4 Disability Insurance Riders That Are A Waste Of Money | 3 That You Probably Need & Several Maybe’s

Updated: April 12, 2024 at 9:39 am

So, you meet with an agent about disability insurance, and he or she starts going over all of the disability insurance riders.

So, you meet with an agent about disability insurance, and he or she starts going over all of the disability insurance riders.

The agent says you need all of these riders.

You want to protect yourself in case anything happens, right, the agent asks?

The quote is no less than sticker shock (as we will show), but you don’t know much about disability insurance. So, you take the agent’s recommendation and apply.

You are approved, which is great! However, every time you see the premium draft out of your checking account, you wonder…

…Do I really need all of those riders?

The answer is, likely, no.

Sure, some of them you probably need. We will go over those.

However, most of them, probably not. Additionally, you could have saved yourself quite a bit of money.

So, in this article, we will discuss the most common disability insurance riders. Moreover, we will discuss 4 disability insurance riders that you probably do not need. They are, often, a waste of money.

We will then go into a handful of disability insurance riders that are very useful and worth the money.

Then, we will discuss some “maybe’s”.

The purpose of this article is to go over these riders, so you can make an informed decision. You can then decide if these riders are right for you. By doing so, you will save yourself a lot of money as you will know which are important to you and which are not.

Article Navigation

Here’s what we will discuss for easy navigation:

- Here’s How To View Disability Insurance

- What Is A Rider?

- 3 Factors That Help Determine If Disability Riders Are Right For You

- 4 Riders That Are A Waste Of Money

- 3 Riders That You Should Have

- Several Rider “Maybe’s”

- Who Needs All Of These Riders?

- Now You Know The Disability Riders And Choose The Right Ones For You

Let’s jump in and quickly discuss disability insurance.

Here’s The Right Way To View Disability Insurance

You probably know what disability insurance is; however, most people analyze it the wrong way.

Disability insurance simply pays you a monetary benefit if you can’t work due to illness or injury. It allows you to not worry about money while you focus on getting better.

That is it.

It’s not really designed to let you sit on your behind for decades, collecting payment.

I often compare disability insurance to a “spare tire” or AAA.

I often compare disability insurance to a “spare tire” or AAA.

If you are in your vehicle, you are driving somewhere. You need to get somewhere.

You never think about your spare tire (or AAA) until you have a flat. Then, you are thankful you have that spare tire.

The same holds true for disability insurance. The disability benefit helps you back on your “road”, which is your family and life.

Example Of Selecting Disability Insurance

Speaking of spare tires and roads, what do you see below?

I see three vehicles, John.

That is right, but now replace these vehicles with the word “disability insurance”.

OK, I am. But, I am not following you.

That’s OK, you will. This is the right way to view a disability insurance policy on yourself.

All of the three vehicles (i.e. disability insurance) you see above get you from point A to point B (i.e. pays a benefit if you can’t work due to accident or illness).

Look at the SUV. Someone who needs an SUV probably lives in a winter climate and needs the 4 wheel drive capability. So, he or she will gladly spend more for that capability.

Contrast with the little car there. Economics aside, who needs that kind of car? Maybe someone in a city footprint, not in a cold-weather location, etc.

Now, look at the truck. We know people who buy trucks usually buys one for the hauling capability. Maybe he or she owns a construction company or does mechanical work. People who drive trucks haul tools, equipment, etc.

What Does This Have To Do With Disability Insurance?

What does this all have to do with disability insurance?

If you only need a car just to get from point A to point B, then the little car will do.

In other words, if you just need a monthly benefit, then a basic (yet, solid) disability insurance plan will do. You don’t have to spend money on a “4-wheel drive SUV” when you won’t need it.

Likewise, if you need additional protection because of your situation, then you may need the SUV or the truck.

See how that works?

This is the right way to view disability insurance.

I’ve seen so many people spend money on the “SUV” when all they need is the little car.

Additionally, a lot of the extra costs have to do with disability insurance riders. Now is a good time to discuss what a rider is.

What Are Disability Insurance Riders?

A rider is simply an “add-on”.

Did you ever buy a new car? Did the salesperson talk to you about customizations and other “add ons” like leather seats?

This is similar to that of insurance riders.

Riders give you the ability to customize your policy to meet your needs.

However, like any car customization, an insurance rider increases the cost of your policy.

How Much Do Disability Insurance Riders Increase Your Policy?

How much do disability insurance riders increase your policy?

That depends on many factors that we will discuss shortly.

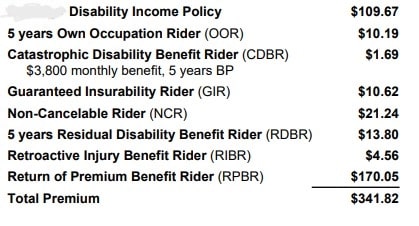

However, to give you an idea, here is a real example quote of a 40-year old woman dental hygienist earning $75,000. This quote includes all available riders and options for her. (It is also a 90-day waiting period and a 5-year waiting period to keep things simple.)

woman dental hygienist earning $75,000. This quote includes all available riders and options for her. (It is also a 90-day waiting period and a 5-year waiting period to keep things simple.)

Do you think she can afford this $342 monthly premium? Maybe.

Could you?

I don’t know, John. That is a lot of money.

I’ve seen many quotes like these from the professionals I work with. I’ve seen more and more from people who are quoting on their own, without knowing what all of this means. They see the “sticker shock”, and then think disability insurance is too expensive. It is not. Like the vehicle analogies above, they are purchasing a truck or SUV when an economical car will do just fine.

In other words, people contact me because another agent told them they need an “Ashton Martin” for disability insurance.

The premium that you see on this quote may or may not be a big deal for you. Why? To answer that question, let’s discuss the factors that help determine if a disability insurance rider is right for you.

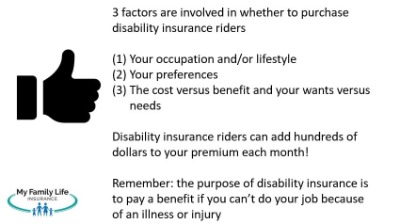

3 Factors That Help Determine If Disability Insurance Riders Are Right For You

Did that quote above give you sticker shock?

Yes, John. How can someone afford that?

First thing, it’s important not to look at the premium, but the value behind the premium.

When you do that, then determining if a disability insurance rider is right for becomes easier.

becomes easier.

Moreover, that increase in premium is now justified.

There are 3 factors that help determine if a rider is right for you.

- Occupation or lifestyle

- Preference

- Cost versus need and the benefits provided

Let’s go over each one by one.

Your Occupation Or Lifestyle

If you’ve read our article on disability insurance underwriting, you know your occupation plays a part.

It also plays a part in determining if you should purchase a rider.

What do I mean by that?

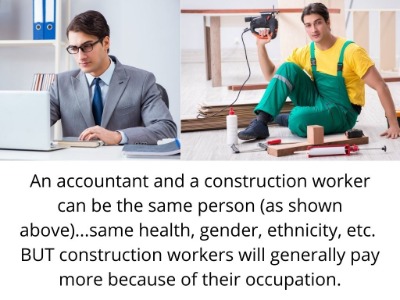

Let’s say there are 2 people of the same health, age, and income. One is a construction worker and the other is an accountant.

Let’s say there are 2 people of the same health, age, and income. One is a construction worker and the other is an accountant.

The construction worker pays a higher amount just because the occupation is more prone to disability.

Having said that, maybe the construction worker should purchase a retroactive injury benefit, catastrophic disability rider, and/or an accident indemnity benefit if available.

These types of riders are more beneficial to people working in blue-collar jobs.

That doesn’t mean the accountant can’t purchase these. What if the accountant likes to participate in downhill skiing and injures himself? This injury leads to a disability. You could receive a benefit due to that accidental injury.

That leads us to our first point. You purchase a rider based on your occupation or lifestyle. For example, a popular rider is the retroactive injury benefit. We generally recommend this rider for labor occupations like truck drivers, construction workers, and the like. This will pay a benefit if you are totally disabled due to an accident – on or off the job. As an accountant, do you need this rider? Maybe. Maybe not. If you participate in extracurricular activities, then maybe.

Preference

You need to think about your preferences as well when it comes to disability insurance riders.

These aren’t governed by your occupation and lifestyle situation, but rather your comfortableness.

Maybe you know someone who is dealing with a catastrophic disability. You say to yourself, “I just need some extra coverage because I’ve seen what my friend is going through…”

Great. There is nothing wrong with that.

Cost Versus Benefit (i.e. Need)

The final aspect is the cost of these riders. You see the real quote above. Some of these riders can be expensive.

Does that mean they are NOT worth the cost? No, but you do have to weigh #1 (more so) and #2 above to determine if spending the extra premium is worth it.

Can you use that money elsewhere? Yes, you can!

That’s why it is really important to understand your preference and needs. As mentioned earlier, sometimes your occupation and/or lifestyle dictate the need for a rider. For example, I usually recommend to truck drivers an accident indemnity plan with one of the carriers we use. For an office manager, maybe not. That decision would fall under her preferences. Since the accident plan covers a family, maybe the office manager who has young children sees value in protecting the family from an accidental injury.

Now it’s a good time to discuss the disability insurance riders we feel are a waste of money.

4 Disability Insurance Riders We Feel Are A Waste Of Money

Before we discuss the 4 disability insurance riders that, we feel, are a waste of money, let’s note that some carriers include some of these riders in their “base” plan.

What is a “base” plan?

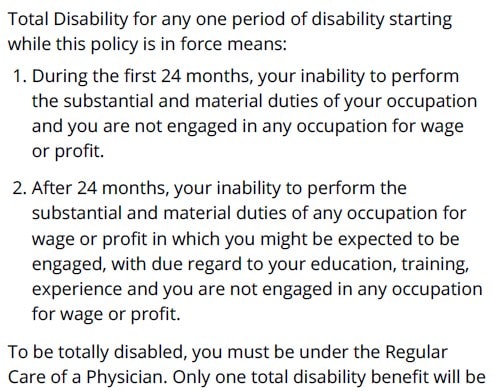

It is simply the plan that has no customization. Think of it as a “shelf” product. Here is an example of the “base” definition of disability from a carrier:

We’ll discuss “base” plans throughout the article.

We’ll discuss “base” plans throughout the article.

Let’s discuss the 4 disability insurance riders now.

Return Of Premium Rider

The return of premium rider (ROP) is just how it sounds. It can potentially return your money if you:

- Never make a claim, or

- make a claim and the premiums you paid are greater than the benefits you received

The ROP rider sounds good, doesn’t it?

However, often, it’s a waste of money.

You see in our example above, it can cost a lot. Look at the quote above for the 40-year old dental hygienist woman. Here it is below:

![]()

Are you prepared to spend $170 additional per month?

Assuming that she keeps the plan until age 65, she will have spent about $53,000 on the rider alone!

Sure, she can potentially receive around $101,000 in total premiums back at age 65. However, is there a better option?

Yes, just invest your money.

If she invested that $170 each month in an IRA for 26 years, earning 8% on average, she will have about $177,000!

How great is that?

Additionally, the carriers that offer the ROP rider limit your ability to withdraw your money.

Usually, they have a 2 to 5 year “waiting period” before you can receive a percentage of your money back if you want to cancel your plan.

So, you don’t receive all of your money if you cancel before age 65.

The percentage you can receive back increases gradually every year until you reach age 65.

So, often, the best option is just to invest your money. There are no restrictions. Moreover, you keep the money you saved.

John, is there a situation where it might make sense?

Yes, when you are young. The cost is much, much cheaper and might make sense. The reason why it is cheaper is the carrier can spread the cost over 40 years.

However, usually, this one is a pass.

Cost-Of-Living Adjustment

Many people think they need the cost-of-living adjustment (COLA).

But, in reality, they don’t. Why?

Well, they don’t understand it. That’s what it really comes down to.

Many people think the COLA is an annual benefit increase every year.

It’s not.

The COLA increases your disability payment after being on a claim for 1 year.

It will increase your payment based on COLA. Most carriers have a minimum of 3% COLA.

Keep in mind that the average claim is around 18 months (claims departments I speak with) and 36 months (stats from the Council For Disability Awareness).

So, what I am saying is there may not be a lot of “juice in this squeeze”. Yes, even in this high inflationary environment.

Moreover, there is a moderate cost, maybe up to $10 to $20 per month. While that doesn’t seem like a lot, is it worth it to spend $20 per month to realize this benefit for 2 years, 5 years, or even a lifetime?

No. There are other ways to keep up with your benefit. One way is to utilize a guaranteed purchase option (we will discuss this later). The other is to receive any “automatic increase benefit” that comes with your plan. Many carriers offer this benefit. It “automatically” increases your benefit by 3% or 4% for a set number of years, like 5 or 6.

Non-Cancellable Rider

Many agents recommend the non-cancellable rider, but it is one you may not need.

The non-cancellable rider locks in your policy and rate for the life of the contract. The carrier can’t change your policy or rate.

You see, disability insurance carriers can increase rates for in-force contracts. They might do this if they are becoming insolvent. In other words, their premiums can’t meet their claims or they have cash issues and going bankrupt.

However, in order to do this, they need approval from State Insurance Commissioners. Carriers must increase the rates for the same class of insureds.

increase the rates for the same class of insureds.

In reality, however, they rarely do this. What they WILL do is increase the rates on NEW contracts (which is why the best time to purchase disability insurance is now).

Moreover, the cost can run between $20 to $30 or more per month depending on the carrier.

One carrier representative told me the last time his carrier increased rates for in-force contracts was World War II. I think you would agree with me that that was a unique situation (and a long time ago).

Most of the remaining disability insurance carriers in the US have existed for 100+ years. If that isn’t a definition of solvency, I don’t know what is.

While there is always a chance a carrier can increase the premium for in-force contracts, I think the risk is very low with the carriers existing today.

So, a guaranteed renewable contract should work just fine. This means you will always have your policy as long as you pay the premiums. The carrier can’t cancel it on you. The carrier can, however, increase the rate. But, as I just described, that probability is low.

Nearly all carriers have guaranteed renewable contracts as their base policy.

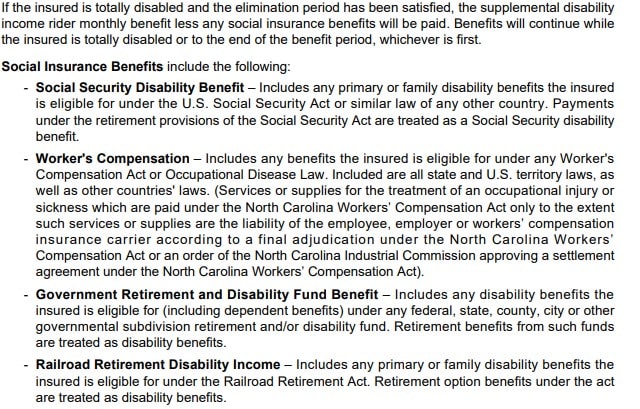

Social Security Offset / Integration Rider

So, this disability insurance rider is a bit different. It actually saves you premium money!

What, John? So, why is it a waste of money?

Because the carrier potentially pays you less. This rider ultimately saves you premium dollars because your monthly benefit coordinates with social security (and other government programs).

Do you see that? The carrier’s risk is less so the premium is less.

John, what’s so bad about coordinating with social security?

Well, first, do you want to deal with the government, especially when it comes to them paying you a disability benefit?

OK…no…

Let’s discuss how this rider works. If you have this rider and make a claim, the carrier offsets its benefit to you by what the government pays you.

(So, this is why many carriers also call this an “offset” provision or “social” insurance. It all means the same thing.)

For example, you have a $3,000 monthly benefit from carrier XYZ. You receive $1,000 from social security. Carrier XYZ pays you $2,000 (not $3,000).

This is an easy example, and it is more involved, but you get the idea.

Additionally, if you have this rider and file a claim, the carrier may hold a portion of your benefit until notification of your social security disability approval (or not).

That decision can take up to 5 months or more! What will you do in the meantime?

Now, do you think this rider is worth it? Likely not!

Additionally, other programs fall into this “social” offset rider, including worker’s compensation. See below for one carrier’s definition of social insurance:

Keep in mind, depending on your occupation classification, carriers may “force” you into a social / offset rider. Sometimes, that is unavoidable. However, we at My Family Life Insurance work with carriers that do not have this limitation.

So, avoid the headaches by avoiding this rider, no matter how cheap it makes your monthly premium.

3 Disability Insurance Riders That Are Worth The Money

We hoped you learned something in our previous section. It’s important to note that your situation and preference dictate the riders you want. However, the 4 disability insurance riders we outlined usually are not worth the money.

But, there are some that are. We would be remiss if we did not discuss disability insurance riders that ARE worth the money.

Here they are in no particular order.

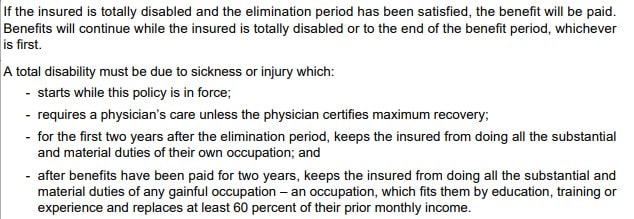

Own-Occupation Rider

Remember I mentioned the “base” plan? Well, all carriers have a base definition of disability, which goes something like this:

You can see that if you make a claim, your payment is based on your inability to do the duties of your job (i.e. occupation).

You can see that if you make a claim, your payment is based on your inability to do the duties of your job (i.e. occupation).

But, it is only good for 2 years…

What happens if you are still disabled after that?

Then, the carrier sees if you can do any occupation based on your education, experience, and training. If they feel you can, then they stop benefits. (This particular carrier is more favorable than others as it contains a 60% income threshold.)

Well, that stinks, John!

Yes, unless you have the own-occupation rider.

This rider extends the own-occupation definition to your benefit period. This means you don’t have to worry about the carrier denying payment if you can do any job.

This rider is essential for anyone performing moderate to significant labor duties like plumbers, construction workers, dental hygienists, hairstylists, etc.

Additionally, it is also imperative that specialists like doctors, surgeons, dentists, trial lawyers, etc. have this rider as well.

Office managers, maybe financial planners, and insurance agents like me probably don’t need the own-occupation definition. I mean, if I can’t do this job as an insurance agent, then I likely can’t do any job.

Again, however, the decision comes down to your situation and preferences. Know that this can be a valuable rider and worth the cost.

Guaranteed Purchase Option

This rider has so many different names, based on the carrier. You may read about future insurability options, guaranteed purchase options, and similar names. These all mean the same thing.

Depending on your age (typically 45 to 50 maximum age to purchase), you can purchase this rider. This guaranteed purchase option allows you to buy more disability insurance in the future with no evidence of health insurability. You just need to show your salary or income increased. You can do that through your W-2 or a tax form if self-employed.

How great is that? Even if you are stricken with diabetes, multiple sclerosis, RA, or anything like that, you can buy more disability insurance.

How great is that? Even if you are stricken with diabetes, multiple sclerosis, RA, or anything like that, you can buy more disability insurance.

I see so many quotes from other people with this valuable rider left off. It makes no sense why.

The cost is inexpensive…like $1 or $2 per month. If your salary increases by $10,000, then you can insure that $10,000 growth.

The carrier will then increase your premium for that additional benefit on the $10,000. Any riders purchased on your original contract are attached, unless there are income limits or carrier limits (contact us about this).

The value of this rider lies in its flexibility and ability to keep up with your income growth.

Enhanced Residual Disability Rider

Of all the disability insurance riders, I think the enhanced residual disability rider is the most overlooked.

Like the guaranteed purchase option, carriers call this many things, but it all means the same thing.

It will cover you on a partial disability. Additionally, you’ll receive a benefit if you return to work from a total disability.

Why is this rider important? Look at the excerpt from a real carrier below:

Their base plan has no partial benefits unless you are on a claim for a total disability.

Tell me what would happen if you developed MS or rheumatoid arthritis?

Or, an injury that did not result in a total disability? Maybe a doctor says you just need physical therapy, rehab, and rest 3 times per week.

Those situations are all potentially partial disabilities. If you did not have the enhanced residual disability rider, you would not receive a partial benefit for loss of income due to your partial disability.

How would make up that income shortfall?

It could be years before you make a claim until you are totally disabled.

How awful is that?

This is why the enhanced residual disability rider is important. It will pay a partial benefit, as long as you get through the waiting period, and you are still partially disabled.

A Formidable Disability Insurance Plan

In my opinion, these 3 disability insurance riders, coupled with a strong base policy, make a formidable disability insurance plan.

If you make a claim, you want to make sure you get paid. These three riders create that solid wall.

If you make a claim, you want to make sure you get paid. These three riders create that solid wall.

Let’s talk next about those disability insurance riders that are “maybe’s”. These are more dependent on your preferences.

Several Disability Insurance Riders That Are “Maybe’s”

There are a handful of disability insurance riders that are “nice-to-haves”. Some of our clients select them and some don’t.

What’s the difference? We explained before:

- your lifestyle/occupation situation

- your preferences balanced with cost and value

These riders are not a waste of money. You just want to make sure they fit your situation.

Here they are in no particular order.

Retroactive Injury Benefit

This rider pays a benefit if you are:

- totally disabled

- due to an accidental injury and

- remain totally disabled through the elimination period

If those three conditions remain intact, then the carrier pays your total monthly benefit X the number of months of your waiting period on the first day of benefit eligibility.

Pay close attention. Your disability has to be a total disability (not partial), due to an accident (not illness), and remain a total disability throughout your elimination period.

If that is the case, then the carrier pays this benefit. For example, you have this rider. Your elimination period is 90 days (3 months). Your total monthly disability is $4,000. You are hurt from an accident. You are still totally disabled on the 91st day of disability. The carrier pays $12,000 to you.

This rider is typically inexpensive as most disabilities occur from musculoskeletal issues and illnesses rather than an accident.

However, we generally recommend this rider for someone doing moderate to hard labor like truck drivers, construction workers, nurses, etc.

Additionally, if you partake in moderate, laborious hobbies like skiing, this rider could prove useful.

Catastrophic Disability Benefit

Disability insurance pays a benefit if you can’t do your job due to illness or injury. What happens if you are disabled severely in an accident or develop a severe condition like ALS or MS?

Carriers call these situations “catastrophic disabilities”. If you have the catastrophic disability benefit, then the carrier pays you an additional benefit on top of your base benefit.

Carriers generally define a catastrophic disability as your inability to perform 2 out of 6 activities of daily living (ADL) independently or have irreversible cognitive impairment (like Alzheimer’s).

The 6 ADLs include:

- bathing

- eating

- transferring (i.e. moving about)

- bathing

- toileting

- maintaining continence

In other words, if you need someone to help you with your first 30 minutes of your day, then you likely meet this catastrophic disability definition.

In other words, if you need someone to help you with your first 30 minutes of your day, then you likely meet this catastrophic disability definition.

If you qualify, then you receive an additional benefit. An example will make this clear.

Let’s say Tim has a $3,000 base disability benefit with a $2,000 catastrophic disability option. He is painting his home and falls off the ladder. His doctor confirms he can’t perform 2 out of 6 ADLs. He will receive his $3,000 base benefit + his $2,000 catastrophic benefit for $5,000 in total.

However, let’s change the scenario a bit. Let’s say he is diagnosed with cancer. He receives his $3,000 base benefit only because he can still meet 2 out of 6 ADLs. Moreover, he does not have cognitive impairment.

See how this works?

This benefit is relatively inexpensive.

Mental, Nervous, Substance Abuse Rider

Remember I said that disability insurance carriers pay you a benefit for anything illness or injury-related?

The same goes for a disability due to a mental or nervous disorder like anxiety or bipolar disorder. Additionally, they pay a benefit if you develop substance abuse which prevents you from working,

However, nearly all the carriers (except one or 2 of them) limit this benefit period to only 24 months, even if you have a longer benefit period like 5 years or to age 65 coverage.

If you don’t believe me, here is an excerpt right from a carrier:

![]()

An example will make this clear.

Let’s say Joe is diagnosed with depression and needs to step away from work. This is a disability. His benefit period is “to age 65”. However, his policy states that the benefit period is 24 months from disabilities due to mental, nervous, substance abuse.

After 24 months, Joe still hasn’t returned to work due to his depression. The carrier stops benefit payments even though Joe has to age 65 benefit period.

Do you see how that works?

Benefits would continue if Joe had purchased this mental, nervous, substance abuse rider.

Do you need this rider? Maybe? With anxiety and depression-related illnesses rising due to the pandemic, possibly. If you have any close family members with severe mental illnesses or substance abuse.

The decision to purchase this rider is a personal decision.

Student Loan Rider

Some carriers have student loan riders available. What are these?

These riders pay a benefit in addition to your base benefit for any outstanding student loans.

These riders pay a benefit in addition to your base benefit for any outstanding student loans.

While there are trillions of student loans, these riders are only available to select occupations like doctors, lawyers, engineers, etc.

Do you need this rider? Maybe, if you have serious student loans. Remember, you still have bills to pay including student loans if you are disabled. The government doesn’t necessarily waive your student loans on a disability.

If you are a business owner and need to protect a loan, there is a different type of disability insurance that protects business loans.

Accident Indemnity

Only a few carriers offer this rider. It is essentially accident insurance.

We work with a lot of accident insurance plans, and this one is by far one of the more valuable and economical of those available.

It pays a fixed benefit if you have to go to the ER or urgent care for an injury. Let’s say you broke your arm and go to the ER. You might receive:

- $500 for the ER visit

- $250 for the x-ray

- $1,000 to set the cast for your broken arm

- $100 for a follow-up doctor visit

Most plans also have an accidental death benefit, which is nice.

These plans extend to your family members even if they don’t have disability insurance themselves.

The cost is really cheap. However, some occupations like truck drivers, fishermen, or construction workers could utilize this rider. Moreover, if you perform moderate lifestyle acitives like motorcycling or skiing, these plans could be beneficial as well.

We do like several stand-alone accident insurance plans. Feel free to contact us on that. Stand alone plans are really cheap, like $25 per month.

Have you seen a theme here? Get the riders that make sense to your situation.

Critical Illness Rider

The critical illness rider is an option on a few carriers. As we said before, the majority of disabilities are from illnesses. Illnesses like:

- Cancer

- Stroke

- Heart attack

These are common disability insurance claims.

The rider pays a lump sum benefit upon diagnosis of a covered illness. This lump sum is in addition to the disability benefit you receive.

I think critical illness insurance is very important. Tell me, do you know someone affected by:

- Cancer,

- A heart attack,

- Stroke?

- Anything else?

The answer is likely “yes”. Even if you personally were not diagnosed with one of these illnesses, you likely were affected one way or another.

Stand-alone critical illness plans exist as well as life insurance with living benefits, which includes critical illness. These may offer better protection as well.

Does Anyone Need ALL Of These Disability Insurance Riders?

Do you need all of these riders?

John, no wonder why you described all of these as sticker shock!

Well, you probably know now you don’t need ALL of these disability insurance riders?

However, some people could use them all.

Who?

These are CEOs, multimillionaires.

They are surgeons, physicians, dentists, lawyers, etc.

People who have an extremely high level of income AND has a lot to lose if they faced a disability.

The reason is not that they can afford the premiums. The main reason is they have a lot to lose for any type of disability.

Now You Know The Disability Insurance Riders – 4 You Don’t Need, 3 You Do, And Bunch Of “Maybe’s”

We hoped you found this article on disability insurance riders informative. There’s a lot here! But, now you know 4 riders that we feel just are not worth your hard-earned money. Additionally, there are 3 we feel are very important to any disability insurance plan and should be included.

Then, we went through a handful of “maybe’s”.

Ultimately, the purchase of disability insurance riders comes down to your needs, preferences, and cost.

Do you have any questions? We know there is a lot of information here. Feel free to contact us or use the form below.

There’s no risk of contacting us. We only work in your best interests. If we can’t help you, then we will point you in the right direction as best we can and part as friends. Seriously! You can always reach back out to us anytime if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".