How A Funeral Trust Helps With Medicaid Eligibility | How It Helps You Qualify For Medicaid and Long-Term Care Coverage

Updated: April 12, 2024 at 9:38 am

I think the Funeral Trust is the best-kept secret in Medicaid planning.

I think the Funeral Trust is the best-kept secret in Medicaid planning.

John, what is that? I’ve never heard of it.

Not many people have. That’s what we are going to discuss in this article. We are going to introduce the benefits of a Funeral Trust and how it helps Medicaid eligibility.

Essentially, it helps people qualify for Medicaid if they have an existing life insurance policy or other spend-down assets. (Don’t worry; we will discuss all this.)

Here’s what we will discuss:

- What Is A Funeral Trust

- How It Helps With Medicaid Eligibility

- What Are The Advantages Of A Funeral Trust

- FAQs About A Funeral Trust

- Now You Know How The Trust Helps With Medicaid Eligibility

Let’s jump in and introduce the trust.

What Is A Funeral Trust?

A funeral trust is a type of trust. Let’s first take a step back a define what a trust is. A trust is a separate, legal entity created when a person transfers assets.

Think of it as a new person created (but not in human form). This new person – the trust – has its own EIN. (Called employer identification number. It is like a social security number for a legal US resident / US citizen.)

the trust – has its own EIN. (Called employer identification number. It is like a social security number for a legal US resident / US citizen.)

You give this new person – the trust – assets. Assets are anything with value. This could be your checking account, stocks, bonds, car, home, life insurance, etc. The process of transferring the assets to the trust is a simple re-titling of ownership. In other words, instead of you being the owner of, say, your checking account, the trust becomes the owner.

But, the trust in real life isn’t human. So, you name a trustee to manage the assets in the trust.

Trustees hold fiduciary responsibility. In the financial world, that responsibility is extremely powerful. Many financial people say they hold fiduciary responsibility, but, in actuality, they don’t. For example, since I am a CFP® Professional, I hold fiduciary responsibility when working with clients on insurance plans.

You can name a trustee, but you want someone who has the knowledge, skill, and fiduciary duty to manage the assets. Many financial advisers, lawyers, and financial institutions have fiduciaries who do just that.

Two Common Types Of Trusts

Many types of trusts exist; however, 2 of the most common are:

- Revocable trusts

- Irrevocable trusts

Revocable trusts allow you to retain control of the assets in the trust.

On the other hand, irrevocable trusts do not. Once you create an irrevocable trust, you can’t break it. Well, it is extremely hard to break the trust. You would have to go to court and spend a lot of money doing so.

A Funeral Trust is a type of irrevocable trust. The Funeral Trust has to be irrevocable in order for it to work correctly for Medicaid eligibility and planning. Many times, a Funeral Trust is called an Irrevocable Funeral Trust. It is the same thing.

We discuss why a Funeral Trust is an irrevocable trust next.

How A Funeral Trust Helps With Medicaid Eligibility And Planning

We just informed you that a Funeral Trust is an irrevocable trust. Sometimes, you will hear Funeral Trusts called Irrevocable Funeral Trusts. These mean the same thing.

A Funeral Trust has to be irrevocable because of one word: control. Here’s why.

When someone applies for Medicaid, the government looks at your:

- Monthly Income

- Assets

- A 5-year look-back rule

In regards to assets, Medicaid says you can’t have more than $2,000 of assets in your name. In other words, you can’t own more than $2,000 worth of assets.

John, what if I have more?

John, what if I have more?

Good question. Now, there are some assets exempt from this rule (outside the scope of this article), but if you have more assets, then you’ll have to spend those assets.

In other words, you have to spend the assets or sell them in order to meet the $2,000 threshold.

This is known as the Medicaid Spend-Down that you may have heard about.

OK, easy! I’ll start giving my assets away to my family or spending them.

Well, not so easy. Medicaid has a rule. It is the 5-year look-back rule.

Ugh, I’ve heard of this!

Yes, essentially, if you’ve spent down or transferred assets in the past 5 years, Medicaid penalizes you by delaying your eligibility.

Then, what do I do?

This is where a Funeral Trust helps.

Here’s How A Funeral Trust Helps With Medicaid Planning And Eligibility

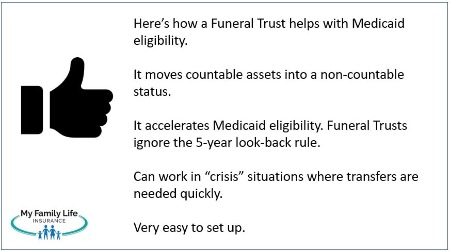

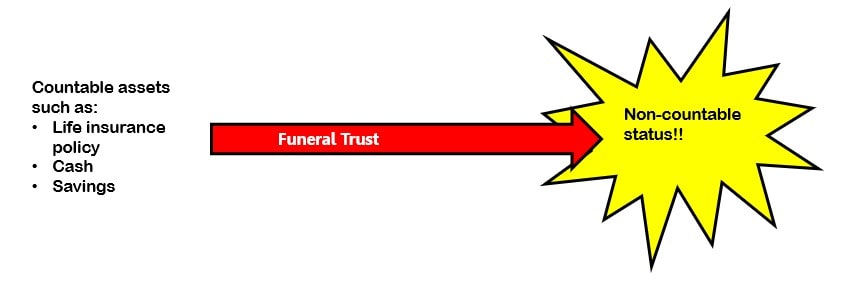

So, how does the Funeral Trust help then? Here’s how the Funeral Trust helps with Medicaid eligibility. It:

- Moves these spendable, countable assets for Medicaid to a non-countable status, and

- Avoids the 5-year look-back rule

That is right. You can transfer assets to the Funeral Trust 30 days ago, for example, and the 5-year look-back rule doesn’t apply.

Assets transferred to the Funeral Trust move to a non-countable status. They don’t count against Medicaid.

Assets transferred to the Funeral Trust move to a non-countable status. They don’t count against Medicaid.

It also doesn’t affect the 5-year look-back rule.

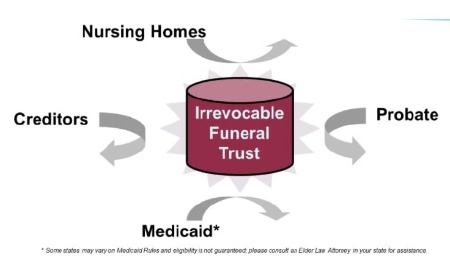

The main reason for this, as we mentioned, is the irrevocable nature of the Funeral Trust. You give up control of the assets in the trust. By giving up control, these assets bypass the spend-down process, and the Funeral Trust helps you qualify for Medicaid quickly.

How Does A Funeral Trust Work?

How Does A Funeral Trust Work?

Here is how a Funeral Trust works.

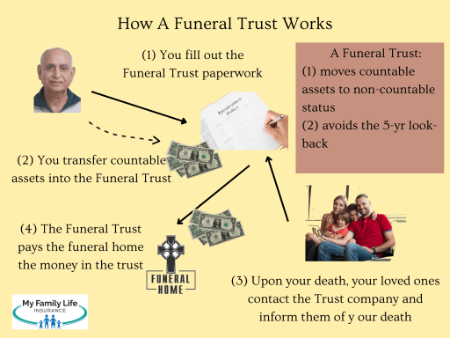

- You fill out an application from the Funeral Trust company. Most companies are life insurance carriers. The applications are usually simple, a few pages, and eligibility is usually guaranteed issue. That means no health questions and no underwriting.

- You transfer assets into the trust. You can do this in various ways. Contact us to learn more. Most states allow up to $15,000 in the trust.

- Once the trust is funded, the trust protects you from creditors, nursing homes, probate, etc.

- The company is the trustee. As we mentioned, the company holds fiduciary responsibility.

- Upon your death, your family contacts the company and tells them of your passing. They give the company details of your funeral home.

- The company transfers the money in the trust to the funeral home to pay for your funeral.

- Any money left over is, by law, included in your gross estate. It will then have to go through probate.

- If the funds are less, then your loved ones will have to pay the remaining balance to the funeral home.

It is a rather easy process.

Note: if you are transferring an existing life insurance policy, the cash value of the policy transfers to the trust.

The Funeral Trust works very well in situations where someone has limited assets and needs eligibility for Medicaid quickly.

The Advantages Of A Funeral Trust For Medicaid Eligibility

Many advantages of Funeral Trusts exist for Medicaid eligibility. These advantages include:

advantages include:

- Moves countable assets to non-countable status

- Avoids the 5-year look-back rule

- Medicaid eligibility quicker

- Creditors, nursing homes, and probate can’t get at the trust

- Peace of mind knowing money is there for your funeral

- Can be completed in “crisis” situations

- It’s portable. The money is not tied to a specific funeral home

Establishing a Funeral Trust allows you to “pre-pay” your funeral. By doing so, you reduce your countable assets and can qualify for Medicaid.

What Are The Disadvantages?

In my opinion, there aren’t many disadvantages to a Funeral Trust. However, there is one main disadvantage.

It is that the trust is irrevocable. Once it is established, you can’t change it.

You need to understand this. That is what the term “irrevocable” means. You can’t change it.

For example, 5 years down the road, you can’t pull the money out or dissolve the trust. Once it is established, it is established. You can’t break it.

Additionally, the Funeral Trust is really designed for people to move countable assets out and qualify for Medicaid. This includes qualifying for long-term care paid for by Medicaid.

If you have significant assets, have long-term care insurance, and don’t need Medicaid you probably don’t need a Funeral Trust.

Instead, you can buy a simple burial insurance or final expense insurance plan to meet your funeral needs.

If you are generally healthy, you even have low-cost burial insurance options.

Contact us if you have any questions.

I am sure you have questions, so in this next section, we address some frequently asked questions about Funeral Trusts and Medicaid eligibility.

FAQs About Funeral Trusts And Medicaid

Here are some frequently asked questions about Funeral Trusts and Medicaid.

What Costs Does A Funeral Trust Cover?

A Funeral Trust will cover these expenses and more:

- Direct funeral services

- Funeral home overhead

- Body embalming

- Other Preparation of the Body such as clothing

- Viewing/wake

- Funeral Ceremony itself

- Memorial Service

- Graveside Service

- Transfer of Remains to Funeral Home

- Hearse

- Limousine

- Immediate Burial

- Cremation

- Anything else

Some expenses are not covered, such as the tombstone (typically). Ask the funeral home whom you work with to determine what expenses qualify.

How Much Can You Transfer Into A Funeral Trust?

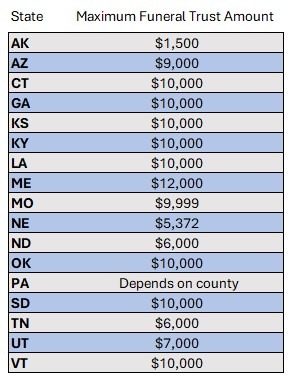

Every state is different; however, most states allow up to $15,000, which is the maximum. Currently, the following states do not allow $15,000:

These amounts are subject to change at any time. Contact us to find out the current maximum amount available in your state.

These amounts are subject to change at any time. Contact us to find out the current maximum amount available in your state.

What If I Have More Countable Assets?

This happens once in a while. If you have more assets over your state’s Funeral Trust maximum, you have some options.

You can establish a Final Expense Trust. This isn’t a Funeral Trust. The Final Expense Trust allows you to transfer up to $100,000 of assets.

However, the 5-year look-back rule governs here, so you would have to plan and have the wherewithal to establish this now.

Additionally, you can establish a Medicaid Compliant Annuity.

Outside the scope of this article, a Medicaid Compliant Annuity is also irrevocable, has no value, and names the state as the beneficiary. When properly structured, a Medicaid Compliant Annuity allows for the acceleration of Medicaid eligibility.

Contact us to learn more. We can help.

What Is A Goods And Services Statement?

Some states require a goods and services statement. A goods and services statement shows an itemized list of the goods and services related to your funeral. It shows how much you will pay.

The value in the Funeral Trust should equal the amount on the goods and services statement.

If you need a goods and services statement, contact us. We can help.

I Just Need To Get My Loved One Coverage For Funeral Needs. How Do I Go About That?

If you have a loved one on Medicaid/receiving SSI already, funeral planning options still exist.

You can still enroll your loved one in a Funeral Trust with your own assets. You just establish the trust for your loved one and pay with your own assets.

Or, you can purchase life insurance for your loved one.

We discuss ways in our life insurance for someone receiving Medicaid article.

State laws are different, so I do recommend speaking to a qualified attorney in your state beforehand.

What Is The Cost To Establish A Funeral Trust?

If you go through us and one of the providers we work with, there is no cost. The cost of setting up the Funeral Trust is free.

There is a 2 or 3-page simple application to fill out.

You don’t pay any fees to us. The carrier pays us. Our fee doesn’t affect the principal you transfer to the trust.

For example, if you have $10,000 of assets and transfer this amount to a Funeral Trust, the trust will contain $10,000 (+ interest).

Am I Locked Into A Funeral Home With A Funeral Trust?

No. One of the advantages of a Funeral Trust is that you can work with any funeral home in the country.

Do you live in Ohio, but your kids live in Florida, and you want to be buried down there? No problem. You can do that.

Once you set up your Funeral Trust, you can:

- Visit any funeral home and set up your funeral. Let the funeral director know you have a funeral trust. Trust me, the funeral director will want to know how he or she is getting paid.

- Or not. Upon your passing, your loved ones can contact a funeral home to set up your funeral. Then, they should contact the Funeral Trust carrier. The carrier will then transfer the money in trust to the funeral home for payment.

I know we don’t wake up in the morning and say, “Geez, it is such a nice day today. I think I am going to head down to the funeral home to set up my funeral.”

That never happens, but establishing a Funeral Trust takes care of a major part of funeral planning. You can then set up the specifics of your funeral at your convenience.

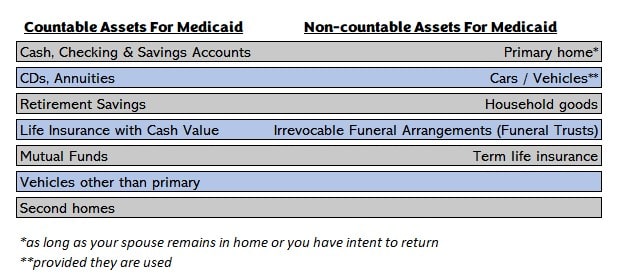

What Are Countable Assets For Medicaid?

Medicaid doesn’t consider everything with value as an asset. Here is a list of countable versus non-countable assets.

Did you see that Medicaid recipients can obtain term life insurance? We do work with a plan that is advantageous for people on Medicaid.

Did you see that Medicaid recipients can obtain term life insurance? We do work with a plan that is advantageous for people on Medicaid.

How Do I Know If A Funeral Trust Is Right For Me?

I think everyone could use a Funeral Trust, but a Funeral Trust really makes sense if you are in need of Medicaid. Medicaid pays qualified individuals:

- Supplemental security income (SSI)

- Long-term care

- Health / Medical coverage and other benefits

The purpose of Medicaid is to support the poor, unhealthy, and disabled. If you are trying to qualify for long-term care through Medicaid, then you will have to spend down your assets. We discussed this earlier. A Funeral Trust (as well as a Medicaid Compliant Annuity, if needed) accelerates your eligibility for Medicaid.

However, if you have no intention of getting on Medicaid, then there are better options to fund your funeral.

You can purchase burial insurance, which is known as final expense insurance.

You can buy up to $25,000 or $50,000 (more if you are generally healthy).

John, I have money saved for my funeral!

I understand. One advantage of life insurance is that the death benefit money completely bypasses probate and goes right to your beneficiary. Your beneficiary can then pay for your funeral. Some carriers allow you to assign part of the benefit to the funeral home you work with.

Money in other savings vehicles, like a savings account, maybe an annuity, or even a 401k / IRA could have to go through the probate process.

Now You Know How A Funeral Trust Helps With Medicaid Eligibility

Now you know how a Funeral Trust helps with Medicaid eligibility. It:

- Takes countable assets like a checking account and moves it to a non-countable status for Medicaid, and

- Accelerates Medicaid eligibility by legally avoiding the 5-year look-back rule

Do you have any questions or ready to get started? Feel free to contact us or use the form below.

There is no risk of contacting us. We only work in your best interests. That means we work for your needs, not ours or some insurance carrier.

If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".