How Photographers Protect Their Wealth With Disability Insurance | We Discuss How To Purchase This Important Insurance, Plan Options, Underwriting, And Costs

Updated: April 12, 2024 at 9:38 am

As a photographer, you have an eye for capturing reality. No two photo shoots are the same! But, if you are like most photographers, you probably don’t think about protecting your wealth and income with disability insurance. Or, even if you need it at all.

But, if you are like most photographers, you probably don’t think about protecting your wealth and income with disability insurance. Or, even if you need it at all.

What if you could no longer do your job if you are sick or hurt? Have you ever thought about that?

Have you ever thought about what would happen if you became sick, ill, injured, and disabled?

How would you pay your bills if you could not work?

If you are self-employed and own a business, what happens then?

Disability quickly affects your future plans and the lifestyle you worked so hard for.

This article discusses disability insurance, how it protects wealth, and how photographers obtain the best disability insurance for their specific situation.

Here’s what we will discuss:

- The Importance Of Disability Insurance

- How Disability Insurance Protects Your Wealth

- Important Policy Attributes

- Disability Insurance Underwriting

- The Best Disability Insurance

- Disability Insurance Cost

- Final Thoughts

Let’s jump in and discuss the importance of disability insurance for photographers.

The Importance Of Disability Insurance For Photographers

We’ve written a lot about disability insurance. There are 5 reasons why disability insurance is important. We will discuss 3 of them here. However, they all revolve around one main theme. That theme is:

If you got sick or hurt yesterday, and can’t work at all, how will you pay your mortgage and bills today?

Honestly answer that. If your answer is, I’ll:

- Borrow,

- Raid my retirement,

- Figure it out,

- Rely on my spouse, or

- I don’t know

Then let’s have an important discussion about disabilities. Here are 3 reasons why photographers should consider disability insurance.

#1 A Disability Happens Often

#1 A Disability Happens Often

You think a disability won’t happen to you, I know. I hear this from professionals all the time.

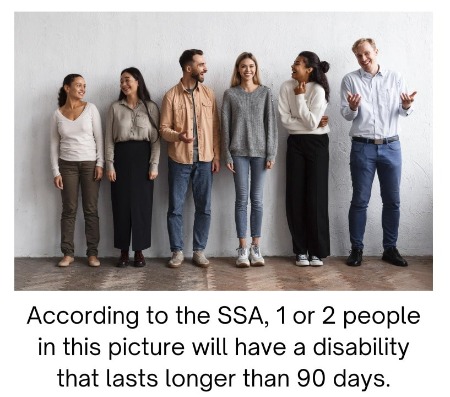

However, the probability of having a long-term disability is anywhere between 1 in 3 and 1 in 4 workers. Contrast this to unexpected death, say from a motor vehicle accident, which is 1 in 114. Even dying from cancer has better odds: 1 in 7.

But, John, I’m not going to get hurt or be in a wheelchair, you say.

That is a costly and erroneous mistake to think that way. A disability for a photographer could be:

- Cancer

- Multiple sclerosis

- Lower back pain

- A herniated disc

- Neck problems

- Heart disease

- A stroke

- blindness or lost vision (you need that, right?)

- Torn ACL

And on and on…

Anything illness or injury-related that prevents you from doing your job as a photographer is a disability.

When we think of disability, we think of someone bound in a wheelchair, right? Not true. According to the Council For Disability Awareness, 90% of disabilities are from illnesses (like cancer) than from accidents. That means an illness or condition, such as cancer or a heart condition, has a higher probability of disabling you than a skiing accident.

#2 A Disability Can Last A Long Time

How long does a disability last?

I don’t know. A few months?

Maybe. The right answer is you don’t know.

Some internet stats say the average disability is 3 years.

The claims departments I speak with say 18 to 24 months.

Neither is right. The right answer is you don’t. You could be out of work for 6 months, a year, 2 years, or longer.

Moreover, what will you do for money during that timeframe?

Look at Tiger Woods. He is disabled (he still isn’t 100% to golf). He can’t do his job full-time as a golfer. His car crash is something that can happen to all of us.

The difference between Tiger Woods and us is that he has millions of dollars to fall back on, and we don’t.

#3 Your Family Is Worth It

Sure, your customers are very important. There is also a group of people who are more important. Who can be more important than my customers, you think? They pay my income.

Sure, your customers are very important. There is also a group of people who are more important. Who can be more important than my customers, you think? They pay my income.

True. They do, but they don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything.

I talk to professionals every day about disability insurance. Many of them just overlook this important part.

If you end up disabled and not making money, you’ll have to answer some tough questions and potentially make some tough decisions.

Would you and your family be able to continue your standard of living without your income? If not, what is “plan B”?

Would your spouse have to work or work more?

What happens to your business?

Would you need to sell your home to make ends meet?

Who could be flexible with the children? Would you have the money to hire someone to take care of the kids?

The tough questions can go on and on.

These questions are answered with disability insurance. With disability insurance you will have:

- Peace-of-mind

- Time to figure out what to do next

- Money

- Time to concentrate on getting better

- Plan “B”

- No worries (or fewer worries than if you had NO money)

A Final Thought About Disability Insurance For Photographers

Many people take the erroneous view that disability insurance should replace all their income and allow them to not work ever again. That isn’t necessarily true. While disability insurance provides a benefit to you if you are sick or hurt and can’t work, its intention isn’t to keep you on the couch watching TV. (For one thing, that view can be very expensive. More on that later.) Disability insurance:

their income and allow them to not work ever again. That isn’t necessarily true. While disability insurance provides a benefit to you if you are sick or hurt and can’t work, its intention isn’t to keep you on the couch watching TV. (For one thing, that view can be very expensive. More on that later.) Disability insurance:

- Pays a benefit if you can’t work

- Provides peace-of-mind

- Allows you to concentrate on getting better without financial worry

- Gets you back to work with value-added programs (depends on the carrier)

You have to think about disability insurance as a spare tire or AAA. You don’t think you will ever need to use the spare tire (or AAA), but you are happy to have it when you need it.

Just like the spare tire gets you back on the road, disability insurance gets you back on the road of “life” with peace of mind. You don’t have to worry about money. You can concentrate on getting better and getting back to work.

Then, like the spare tire, once you are back at work, the disability insurance goes back in the “trunk” (sort to speak) and is there in case you need it again.

We will discuss this theme throughout the article.

How Photographers Us Disability Insurance To Protect Their Wealth

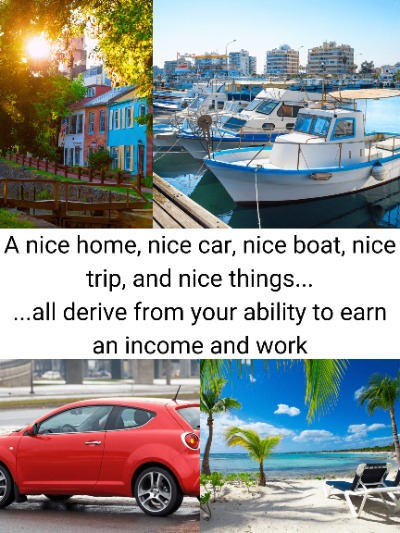

You should understand now how disability insurance protects your income. However, have you ever thought about how it protects your wealth?

It is the most overlooked advantage, yet no one talks about it or discusses the wealth preservation advantage of disability insurance.

The average photographer in the US makes about $54,000.

What happens to this income if you are disabled for 2 years? Yes, you lose $108,000. That’s a lot of money. Does your family rely on this income? Likely, they do.

Where will this money come from if you are disabled and can’t work? That is why I asked all those questions earlier.

I’ll use simple examples of how photographers use disability insurance to protect their wealth.

Examples Of The Importance Of Disability Insurance For Photographers

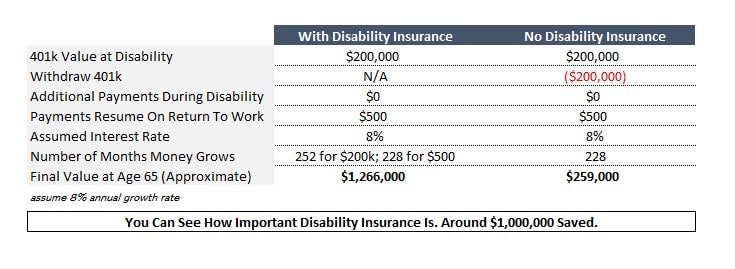

Let’s say you are a 45-year-old, male, self-employed photographer. You have a consistent net income of $60,000. You have $200,000 saved through IRAs and 401(k)s and contribute $500 per month to a solo 401(k).

If you never miss work due to any illness or injury, your 401(k) balance will increase to about $1.3 million at age 65, assuming consistent investment and an 8% average annual return.

Nice, right?

But, let’s say you are disabled. You got into a serious accident, and you don’t have disability insurance.

You need money and your spouse can only work so much. Plus, while health insurance covers some things, it doesn’t cover all expenses related to your injury. This is a fact.

So, you start withdrawing from your 401(k). Even though you pay a tax penalty for the early withdrawal, you need the money to pay for things: mortgage, kids, food, utilities, and health expenses. Your spouse can only do so much with the kids.

You exhaust your 401(k) completely. Thankfully, you make a recovery in 2 years’ time. You are back at work full-time.

You start your $500 per month 401(k) contributions again. But now, your retirement account at age 65 is so much different.

At age 65, your 401(k) balance is about $259,000.

Wow! $1,300,000 versus $259,000. Your 2-year disability wiped out $1,000,000 of your retirement. Why?

- You raided your 401(k)

- Your $200,000 could not compound another 20 years

- You missed 2 years of 401(k) contributions

What happens if you had disability insurance?

Here’s What Would Have Happened If You Had Disability Insurance

If you had disability insurance, you would have been in a much better position.

You wouldn’t have had to raid your 401(k). The only impact is you don’t contribute to your 401(k) for 2 years ($12,000 total).

So, using the same assumptions and variables, at age 65, you would have accumulated $1,266,000.

$1,266,000 versus $259,000. Which do you choose?

Many people tell me about the “insurance-poor” syndrome. They don’t want to buy so much disability insurance that they can’t spend somewhere else.

I get it. (Luckily, we at My Family Life Insurance take an economical approach to premium costs. More on that later in the article.) However, you see from our examples that disability insurance has an immaterial cost on your wealth.

Sure, we always want to pay a low and reasonable premium. But, cost should be secondary. Getting the right coverage, and getting it now, is primary.

I know. This was an easy example. But, it illustrates the impact.

Instead of your 401(k) in this example, replace it with any other assets. Would you have to sell a second home or borrow money?

A disability makes a serious and negative impact on your wealth if you don’t have disability insurance.

Important Disability Insurance Policy Attributes For Photographers

Hopefully, we have made a great case showing that photographers need disability insurance.

I am ready to apply, John.

Sounds good, but first, we really need to go over some important disability insurance policy characteristics for photographers.

Having the right foundation in place is essentially knowing what is “under the hood” of your policy.

The Disability Definition Matters

The definition of disability matters.

You generally want some type of “own occupation” coverage. Own occupation means you receive a disability benefit if you can’t do your job as a photographer, even if you can do another job.

Two common types of own-occupation definitions exist (there are more, but these are the most common):

- True or pure own occupation

- Modified own occupation

True or pure own occupation means you can work in another occupation while receiving disability benefits for your own occupation as a photographer.

So, let’s say you hurt your back which prevents you from photography. However, you can still greet people at Walmart. If that is the case, you will receive disability benefits in addition to your earnings as a Walmart greeter.

So, let’s say you hurt your back which prevents you from photography. However, you can still greet people at Walmart. If that is the case, you will receive disability benefits in addition to your earnings as a Walmart greeter.

Modified own occupation is a bit different. You will receive a disability benefit based on your inability to do your job as a photographer. However, you can’t work in another job. So, if you work as a Walmart greeter, you won’t receive disability benefits under the modified own occupation definition.

Finally, there is the stringent “any occupation” definition. This means, simply, if you can work in any gainful occupation (for which you are reasonably suited, considering your education, training, and experience), the carrier denies disability benefits. So, under this definition, you won’t receive a disability benefit based on your education and experience as a photographer because the insurance carrier says you can work as a Walmart greeter.

(The SSA has a stringent “any” occupation definition).

Generally, I recommend staying away from this “any” occupation definition if you can help it.

The plans we work with contain the favorable own occupation definition for photographers. Moreover, you can align this definition to match some or all of your benefit period.

Waiting Period And Benefit Period

There are several definitions and provisions you’ll need to understand about disability insurance to make an informed decision.

First is the elimination period, or waiting period. This is like a deductible.

It is the length of time that elapses before disability benefits begin.

For example, if you select a 90-day elimination period, your benefit eligibility begins on the 91st day. However, typically with carriers, you won’t receive your benefit until 30 days later (day 120 of disability or so). This means you need to have adequate savings to carry you and your family until benefits begin.

For long-term disability insurance, you can go as low as 30 days for a waiting period.

The second definition is the benefit period. The benefit period is the maximum time you receive your benefit for 1 claim. Disability benefit periods can be as low as 2 years and, with some carriers, as high as to age 67.

If the average disability lasts around 30 months, then a 5-year benefit period should be OK.

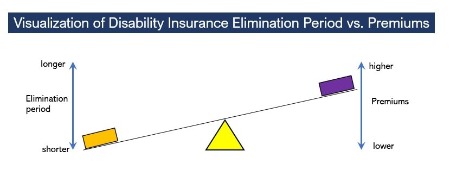

We will get into premiums later, but the corresponding costs are like a see-saw. A shorter elimination period usually costs more whereas a shorter benefit period costs less, all things being equal, of course.

Partial Disability Benefits

Have you ever thought if you got hurt or sick, and could still work a little bit, but not full-time?

Yes, John.

Well, most plans wouldn’t pay a benefit.

What?

Let me explain further. Some plans will only pay a partial benefit after a total disability.

But, what if your disability begins as a partial disability?

For example, let’s say you are diagnosed with MS or carpal tunnel. Maybe you can only work a few days per week. But, your disability, currently, is not a total disability.

Then, with some plans, you wouldn’t receive any benefit money until your disability is considered a total one. Look at the excerpt from one popular carrier.

That total disability claim could be months or years down the road!

So, it’s important that your policy contains robust partial disability benefits that pay a benefit even upon a partial disability.

We at My Family Life Insurance offer these types of plans for photographers.

Guaranteed Insurability Options

Guaranteed insurability options are an important component of any disability insurance plan.

Essentially, this option (a rider) allows you to purchase more disability insurance in the future without going through underwriting again. (We discuss underwriting in the next section.)

All you need to do is show your income or salary increased, and then you have more disability insurance.

No underwriting is just how it sounds. You could be diagnosed with diabetes, with RA, charged with a misdemeanor, or injured and still purchase more disability insurance.

This is an important component many people overlook. You don’t need this option if you feel you are at the top of your pay scale.

The own-occupation, partial benefits, and guaranteed insurability options create a formidable plan.

But, let’s talk about disability insurance riders available to photographers.

Disability Insurance Riders For Photographers

Disability insurance riders allow you to customize your plan to your needs.

However, customization also increases the cost. It’s like purchasing a car. The “base” car might cost “$30,000”, but with customization, your car now costs “$45,000”.

Adding riders isn’t a bad thing. As I write in my disability insurance riders guide, you just want to make sure the riders are:

- Valuable

- Cost-effective

- Important to you

You can add optional riders at an additional cost to your policy to best fit your needs and budget. Some popular disability insurance rider options for photographers include:

Return of Premium Rider: This rider pays back all of your premiums should you never go on claim. If you do go on claim, the rider pays the net benefit (premiums less any benefits paid).

Return of Premium Rider: This rider pays back all of your premiums should you never go on claim. If you do go on claim, the rider pays the net benefit (premiums less any benefits paid).

Retroactive Injury Benefit Rider: Pays benefits from the date of disability due to injury if disability occurs within 30 days of the injury and continues through the elimination period.

Activities of Daily Living Rider: This rider pays an additional benefit if you can’t perform two or more of the activities of daily living or have cognitive impairment. This condition is a catastrophic disability.

Think of this rider this way: this rider pays an additional benefit if you need help or assistance with the first 20 minutes of your day – dressing, toileting, eating, transferring (i.e. walking), etc.

Contact us to find out more.

Disability Insurance Underwriting For Photographers

Disability insurance underwriting for photographers consists of 5 areas:

- your age

- income

- health conditions

- your occupation

- lifestyle situations

Your age and income are straightforward. The older you are, the more expensive the policy will be.

The higher your income, the higher the benefit, and the higher the premium. Don’t worry about the actual premium. As I illustrated earlier, you could have a serious, impact on your wealth without disability insurance. Nevertheless, we always strive to get you the lowest premium for your situation. I’ll discuss that more when we talk about premiums below, and how we are different than other agencies.

The higher your income, the higher the benefit, and the higher the premium. Don’t worry about the actual premium. As I illustrated earlier, you could have a serious, impact on your wealth without disability insurance. Nevertheless, we always strive to get you the lowest premium for your situation. I’ll discuss that more when we talk about premiums below, and how we are different than other agencies.

In case you were not aware, your income is your W-2 gross salary if you are an employee and your net income (after business taxes) if you are self-employed. So, if your W-2 salary is $60,000, carriers use that number for underwriting. Carriers also like to look at the last 2 years or 3 years and average out. So, having the last 2 or 3 years of salary on hand is handy for the application process.

Let’s talk about health conditions and your occupation next. Disability insurance underwriting is a little more complicated than, say, that of life insurance.

Why Health Conditions Matter In Underwriting

To get right to the point, usually, carriers exclude pre-existing health conditions from coverage. For example, if you have a pin in your right wrist from breakage 5 years ago, your policy excludes coverage on that right wrist.

If you had complications of pregnancy, then the carrier excludes any complications of future pregnancies.

If you are on anxiety medication, the carrier excludes coverage of any mental or emotional disorders.

That’s just how disability insurance works. Remember, the carrier is underwriting your potential disability. So, it will (generally) exclude any health complications or injuries you’ve had in the past.

If you have more serious health conditions, the carrier could place a rating on your policy. A rating is an extra premium the carrier charges for an increased disability risk. Moreover, the carrier may limit options such as limited waiting periods or reduced benefit periods.

Having an exclusion or a rating is not a reason to ignore a disability insurance policy. There are nearly endless ways for a disability to occur.

We discuss many scenarios about disability insurance underwriting. Additionally, we illustrate why it is NOT advantageous to decline a policy with any exclusions.

Your Occupation Matters

This is an important aspect of disability insurance for photographers. So, all the disability insurance carriers classify occupations. In general, the carriers classify occupations from a 1 to a 5 or 6.

disability insurance carriers classify occupations. In general, the carriers classify occupations from a 1 to a 5 or 6.

An occupation with a class 6 has the lowest occupational disability risk and class 1 has the highest. All things being equal, you’ll pay a higher premium if you are a class 1.

The classification for photographers depends on the type of photography. Here are various types of photographers with corresponding classes:

- Traditional, non-hazardous studio photographer – 3 or 4

- Motion picture / TV – 2 or 3

- Commercial, non-studio (e.g. sporting events) – 2 or 3

- Freelance – contact us

- War or foreign correspondent photographers – contact us

What does this mean?

Again. all things being equal, carriers with a higher occupation classification save you money with lower monthly premiums.

If you are a freelance, foreign, or war photographer please contact us.

Your Lifestyle Matters, Too

People don’t realize that your lifestyle matters, too. So, if you (for example):

- Like going to the chiropractor a lot,

- Smoke marijuana,

- Have many speeding tickets or car accidents, or

- Jump out of airplanes,

Then these types of situations play a role in underwriting.

For example, if you go to the chiropractor consistently, the carrier may exclude your back and spine from coverage, including wellness.

Please contact us for specific situations.

We address lifestyle situations in more detail in our disability insurance underwriting guide.

The Best Disability Insurance For Photographers

You are probably wondering who we like to work with. First, we work with many disability insurance carriers. So, we are sure we can find one that meets your needs and budget.

The carriers we like classify the photographer occupation at a class 4 or a class 5 with qualified classification upgrades (contact us to find out more).

Additionally, the carriers we like all have the:

- own-occupation definition

- partial disability benefits

- guaranteed purchase options

and additional options as discussed. The carriers we like also have solid, value-added benefits like re-training programs.

If you are Christian, we also work with a disability insurance carrier dedicated to the Christian community.

Moreover, if you work part-time as a photographer, we have disability insurance options.

Contact us if you would like to learn more. We are happy to chat with you. We can definitely fulfill your disability insurance needs in an economical way.

Protect Your Business If You Are A Business Owner

Are you a business owner or a self-employed photographer? You have an advantage.

Are you a business owner or a self-employed photographer? You have an advantage.

John, stop right there. I already have this insurance.

Nope. I doubt it. You are thinking about business interruption insurance which is common through your commercial property and casualty insurance.

Business interruption insurance does not cover you if you are disabled and can’t work. How will you pay your rent or employees if you are sick or hurt and can’t work?

The answer is a business overhead expense policy.

You can enroll in a policy that will pay your business expenses upon a disability.

Premiums are tax deductible. If structured properly, benefits are tax-free as well. This type of policy will ensure your business remains solvent during your inability to work from a disability.

This is an additional reason why photographers need disability insurance. Contrast this policy to a traditional disability insurance policy which pays a percentage of your income.

Carriers who offer this type of insurance typically offer a discount on an individual disability insurance policy. Additionally, we only work with carriers that offer an occupation upgrade as well, which means lower premium costs, all things being equal.

Group Employer Disability Insurance For Photographers Is Available As Well

If you have employees who work for you, we can also set up a disability insurance plan through your company, at guaranteed issue starting at 2 lives. Short-term disability plan options are available.

As long as you have two employees (not 1099 contractors), you can obtain at guaranteed issue:

- term life

- short-term disability insurance

- long-term disability insurance

and more.

The carrier we like will cover husband and wife businesses as well as family businesses. Many group employer plans limit options for these situations.

Disability Insurance Cost For Photographers

The cost of disability insurance depends on everything we discussed in our underwriting section.

But, more often, the cost of disability will be around the cost of a cup of coffee or even the cost of lunch.

In fact, the cost of disability insurance costs around 2 cents for every dollar you make.

Here’s an example. Let’s use a 30-year-old female, self-employed photographer. She net $60,000 annually.

A 90-day waiting period, 5-year benefit period with a $3,750 monthly benefit costs $92 per month or about $3.00 per day. This plan includes the true own-occupation definition, partial disability benefits, and guaranteed insurability options.

Does cost matter? Of course, it does! However, review my wealth example earlier. While every claim situation is different, I think you’ll agree with me that not having any disability insurance creates a potentially devastating situation. It makes sense to have some amount of disability insurance.

Now You Know How Photographers Obtain The Best Disability Insurance

We hope now you have a solid idea of why photographers need disability insurance, and how disability insurance protects photographers’ wealth.

Confused? Don’t feel that way. We’re here to help educate you and protect your income and future. Don’t know where to start? Use this disability insurance needs analysis worksheet.

Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy).

Next, feel free to reach out to us for our assistance or a quote. Or, use the form below.

We only work for you, your family, and your best interests only. We have helped many photographers (even those who were declined before) secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".