3 Strong Reasons Why Millennials Need Disability Insurance | Learn Why This Insurance Is Extremely Important

Updated: April 12, 2024 at 9:39 am

Millennials usually don’t think about disability insurance. If you are a millennial, I think you’ll agree with me about that.

Millennials usually don’t think about disability insurance. If you are a millennial, I think you’ll agree with me about that.

There’s a lot going on in your life, right?

Disability insurance can wait, you say.

Well, not really. If there is one insurance I’d say to obtain as soon as you possibly can, it is this one.

I’m writing this article so you don’t make similar mistakes as other people I speak with. Disability insurance has to be, hands down, the most overlooked insurance, yet one of the most important.

Every day, I have tough discussions and conversations with people. These discussions could have been avoided long ago.

In this article, I discuss the 3 reasons why millennials can’t ignore disability insurance.

Throughout the article, I discuss the need and how relatively inexpensive disability insurance can be for millennials.

Yes, that is right. I bet the daily cost is less than the latte you buy at Starbucks.

For quicker navigation, feel free to use the links below:

- What Is Disability Insurance?

- #1 Strong Reason

- #2 Strong Reason

- #3 Strong Reason

- Your Employer May Not Have Enough Coverage

- Now You Know The Reasons Why Millennials Can’t Ignore Disability Insurance

Let’s jump in and discuss disability insurance.

What Is Disability Insurance?

Disability insurance pays you a benefit if you can’t work due to an illness or injury. It’s that simple.

People ask me all the time if they need disability insurance. I always say:

If you make money, and

- you and your family rely on that money, and

- you and your family would be in financial disarray from your not working due to injury or illness, then

So, that is like every working person here in the US!

Think of it as the spare tire in your car or AAA. If your battery dies or you have a flat tire, you are really happy to have the spare tire of AAA. Except, disability insurance is the spare tire for your life.

flat tire, you are really happy to have the spare tire of AAA. Except, disability insurance is the spare tire for your life.

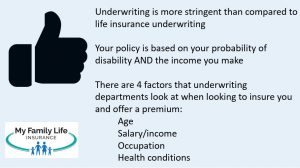

When you submit an application, the carrier reviews your application and either approves or denies it. This is called underwriting. Here’s what underwriting departments look at on your application:

- Age

- Income you make

- Occupation

- Health conditions

- Any hazardous activities

- Anything else carriers deem important

That’s great, you say.

I know this seems rather boring, so let’s give an example demonstrating the importance of disability insurance for millennials.

Example Of The Importance Of Disability Insurance For Millennials

Let’s say you get in your car one morning. It’s 7 am, and you head to a meeting. It’s an important meeting, one that puts you on the upward leadership path with your company. You think positive thoughts and how well you will do.

You really weren’t paying attention to the road. On a turn, though, you unexpectedly lose control. You took a turn really fast and didn’t slow down. The car careens off the road at a high speed, crashing into some trees. The car rolls, glass and metal splattering everywhere. Pain shoots up throughout your body. You are in shock and lodged in your car. It’s only about 7:15 am.

You try to move, but you can’t.

First responders extract you from the car. At the ER, doctors determine both legs are severely broken. You’ll probably require months of rehabilitation just on that. Moreover, you broke your right wrist, right elbow, and right upper arm. You have some torn ligaments, too, and facial lacerations. You have numerous other injuries, but moderate compared to your broken bones and torn ligaments.

Your doctors suspect months of rehab. Maybe you’ll get back to work in 9 months…or longer.

Wow…how in 15 minutes, your life changed.

At a loss, you are worried about what the next 9 months to a year will bring.

But…

You are happy you don’t really have to worry about money. Thankfully, you have disability insurance, which pays you a monthly benefit. You use this money to pay for your mortgage, groceries, and other needs while you focus on getting better. That is one less thing you have to worry about.

You concentrate on getting better.

Sounds good, you say. But, I’m not going to get in an accident.

What? Do you know this is a real-life story?

Huh?

This is, essentially, what happened to Tiger Woods. I bet Tiger didn’t expect to get in a serious accident. He is disabled. He can’t golf. I simply replaced his situation with you.

in a serious accident. He is disabled. He can’t golf. I simply replaced his situation with you.

How does that make you feel now?

Now, you see a disability can happen to anyone. The difference between Tiger and you and me is he has millions. We don’t. If this happens to you, how will you support your family?

OK, John. I’m listening.

Let’s get into the reasons if the above example wasn’t convincing enough already.

Strong Reason #1 Why Millennials Need Disability Insurance – A Disability Happens Anytime

Insurance agents spout statistics like water. I tend to ignore those because you don’t protect yourself or your family on statistics alone. I mean, the probability of your house catching fire is 1 in 3,000, but we still get homeowner’s insurance. Why? Because our home has value, and if something happened, we need money to build a new one.

Same with disability insurance and your life.

However, a few insurance statistics stick with me because they feel right. Here is one disability insurance statistic from the Social Security Administration. It is more damaging than the probability of your house burning down:

A 20-year old has a 1 in 4 chance of being disabled before retirement age.

Next time you and 7 of your friends get together, know that, on average, 2 of you will be disabled. Maybe that is you?

Next time you and 7 of your friends get together, know that, on average, 2 of you will be disabled. Maybe that is you?

Other industry data suggests your chance of disability increases with age.

You don’t need statistics, though. Look around you. I bet you know several people who needed to stop working due to an injury or illness.

But, John, you say. I don’t know anyone in a wheelchair.

Didn’t you listen about the Tiger Woods situation? He’s not in a wheelchair, but is now disabled. OK. Let’s explain this further.

Disabilities Are More Than Wheelchairs

I get it. We all think being in a wheelchair is the only path to a disability. Not true. Having cancer, multiple sclerosis, degenerative back pain, nerve pain, long-term COVID-19 complications, fused vertebrae, etc. all are disabilities.

If you can’t work due to an illness or injury, that’s a disability.

And, these all happen anytime.

So, now. How many people do you know can’t work or can’t work full-time because of an injury or illness?

OK, yes, more, John. But, I am not going to be disabled tomorrow.

How do you know that? I know you can’t predict the future. If you did, you would have predicted the pandemic. But, you did not.

Additionally, if we learned ANYTHING from the pandemic, we learned your life can change in a snap.

Just look at the Tiger Woods example again. He entered his car at approximately 7:00 AM PST on February 23rd. At about 7:10 PST, his life changed forever. He didn’t expect this accident to happen.

Tiger is disabled. He can’t do his job as a golfer. At least right now.

Now, the difference between Tiger and us is his worth. He can likely get through this disability without any financial impact. He may never golf again, though.

However, replace Tiger’s name with yours. If this happened to you – and it can – how would you and your family survive financially?

OK, John. I am listening. But, how much would this all cost? I don’t want to be insurance-poor.

You won’t. At least if you take advantage now. That brings us to our second reason.

Strong Reason #2 Why Millennials Need Disability Insurance – You Are (Typically) Healthy & The Cost Is Low

We all want to save money on something. This might sound funny, but if you want to save money on disability insurance, you have to get it now. Not next year or whenever you feel like it.

Now. Today.

Why is that, John, you ask?

Because you likely won’t be as healthy as you are today. Moreover, you won’t be as young as you are right now.

As we wrote in our disability insurance underwriting guide, there are many aspects to the underwriting process. As we mentioned earlier in the article, underwriters look at your:

- Age

- Occupation

- Income / salary you make

- Health conditions you have

- Any hazardous activities you participate

There is no controlling #1. As you age, your premiums increase. Generally, the  same with #4. One-time injury or illness is OK. But, if you are diagnosed with a long-term health condition like diabetes, then the carrier reflects that health condition in your premium and/or coverage.

same with #4. One-time injury or illness is OK. But, if you are diagnosed with a long-term health condition like diabetes, then the carrier reflects that health condition in your premium and/or coverage.

Buying disability insurance now won’t cost an arm or a leg if you are young and healthy. In general, disability costs 2 cents for every $1 you earn. Think about that. You spend thousands on electronics, video games, and whatever else. But, disability insurance is so important, yet takes a back seat on the back burner. Additionally, it can be cheap.

In general, disability costs 2 cents for every $1 you earn. Think about that.

Let’s give you an example to put real numbers in context.

Example Of Disability Insurance Cost

Let’s say you are 27 years old, making $75,000, working as a dental hygienist. You gave me a call and wanted to know about disability insurance. You are young and healthy, with no issues, although you see a doctor for an annual checkup. Great! We discussed the elimination period, benefit period, the own-occupation disability definition, among other things. You are young enough that you can afford a to age 67 benefit period.

Here’s an estimated premium, 90-day waiting period, to age 67 benefit period, with a $3,750 monthly benefit: $110 per month. That’s about $3.67 per day…better than the latte you buy at your favorite coffee shop! Not a bad premium at all, considering the true own occupation definition as well as other favorable benefits. At your age, the to age 67 benefit period is still affordable.

But, you tell me you’ll think about it (even though I know there’s nothing to think about…it’s insurance, ?) Or, you are too busy. Or, there is some other reason why this isn’t important to you at this moment.

13 years later, at age 40, you call me again. Now you are ready. You want the same plan! You were diagnosed with some minor health ailments. No biggie. However, you now go to the chiropractor. You go a lot – 2 X per month for back adjustments. The carrier says this frequency indicates an underlying back issue. They have a point. It could. So, they place a back and spine exclusion. (Related: see how we approach chiropractic visits in our disability insurance underwriting guide.)

13 years later, at age 40, you call me again. Now you are ready. You want the same plan! You were diagnosed with some minor health ailments. No biggie. However, you now go to the chiropractor. You go a lot – 2 X per month for back adjustments. The carrier says this frequency indicates an underlying back issue. They have a point. It could. So, they place a back and spine exclusion. (Related: see how we approach chiropractic visits in our disability insurance underwriting guide.)

Moreover, to add insult to injury, I tell you rates changed. You knew they would. But, I could feel you fall off a chair as I tell you your new rates:

90 day waiting period, $3,750, to age 67 benefit period: $180 per month.

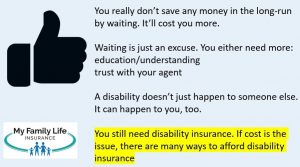

You Don’t Save Money By Waiting

Well, John. I saved money, you say. I didn’t pay anything for the first 13 years!

Like a mirage, you are just seeing things.

Let’s say you keep the disability insurance until age 65. If you bought the policy at age 27, you would have paid $51,500 in premiums. (39 years X 12 months X $110).

age 27, you would have paid $51,500 in premiums. (39 years X 12 months X $110).

If you buy the policy at age 40, you will have spent $56,200! (26 years X 12 X $180).

So, you’ve spent almost $5,000 more over your lifetime by waiting! Moreover, you now have a back and spine exclusion! If you got the disability insurance 13 years prior, there would be no exclusion.

But won’t the carrier re-underwrite me?

No. There is a 2-year contestability clause which is common in all policies. Basically, if you make a claim in the first 2 years of the policy, the carrier can investigate to make sure they didn’t miss anything during underwriting.

But, if you go after you are 100% covered, there’s still no exclusion. Once you are insured, you are covered.

What if you were diagnosed with rheumatoid arthritis or depression? Both are manageable conditions, but disability insurance carriers adjust your premiums and benefits for an increased risk of disability due to these conditions. That means higher premiums or reduced benefits.

Well, John. I invested that money. The $110 in the first 13 years.

Did you? Be honest with yourself. Yes, all insurance is a sunk cost. However, I know you did not invest that money because many people don’t invest. But let’s say you did. Ok. You then you likely made up for the overspend. But I can make the same argument: What if you invest that $70 you don’t pay from waiting? You could have around $225,000 at age 65!

A bad accident or illness can happen at any time, even to young professionals.

The right answer is to get the disability insurance now and not wait.

Strong Reason #3 Why Millennials Need Disability Insurance Now – You Are A Millionaire

Yes, you are a millionaire. At least you are on the path.

That doesn’t make sense, you say. I only make $40,000 annually!

Look at it this way. Even if you make $40,000 over the next 30 years – and you will – you’ll have made $1,200,000!

Isn’t $1.2 million, or some piece of it, worth protecting?

Your Greatest Asset Is…

Millennials have long-term earning power, making disability insurance essential. While you may not have many assets right now, your ability to earn an income is your greatest asset, even bigger than a house or 401k.

Your ability to earn an income is your greatest asset. Without it, you have nothing.

Think about it: no ability to earn an income means no nice life, and no nice things.

We just discussed how relatively inexpensive disability insurance can be, particularly compared to other non-essentials.

What if you can’t afford “to age 67” coverage? Well, a 5 year benefit period works, too. Look at it this way, you’ll have a “bucket of money” available to you upon a claim, that can last up to 5 years.

Many industry statistics suggest most long-term disabilities are 30 months. However, the claims departments I speak with tell me claims last around 18 months.

So, a 5 year benefit period can work. In this case, you’ll insure $200,000 of your income.

Isn’t that better than raiding your 401(k) or having to sell your home to make ends meet? (Hey, the last-resort option happens more than you think. I just had a conversation with a woman about that.)

A properly constructed disability insurance plan prevents you from utilizing your assets for your care and needs.

And, as we discussed, disability insurance doesn’t have to be that expensive for millennials.

Your Employer Likely Does Not Offer Enough

Millennials tell us they have disability insurance already.

John. I already have some through my employer, they say.

OK. Tell me about the plan.

Crickets…

Here’s the thing. Sure, you probably do have some coverage through your employer.

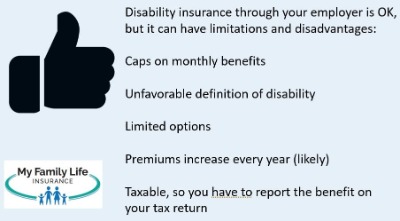

However, it’s not great insurance. It’s OK. Group disability insurance is designed to meet the needs of many, not you. So, it is OK insurance. It might have a limited definition of disability, have a monthly cap, or increase in premium each year (likely).

to meet the needs of many, not you. So, it is OK insurance. It might have a limited definition of disability, have a monthly cap, or increase in premium each year (likely).

Moreover, your disability insurance benefit through your employer is taxable.

That’s right.

Unlike a private, individual disability insurance policy, benefits through your employer’s plan are taxable.

So, let’s say you have a $2,500 monthly benefit through your job. If you go on claim, expect to pay $500 to $1,000 of each payment for taxes.

How does that make you feel?

The good news is that carriers know this and allow a plan to supplement your income.

Additionally, this plan isn’t expensive.

Using our benefit numbers from the example above, if you are age 25 making $50,000, a supplemental disability insurance policy costs likely another $15 to $30 per month, depending on the benefits selected.

This amount essentially pays any taxes you’ll face if you make a claim on your employer’s coverage.

So, don’t think your group employer plan covers you 100%. You will still be exposed.

Now You Know The 3 Reasons Millennials Can’t Ignore Disability Insurance

We’ve outlined the 3 reasons why millennials can’t ignore disability insurance. These reasons are:

- a disability happens anytime

- millennials are (generally) young and healthy, so their protection cost is lower. Moreover, they will spend more money if they decide to wait

- millennials are millionaires in the making

Do you have any questions about disability insurance? Do you want to know it works in more detail? I am happy to discuss and answer any questions you have. Feel free to contact us or use the form below.

There’s no risk in contacting us! We only work in your best interest and put your needs first, not our own. If you don’t feel we can help you, we’ll try our best to point you in the right direction, and part as friends. Seriously! And, you can contact us again if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".