.

We also work with many guaranteed issue plans for people under the age of 40. For example, we work with a guaranteed issue term plan for people starting at age 18. You can self-enroll here.

We also work with another guaranteed issue term plan in which you can purchase $50,000. Rates are reasonable. The plan is through an association, so you do have to pay a monthly association fee. The main requirement is gainful employment, so you have to be gainfully working and earning an income. The carrier will verify this. Please contact us for more information.

FAQs About Life Insurance, Vaping, And E-Cigarettes

You do have life insurance options if you vape. Sure, they aren’t perfect, but you aren’t paying tobacco rates, either.

Here at My Family Life Insurance, we strive to get you the best life insurance coverage at the lowest price possible.

If you vape, there just aren’t a lot of carriers that will insure you at non-smoker rates. However, you still have options.

In this section, we answer some commonly asked questions about vaping and life insurance.

Does Vaping Affect Your Life Insurance Rates?

Yes, vaping does affect your life insurance rates. Nearly all carriers consider e-cigarettes and vaping as tobacco use. You’ll pay up to 3 times more for your life insurance compared to a non-tobacco user, unless you quit vaping and remain nicotine free for a minimum of 12 months. At that point, you are considered a non-tobacco user.

Or, you can select one of the carriers we described in this article that allows non-smoker rates for vaping/e-cigarette use.

Do Life Insurance Carriers Test For Vaping?

They don’t test for vaping/e-cigarette use by itself. They will test for nicotine (cotinine) in your urinalysis. If the nicotine (cotinine) marker is positive, the carrier charges you tobacco rates.

However, if you select one of our non-medical or simplified issue carriers, you won’t need to worry about that.

Can’t I Just Lie About Vaping On The Life Insurance Application?

Don’t do it. Lying on an application constitutes fraud. If the carrier finds out – and they likely will – they could decline your application.

There’s no need to lie. You can just enroll with one of the carriers that consider vaping and e-cigarette use at non-smoker rates.

If I Vape Once In A While, Am I Considered A Smoker?

Yes. If you vape even 1 time in the last 12 months, carriers consider you a tobacco user.

I know that sounds crazy.

That is why many carriers have relaxed their standards around cigarette use and other types of tobacco use including cigars. For example, some carriers will allow non-smoker rates for someone who smokes fewer than 12 cigarettes in a year.

However, many carriers still consider vaping as tobacco use, even if you take one puff.

Except for the life insurance options we outlined in this article.

If I Quit Vaping, Can I Be Moved To Non-Smoker Rates?

Yes, generally speaking, you have to be nicotine free for a minimum of 12 months. You then put in a request to your carrier that you would like your rates to be moved to non-tobacco rates.

The carrier will then want a blood and/or urinalysis showing a negative nicotine/cotinine marker. You will likely have to pay for this test out of pocket.

Some carriers will also require you to re-answer the health questionnaire and will look up your medical claim history through the MIB and your prescription drug history. They do this to make sure your health hasn’t negatively changed.

If your test comes back negative for nicotine and your health has been stable (or improved), then the carrier moves you to non-smoker rates.

You can do all this or, you can simply start with one of the carriers that accept vaping use at non-smoker rates.

Cost Comparison – Are Tobacco Rates Better?

Well, the answer is, it depends on your gender, age, and how much death benefit you are looking for.

Generally, though, they are not better. But, we do have some life insurance plans that offer competitive smoker rates.

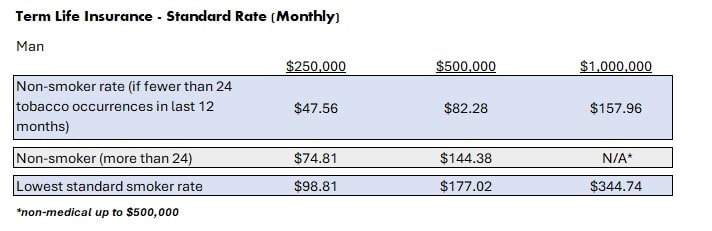

Let’s give you a comparison. For the term plans, I will assume a 35-year-old man and woman, standard health (i.e. standard rating) wanting a 30-yr term policy. Rates are subject to change at any time.

Here are comparison rates for the male:

As you can see, it makes sense for the male to enroll in the non-smoker options.

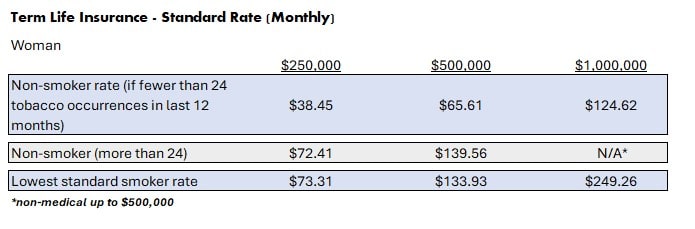

Here are the term comparison rates for the female:

Unless a female uses e-cigarettes fewer than 24 times a year, it might make sense to go with a competitive carrier with tobacco rates. However, rates change all the time. Additionally, final rates are based on your age, underwriting situation, etc. It is best to contact us so we can review your specific situation.

Some strategies abound here. For one, if you are thinking about quitting, then it may make sense to go with a 10-year term or an annually renewable term. Once you are nicotine free for 12 months, then you could apply for non-smoker rates at any carrier. The issue here is if your health changes drastically in a short amount of time. While that probability is low, it can happen.

Moreover, if you have a tobacco-rated life insurance plan and quit vaping, you can request a premium reduction to non-smoker rates. The carrier will require lab work (likely at your expense) showing negative for cotinine/nicotine. They may also require an updated health questionnaire answered.

Now You Know You Can Get Non-Smoker Life Insurance Rates If Vaping

People who enjoy vaping can obtain life insurance at non-smoker rates. We outlined 3 different life insurance options at non-tobacco rates for vapers. These options include:

- Term life insurance

- Simplified issue life insurance

- Guaranteed issue life insurance

Are you ready to get started? Feel free to contact us or use the form below.

You probably think there is a risk to contacting an insurance broker. Maybe that is the case with others, but not with us. There is no risk of contacting us. We have your best interests and your needs first, not our own. If we can’t help you, we will point you in the right direction as best we can, and we will part as friends. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".