How Nurses Protect Their Income And Wealth With Disability Insurance | Nurse’s Guide To Understanding Disability Insurance And The Best Disability Insurance Options Available

Updated: April 12, 2024 at 9:38 am

Nurses usually don’t wake up in the morning and think, “Gosh, I need some disability insurance!”

Am I right?

If you are a nurse, you are busy. Being on your feet, helping doctors and patients with examinations, and treating patients with care is part of your livelihood. Nursing can definitely be a very tough job, but a rewarding one both emotionally and financially.

However, have you ever thought about what could happen if you could no longer do your job?

What would happen if you became sick, ill, injured, and disabled?

How would you pay your bills if you could not work?

Moreover, how does your lack of income affect your family?

What will happen to your future, financially and emotionally?

These are serious questions that need answering. As we will discuss, a disability happens at any time.

A disability quickly affects your future plans and the lifestyle you worked so hard for.

This is a robust guide for nurses to understand disability insurance, how it protects their income and wealth, and how much it costs.

Here is what we will discuss:

- Why Do Nurses Need Disability Insurance?

- How Disability Insurance Protects Your Wealth

- Elements Of A Strong Disability Insurance Policy For Nurses

- How Underwriting Affects Your Plan

- The Best Disability Insurance Options Available For Nurses

- What About The Offering From NSO?

- What If I Have A Policy Through My Employer?

- How Much Does Disability Insurance Cost For Nurses?

- Now You Know How To Protect Your Income And Wealth With Disability Insurance

Let’s jump in and discuss the #1 reason why nurses need disability insurance

Why Nurses Need Disability Insurance

Disability insurance is, simply, a type of insurance that pays you a dollar benefit if you can’t work due to illness or injury. The benefit is a percentage of the salary or income you make (more on that in a minute).

Your job can be tough and laborious. Nurses can face back and neck injuries when they lift heavy patients. They are on their feet for most of their shift. Disability insurance pays a benefit in these cases as well as many more.

You’ll hear disability insurance differently. Some people call it disability income insurance and others call it income protection insurance. It all means the same thing.

Do you need disability insurance?

Many nurses tell me, “No”, (more on that in a minute) but if you:

Make money, and

You use that money to pay your mortgage, groceries, and other needs, (i.e. your living expenses) and

If you and your family would be in a tough financial situation if you could not work, because of an injury or illness, then:

It is really that simple.

It is really that simple.

Essentially, if you will struggle to pay the bills upon an illness or injury, you probably need disability insurance.

3 Main Reasons Nurses Need Disability Insurance

There are really 3 reasons why nurses need disability insurance. We’ve talked about the first 2 ad nauseum in many other articles.

Here are the first 2:

- A disability happens way more than you think – this is true. Government stats report that a 30-year-old today has a 1 in 3 to 1 in 4 chance of experiencing a disability greater than 90 days.

Remember that anything injury or illness-related can be a disability if it prevents you from doing your job as a nurse. It’s not just “wheelchair-related” disabilities. A disability for a nurse could be depression, COVID-19, MS, a severe injury, another type of medical condition, and on and on…

- A disability can last a long time. There are stats stating that the average disability is 3 years. Maybe. Personally, I think that information is a bit flawed as it probably includes people who don’t want to go back to work. The claims departments I speak with tell me their average claims are around 18 months to 24 months.

Nevertheless, 18 months, 1 year, 3 years, or even longer is a long time to not work.

Can you afford to lose your income if you are sick or hurt and can’t work?

Additionally, as a nurse, you probably see this every day – people who are in disabling situations.

Regardless, can you survive financially without receiving a paycheck or income for 1, 2, or 3 years and more if the unexpected happens?

Think hard about that. This brings us to our #1 reason why nurses need disability insurance

Here’s The #1 Reason: More Important People Rely On You

Your patients are very important. There is also a group of people who are more important. Who can be more important than my patients, you think? They pay my income.

True. They do, but they don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything.

True. They do, but they don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything.

If you are disabled without disability insurance, you’ll have to answer tough questions and make tough decisions, like:

- Would you and your family be able to continue your standard of living without your income? If not, what is “plan B”?

- Who could be flexible with the children? Would you have the money to hire someone to take care of the kids?

- Would your spouse have to work or work more? He or she would have to bring money in. How?

- Would you need to sell your home to make ends meet? (Truthfully, I had a person call me about this. Her husband got disabled and was the breadwinner. With no money coming in, their mortgage was at risk. Sadly, no. It was too late. This is why disability insurance is way more important for “mortgage protection” than life insurance.)The tough questions can go on and on.

I describe disability as the destroyer of dreams. Your future and family dreams could be destroyed. They don’t have to, though. With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

How Disability Insurance Protects Nurses’ Income And Wealth

At this point, you should have a general understanding of how disability insurance protects your income. We will get into the details later, but you know that if you get sick or hurt and can’t work, you’ll receive a disability benefit to help you pay the bills and other living expenses.

However, many professionals including nurses don’t know how disability insurance protects their wealth.

Here’s how. First, let’s dive into some statistics.

According to the Bureau of Labor Statistics, nurses earn, on average, about $89,000 gross annually. Let’s average that to $7,417 monthly.

Where Would The Money Come From?

What if you were disabled for 2 years (24 months)? What would happen financially?

Well, you would lose $178,000 of gross wages over that 2-year period (24 months X $7,417).

Certainly, your household uses the money you earn as a nurse for your lifestyle, right?

So then, where would that money come from to pay $178,000 over those 2 years?

This is why I asked all those questions at the beginning of the article. In order to replace $178,000, would your spouse have to work more? If so, what gives? (The kids, the house…something has to.)

Now, disability insurance isn’t designed to replace all of your gross annual salary. It’ll replace about 60% of it. Why? For one thing, you aren’t paying tax on those disability insurance benefits.

So, disability insurance will help pay for the mortgage, groceries, etc. However, what people don’t realize is that it has a huge, positive impact on protecting your wealth.

Why?

Well, where do you go next if you don’t have any disability insurance?

I do have retirement money saved through my employer…

Right. People tell me they will raid their retirement accounts if faced with a disability. They say it so nonchalantly as they don’t understand the financial consequences.

Doing so will have a huge, negative impact. Let’s illustrate that next.

Here Is How Nurses Protect Their Wealth With Disability Insurance

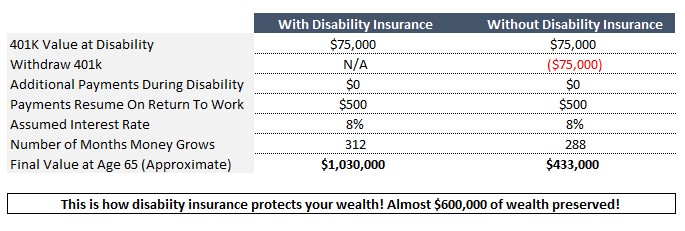

Let’s say you are a female nurse, age 40, and make $100,000 gross or $60,000 after taxes and deductions. You have $75,000 saved through your 401k, and you contribute $500 each month to your 401k. Retirement for you is age 65.

You are unexpectedly disabled. However, you don’t have disability insurance.

Gone are your monthly 401k contributions. You aren’t working! But, you aren’t worried about that. Your main worry is money. You just need money to help pay the bills.

What do you do?

While your spouse tries to pick up extra work, you remember you have money saved in your employer’s 401k. At least that will help pay the mortgage, you think.

You turn to your retirement savings and request distributions from your 401k. These distributions are taxable and subject to a penalty (link). But, you need the money.

What Happens If You Have No Disability Insurance

Let’s compare how your 401k would look with and without a disability.

Assuming an 8% return, without a disability, you would have accumulated about $1,100,000 at age 65.

But, because you are disabled, you exhaust the $75,000. It’s gone. You are still disabled. Additionally, your spouse works more, and the family helps with the kids. You take out a home equity loan to pay for things, too. While you remain grateful, you still feel financial strain and stress. You are worried. To add insult to injury, you are worried about your disability as well.

After 2 years of disability (average claim), you are back at work. You’ve used $120,000 ($5,000 per month) between your home equity loan and 401k. However, you are now 2 years older. Moreover, you don’t have retirement savings anymore, so you start over.

You contribute $500 each month. At age 65, you have about $433,000!

Your wealth dropped because the $75,000 saved could not compound for another 25 years. Because it was gone.

Don’t forget, too, that you have the home equity loan to pay back.

What do you think about this?

What Happens If You Had Disability Insurance?

John, but this person was only out of work for 2 years?

Yes. That is still a long time of not making any money. Since the person didn’t have disability insurance, he or she had to raid and deplete the 401k.

Let’s change the example around. What if you had disability insurance? What would have happened?

You would have been much better off!

Sure, you would not have contributed $500 each month for 2 years ($12,000). However, your 401k stays intact!

Look at the chart.

Your $75,000 value still would have compounded those 2 years while you were not working.

So, if you had disability insurance, you would have ended up with approximately $1,030,000 at age 65.

That is about $600,000 of wealth preserved.

What, you exclaim!

Yes, and remember…this is a 2-year disability. What if your disability was 5 years or more?

This is how disability insurance protects your wealth!

How much is (in this example) a $600,000 wealth and income protection insurance worth to you?

You don’t have to answer that now. We will discuss the costs later. However, you can see how valuable disability insurance is

Elements Of A Strong Disability Insurance Policy For Registered Nurses

Hopefully, we have made a great case showing that nurses need disability insurance. Moreover, how it protects your wealth.

I’m ready to enroll now, John, you say.

Sounds great. First, though, let’s discuss the characteristics that make a strong policy.

You see, many policies on the market offer limited benefits.

You don’t want to mess with those policies. The worst thing that could happen is you file a claim, expect a payout, and don’t receive one.

So, let’s first discuss the basic elements (I feel) needed in any disability insurance policy for nurses. We will then discuss additional insurance options and riders.

Disability Insurance Policy Basics

I speak to nurses about disability insurance every day. There are 2 major sources of confusion that these professionals hear from elsewhere. These confusing components are essentially “the basics”, but if you get these wrong, you could be in for a surprise when it comes time to make a claim.

The first is the waiting period or elimination period. In terms of disability insurance, it is not the period of time before your policy is in effect. That is correct for other types of insurance, but not for disability insurance.

The elimination period is the length of time – a waiting period – that elapses before you are eligible for disability benefits. It happens upon disability insurance claims. For example, a 90-day elimination period means your benefit period begins after 90 days of disability. On the 91st day, you are eligible for benefits. Typically, for long-term disability benefits, you receive your first benefit 30 days after that.

This means you need to have adequate savings to carry you and your family until benefits begin.

The Benefit Period

The second is the benefit period. The benefit period starts when you are eligible for benefits (at the 91st day in our example above) and lasts until the end of the benefit period or if you return back to work, whichever occurs first. It is not the maximum timeframe that your policy exists. As long as you pay the premiums, you will have the policy until age 65 or 66 – at retirement age. (Actual age depends on the disability insurance company.)

Like the waiting period, the benefit period occurs on a claim. For example, if you file 4 disability insurance claims during your working career (you are rather unlucky), you’ll have 4 elimination/waiting periods and 4 benefit periods.

Typically, the maximum benefit period for nurses is to age 67, but that depends on what type of nurse you are and the disability insurance company. More on that later.

Remember, the average disability claim is 35 months (internet stats) or 18-24 months (from claims departments). So, even disability coverage with a 5-year benefit period can work.

3 Provisions That Make A Formidable Plan For Nurses

If you spend premiums on a disability insurance policy, you want to make sure you get paid, right?

In my opinion, 3 important disability insurance provisions exist. They make a formidable plan.

I call these “non” negotiables. Let’s discuss these now.

I call these “non” negotiables. Let’s discuss these now.

#1 The Definition Matters of Disability Matters For Nurses

The definition of disability matters. As a nurse, you generally want some type of “own occupation” definition.

Two main “degrees” of the own occupation definition exist: “true” or “pure” own occupation and the “modified” own occupation definition. (There are other own occupation definitions, but these are the two most common.)

Here’s what they each mean. The “true” own-occupation definition means:

- you will receive a disability benefit based on your inability to do your job (as a nurse), AND

- also earn an income from another job for an earned income (should you decide you can).

In other words, you can continue to work in another occupation while receiving disability benefits for the inability to do your job as a nurse.

disability benefits for the inability to do your job as a nurse.

So, if you can’t use your hands, but you can greet people at Walmart, you will receive disability benefits in addition to your earnings as a Walmart greeter.

That’s the true own occupation definition.

The modified own occupation is a bit different. It still says that you will receive a disability benefit based on your inability to do your job. That is still great! However, you can’t work in another job. So, if you worked as a Walmart greeter, you won’t receive disability benefits under the modified own occupation definition.

This is a good definition, too. Under the modified definition, you are still eligible to receive benefits based on your own occupation. You just can’t be working in another occupation. Honestly, if you are sick or hurt, do you really want to be working? Be honest.

In summary, nurses need some type of own occupation definition.

Be Aware Of The Any Occupation Definition

Finally, there is the stringent “any” occupation definition. This means, simply, if you can work in any gainful occupation (for which you are reasonably suited, considering your education, training, and experience), the carrier denies your benefits. So, under this definition and using our example, you won’t receive a disability benefit because the insurance carrier says, based on your education and experience, you can work as a Walmart greeter.

Do you want this definition? As a nurse, probably not.

Personally, I always like to play it safe and have my nurse clients’ policies contain, at minimum, the “modified” own occupation definition.

#2 Residual / Partial Disability Benefits

This is an often overlooked rider, much to the insured’s dismay if he or she ever had to make a partial disability claim or return back to work.

As it sounds, this important rider pays a benefit if you are partially disabled.

Contrary to popular belief, you don’t have to be totally disabled to receive a benefit. If you can still work, but not full-time because of an injury or illness, that is a partial disability.

If you have this rider, carriers will pay a benefit based on your loss of income. Usually, the amount of disability income you receive is a percentage of your total monthly disability benefit. For example, let’s say you experience a 40% income loss because of a partial disability. If your monthly disability benefit is $4,000, you will receive $1,600 ($4,000 X 40%).

This rider will also pay a benefit if you return to work in your occupation from a total disability. It works the same way. The disability insurance company looks at your pre-disability earnings versus your earnings returning to work. It then pays a pro-rated disability benefit amount based on this income loss.

Why would you need this rider? Most disability insurance companies allow partial disability benefits upon total disability first. In other words, if you are only partially disabled (i.e. you can still work but not full-time), you will not receive any benefits until you have met the carrier’s requirements for total disability first. But, you are partially disabled, not totally disabled. Without this important rider, you won’t receive any partial disability benefits until you have met the total disability requirements first. Ugh!

Example

Typically, this rider circumvents the total disability requirement and allows you to receive benefits immediately (after you satisfy the elimination period).

Here is another very easy example. You lose feeling in your wrists and fingers. The doctor says you need to rest and limits your work to 2 days per week. Without this rider – or a plan that has a partial benefit without a total disability requirement first – you would not receive any disability benefits because you are still working. You will only receive a benefit when you are totally disabled.

#3 Guaranteed Insurability Option

The guaranteed insurability option is another important rider. You may hear it as a “future purchase option”, “future increase option”, or “guaranteed purchase option”. They all mean the same thing.

This option allows you to obtain additional disability coverage in the future without evidence of good health. You just need to show your salary (through a W-2) or your income (your tax return) increased.

In other words, you can buy more disability insurance as your salary grows (subject to carrier income and coverage limits) with no underwriting.

How great is that?

You can develop type 2 diabetes, develop RA, heart disease, or get hurt. Despite those diagnoses, you can still buy more disability insurance because of no underwriting.

You generally can purchase additional coverage every 2 years up to age 55. (You do not need to wait 2 years if you had a life change, defined as a marriage the death of a spouse, divorce, or birth or adoption of a child; Instead within 3 months of a life change, you may purchase additional disability coverage.)

Optional Disability Insurance Riders For Nurses

Hopefully, you see how important these provisions are. From my point of view, you want a plan that will pay a benefit no matter what and one whose benefits can increase as your salary increases.

After these 3 provisions, though, you can customize your policy any way you want. There are many disability insurance riders available.

Like purchasing options in a new car, purchasing riders increases the cost of your policy.

That doesn’t mean it is a bad thing. You just want to make sure it fits your needs. Some riders, in my opinion, may not be worth the additional money. Moreover, some might be. It depends on your needs and situation

You can add optional riders at an additional cost to your policy to best fit your needs and budget. Some popular rider options for nurses include:

- Retroactive injury benefit

- Mental/nervous benefit for the duration of the benefit period

- Catastrophic disability benefit

- Coordination with social security administration benefit (it lowers the cost of your policy, but I generally don’t recommend it. Contact me for further information)

Contact us or review our article on disability insurance riders. We will be happy to answer any questions you have.

Disability Insurance Underwriting For Nurses

Now that you know the important elements of a disability insurance policy, you need to understand how disability insurance companies underwrite your application.

Oh, I just went through the life insurance process. I know how it works, you say.

Great. But, disability insurance underwriting is completely different.

Carriers aren’t insuring your mortality. They are insuring your morbidity. In other words, the risk of a disabling accident or illness and paying you a percentage of your salary.

That happens way more often than an unexpected death.

So, carriers look at the following attributes in an application.

When it comes to underwriting, carriers look at your:

- Age

- Health

- Income / Salary

- Occupation

- Other hazards and lifestyle situations

The Specifics

Age is a factor. The older you are, the more expensive the policy – all things being equal, of course. This is why you want to start your policy as soon as possible.

Obviously, your health matters. If you have a chronic illness or had a severe injury in the past, likely that illness or injury won’t be covered. Additionally, carriers can limit benefits based on any health conditions. For example, if you take any anxiety or depression medication, nearly all the carriers limit the waiting period to a minimum of 90 days. Please note that pre-existing conditions are rarely covered (link).

As we mentioned before, carriers insure a percentage of your salary. This percentage is usually 60% of your gross salary.

Your occupation matters as well. All the disability insurance carriers classify your occupational disability risk. The classification table is usually a 1 to a 5 (or 6 with some carriers). An occupation with a class 1 is most risky while an occupation with a class 5 is least. For example, carriers classify a construction laborer at a 1 and an accountant at a 5.

Usually, carriers classify the nursing profession at a class 2 or class 3. Sometimes, higher classifications are available. We work with one carrier that classifies at a class 5, depending on your duties. If you are a nurse practitioner, expect a 4 or 5 classification. Other types of nurses, like LPNs and CNAs, are classified lower. Contact us for the specific occupational classes for nurses.

Finally, carriers also consider other situations and lifestyle choices like hazardous hobbies. Do you like to rock climb or use marijuana? If so, that hobby will be excluded from your policy.

What Do The Carriers Do With The Information?

The underwriters review all this information and make an approval decision or not. They routinely look up your medical background in the MIB, prescription drug databases, driving records, tax records, etc.

As we discussed, underwriters may limit benefits, benefit periods, and/or waiting periods based on your health history. They may also increase premiums to compensate for an increased disability risk. For example, if you use marijuana, some carriers will rate your policy (i.e. increase the premiums).

Nevertheless, if your benefits are modified in any way, it still makes sense to purchase the policy. We discuss more in our disability underwriting guide.

The Best Disability Insurance Options For Nurses

So far in this article, the disability insurance we have discussed is long-term disability insurance. A long-term disability policy protects against those types of disabilities that can yield a tough financial impact on your family. (Remember, the average disability claim is about 24 months.)

We do work with a short-term disability insurance plan available on an individual basis. However, reach out to us if you have questions about it. It isn’t very good, in my opinion.

You are probably wondering who we like to work with. First, we work with many disability insurance carriers. So, we are sure we can find one that meets your needs and budget.

Second, the “best” is only the best one that fits your needs, situation, and budget. We don’t try to fit a square peg in a round hole with such important insurance coverage.

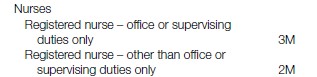

However, not all carriers insure nurses the same. Look at this snapshot out of this carrier’s underwriting guide. They classify the registered nurse occupation at a class 2 if you are not an office or supervising RN.

Carriers We Like

The carriers we like insure registered nurses at a minimum class 3. Moreover, there is no limitation of benefits. (That’s why it is important to work with an experienced broker like My Family Life Insurance.)

Additionally, the carriers we like all have the following:

- Own-occupation definition

- Partial disability benefits

- Guaranteed insurability option

And, additional options as we discussed. Moreover, the plans we like offer value-added benefits like retraining programs.

If you are Christian, we also work with a company dedicated to practicing Christians.

Contact us if you would like to learn more. We are happy to chat with you. Since we work with so many disability insurance carriers, I am sure we can find a carrier that meets your needs and budget.

Be careful of blindly applying online without knowing what you are getting yourself into. Buying directly online, currently, is the wrong way to buy disability insurance. Why? As we illustrated earlier, there are so many moving parts with disability insurance. How do you know what you are applying for is right for you? If you apply online without the aid of a reputable broker or agent, you don’t.

What About The NSO Disability Insurance?

John, I love the article so far. I am just going to apply with the NSO, you say.

I say, hold up until you read this.

If you belong to your state’s nurses association, you have access to many benefits including disability insurance through the Nurses Services Organization (NSO).

The NSO is an organization that offers insurance for nurses. It is managed by Affinity Insurance Services which is the third-party administrator. New York Life underwrites the disability insurance plan.

In our opinion, the insurance program is neither good nor bad. New York Life underwrites many association insurance programs.

This plan is essentially an association disability insurance plan. Nearly all disability insurance policies offered through associations are on a group basis. This isn’t a bad thing. It keeps your premiums low.

However, association disability insurance programs tend to be “plain vanilla”, which means they are simple and basic and may not meet your specific needs. Additionally, because of their simplicity, they tend to be lower in cost as well.

Benefits of the NSO disability insurance include:

- Low monthly rates – we’ll get into why. The rates are cheap.

- Easy application

- Replacement of up to 70% of your average monthly earnings

- Own occupation definition

- Pre-existing conditions are covered (if eligible)

There are some disadvantages, though, which bear some details. We discuss those next.

Disadvantages Of The NSO Disability Insurance Plan

As we mentioned, association disability insurance plans tend to be plain vanilla. They have to be to keep costs low and appease the members. A low-cost plan doesn’t mean it is right for you.

Below are some disadvantages of the NSO disability insurance plan:

Integrates with the Social Security Administration- one reason why the plan is cheap is that it integrates with social security or any other benefits you receive. Although the plan allows 70% replacement of your income, likely any disability benefits you receive are reduced by other insurance benefits.

It appears no “true” partial disability benefit – in our opinion, this is a significant exclusion. Many long-term disabilities start as a partial disability. That is, you can work, but not full-time. Think about this scenario. Your doctor diagnoses you with multiple sclerosis. She advises you to slow down and focus on treatments for the next year. This is a partial disability. You can still work – and plan to – but just not full-time. Under the NSO disability insurance, it appears you would not receive any benefits because you need to be totally disabled first.

Doesn’t appear own occupation as a true own occupation definition. This isn’t a significant disadvantage as the NSO disability insurance has an own occupation definition, just not true. Recall that a True Own Occupation definition allows you to work in another occupation while receiving disability insurance benefits. Moreover, their own occupation definition lasts only 24 months. If you are still disabled after that, the plan reverts to the “any” occupation definition.

Only a 5-year benefit period is available. The plans we use allow up to age 67, if you prefer that.

Is the NSO disability insurance plan right for you? Maybe. We think some disadvantages outweigh the benefits and cost savings.

What If Nurses Have Disability Insurance Through Work?

John, great article, you say. I have disability insurance through work, and I am all set.

Most nurses do. However, you are unlikely “all set”.

If you receive a disability insurance plan through work, it’s likely not enough.

For one thing, if your employer or union pays for your disability insurance, that benefit is taxable to you.

Additionally, if you pay the premium yourself with pre-tax money (i.e. through payroll), that benefit is also taxable to you.

What does this mean? It means if you make a claim and receive benefits. You receive a tax statement for the benefits paid to you. You then include the benefit amounts on your tax return. Therefore, it is a taxable benefit.

Ugh! My HR person never told me this!

Most don’t.

Moreover, many union / employer / group plans have limited benefits. For example, many of them cap the monthly benefit. Let’s say your employer plan offers 60% of your salary up to $3,000 monthly benefit. If you make $100,000, how far do you think $3,000 will take you? Especially since the benefit is taxable…

Not far, John. That won’t even cover my mortgage and child care.

Right. Thankfully, adding an individual policy makes up for this shortfall.

Moreover, it doesn’t cost much.

Supplemental Disability Insurance For Nurses

Adding an individual policy to existing group/employer coverage is known as supplemental disability insurance. You are “supplementing” your employer plan with individual coverage.

Here’s an example.

Let’s say you make $80,000 as an RN. You are a 35 year-old woman. You have disability insurance through your employer, in which they pay 100% of the premiums.

That means you have a $4,000 monthly benefit, which is 100% taxable to you if you receive a benefit.

You don’t like that and want a supplemental policy to offset the tax impact. You reach out to us and we provide a carrier that provides an economical plan.

The carrier allows an additional $1,350 monthly benefit. It contains a 90-day waiting period and to age 67 benefit period.

It also contains the true own occupation definition along with a guaranteed insurability option and partial benefits.

The cost is about $82 per month or under $3.00 per day.

If you wanted a 5-year benefit period, the cost is about $52 per month.

In either case, you can see the extra protection is affordable.

The Premium Cost Of Disability Insurance For Nurses

After all of this, how much does disability insurance cost for nurses? That’s the $1,000,000 question. Well, the premiums you pay are a function of everything we discussed above in the underwriting section.

However, disability insurance is not incredibly expensive.

However, the cost of disability insurance has risen thanks to inflation and the current economic environment (as I write this).

Depending on your situation, an individual disability insurance policy costs between $5.00 and $8.00 per day. Sometimes it is more; sometimes it is less.

If you think that is a lot, go back to my wealth example. Wouldn’t you agree that spending $5 or $9 per day is worth protecting $600,000?

If you have group disability insurance, a supplemental policy might cost $1 to $3 per day, give or take.

The cost is about the cost of lunch or a cup of coffee at your favorite coffee shop.

If you can afford a cup of coffee, or lunch, you can certainly afford disability insurance.

For example, a nurse, female, age 35, making $80,000 gross salary could have a $4,000 monthly benefit, true own-occupation definition policy up to age 67 for around $265 per month, or a little over $8.00 per day. Or, she she could select a 5-year benefit period which costs about $178 per month or $5.85 per day.

But, a supplement plan could cost $50 to $90 per month, or around $3.00 per day.

Think about what you spend each day. You can definitely afford disability insurance.

If you feel $8.00 is too much, we can adjust your plan to meet your budget. Some coverage is better than none! For example, a 5-year benefit period works and costs much less.

Remember the wealth example I showed above? It clearly shows how disability protects a nurse’s wealth.

Now You Know How Disability Insurance Protects Nurses’ Income And Wealth

We hope now you have a solid idea of why nurses need disability insurance. We went through what it is, important elements, costs, and underwriting. Additionally, we showed how no disability insurance coverage negatively impacts your wealth!

Confused? Don’t feel that way. We’re here to help educate you and protect your income and future. Don’t know where to start? Use this disability insurance needs analysis worksheet. Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy).

Next, feel free to reach out to us for our assistance or a quote. Or, use the form below. We only work for you, your family, and your best interests only. We have helped many nurses secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

3 thoughts on “How Nurses Protect Their Income And Wealth With Disability Insurance | Nurse’s Guide To Understanding Disability Insurance And The Best Disability Insurance Options Available”

Comments are closed.

I am interested

Thanks

Hi Sarah,

Thanks for reaching out to us. I will send you an email shortly with more information on how we help registered nurses obtain disability insurance. I am happy to go over the information with you and answer any questions you have. As I always say, even if we can’t help you, you’ve learned a little more, and we will part as friends.

John