Your Final Expense Insurance Could Be Taken By Nursing Homes – Unless You Do This

Updated: April 12, 2024 at 9:40 am

If you have a final expense life insurance policy, you probably don’t think it could affect your care in nursing homes.

If you have a final expense life insurance policy, you probably don’t think it could affect your care in nursing homes.

We know you did the right thing. You purchased a final expense insurance policy to take care of your burial expenses and leave some money to your spouse or surviving heirs upon your death. And, you feel good about the decision. It is a good one: you don’t want them to worry about paying for a funeral while grieving. Of course, you want to leave a legacy for your family as well.

But you weren’t aware of a potential problem with nursing homes and life insurance (which is final expense insurance).

Several years later, you enter a nursing home. It was a surprise, because you were very healthy. Your spouse and your family spend assets to pay for your care. After spending a significant amount on nursing home costs, your spouse and children decide your assets have reached a limit where Medicaid will start to pay.

Per state Medicaid law, the state requires you to list your remaining assets on the Medicaid application. A few weeks later, your spouse and children receive notice from Medicaid. Expecting an approval, they are shocked when they read the notice. Medicaid denies your application. Medicaid says the cash value in your final expense insurance policy will have to be used to pay for your nursing home care before it will pay. As a result, your spouse and children become very concerned, wondering what they will do now to pay for your burial and final expenses.

An All-Too-Common Situation With Final Expense Insurance And Nursing Homes

This can be an all-too-common situation. You have good intentions and purchase a final expense insurance policy to pay for your burial expenses. But, you did not realize an important factor.

What you did not realize is that Medicaid forces you to spend the cash value in final expense insurance before it will pay for nursing home care.

It’s true.

In fact, Medicaid forces cash value from any life insurance policy to pay for nursing home care. This is state Medicaid law. Generally, any asset in your name is used to pay for nursing home expenses. Assets include the cash value in a life insurance policy.

Many people do not realize this until it is too late.

The process of using your assets to pay for nursing home care is called Medicaid spend down. Medicaid pays for nursing home care once your assets are “spent down” to a certain state level. Every state has different asset levels. Generally speaking, though, the asset level is $2,000 or $3,000. It’s not much.

Once you attain this threshold, you are eligible for Medicaid. We know; that practically leaves you destitute. You worked hard for your money. Now your money is gone.

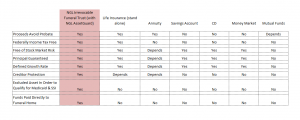

That means the CD you bought, your retirement accounts, the savings accounts, etc – those all could be subject to Medicaid spend down. Social security checks and certainly your retirement savings, too. See below.

Additionally, in some states, the equity in your home can be subject to the Medicaid spend down process. There are higher asset provisions for the non-custodial spouse. For instance, some states allow the non-custodial spouse to have between $100,000 and $150,000 in assets.

Nevertheless, this process stinks. Medicaid considers your final expense life insurance as a spendable assets for nursing home care.

Ways To Protect Your Final Expense Insurance From Nursing Homes

Luckily, there are ways around this if you plan.

The first is a traditional long-term care (LTC) insurance policy. We at My Family Life Insurance believe a traditional LTC policy can be one of the best ways to protect your assets from nursing home costs; however, two dilemmas face consumers:

- the high premium expense

- the perceived notion of paying for insurance you won’t use

While we believe many people will need some long-term care in the future, people just don’t want to pay for this type of insurance. Fortunately, there is another type of LTC policy which can help.

The second way is a hybrid LTC insurance policy. In this option, a LTC insurance policy attaches to a life insurance policy or an annuity. These can be a solid option as it avoids the “use it or lose it” perception as with a traditional LTC policy. However, it lacks several advantages of a traditional LTC policy including tax advantages and estate protection.

A Funeral Trust Can Help Protect Your Final Expense Insurance From Nursing Homes

An easy way to avoid the Medicaid spend down process, prevent nursing homes from getting your life insurance, and retain your final expense life insurance is using a funeral trust.

What is a funeral trust?

A funeral trust is simply an irrevocable trust funded with a life insurance policy. The life insurance policy is a pseudo-life insurance / annuity policy.

Every state allows a maximum amount of money contributed to this particular trust (up to $15,000, depending on the state).

In our opinion, a funeral trust is really the simplest way to protect your final expense life insurance assets from nursing homes.

It’s important to reiterate that the funeral trust protects the cash value of your existing life insurance / final expense insurance policy. It does not protect the death benefit value. Why? Because Medicaid and nursing homes go after the cash value. You own that. Unless it is a crisis siutation, we recommend transferring your final expense life insurance policy when the cash value reaches around 70% of the death benefit.

If you have saved for your burial – or thinking about it now – you already earmarked money anyway. Essentially, you already “spent them away” on your funeral. A funeral trust will officially protect the cash value from Medicaid, the spend down process, and nursing homes.

Most importantly, your surviving family will have the confidence the money will be there for your funeral. They won’t have to pay out of pocket.

The Advantages Of A Funeral Trust

The trust itself and life insurance are very easy to set up. Here are the advantages:

- the trust is easy to set up – a two-page application

- no cost for trust; it is free

- the trust can be used at any funeral home

- the peace of mind that everything is taken care of

- avoid probate

- upon death, money to the funeral home within 48 hrs

- avoids 5 yr lookback – immediate exclusion from Medicaid spend down process. This can be extremely useful in “crisis” situations if a family member is in a nursing home with a life insurance policy at risk

The Disadvantages Of A Funeral Trust

Of course, nothing is perfect. There are advantages and disadvantages to everything. While we believe the advantages outweigh the disadvantages, the disadvantages are:

- the trust is irrevocable, which means once it is set, it can’t be changed. You can’t access the cash value of the life insurance. Therefore, you can’t change the particulars.

- the money is paid directly to the funeral home. Your estate receives any excess money. As a result, the excess could go through the probate process.

Example How The Funeral Trust Works

Let’s say you have a $15,000 final expense insurance policy with $11,000 of cash value. The cash value is subject to the Medicaid spend down process. You want to move the cash value from a spendable asset to a protected one.

You fill out the life insurance application and trust paperwork. The cash value tranfers to the trust. The value of the trust increases $500 to $11,500. Your state has a $15,000 limit, so you can add up to $3,500 more if you wish.

Alternatively, you can pay into the trust every month. Let’s say you pay $120 per month to the trust. The trust will grow approximately $120 each month (a little more because the cash value grows at a pre-determined interest rate).

What happens if you or a family member are in a “crisis” situation with Medicaid ready to take your final expense insurance policy and use the cash value for the nursing home? Well, we inform the carrier and they expedite the process so any cash value in the policy is not lost to the nursing homes.

What Expenses Are Paid By A Funeral Trust

Many expenses including, but not limited to:

- Dressing/Cosmetology

- Funeral Home Services

- Casketing

- Viewing/Visitation

- Funeral Service

- Memorial Service

- Graveside Service

- Clergy

- Death Certificates

- Musician

- Obituaries

- Stationery Packages

- Flowers

- Clothing

- Open/Closed Casket

- Burial Container

- Transportation Equipment & Driver

- Transfer of Deceased

- Limousine

- Hearse

- Cemetery Charges

- Utility/Service Vehicles

Back To The Example

Recall that one of the benefits of a funeral trust is the immediate exclusion from the Medicaid spend down process. In our example, the spouse and family can apply for the funeral trust, even if the spouse is in the nursing home. The family could transfer the cash value of the existing final expense insurance policy to the funeral trust. Once established, the trust protects the money from nursing home costs.

What Assets Can Fund The Trust?

Several types of assets can fund the trust. These assets include: CDs, savings accounts, non-qualified brokerage accounts, cash value from existing life insurance policies (such as a final expense insurance policy). Really, any asset you own that is non-qualified (i.e. not a 401k or IRA) can fund the trust.

An Estate Planning Trust Expands Protection

Let’s say you have more assets that you want to protect. For example, you want to leave money to your children, grandchildren, or a charity. You can establish an estate planning trust. The estate planning trust expands the maximum protection, up to $100,000 in most states. The estate planning trust contains similar advantages and disadvantages as a funeral trust. The one big difference: you must meet the 5 year Medicaid look back provision. If not, you could face a penalty or delay of payment by Medicaid for nursing home care.

If you need a full estate planning review, we always recommend that you speak to a qualified attorney specializing in elder law care.

Final Thoughts

In conclusion, we believe a funeral trust is a solid foundation to protect assets and your final expense life insurance from nursing homes and the Medicaid spend down. We at My Family Life Insurance know how important money and protection is. We work in your best interest always and have helped many families develop and establish the protection they need to have peace of mind. Feel free to contact us or use the form below to request a quote or find out more information. We are happy to help you with your specific situation.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Your Final Expense Insurance Could Be Taken By Nursing Homes – Unless You Do This”

Comments are closed.

My Mother-in-law is concerned about a nursing taking her funeral life insurance and wants to know how to prevent this from happening to her.

Hi Cindy – thanks for reaching out to us. There are a few ways to handle. She could transfer ownership to someone else (someone very trustworthy) or transfer the cash value to a funeral trust. The ownership transfer can be tricky. Many other agents suggest this route, but if the transfer is within 5 years of needing Medicaid/nursing home, your mother-in-law will have a penalty. I generally always recommend the funeral trust.

If you would like to chat further, feel free to contact us at (800) 645-9841.

John