Does Life Insurance Affect Your Medicaid Eligibility? It Can. We Discuss 3 Options That It Won’t

Updated: August 16, 2024 at 7:16 pm

Medicaid, life insurance, and Medicaid eligibility.

These together aren’t like peas and carrots. More like oil and water!

Far too often, people applying for Medicaid find out that their life insurance policy can disqualify them from Medicaid eligibility and benefits. This is true.

You may have heard different information about Medicaid eligibility and life insurance. Frankly, much of the stuff you read on the internet is inaccurate.

In this article, we dispel the inaccuracies and tell you what you need to know about how Medicaid works with life insurance, especially when it comes to qualifying for Medicaid (or nursing home care paid by Medicaid).

More specifically, we describe how Medicaid/SSI recipients obtain life insurance the right way. We also give you 3 life insurance options available to Medicaid recipients.

The quick answer to everything: it really depends on your situation. However, we have helped many Medicaid recipients obtain life insurance and keep their Medicaid eligibility. I am sure we can help you out, too.

It’s important to stress that we are not lawyers and recommend you consult a lawyer in your state for any specific information regarding the laws in your state.

Here is what we will discuss. We start with a discussion about the Medicaid program and then lead into how Medicaid eligibility affects life insurance ownership. We then discuss 3 life insurance options that will not affect your Medicaid eligibility.

- What Is Medicaid?

- What Are The Medicaid Asset Limit And Income Limit

- How Life Insurance Impacts Medicaid Eligibility

- 3 Life Insurance Options That Don’t Impact Medicaid Eligibility

- Can Medicaid Take Away Your Insurance?

- Can You Qualify For Life Insurance If You Already Receive Medicaid?

- How Does Receiving The Life Insurance Death Benefit Affects Your Medicaid?

- Does The Death Benefit Affect Your Beneficiaries?

- Final Thoughts

Let’s start off and discuss Medicaid. Skip ahead if you already have a solid understanding of the Medicaid program.

What Is Medicaid?

Medicaid is a state-administered program designed to assist and provide health coverage for low-income adults, children, women, the elderly, and the disabled.

However, it is more than healthcare coverage. Consider these programs administered by Medicaid (depending on the state):

(1) Autism services

2) Dental care

3) Behavioral services

(4) Telemedicine

The states determine Medicaid services, but they must follow mandatory benefits established by the Federal government. The Federal government partly funds the state’s Medicaid programs.

Medicaid Eligibility Through The Medicaid Asset Limit And Income Limit Tests

Eligibility for Medicaid is not as straightforward as it sounds or should be. The Affordable Care Act split Medicaid eligibility into 2 groups.

- Based on Modified Adjusted Gross Income (MAGI) and

- those who are not eligible based on MAGI (ie. Non-MAGI)

Certain individuals fall under the MAGI category. Nursing home eligibility and Medicare beneficiaries under 100% of the federal poverty level fall under the non-MAGI category.

If you are non-MAGI eligible (which is likely), you must meet an income and asset test to qualify for Medicaid.

The income test varies among the states. For example, a single individual living in Illinois has an income limit of $1,215 per month. However, the income limit in Maine is $2,742.

Although a few states are different, most states have an asset limit of $2,000 for a single person.

Anything you have below these limits essentially qualifies you for SSI. SSI, or Supplemental Security Income, is paid in addition to the social security payments you’ll receive from your work credits.

In other words, you have to have fewer than these limits in order to qualify for Medicaid! Crazy, right?

This means if you need government assistance (and long-term care services paid by Medicaid are considered government assistance), and you have significant assets, you will have to spend down your assets.

Some types of life insurance are a countable asset for Medicaid. Life insurance policies that contain a cash surrender value, in particular, are a countable asset for Medicaid purposes. Let’s discuss countable assets and exempt assets in more detail next.

Your Assets = Resources For Medicaid Eligibility

The income limit is pretty straightforward. You just can’t earn an income above the Medicaid income limit.

However, there is some confusion regarding how Medicaid categorizes assets. First, Medicaid calls your assets “resources.” Some resources are “countable,” and some are exempt assets for Medicaid eligibility purposes.

Medicaid has a unique list of what is a resource and what is not.

The link shows what assets are countable toward the $2,000 Medicaid resource limit. Generally speaking, your home, car, and some nominal personal items are exempt assets for Medicaid eligibility purposes. In other words, they do not “count” towards the $2,000 Medicaid resource limit. They are an exempt resource.

However, many assets do count. Financial assets such as checking and savings accounts, IRAs, brokerage accounts, and 401(k)s are countable resources. We will get into this further, but whole life policies containing cash surrender value are a countable asset as well.

What does this all mean if you need to qualify for Medicaid?

Easy Example Of The Medicaid Asset Limit

Here’s an example. Let’s say you have $150,000 in a 401k. You are diagnosed with Alzheimer’s. Your family enrolls you in a nursing home, and they immediately apply for Medicaid to pay for your care. Medicaid says, “Nope. You will need to spend down that $150,000 for us to pay.” This scenario is the infamous “Medicaid spend-down” process.

Of course, this is an easy example. Moreover, there are tax and estate implications without proper planning. These implications are outside the scope of the article. Again, we recommend you speak to a lawyer in your state for answers to specific questions. Essentially, to qualify for Medicaid, you must be completely destitute, spend down your countable assets (if you have any), and really not maintain any assets.

How does life insurance affect Medicaid eligibility, though? We discuss that next.

How Does Life Insurance Affect Medicaid Eligibility?

You may be wondering, “How does life insurance affect my Medicaid eligibility?” Well, here’s how.

In a few ways:

- If you are receiving SSI, or

- You are eligible through other non-MAGI limits, or

- You need nursing home care

Then, having a life insurance policy could deem you ineligible for Medicaid.

But, just not any life insurance policy. The type of life insurance you have matters to Medicaid.

Whole life policies with cash value are considered a countable asset for Medicaid eligibility. In order to qualify for Medicaid, you would have to “spend down” these whole life policies. Specifically, policies containing more than $1,500 of a face amount must be spent down or removed in some way. (See our recommendations below.)

The cash surrend er value contained in permanent life insurance (whole life and universal life insurance) contains value. This value is an available asset for Medicaid eligibility purposes. You would have to “spend it down” somehow to qualify for Medicaid.

er value contained in permanent life insurance (whole life and universal life insurance) contains value. This value is an available asset for Medicaid eligibility purposes. You would have to “spend it down” somehow to qualify for Medicaid.

To be clear, generally speaking, term life insurance policies are exempt assets for Medicaid eligibility. Term life insurance has no cash value. If you cancel your term policy, then you receive $0. The $0 value is why Medicaid considers term life insurance an exempt asset. However, speak to a qualified attorney in your state, as Medicaid rules are different among the states.

Example Of Cash-Value Life Insurance And Medicaid Spend Down

Here’s an easy example that illustrates the cash value. Let’s say you have a life insurance policy with a face amount of $100,000 that contains $55,000 of cash value.

That is definitely a countable resource. The $100,000 is above the $1,500 face amount limit, which means the cash value becomes countable for Medicaid eligibility. In other words, Medicaid will say, “Mr. Jones, in order for us to pay your Medicaid needs, you have to spend down that $55,000 in cash value.” (Moreover, this does not assume other spendable assets you have.)

What does this mean for your life insurance? It means your policy is essentially ineffective. You’ll have to terminate your life insurance policy. Or, you can utilize some of the recommendations we describe below.

However, that stinks, doesn’t it? You paid into a policy all those years. Now the life insurance is used for something other than its original intention.

What will your loved ones do for your funeral and final expenses? If like most families, they don’t have $10,000 to $20,000 for a funeral, let alone yours.

What do you do? Not to worry. There are solutions. The fact that you are reading this article now shows you can take care of this now.

Now is a good time to discuss the 3 life insurance options that allow you to keep your Medicaid benefits.

3 Ways To Obtain Life Insurance And Keep Your Medicaid Benefits

Before we discuss the 3 life insurance options available to Medicaid recipients, let’s recap what we have discussed so far.

We discussed that Medicaid is a program designed to support the poor, disabled, or destitute.

Medicaid recipients qualify for Medicaid through (primarily) meeting an income limit test and an asset limit test.

In order to qualify for Medicaid, a Medicaid applicant must have resources below these limits.

Medicaid considers the cash surrender value of life insurance that contain a face amount of $1,500 and higher as a countable asset towards the asset limit. Life insurance policies that contain cash value include universal life and whole life policies.

Generally speaking, Medicaid does not consider term life insurance policies as a countable asset. The reason is that term life insurance contains no value.

So, what are your options, then? Let’s talk about them next.

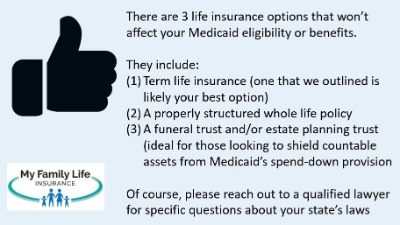

#1 Term Life Insurance For Medicaid Eligibility

As we discussed earlier, term life insurance is an option. Since it contains no cash value, it contains no asset value. If you have term life insurance, or apply for term life insurance, Medicaid won’t disqualify your eligibility because there is no cash surrender value to spend down.

We do work with a term life insurance policy that most people on Medicaid/SSI qualify for. Depending on your age, you can purchase up to $150,000 of death benefit. The rates are fixed for up to 35 years.

Moreover, we are one of the few brokers who offer a guaranteed issue term life insurance policy.

Before going forward with any of these, though, it is best to contact us first so we can understand your situation and explain the term policies.

Again, If you have specific questions about the Medicaid laws in your state and eligibility, please contact a qualified elder law attorney in your state.

#2 Whole Life Insurance…If Structured The Right Way

Whole life insurance is an option.

John. You just said whole life has a negative impact on my Medicaid eligibility!

Yes, that is right. However, a simple solution to this is to have someone else not on Medicaid own the policy. Say a son, daughter, or brother or sister.

on Medicaid own the policy. Say a son, daughter, or brother or sister.

Remember, Medicaid looks at ownership. If someone else owns a policy on you, they own the policy. Not you.

Ownership is the issue with Medicaid. Most people own their life insurance policies outright. If they need Medicaid, their whole life insurance is subject to the spend-down process.

Now, this is where you should contact a qualified lawyer in your state. However, we discuss a general overview here.

If someone else owns the policy, then that scenario usually keeps you eligible for your Medicaid assistance. Again, speak with a lawyer for specific questions about your state or situation.

As we stated, the issue is ownership. On the life insurance policy, you will be the insured, and someone else will be the owner.

Now, not anyone can be the owner. Typically, an owner should be a trusted loved one like a son or daughter or a sibling.

Ownership And Insurable Interest Are Important In Life Insurance And Medicaid

Carriers look at insurable interest connections for beneficiaries. Insurable interest means the beneficiary will be negatively impacted upon your death. This means the beneficiary should be a loved one, relative, or even a business associate. Death impacts these relationships.

Insurable interest also affects ownership. Most carriers do not allow a stranger to own the policy or some distant relative with no love or business connection.

Of note: we have many children who purchase small whole life insurance policies on their parents. The parents receive SSI, and the adult child is the owner.

As long as the owner is not on Medicaid his or herself, then having a loved one own the policy is no problem. Again, please reach out to a lawyer in your state regarding any specific state laws.

#3 A Funeral Trust Keeps You Eligible For Medicaid

To solve the Medicaid and life insurance eligibility problem, a funeral trust works nicely.

Just as it sounds, it is a trust.

First, though, 2 popular types of trusts exist. One type of trust allows you to maintain control of the assets in the trust. Because of this control, Medicaid and creditors could legally force you to use the trust value (the life insurance and any other assets) inside the trust to pay off debts, etc, including nursing home costs. These are called revocable trusts.

This isn’t the type of trust used for a funeral trust.

The other type is called an irrevocable trust. A funeral trust is irrevocable. This means the trust protects the value from Medicaid, creditors, etc. They can’t get at it, touch it, or force you to use it.

Conversely, neither can you.

Once the money is in there, it’s in there. You can’t borrow from it, you can’t change it, nothing…

But, why would you want to change it? The purpose of the Funeral Trust is to prevent Medicaid or the nursing home to use the accumulated cash value in your current life insurance policy.

From that standpoint, the funeral trust serves its purpose rather nicely.

Specifics On Transferring The Cash Surrender Value To The Trust

When you transfer your life insurance policy to the trust, you are in fact transferring the cash value of the policy, not the face value of the policy. For example, let’s say you have a small whole life insurance policy with a face value of $10,000. It contains $7,000 of cash value. It’s the cash value that transfers to the funeral trust.

Some people don’t like that. However, think about this. Would you rather protect that $7,000 and use it for your burial needs or force to terminate the policy? Because that is what you will have to do if you want to qualify for Medicaid.

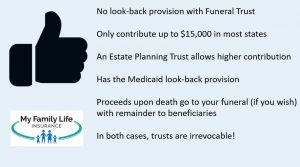

A funeral trust works well for someone who has assets and is in need of qualifying for Medicaid. The trust avoids the 60-month look-back period.

Just as it sounds, the money pays out for your funeral or burial expenses.

Most states allow up to $15,000 transferred into the funeral trust.

If that doesn’t seem like much, then there is the Estate Planning Trust.

A Bonus: Estate Planning Trust

As we stated, a funeral trust has no look-back provision. With asset transfers and Medicaid, currently, asset transfers within 5 years of entering into a nursing home are subject to penalties.

With a funeral trust, once the money is there, the money is protected from day 1.

How great is that?

However, what if you want to fund more money above your state’s maximum? Or, what if your state does not allow a funeral trust?

Good news. An Estate Planning Trust exists. It operates similarly to a funeral trust. Same protections. The difference?

- you can fund up to $100,000 in combination with the funeral trust

- 5-year Medicaid look-back exists

- money left over from your funeral goes to your designated beneficiary, not your gross estate

Like the funeral trust, this is irrevocable. Once it is done, it is done. But, think back to what we said. What are we protecting here? Your life insurance and other assets from Medicaid, right?

So, if you have money set aside for your children, say in a brokerage account, that money is subject to the Medicaid spend-down rules.

Remember, cash-value life insurance is subject to the Medicaid spend-down process as well, unless you transfer the cash value into a funeral trust.

The Estate Planning Trust works the same way. The cost of the trust is free. You just need to be aware of the 5 -year Medicaid look back for nursing home spend-down.

Let’s now discuss some common questions many people ask about Medicaid and life insurance.

Can Medicaid Take Life Insurance Away?

No Medicaid can’t take your life insurance away. What happens, however, is if you apply for Medicaid, any life insurance with cash value becomes a spendable asset.

So, in order to qualify and be eligible for Medicaid, you must spend down those assets, including life insurance with cash value (whole life or universal life).

Or, you can utilize one of the strategies we identified earlier.

In terms of term life insurance, Medicaid has no problem with your owning term life insurance. In other words, Medicaid can’t take your term life insurance away.

However, the problem becomes in order to qualify and maintain eligibility for Medicaid (based on non-MAGI), you’ll need to spend down those assets, typically to $2,000, and/or maintain a low income (varies by state).

Anyone should understand that is poverty level.

Additionally, Medicaid allows you to keep the cash value in a life insurance policy with face amounts of $1,500 or less. However, those face amounts are not realistic. Do you know anyone with a life insurance policy of $1,000? Neither do I.

For any amount above that $1,500, you will need to spend down the cash value in the policy.

In other words, having a life insurance policy with cash value can affect your Medicaid eligibility and your aid. We discuss more next.

Can You Get Life Insurance If You Are On Medicaid Or Receiving SSI?

I receive this question a lot, and the short answer is, yes. As mentioned earlier, you can still purchase life insurance if you are on Medicaid and/or receiving SSI.

We discussed three life insurance options if you receive Medicaid or need eligibility for Medicaid.

However, be careful of what you read and hear elsewhere. Many agents will say that life insurance has no effect on Medicaid eligibility. On the one hand, this is right. However, on the other hand (and most importantly), Medicaid will disqualify your assistance if you have too much cash value in your life insurance. They’ll essentially say, “Hey, Mrs. Jones. Sure, you can keep your life insurance policy. But, you’ll disqualify yourself from your Medicaid assistance. What do you choose?”

Is that what you want? Do you want to disqualify yourself from Medicaid?

Likely not.

Many agents will say, “Mrs. Jones. No need to worry. The cash value grows slowly. You will have nothing to worry about.”

This is false and risky.

In fact, the cash surrender value – remember, this value is considered an asset for Medicaid eligibility – can grow rather rapidly.

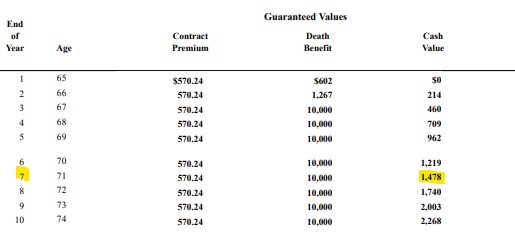

Check out this real illustration. It is from a conservative life insurance company. In other words, their cash value typically grows slower than that of other carriers. Moreover, it is a guaranteed issue life insurance policy. These policies typically have slower cash value growth.

I highlighted an alarming number. In year 7 of the policy, Medicaid will likely disqualify you from aid. So, unless you die before then, you’ll have a tough decision to make.

Is this what you want? Probably not. If you get to this point, the agent who wrote you the policy could be long gone or just tell you that you have other options.

That’s unsettling to us, so we don’t put our clients in that position to begin with.

How Does Receiving A Death Benefit Affect Your Medicaid Eligibility?

People ask us about the impact of receiving a life insurance death benefit. How does that death benefit impact a person who receives Medicaid?

Again, I am not a lawyer, and I recommend you speak to a reputable Medicaid/elder law attorney in your state for specifics.

However, if you are on Medicaid and receive a death benefit, that death benefit amount is usually considered income. Depending on the laws in your state, receiving that income will negatively impact your Medicaid eligibility and cancel your benefits. The death benefit is not taxable to you, but it is likely reportable to Medicaid.

Again, you need to check the laws of your state and speak to a qualified attorney.

There are ways around this scenario. A trusted loved one could be the beneficiary instead of you. Additionally, a trust could be the beneficiary. The trust could pay you income as the Medicaid recipient and not impact your assistance. However, check with a lawyer as this topic is beyond the scope of this article.

Does A Life Insurance Death Benefit Affect A Payout To My Beneficiaries?

Moreover, owning the life insurance policy outright doesn’t affect your beneficiaries. In other words, Medicaid can’t go after your beneficiaries for any estate recovery upon their receiving the death benefit. The death benefit goes directly to your beneficiaries and avoids probate.

However, if you yourself, as a Medicaid recipient, name yourself as the primary beneficiary, then yes, Medicaid could make claim to your death benefit.

If this happens, your death benefit will enter your gross estate (since you named yourself as beneficiary). Then, Medicaid and any other creditors can make a claim for estate recovery.

Only after all creditors and liens have been satisfied will your next of kin receive any remaining death benefit.

(Note: see our related article on life insurance beneficiary mistakes.)

Now You Know 3 Life Insurance Options That Don’t Affect Your Medicaid Eligibility

I hope you found this article informative. Yes, you can protect your life insurance from Medicaid, keep your Medicaid benefits, and protect the spend-down process. We discussed several ways you could go about this, including:

- Term life insurance

- Whole life structured properly

- A funeral trust and/or an estate planning trust

Don’t know what to do next? Give us a call, contact us, or use the form below. We would be happy to help you.

As with everything we do, we place your best interests first. That means we won’t recommend a solution if it does not make sense in your situation. Even if there is a solution that we can’t provide, we will tell you about it and help you in any way we can. This is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

10 thoughts on “Does Life Insurance Affect Your Medicaid Eligibility? It Can. We Discuss 3 Options That It Won’t”

Comments are closed.

My 86 year old mother is in a nursing home and, other than a $15,000 whole life insurance policy, would qualify for Medicaid.

She has a pre-paid irrevocable funeral contract, so the funeral trust is not an option.

Her adult children would like to preserve the life insurance value above the current cash value ($9000).

One suggestions has been for the adult children to “buy” the policy from her – basically pay her the cash value and transfer ownership to one of them, but how would that need to be done to make Medicaid happy.

Hi Gladys,

The funeral trust is one, easy way, but your Mom has fulfilled that option already.

I am not a lawyer, and I suggest you speak to one to obtain the correct guidance for your state. Generally speaking, her adult children could become the owners of the policy, but she has to be of sound mind to do so. Again, I would consult an attorney in this regard so you can follow the rules in your state.

John

My wife has Alzheimer and is in a memory care facility. I have POA and she has no life insurance at all. She is currently on Medicaid. We get plenty of offers for guaranteed acceptance whole life, no medical exam, no medical questions and structured payout for the first 2 years of the policy. Is it too late to purchase life insurance on her behalf and still get it in an irrevocable trust? There seems to be no sense to get a burial policy if Medicaid is just going to take the proceeds. Is there any way around this so I can at least get funds to bury her? If it helps I’m a 100% disabled Vietnam veteran who does get a free burial plot for my wife.

Hi Don,

Thanks for reaching out to us. I am sorry to hear this. Life insurance is available. It would be a guaranteed acceptance policy as you said since your wife is in a facility. As we wrote, there is a carrier that has this irrevocable trust now. Availability and the amount you can put into the trust depends on the state you live in. Let us know if you want us to help more. We will send you an email.

John

My mother has whole life insurance of $8000. She needs to go on Medicaid for long term care. Can Medicaid take the policy if my brother and I are named as beneficiaries…OR..if I as her adult child is on permanent disability?

Hi Deb – Thanks for reaching out to us. I appreciate it. I would suggest speaking to a qualified lawyer who specializes in Medicaid law in your state. But, I can give you a general education. First, yes, they can if your mother needs to qualify for Medicaid. It really depends on the cash value in the policy. Medicaid might say “Hey, before you want us to pay for your Mom’s care, she needs to use that cash value in the policy”. These cases might terminate the policy. If your mom is of sound mind, she could transfer the policy to you as owner.

However, if your mom passes, Medicaid can’t take life insurance from you or your brother as beneficiaries.

John

Hi John, My name is Bob and I reside in Illinois. I had stopped working and went on SS (my only source of income) and have used Medicare/Medicaid at/since age 62; I am now 68. I have a $100,000 term life policy with my now ex-wife and two (2) sons as beneficiaries. I have no retirement income but what I receive from SS. Do I have to worry about Medicare or Medicaid coming after that policy? My health, at the present moment, doesn’t dictate that I’ll be having the need of Long term Care provided by the state; however what DHS has picked up/assisted with, has helped tremendously. I don’t own property anymore and my annual income is less than 16k/per year. I would like to leave my family something to help out with their futures. I would appreciate any advise or insights you have . Much appreciation. Thank you in advance for helping.

Hi Bob,

Thanks for reaching out. I am happy you found our article informative.

First thing, I am not an estate lawyer, so if you have specific questions about Medicaid, you should contact an elder law attorney in Illinois.

Generally speaking, Medicaid can’t take the death benefit money on life insurance. Upon your passing, that money goes to your beneficiaries. It is outside of probate. Unless your beneficiaries are on Medicaid or receiving some type of aid which depends on an income/asset resource test, your beneficiaries should receive that money OK.

If you are looking for more life insurance, likely the only type you will qualify for now is whole life. That contains cash value and can potentially affect your resources if you own the policy. I have heard and read many other agents say it is OK for you to own the policy. In my opinion, it is not. The cash value can increase rapidly and before you know it, the life insurance cash value would be a countable asset for Medicaid. That would seriously disrupt your aid.

This is why I generally recommend having someone else own the policy (say your sons) provided the person who owns it is not on Medicaid themselves.

Again, this is a general answer. I am not a lawyer, and I recommend you speak to one if you have specific questions as every state has some nuances when it comes to Medicaid.

If you’d like to chat about it, I would be happy to and can be reached at (800) 645-9841.

John

Hi john, my name is Mckenzie i reside in Kentucky and i am a beneficiary on my friends life insurance policy i dont know the cash surrender value i just know its a whole life policy of 75,000 the thing is if he passes away and leaves me his policy will it effect my medicaid eligibility

Hi McKenzie,

Thank you for reaching out to us. First, I would consult a lawyer in your state to find out specific information about the Medicaid laws in KY. However, usually, if a Medicaid recipient receives a life insurance death benefit, the death benefit will count toward his or her income for Medicaid and potentially disqualify from aid.

John