How To Get Disability Insurance With Pre-Existing Conditions The Right Way | We Set Your Expectations Correctly In This Guide

Updated: April 12, 2024 at 9:38 am

You purchase disability insurance to protect your income and wealth in case you are sick or hurt and can’t work. However, did you know that most disability insurance plans do not cover pre-existing conditions?

You purchase disability insurance to protect your income and wealth in case you are sick or hurt and can’t work. However, did you know that most disability insurance plans do not cover pre-existing conditions?

No, John, I did not know that!

Yes, that is right.

Actually, I would guess that all private, individual disability insurance plans exclude any pre-existing conditions or lifestyle situations from coverage.

However, as we will discuss, having a pre-existing condition doesn’t mean you should avoid or not accept this very important insurance.

If you have pre-existing conditions, and most people do (including me), you can still obtain disability insurance.

I’ve spoken to so many professionals and read so many articles that generally misinform the purpose of disability insurance and place too much weight on pre-existing conditions.

In this guide, I will go into detail about how disability insurance carriers approach pre-existing conditions. Treat this article as a guide to setting your expectations correctly and the right way when applying for disability insurance.

Here is what we will discuss:

- What Are Pre-Existing Conditions?

- Why Do Pre-Existing Conditions Matter?

- What Is The Right Approach?

- Are Pre-Existing Conditions Covered?

- Can A Carrier Remove A Pre-Existing Condition?

- Does It Make Sense To Accept A Policy?

- FAQs Pre-Existing Conditions

- Plans That Cover Pre-Existing Conditions

- Final Thoughts

Let’s jump and discuss pre-existing situations and conditions. Please also be aware that we address many questions about disability insurance and pre-existing conditions in our FAQ section.

What Are Pre-Existing Conditions In Disability Insurance?

I think we all know what pre-existing conditions are.

Yes, John. They are previous illnesses or injuries you had.

Yes, so pre-existing conditions include (for example):

- Back pain

- Anxiety or depression

- Broken bones

- Carpal tunnel

- Asthma

- Cancer

- On and on and on…

However, you are half right.

Health conditions are one-half in the realm of the pre-existing condition.

In the insurance world, including disability insurance, pre-existing conditions include lifestyle and non-medical conditions as well.

Not many people, including other agencies or brokers, focus on these other situations, but:

- Past DUIs

- Felonies

- Skydiving

- Marijuana use

- Bad driving records

- Chiropractic visits

- Significant foreign travel

- And on and on and on…

These are pre-existing conditions as well.

If you have any pre-existing conditions or situations, disability insurance carriers will likely exclude them from coverage or limit your benefits in some way.

We discuss why next.

Disability Insurance Carriers And Pre-Existing Conditions

First, let me say this:

If you have a pre-existing condition, you can still (likely) obtain disability insurance coverage!

That is right.

Moreover, depending on the severity, some carriers cover pre-existing conditions. For example, carriers may cover a healed broken arm that is longer under treatment.

However, carriers will (likely) exclude most pre-existing conditions or situations from coverage. (More on the “likely” here in a minute.)

That is what bothers people.

For example, if you hurt your lower back, most (likely all) carriers will exclude that lower back, spine, muscles, and ligaments from coverage.

This means if you injure your lower back, the carrier won’t pay a disability benefit.

But, if you hurt or injure your upper back and can’t work, the carrier will pay a benefit.

But, if you hurt or injure your upper back and can’t work, the carrier will pay a benefit.

John, this all stinks. But, I got life insurance with no problem with no exclusions!

Life insurance and disability insurance are completely 2 different products that underwrite differently. In fact, most times, people can obtain life insurance, but are denied disability insurance.

I understand you are upset. However, many reasons exist why carriers exclude pre-existing conditions from coverage:

- Carriers are insuring your income (by paying a monetary benefit if you can’t work) and

- They underwrite your future probability of a disability

It’s the second bullet point that carriers focus on.

Let’s say you have anxiety or depression. You take medication, and your situation is stable. You’ve never been hospitalized for anxiety and depression or missed work.

Carriers will then offer you a policy. However, they will place an exclusion for any mental illness disorder.

The Reason Why Disability Insurance Carriers Exclude Pre-Existing Conditions

Here’s the reason. You’ve been diagnosed with a condition that can lead to a future disability, so carriers exclude it from coverage.

Does that make sense?

Yes, John, but I don’t like it.

I understand you probably don’t. However, take a 30,000-foot view and consider these elements of disabilities:

- Disabilities can happen in an infinite number of ways, and not just from the pre-existing conditions excluded in your policy.

- People focus on the negative, not on the positive.

- Without insurance, disabilities can lead to a possible, serious negative financial impact. A disability is a leading cause of mortgage failures. It is not death as the life insurance industry wants you to think.

- About 1 in 4 20-year-olds will face a disability that lasts longer than 90 days. This statistic changes as people age.

- If policies did cover pre-existing conditions, premiums would be very expensive (currently, depending on various underwriting factors, the cost is around a cup of coffee).

Think of it this way. Let’s say you are a disability insurance carrier. A prospect approaches you who avidly rock climbs. Would you insure her without any exclusions?

No, John, I won’t.

Why not?

Rock climbing is a dangerous activity.

Yes, and…

Well, I’d have to charge her a lot to compensate for that risk, possibly falling and getting hurt.

Right. Same thing if someone has anxiety or depression, especially knowing there are nearly endless ways for a disability to occur.

Even if you think your pre-existing condition is no big deal, you need to let the carrier know.

Now is a good time to discuss the right approach for disability insurance and pre-existing conditions.

Here Is The Right Approach For Pre-Existing Conditions and Disability Insurance

Let’s recap so far what we have discussed:

- We all (likely) have pre-existing conditions.

- Even if you think your pre-existing condition is no big deal, it might be to the carrier.

- Life insurance underwriting is much different than disability underwriting. You might qualify for a life insurance policy with no exclusions, but that isn’t the case with disability insurance.

- Disabilities can happen in nearly endless ways.

- If the pre-existing condition or situation is severe enough, carriers will decline an application.

The right approach when applying for disability insurance is knowing the carrier could exclude any condition or situation.

could exclude any condition or situation.

While that may make you feel upset, consider if the pre-existing condition will really cause a future disability.

Let’s go back to anxiety and depression, which are common pre-existing conditions. Let’s say you have mild anxiety, for instance, and are under medication. Do you think your anxiety will cause a disability?

The right answer is you don’t know. However, I bet that an equal, or better, chance exists of the millions of other ways than your controlled anxiety or depression.

Do you see my point here?

We focus on the negative. John, I want a complete plan, many professionals retort when I tell them the carrier will exclude their gastritis (for example) from coverage. They then hang up the phone. However, they are “hung up” on one condition, that is controlled, and (likely) will not cause a long-term disability.

The Negative Impact Of Not Taking A Policy

They then go months or years without coverage. Then, they receive a serious diagnosis. Or, worse, they are hurt in an accident. Their pre-existing condition had nothing to do with their disabling situation.

If you think I am joking, I am not. I receive far too many requests from people whom I have spoken to in the past to revisit disability insurance. My first question to them is, “What changed?” I discover they hurt themselves, or they await a diagnosis.

Again, their pre-existing condition wasn’t the cause.

I’ve written about how important disability insurance is to a family. We know that it “protects your paycheck”. Let’s say you have no disability insurance coverage and a disability happens. You can’t work. How will you pay for your mortgage, bills, etc.? The money has to come from somewhere, and that is usually your retirement account, selling your home, etc.

For example, in our latest article about disability insurance for photographers, I went through an easy, but plausible, scenario of the negative financial impact of NOT having disability insurance.

So, the right approach here is to:

- be truthful on the application,

- disclose your pre-existing condition, and

- understand that your policy will cover the nearly endless possibilities of disabilities.

If you still don’t like it, then jump to my section on disability insurance policies that DO cover pre-existing conditions.

Can Carriers Cover Pre-Existing Conditions?

To get to the point, yes, some carriers cover pre-existing conditions.

However, doing so really depends on the situation. So, as we described before, expect carriers to exclude pre-existing conditions from coverage.

Nevertheless, some situations allow pre-existing conditions coverage. Here are some possible examples. (These are examples for illustration purposes. Your situation is completely different and subject to disability insurance underwriting.)

- Broken bones with no pins or rods

- Well-controlled high blood pressure (not due to another health condition)

- Controlled cholesterol

- Going to the chiropractor a few times per year for wellness only

- Kidney stones (one-time issue)

- Torn ligament or muscle, as long as healed and no further treatment required

Generally speaking, these are the type of situations that disability insurance carriers cover with no exclusions. However, as we stated, having a pre-existing condition covered really depends on your specific situation and underwriting guidelines.

Can Carriers Remove Pre-Existing Conditions?

The short answer is, yes.

However, doing so does require some patience. Moreover, removal is not guaranteed.

First, let me say that most plans will not remove chronic illnesses. Situations like anxiety, multiple sclerosis, neuralgia, etc. will just stay excluded on your policy.

First, let me say that most plans will not remove chronic illnesses. Situations like anxiety, multiple sclerosis, neuralgia, etc. will just stay excluded on your policy.

However, as I wrote earlier, will these be the cause of a disability claim? Maybe…maybe not, though. There are nearly endless ways for a disability to occur.

So, you have “un-stick” yourself from your health condition. Understand that a million ways exist for a disability to occur other than your excluded health condition.

Nevertheless, depending on your situation, carriers may remove a pre-existing condition.

These pre-existing conditions are more lifestyle, injury-related conditions.

For example, let’s say you pull your lower back and went to the doctor. The doctor takes MRIs or x-rays and nothing is wrong. You just pulled a muscle.

Six months later, you apply for disability insurance. The carrier places an exclusion on your lower back. The carrier says as long as no reoccurrence or symptoms exist after 2 years, it will consider removing the exclusion.

This is known as a temporary exclusion.

Two years elapse. Your back is still fine. Moreover, a doctor or medical professional has not treated your back since. The disability insurance carrier confirms this through your doctor’s records. It removes the exclusion.

If you still had pain or a doctor treated your back, the carrier would have kept the exclusion on.

Note: if you want an exclusion removed, you will likely have to pay for any fee associated with the process. (Records transfer, follow-up x-rays, etc.)

Examples Of (Possible) Removable Exclusions

Here are some examples of exclusions we have helped our clients remove. Again, no guarantees exist about removing the exclusion. Doing so depends on your specific situation:

- Broken bones

- Back pain

- Chiropractor visits

- Inner ear issues

- Torn ACLs (fully healed and no restrictions)

There are more situations as well.

Contact us for any questions. I can contact an underwriter to assess your specific situation.

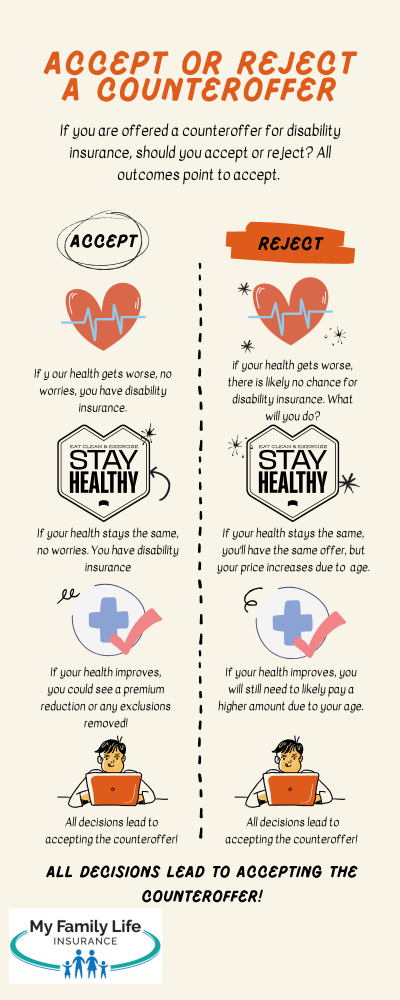

If You Have An Excluded Pre-Existing Condition, Does It Make Sense To Accept A Disability Insurance Policy?

Of course, yes, it does.

Three things happen (usually) when I tell people their plan will (likely) exclude their pre-existing condition. They:

- Are upset and focus on the negative

- Don’t consider the endless other ways a disability happens

- Think disability insurance is now a waste of money

First thing, and here is a secret: all types of insurance are a “waste” of money. They are sunk costs. This means you pay a premium and if the event happens, then you receive a benefit. If not, you receive nothing.

Here’s the purpose of insurance. It protects you from situations where self-insurance (i.e. you use your own savings) is impossible.

For example, do you have $500,000 spared in case a disability happens to you? Likely not.

I think you’ll agree with me that a serious, potential financial problem may occur if you are disabled for 6 months, a year, or longer. Moreover, a rather significant one.

In previous articles, I’ve illustrated how not having disability insurance can potentially destroy your wealth.

But, people only focus on the excluded pre-existing condition. They feel that a future disability will only occur from that pre-existing condition.

While anything can happen, anything CAN happen, including the other endless ways a disability happens.

Is your pre-existing condition controlled by medication and your doctor? If so, honestly ask yourself if it will cause a disability. The right answer is maybe. But, also, maybe the other thousands of ways a disability happens.

If you stop focusing on the negative, then you will see that the disability insurance policy is an extremely valuable policy protecting your income, family, and wealth.

Moreover, as I indicated earlier, if your pre-existing condition improves, we can always have the carrier revisit your situation.

FAQs About Pre-Existing Conditions And Disability Insurance

We address commonly asked questions about pre-existing conditions and disability insurance here.

Do Carriers Decline An Application If You Have Many Pre-Existing Conditions?

Good question. While severity matters, generally, yes, after so many pre-existing conditions, carriers will say that an applicant is uninsurable.

Many carriers don’t state this outright; however, they all have a limit.

That limit is probably 3 to 4 pre-existing conditions.

For example, if you have:

- back pain

- gastritis

- chronic migraines

- neuralgia from shingles

carriers will likely decline your application. Some may place a rating and limit benefits in other ways (see our disability underwriting guide for more details).

If you have many pre-existing conditions, contact us so we can go over your other options.

Why Is Pregnancy A Pre-Existing Condition In Disability Insurance?

This is a good question. The answer can be rather complicated because a couple of moving parts exist. We break it down.

First, if you have given birth via cesarean or had complications of pregnancy, the carrier will exclude from coverage any disability arising from future pregnancies (i.e. complications of pregnancies).

Second, many women contact us about childbirth and maternity leave. If you did not know, many group employer plans typically cover maternity leave/childbirth as a disability.

However, when it comes to individual disability insurance, many carriers will only cover childbirth/pregnancy only if complications exist which prevent you from getting back to work.

All, except one. We work with a short-term disability insurance carrier that covers childbirth as a disability.

Contact us if you have any questions.

Can Carriers Remove Exclusions?

Yes, carriers can remove exclusions.

However, we explained earlier there is a process for removing exclusions. Moreover, carriers won’t remove most pre-existing exclusions simply due to their nature. For example, many chronic illnesses will likely stay as an exclusion.

What If I Develop A Health Condition After I Am Approved?

Then the carrier covers that health condition. This is why we say the best time to obtain disability insurance is right now.

If you are a young adult reading this with no pre-existing health conditions, I recommend you purchase a policy now. The policy doesn’t have to cost a lot. We can place a guaranteed insurability rider on the policy. The guaranteed insurability rider allows the future purchase of additional dsiability insurance coverage with no health underwriting.

Read more about disability insurance for millennials.

If you are older and/or have health conditions, the right time to buy disability insurance is now.

Can Carriers Deny My Benefits If I Have A Pre-Existing Condition?

Yes, if the pre-existing condition contributed to the disability.

OK. If My Pre-Existing Condition Contributes To A Disability, Should I Still File A Claim?

Even though your claim may be denied, I would generally recommend submitting a claim. Most carriers review claims on a case-by-case basis and determine if your pre-existing exclusion contributes to a disability.

For example, let’s say you have arthritis in your left knee. The carrier excludes your left knee from coverage. If you tear your ACL in your left knee, and arthritis did not cause or contribute to the tear, you have a good case for a claim.

However, generally, these situations lead to a declined claim. For example, if you have anxiety and then you need to take off a few months because of a mental breakdown, the carrier will likely decline the claim.

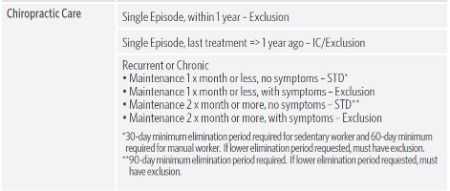

Why Do I Have A Back And Spine Exclusion Because I Go To The Chiropractor?

This is always an interesting topic.

People go to the chiropractor for, mainly, 2 reasons:

- Because they have pain, problems, or issues with back, neck and/or other areas

- Because they like back adjustments or wellness

A chiropractor is a doctor, right?

So, look at this from the disability insurance carrier’s point of view.

If you go to the doctor (chiropractor), there must be something wrong.

But, John, I only go for wellness!

I get it. Look at it from the disability insurance carrier’s perspective, though.

They see you go to a doctor. Moreover, getting back adjustments could lead to a disability.

However, in the last 10 years, many carriers have relaxed these standards.

Some will not place a back and spine exclusion on your policy as long as your annual visits to the chiropractor aren’t excessive.

What’s excessive? It depends on the carrier and your occupation. However, I would hazard to guess that fewer than 6 times per year.

I’ve had people tell me they go 12 to 24 times in a year for wellness.

Honestly, that is excessive. Any carrier will say that.

But, we still have options if you go an excessive amount for wellness.

We have a carrier that will not exclude your back and spine from coverage provided the visitation is only for wellness and not for symptomatic body pain.

However, this carrier may not be the right one for you.

So, going back to what I discussed, you will have to decide if:

- Disabled, will it really be from your back and spine? If you continuously go to the chiropractor, aren’t you already trying to protect that? Or,

- Disabled, will it be from the endless other reasons why?

Contact us if you have questions.

Why Do Anxiety / Depression Diagnosis Come With Limited Benefits?

Your doctor prescribes you an anxiety or depression medication. When that happens, you’ve just limited your disability insurance policy.

What do I mean? I mean just about all the carriers, if not all of them will:

- Allow a minimum 90-day waiting period

- Allow a maximum 5-year benefit period

- Exclude all disabilities from mental or nervous disorders from coverage.

I have discussed with many disability insurance underwriters, from many carriers, and they are all aligned on the minimum 90-day waiting period, 5-year benefit period.

They share that, even in the mildest cases, claims information indicates that having a mental or nervous disorder, even mild, increases the probability of a long-term disability claim for anything.

So, while this may sound unfair, the disability insurance industry aligns with this.

However, is it really something to be angry or upset about? If your anxiety or depression is under control, will it disable you?

Maybe, but as I said, maybe not. As I said, there are umpteen ways to a disability.

A 5-year benefit period is still really great coverage. You will have to decide if having some type of coverage, covering the other chances for a disability, is right for you.

What Health Conditions Lead To A Decline?

Some pre-existing conditions simply lead to a decline. These include:

- Multiple sclerosis

- Severe bipolar disorder

- ALS

- Congestive Heart Failure

- Multiple or serious back and neck issues

- Multiple DUIs

- Felonies (depending on type)

- Bankruptcies

- Many chronic musculoskeletal issues

Basically, carriers will decline your application if you have a poorly controlled, current, or severe health condition.

If that is the case, or you simply want your pre-existing conditions covered, then you will want to read our next section.

Disability Insurance Plans That Cover Pre-Existing Conditions

John, I just want a disability insurance policy that covers pre-existing conditions.

OK, well, a couple of these exist.

However, they may not be the right fit for you.

We will discuss this further.

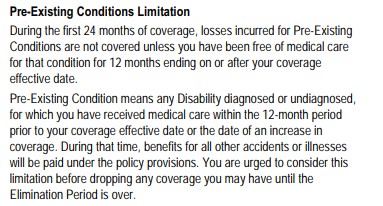

Association Disability Insurance Plans

Many occupations offer disability insurance plans through their associations.

As we wrote in our association disability insurance plans article, one of the benefits of the association plans is that they, generally, cover pre-existing conditions.

You’ll read something like this in a typical association disability plan (see excerpt).

excerpt).

That is really great, John!

It sounds so, yes, but peel back the onion layers.

As we wrote in our article, association disability insurance plans typically come with many limitations including, but not limited to:

- Limited own occupation definition

- Automatic coordination with social security

- No partial disability benefits

- No future purchase options

- Limited riders and options

As have written in previous articles, having own occupation definition, partial benefits, and future purchase options creates a “formidable” insurance plan.

You can see that association disability insurance plans typically lack that. You will have to decide if having pre-existing conditions covered is worth having a weak plan.

Group Disability Insurance

Disability insurance through your employer also covers pre-existing conditions. Moreover, we work with a solid employer disability insurance plan for self-employed business owners with at least 1 other employee. The plan contains guaranteed issue underwriting (i.e. you can’t be turned down for health reasons). Additionally, the plan covers pre-existing conditions after 1 year.

The issue, like the association plans, is that the plan contains limitations. Nevertheless, it can be a good option for small business owners.

Contact us if you’d like to learn more.

Now You Know The Right Way To Approach To Pre-Existing Conditions And Disability Insurance

We hope you learned more about how carriers approach pre-existing conditions and why they exclude them from coverage.

More importantly, we discussed why you should take a disability insurance policy anyway, regardless of any pre-existing conditions on your plan.

Moreover, we discussed that carriers can remove some pre-existing conditions.

Do you have any questions? Would you like to discuss your pre-existing conditions and see what our carriers say? Please contact us or use the form below.

There is no risk of contacting us. We only work in your best interests, not our own. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".