Your Best Cost For $10,000 Whole Life Insurance Policy [By Age & Health]

Updated: June 25, 2024 at 8:41 am

Are you looking for a $10,000 whole life insurance policy? Many options exist; however, you want to ensure you purchase the right type of policy.

Are you looking for a $10,000 whole life insurance policy? Many options exist; however, you want to ensure you purchase the right type of policy.

$10,000 is a popular coverage amount because the average funeral costs about $8,000 here in the United States. That is an average. In some parts of the country, a funeral costs more. In other parts, it will cost less. Moreover, generally speaking, cremations cost much less compared to a funeral.

Most people select a whole life policy because it is designed to last a lifetime. When you purchase a whole life insurance policy, you have “pre-funded” your funeral (or other obligations). In the article, we will discuss why whole life insurance is more advantageous compared to other life insurance options like term life insurance.

We work with many life insurance companies offering $10,000 whole life insurance policies.

Here is what we will discuss:

- Overview of $10,000 Whole Life Insurance Policy

- Other $10,000 Life Insurance Options – If You Are Healthy or Not, We Have Them

- Your Best Cost For A $10,000 Whole Life Insurance Policy (Cost by Age and Health)

- Advantages and Disadvantages of $10,000 Whole Life Insurance Policy

- Application Process for $10,000 Whole Life Insurance Policy

- FAQs About $10,000 Whole Life Insurance Policy

- Final Thoughts

Let’s jump in and discuss the overview of a $10,000 whole life insurance policy.

Overview of a $10,000 Whole Life Insurance Policy

Let’s discuss what whole life insurance is, the face amount of $10,000, and how these two intersect.

There are many types of life insurance, but the two most common are term life insurance and whole life insurance.

Term life insurance exists for a set number of years (the term period). The term period could be 10 years, 20 years, or 30 years. A couple of life insurance companies even offer a 40-year term.

Term life insurance is good for temporary needs to cover obligations and commitments if you suddenly pass away. For example, many people purchase term life insurance to cover a home mortgage or provide for a young family on the unexpected death of a parent.

Conversely, whole life policies cover the insured for his or her entire lifetime. They pay a benefit when the insured passes away, whether tomorrow, 15 years from now, or when the insured is 99 years old.

Whole life insurance rates remain fixed for the insured’s entire lifetime. Once you are approved, the carrier locks in your monthly premium rate.

The $10,000 life insurance coverage amount is actually a low death benefit amount. A face amount of $10,000 is typically used for burial costs or funeral expenses. This is why you hear about a $10,000 whole life insurance policy called “burial insurance.” The life insurance industry calls small whole life insurance policies burial insurance because the intention of life insurance is to cover your funeral costs upon your passing and other final expenses.

amount. A face amount of $10,000 is typically used for burial costs or funeral expenses. This is why you hear about a $10,000 whole life insurance policy called “burial insurance.” The life insurance industry calls small whole life insurance policies burial insurance because the intention of life insurance is to cover your funeral costs upon your passing and other final expenses.

You’ll hear burial insurance called as:

- final expense insurance

- funeral insurance

- end-of-life insurance

They all mean the same thing.

Burial Insurance: Easy Application

The good news is that burial insurance companies make it very easy to obtain a $10000 whole life insurance policy.

- no medical exam is required – answer some health questions, and that is it. The company looks up your medical history through the Medical Information Bureau (MIB)

- a decision on approval or not takes a day or so

- incorporates many health issues – burial insurance policies cover many severe health conditions like COPD, stroke, and obesity

- your premium rates remain fixed forever

- usually a short electronic application with an instant decision or a few days after

We will discuss this further in this article. Just know that the easiest way to obtain a $10,000 whole life insurance policy is through a burial insurance plan.

Other $10,000 Life Insurance Options – If You Are Healthy Or Not, We Have Them

As we discussed in the previous section, one of the best and easiest ways to obtain a $10,000 whole life insurance policy is through a burial insurance platform.

Life insurance companies have made it very easy to obtain $10,000 of whole life insurance this way.

But, John. I am healthy. You said burial insurance incorporates health conditions in the underwriting. Is there anything for healthy people like me?

Yes, we have other $10,000 life insurance options for people in good health and with mild health conditions, such as controlled high blood pressure.

We discussed this before in our low-cost burial insurance for seniors guide.

We discussed this before in our low-cost burial insurance for seniors guide.

For example, many brokers use Mutual of Omaha for a $10,000 whole life insurance policy. Mutual of Omaha is a great carrier and one that I recommend in most cases.

However, other options are likely available if you are healthy and have very minor health conditions. Let’s say you are a 55-year-old man. A $10,000 whole life insurance policy costs about $36 per month (at the time of this writing) with Mutual of Omaha.

But, another company we work with – and many other brokers don’t – offers $10,000 whole life insurance for about $28 per month.

John, what is really a $8 difference per month?

I understand. However, that $8 difference could mean a lot for a person on a fixed budget.

We have many options like this. You’ll pay much lower rates if you are healthy than someone with health issues.

Low-Cost Life Insurance Options

Additionally, we have companies that offer “no-dividend” whole life insurance policies. Without getting into the weeds, these policies have lower monthly rates because they do not offer dividends. If your intention is to cover and pre-fund your funeral costs, then a “no-dividend” whole life insurance policy should work well.

Moreover, a guaranteed universal life insurance (GUL) policy typically offers a lower cost per $1,000 of coverage. The one drawback is that carriers (that offer GULs) require a minimum face value of $25,000.

For example, let’s say you initially wanted a $10,000 whole life insurance policy. After reviewing your situation, you decide to buy $25,000 to cover some additional expenses and leave a little money to your kids. You are a 65-year-old woman in good health.

A broker says he can get you a $25,000 whole life insurance policy (i.e.burial insurance) for about $100 per month. You then come across our article on low-cost burial insurance (remember, burial insurance is just another name for a life insurance policy).

A GUL on yourself for $25,000 costs about $74 per month.

So, you can save yourself $312 annually over the rest of your life. If you pass away at age 90, then you saved yourself around $7,800. That’s not chump change, especially for people on a budget.

$10,000 Term Life Insurance Options

John, I really would like $10,000 of term life insurance. Do you have that? A broker I visited said they don’t exist at that face amount.

While $10,000 is a low face amount for a term policy, an option does exist.

We work with an “almost” guaranteed issue term life insurance plan through an association. I say “almost” because there are 3 lifestyle questions that need answering.

It is available for people ages 18 to 74. The initial death benefit is $20,000. It is term to age 100, so it essentially lasts your entire life.

You apply through a self-enrollment link we have. (Contact us if you would like the link). It is an easy online application with a few standard lifestyle questions.

Association plans are generally based on group-term life insurance. At retirement ages, the death benefit decreases. This is typical with group-term life policies. In this case, at ages:

- 70, the death benefit is $13,500

- 75, the death benefit is $10,000 to age 100

People between the ages of 18 and 49 pay $50 per month. If you enroll at age 50 and beyond, the cost is $60 per month. There is a one-time administrative charge of $25.

Because it is “almost” guaranteed issue, the company has a waiting period. Carriers offering guaranteed issue life insurance don’t ask health questions, so they have a waiting period.

In this case, the carrier has a 1-year waiting period versus the typical 2-year waiting period with other life insurance companies.

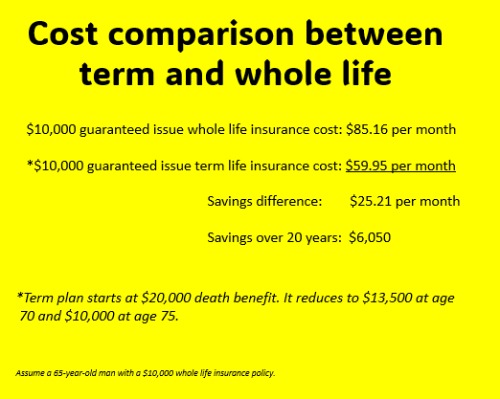

The cost sets the guaranteed issue term life apart from their guaranteed issue whole life counterparts.

Term Life Cost Competitive Versus Whole Life

For example, let’s say a 65-year-old man wants $10,000 of whole life insurance at guaranteed issue. A typical $10,000 guaranteed issue whole life insurance costs $85 per month.

However, he finds us and realizes he can purchase the guaranteed issue term for $60 per month with an initial death benefit of $20,000. If he is still living at age 75, then face value drops to $10,000 until age 100. Knowing that the probability of living to age 100 is less than 1%, he purchases the guaranteed issue term for $60 and saves almost $25 per month.

We at My Family Life Insurance offer many $10,000 life insurance options, whether whole life or term life.

$10,000 Whole Life Insurance For Serious Health Conditions

John, I have some serious health conditions and am in poor health. What options do I have for $10,000?

You do have life insurance options. The $10,000 guaranteed issue term life insurance is a great option if you qualify (through the lifestyle questions).

However, if you don’t qualify, we have $10,000 whole life insurance options for people with serious health conditions.

As I mentioned earlier, we have the “almost” guaranteed issue term life. Some people are partial to term, and if that is you, we have term coverage to age 100.

Additionally, we have graded whole life insurance. What is graded whole life insurance? It has a graded death benefit because it is designed for people with moderate to serious health conditions.

Essentially, in the first couple of years, the life insurance company limits the death benefit to:

- a return of your premium or

- a percentage of the death benefit

For example, a life insurance company might say that if you pass away from any illnesses or natural causes in the:

- 1st year: 10% of the death benefit

- 2nd year: 60% of the death benefit

- 3rd year and beyond: 100% of the full death benefit

If you pass away from an accidental death, then the carrier pays 100% of the death benefit, no matter when you pass away.

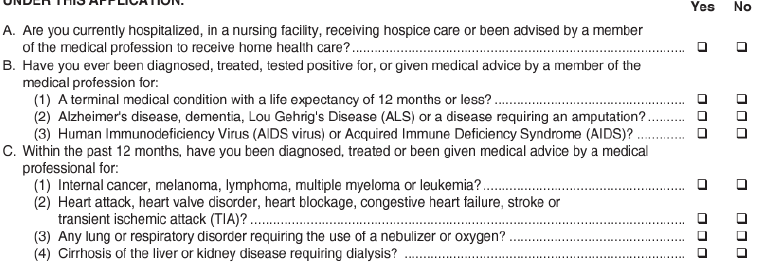

Example Graded Death Benefit Questionnaire

Here is an example health questionnaire from a life insurance company offering graded death benefit insurance:

As you can see, if you have moderate to serious health issues, you can still qualify for graded whole life death benefit insurance.

As you can see, if you have moderate to serious health issues, you can still qualify for graded whole life death benefit insurance.

Nevertheless, as I mentioned in other articles, we can probably get you an immediate benefit life insurance policy even with serious health conditions or lifestyle situations.

If you have very serious health conditions, then you can obtain a $10,000 guaranteed issue whole life insurance policy.

$10,000 Guaranteed Issue Whole Life Insurance

If you have serious health conditions, then a guaranteed-issue whole life insurance policy is likely the only option available to you.

Guaranteed issue whole life insurance is a type of life insurance with no health questions or underwriting. You apply, and you have life insurance.

While that sounds great, limitations do exist:

- you’ll pay higher premiums than a traditional $10,000 whole life insurance policy because of your health.

- a waiting period exists, as mentioned before, because of no health underwriting.

- most companies limit the death benefit to $25,000. However, that should not be a problem if you are only looking for $10,000.

Again, guaranteed issue life insurance is usually reserved for people in serious medical or lifestyle situations such as:

- current cancer

- dementia or Alzheimer’s

- current parole or probation (although we can usually get some immediate coverage)

If you feel you need guaranteed-issue life insurance, please contact us. We have many guaranteed-issue life options, including those for those 40 and younger, and even some plans with no waiting period if you qualify.

Cost of $10,000 Whole Life Insurance Policy

Expect to pay anywhere from $25 per month to $100 per month or more for a $10,000 whole life insurance policy. The actual premium rate you’ll pay depends on your:

- age

- gender

- health or lifestyle situation

- state where you live

- nicotine use

You can look up burial insurance quotes for $10,000 in the quoter below.

Note: these are estimates only. In the health status field, just enter:

- good health – if you are in good health with limited health conditions (will show immediate benefit options)

- decent health – if you have moderate health or lifestyle situations (will show graded death benefit options)

- poor health – if you have serious health or lifestyle situations (will show guaranteed issue life insurance options)

Let’s discuss the $10,000 life insurance cost by age, gender, and health next.

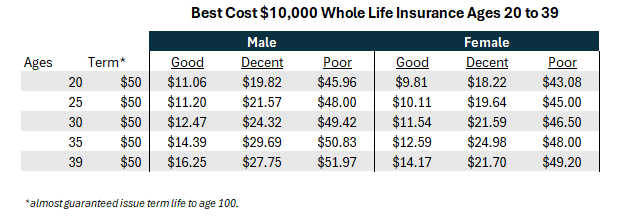

Best Cost for $10,000 Whole Life Insurance Policy

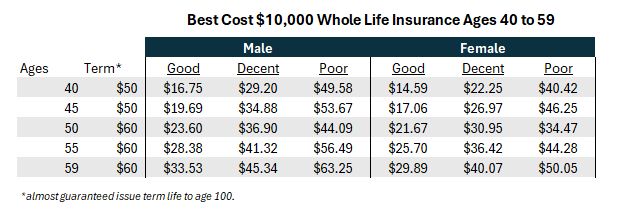

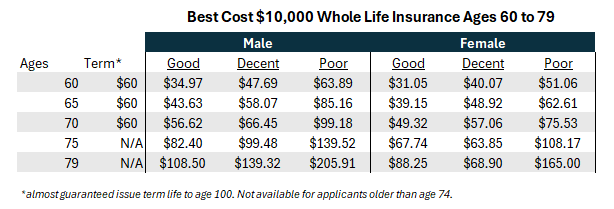

In the charts below, we give our best premium cost for $10,000 whole life insurance. Note: we list the $10,000 almost guaranteed issue term life insurance as an option since it lasts to age 100 (a lifetime for most people).

Note: The rates below, with the exception of the rates in the term and poor columns, are non-tobacco rates. If you want tobacco rates, please contact us.

Premiums can change anytime.

“Good” means good health with minor, controlled, stable medical conditions like high blood pressure. These are our lowest-cost, immediate death benefit plans.

“Decent” means you have moderate health conditions. The premiums in the “decent” column represent graded whole life death benefit plans.

“Poor” means you have serious medical or lifestyle situations. These premiums represent guaranteed issue whole life plans.

Note: as we indicated earlier, even if you have moderate health conditions like multiple sclerosis, bipolar disorder, schizophrenia, stroke history, etc., we can still likely help you obtain a $10,000 whole life insurance policy with an immediate death benefit. The cost would be somewhere between the “good” rate and the “decent” rate defined below.

Additionally, the rates below do not account for specific health or lifestyle situations. Your premium depends on your:

- age

- health

- lifestyle

- tobacco use

- etc.

Finally, rate variability occurs as life insurance companies come to market. In other words, more life insurance companies offer $10,000 whole life insurance policies for people age 50 than for those age 25.

$10,000 Whole Life Insurance Cost Ages 20 to 39

Below are the costs for $10,000 whole life insurance between ages 20 and 39.

$10,000 Whole Life Insurance Cost Ages 40 to 59

Below are the costs of $10,000 whole life insurance for people between the ages of 40 and 59.

Note: a person applying for the “almost” guaranteed issue term pays a higher premium starting at age 50.

$10,000 Whole Life Insurance Cost Ages 60 to 79

Below are the costs of $10,000 whole life insurance for people between the ages of 60 and 79.

Advantages and Disadvantages of $10,000 Whole Life Insurance Policy

Many advantages and disadvantages exist with a $10,000 life insurance policy as follows:

Advantages of $10,000 Whole Life Insurance Policy

- You and your loved ones will have peace of mind knowing there is money and financial protection in place for your funeral needs

- Will cover the current average cost of a funeral here in the United States

- Whole life has a guaranteed death benefit for your lifetime (term policies guarantee the death benefit during the term period)

- $10,000 life insurance policy is usually a good budget for anyone at any age

- You could borrow against the cash value as policy loans (if allowed by the life insurance company)

- Your beneficiary (or funeral home if you “assign” any part of the death benefit to them) receives the death benefit income tax-free

- Some plans offer living benefits

- Life insurance premiums remain fixed for your entire life

Disadvantages of $10,000 Whole Life Insurance Policy

Disadvantages of a $10,000 whole life insurance policy include:

- $10,000 is rather a limited death benefit. With the inflation increase in recent years, $10,000 may not “stretch” as much as it used to

- You have limited coverage if you have a graded death benefit or guaranteed issue plan and pass away during the waiting period

Application Process for $10,000 Whole Life Insurance Policy

Applying for $10,000 life insurance is very easy. As we mentioned earlier, the life insurance industry has made applying for life insurance much easier than 5 or 10 years ago.

Here are the steps if you want to apply for a $10,000 whole life insurance policy through us.

(1) Contact us – you need to contact us either through the form at the end of this article, the contact us link, or call us at (800) 645-9841.

(2) Tell us your situation – tell us your date of birth and other information so we can analyze your situation. It is important that you tell us the health conditions you have (and medication) so we can accurately identify carriers that may approve you. It wastes everyone’s time if you are not upfront and transparent with any health conditions or lifestyle situations. In most cases, we can get you an immediate benefit $10,000 whole life insurance policy.

(3) Carrier selection – based on the information you tell us, we identify companies together that may approve you. We review these companies with you and their health questions.

(4) Apply – After we identify a company, you apply with us over the phone. Most applications take 30 minutes.

(5) Approved! – If everything checks out, then you are approved for the $10,000 life insurance policy

However, sometimes carriers decline our client’s applications. Usually, the reasons are as follows:

(1) you forgot an important component of your health or lifestyle situation

(2) something in your MIB knocks your application to decline status

(3) you forgot to tell us about a medication that knocks your application to decline status

Again, it is important that you tell us your complete health and lifestyle history so we can identify the right carriers for you.

Frequently Asked Questions About $10,000 Whole Life Insurance

Here are several frequently asked questions about a $10,000 whole life insurance policy.

How Much Does a $10,000 Whole Life Insurance Policy Cost?

A $10,000 whole life insurance policy may cost between $25 per month and $100 per month or more. The actual cost depends on your:

- age

- gender

- tobacco status

- health conditions

- lifestyle situations

For example, a 55-year-old woman with bipolar disorder might pay $27.60 per month if she is healthy every other way. Let’s say she does not have bipolar disorder and has no health conditions whatsoever. In that case, her $10,000 whole life insurance policy might cost $25.50 per month (assuming she lives in the state where available).

What Is the Cash Value of a $10,000 Whole Life Insurance Policy?

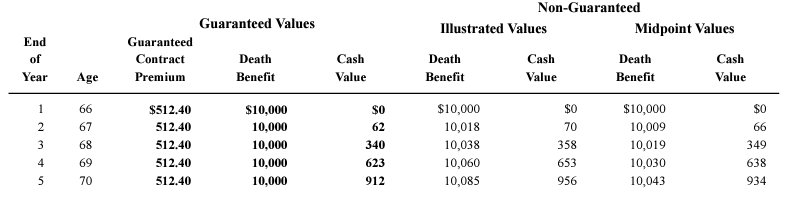

The cash value of a $10,000 whole life insurance policy differs among the life insurance companies. Here is one example of a 65-year-old woman and a $10,000 whole life insurance policy:

It is important to note that the cash value account is an asset. If you go on Medicaid, you could lose your whole life insurance policy because Medicaid considers the cash value as a “spendable” asset.

It is important to note that the cash value account is an asset. If you go on Medicaid, you could lose your whole life insurance policy because Medicaid considers the cash value as a “spendable” asset.

Please contact us if this happens to you or a family member. We do have options, including a funeral trust, to protect that cash value. I also recommend that you contact an elder care attorney in your state.

How Long Does It Take For a Whole Life Policy to Build Cash Value?

It can take some time. Look at the example above. In year 5, the policy has $912 of guaranteed cash value.

A way to increase your cash value quicker is through a paid-up additions rider. Paid-up additions are outside the scope of this article. They are usually on plans reserved for healthy clients or with minimum death benefits of $50,000 or more. Contact us if you have any questions.

Can You Cash Out a Whole Life Insurance Policy?

Yes, you can cash out a whole life insurance policy. Cashing out a whole life insurance policy means you are terminating the policy. When you do that, you receive whatever cash value is in the policy.

For example, if our 65-year-old woman above decided to cash out her policy in year 5, she would potentially receive $956.

If her cash value exceeds her premiums paid, the IRS taxes the difference at ordinary income rates.

What Are the Benefits of $10,000 Whole Life Insurance?

The benefits of a $10,000 whole life insurance policy include:

- You and your loved ones will have peace of mind knowing there is money and financial protection in place for your funeral needs

- Will cover the current average cost of a funeral here in the United States

- Whole life has a guaranteed death benefit for your lifetime (term policies guarantee the death benefit during the term period)

- $10,000 life insurance policy is usually a good budget for anyone at any age

- You could borrow against the cash value as policy loans (if allowed by the life insurance company)

- Your beneficiary (or funeral home if you “assign” any part of the death benefit to them) receives the death benefit income tax-free

- Some plans offer living benefits

- Life insurance premiums remain fixed for your entire life

How Does $10,000 Whole Life Insurance Differ from Term Life Insurance?

Whole life will pay out the death benefit no matter when you pass away. That could be tomorrow or age 100. Term life pays the death benefit if you pass away within the term period. If you are still living beyond the term period, your beneficiaries receive nothing unless you have additional life insurance coverage elsewhere.

That is the main difference. Another difference is the premiums. Whole life premiums are much higher than that for term life because of this guaranteed death benefit payout.

As mentioned earlier in the article, we do have a $10,000 “almost” guaranteed issue term life plan available.

Is $10,000 Enough Coverage for Whole Life Insurance?

That really depends on you, your needs, and your budget. However, a $10,000 whole life insurance policy may just cover your funeral expenses, and that is about it. Generally, speaking, you probably need more.

Can I Customize the Coverage of $10,000 Whole Life Insurance?

Yes; however, customization depends on the life insurance company. Some life insurance companies allow:

accidental death rider – will double the death benefit if you pass away from an accident (like a car accident)

child or grandchild term rider – allows you to purchase a $5,000 or $10,000 term policy on your child or grandkids. The ones we like are at guaranteed issue.

terminal illness rider – advances part of the death benefit sooner if you have a life expectancy of 12 months or less

living benefits rider – allows you to advance the death benefit sooner for any covered illness or chronic care needs

Again, the customization depends on the life insurance company.

Are There Any Restrictions or Exclusions for $10,000 Whole Life Insurance?

Not necessarily. However, remember, you have a graded period or waiting period if you have a graded death benefit or guaranteed issue life insurance policy. If you pass away during this period, the death benefit could be limited.

What Happens to the Cash Value of $10,000 Whole Life Insurance Over Time?

The cash value will grow at a defined growth rate. If your $10,000 whole life insurance policy offers dividends, you can reinvest these dividends into the policy (known as paid-up additions). This increases your cash value and your death benefit (beyond the $10,000 face amount).

Can I Borrow Against the Cash Value of $10,000 Whole Life Insurance?

That depends on the life insurance company. Some companies don’t allow borrowing with such a low death benefit amount.

You need to contact the life insurance company and find out.

You have to ask yourself, “What is the purpose of the life insurance?” Borrowing the cash value is secondary if the life insurance covers burial and funeral expenses.

However, if you are buying whole life insurance with the intention of cash value growth, then better options exist. Moreover, you will have to purchase a higher face amount (like $50,000) and be in good health.

What Happens If I Miss a Premium Payment?

If you miss a payment, the life insurance company will notify you (and me). Typically, the company gives you 30 days to pay the missed premium. Generally speaking, the life insurance terminates if you don’t pay within that 30-day period.

Some whole life policies have safety net provisions. These provisions use the cash value to keep your policy going if the company can’t reach you to make your missed payment. These provisions include:

extended term insurance – the company uses the cash value, as a single premium, to buy the same face amount as a term life policy. For example, Joe has a $50,000 whole life insurance policy with a $25,000 cash value. If his policy lapses, the company uses the $25,000 to buy a 10-year term, $50,000 face amount.

reduced paid-up insurance – the company uses the entire cash value in the policy to buy a new whole life insurance policy (as a single premium). For example, let’s say Joe has $25,000 cash value in his $50,000 whole life policy. His policy lapses. The company uses the $25,000 as a single-premium payment to buy $10,000 whole life insurance.

automatic premium loan – the company will use any cash value to pay your missed premiums. They take these premiums out as a loan that you can pay back. If you don’t pay it back, the life insurance company will keep taking loans out to pay your policy. At some point, the loans will be so great that the company will terminate your life insurance.

You select these provisions at the time of application.

The moral of the story here is that these are nice safety nets, but you need to pay the premiums on your policy if you want your policy original and intact.

Final Thoughts About Your Best Cost Of A $10,000 Whole Life Insurance Policy

Now you know your best cost for $10,000 whole life insurance policy. The actual premiums depend on:

- your age

- your health situation

- the state where you live

- your gender

- your tobacco use

- anything else pertinent to the application

We also discussed how to buy $10,000 of whole life insurance and the application process if you work with us. You can also quote $10,000 whole life insurance through the quoter in this article.

Do you have any questions or would like to get started? Feel free to contact us or use the form below.

As always, we only work in your best interests. It is the only way we know how to. There is no risk to speaking with us. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs or situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".