Best Disability Insurance For Secretaries And Office Managers | We Discuss This Important Insurance & The Carriers We Like To Use

Updated: April 12, 2024 at 9:39 am

In this article, I discuss why secretaries and office managers need disability insurance.

As a secretary, administrative assistant, or office manager, your job is more important than people realize. Each day brings something different. You enjoy the challenge of solving problems as well as communicating with office staff, customers, patients, or clients. You rely on your people skills as well as educational “know-how” to get the job done. Without you, the office and the business would not flow!

What if you could no longer do your job? Have you ever thought about that?

Have you ever thought about what would happen if you became sick, ill, injured, and disabled?

How would you pay your bills if you could not work?

Disability quickly affects your future plans and your lifestyle. In this article, we discuss disability insurance and the best disability insurance for secretaries and office managers.

Here’s what we will talk about:

- What Is Disability Insurance?

- Why Do You Need Disability Insurance?

- The Characteristics Of A Strong Policy

- The Best Disability Insurance

- How Carriers Underwrite Your Application

- Estimated Premiums Of Disability Insurance

- What If You Have Coverage Through Work?

- Final Thoughts About Disability Insurance

Let’s jump right into discussing what is disability insurance.

What Is Disability Insurance?

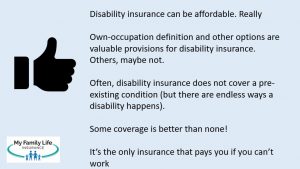

Disability insurance is, simply, a type of insurance that pays you a dollar benefit if you can’t work due to illness or injury.

Do you need disability insurance?

Many people say, “no”, but if you:

- Make money, and

- You use that money to pay your mortgage, groceries, and other needs, and

- If you and your family would be in a tough financial situation if you could not work, then:

It is really that simple.

Think of disability insurance as “paycheck protection”. We have our house, cars, vacations, luxury items, and necessities. Think of all that. All of that is derived from your ability to work and earn an income.

Conversely, all of that is potentially gone with your inability to work and earn an income.

How much benefit do you receive if you can’t work? That depends on how much you make and your income. If you are an employee, carriers pay around 60% of your salary. If you are self-employed, then carriers will insure around 70% to 80% of your net income.

It’s A Spare Tire

Carriers rarely insure 100% of your income or salary. Why? Well, there are a couple of reasons:

- If you receive a benefit, your benefit is income tax-free. So, you pay no taxes on

your benefit, and

your benefit, and - To incentivize you back to work

Human nature tells us that if we receive 100% of our income, we probably don’t want to go back to work, right?

There are ways to potentially obtain 100% of your income. It is outside the scope of the article. If you want to learn more, feel free to reach out to us.

As a final thought here in this section, think of disability insurance as a “spare tire”. You really don’t think of your spare tire (or AAA) until you really need it. And, when you do, you are thankful you have that spare tire or the AAA membership. A temporary tire replaces your flat. You are back on the road, and you get your other tire repaired.

Disability insurance is no different, except it gets you back on the road of your life.

Why Do Secretaries And Office Managers Need Disability Insurance?

Now that you have an understanding of disability insurance, here is why you need it.

Wait, John, you say. I am not going to get disabled.

Is that right? How do you know? If you did, you could play the lottery and enjoy your winnings. Know what I mean?

Additionally, we can look at Tiger Woods’ crash that a disability can happen at any time.

This unknown brings us to our first reason. The chance of disability for all of us is really high. According to the SSA, an adult worker has a 1 in 4 chance of experiencing a long-term disability.

This unknown brings us to our first reason. The chance of disability for all of us is really high. According to the SSA, an adult worker has a 1 in 4 chance of experiencing a long-term disability.

That is higher than common scenarios such as passing away from cancer (1 in 7) and even death from a car accident (1 in 107). (See NSC Injury Facts)

Remember, a disability is any injury or illness that prevents you from doing your job. So, a disability could be a:

- Broken hand

- Cancer diagnosis

- Back injury

- Head injury

- Multiple sclerosis diagnosis

- Torn ACL

- Loss of eyesight

- A stroke

The list goes on and on…

No one plans for a disability. Here is a fact: disabilities do not discriminate. They do not care about your ethnicity, job, or how much you make. It occurs when you least expect it.

Tiger Woods knows this. Recall his horrible car accident. He left his hotel at 7AM. Around 7:10, he became disabled. His job is golfing, and he can’t do that.

The difference between Tiger Woods and us is he has millions to live off of. We don’t.

What if you faced a situation where you could no longer work? That is a disability.

What would you do if you could not bring in an income to support your family?

Now, do you see the importance of disability insurance?

More Important People Rely On You

Here’s another important reason. You may think your boss and support team are the most important people. Who can be more important than the company I work for, you think. They pay my income.

True. The business does. Let’s be honest, though, the boss or executives don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything.

you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything.

If you are disabled, without disability insurance, there are tough questions that need answering.

- Would you and your family be able to continue your standard of living without your income? If not, what changes would need to be made?

- Would your spouse have to work or work more?

- Would you need to sell your home to make ends meet? (That can happen.)

- Who could be flexible with the children?

- Would you have the money to hire someone to take care of the kids?

The tough questions can go on and on.

I call disability the destroyer of dreams. Your future and family dreams could be destroyed. I’m being honest here.

They don’t have to, though. With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

Remember the spare tire/AAA analogy. That is the sole purpose of disability insurance: to provide payments to you in case you can’t work. Then, you can focus on rehab, treatments, getting better and getting back to work.

The Elements Of A Strong Disability Insurance Policy For Secretaries and Office Managers

Hopefully, we have made a great case showing that secretaries, administrative assistants, and office managers need disability insurance.

I’m ready to enroll now, John, you say.

Sounds great. First, though, let’s discuss the characteristics that make a strong policy.

You see, there are many policies that offer limited benefits.

You don’t want to mess with those policies. The worst thing that could happen is you file a claim, expect a payment, and don’t receive one.

So, let’s first discuss the basic elements needed in any disability insurance policy for secretaries, administrative assistants, and office managers.

Disability Insurance Policy Basics

I speak to professionals, including secretaries and office managers, about disability insurance every day. There are 2 major sources of confusion that these professionals hear from elsewhere. These confusing components are policy basics, but if you get these wrong, you could be in for a surprise when it comes time to make a claim.

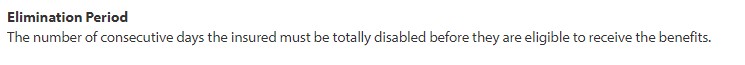

The first is the waiting period or disability insurance elimination period. In terms of disability insurance, it is not the period of time before your policy is in effect. That is correct for other types of insurance, but not for disability insurance.

The elimination period is the length of time – a waiting period – that elapse before you are eligible for disability benefits. It starts with an approved claim. For example, a 90-day elimination period means your benefit period will begin after 90 days of disability. On the 91st day, you are eligible for benefits. Typically, you receive your first benefit 30 days after that.

This means you need to have adequate savings to carry you and your family until benefits begin.

The second is the benefit period. The benefit period starts when you are eligible for benefits and lasts until the end of the benefit period or if you return back to work, whichever occurs first. It is not the maximum timeframe that your policy exists. As long as you pay the premiums, you will have the policy until age 65 or 66 – at retirement age.

The maximum benefit period for secretaries and office managers is to age 67. This means you will have disability benefits for your work lifetime if you choose. However, a 5 year benefit period works just fine, too.

The Definition Matters

The definition of disability matters. You generally want “true own occupation” coverage followed by a form of modified own occupation if possible. What is “true own occupation”? Simply, it means you can continue to work in another occupation while receiving disability benefits for your own occupation as a secretary or office manager. So, if you can’t use your hands, but you can greet people at Walmart, you will receive disability benefits in addition to your earnings as a Walmart greeter.

coverage followed by a form of modified own occupation if possible. What is “true own occupation”? Simply, it means you can continue to work in another occupation while receiving disability benefits for your own occupation as a secretary or office manager. So, if you can’t use your hands, but you can greet people at Walmart, you will receive disability benefits in addition to your earnings as a Walmart greeter.

Modified own occupation is a bit different. You will receive a disability benefit based on your education and duties as a secretary or office manager. However, you can’t work in another job. So, if you work as a Walmart greeter, you won’t receive disability benefits under the modified own occupation definition. You have to choose. This is a good definition, too.

Finally, there is the stringent “any occupation” definition. This means, simply, you won’t receive benefits if you can work in any gainful occupation (for which you are reasonably suited, considering your education, training, and experience). So, under this definition, you won’t receive a disability benefit based on your education and experience as a secretary or office manager because the insurance carrier says you can work as a Walmart greeter.

The plans we work with contain the favorable true own occupation definition for secretaries and office managers. Moreover, you can align this definition to match some or all of your benefit period.

2 Important Elements That Most Times Are Missing

When I review quotes or policies from office managers or secretaries, I see 2 elements missing from most policies. Sure, these policies have some type of own-occupation definition. However, that is it.

In my opinion, it is imperative your policy contains the following.

Residual or Enhanced Partial Disability Benefit

The disabilities we have implied so far are total disabilities. In other words, you can’t work at all.

However, many disabilities start out or end as a partial disability. What if you can work, just not full-time?

This is where you want partial disability benefits. A plan that offers partial disability benefits pays a pro-rated benefit of the time or work lost because of the partial disability.

Many policies offer an enhanced partial disability benefit. This provision pays a benefit if you work in your occupation on a part-time basis due to an illness or injury.

Usually, the amount of disability income you receive is a percentage of your total monthly disability benefit. For example, let’s say you work 3 days a week now and therefore experience a 40% income loss. If your monthly disability benefit is $4,000, you will receive $1,600 ($4,000 X 40%). This is a simple example to illustrate.

However, beware. Many policies state they have partial disability benefits. But, when you read their definition, it states that partial benefits are paid after a period of total disability. Just look at this excerpt from a carrier.

This means if you are only partially disabled (i.e. you can still work, but not full-time), you will not receive any benefits until you have met the carrier’s requirements of a total disability first.

That could be years away. Take multiple sclerosis or carpal tunnel syndrome. Both of these conditions may start as a partial disability. However, if you don’t have adequate partial disability benefits, you won’t receive anything until you are totally disabled.

This scenario underscores the importance of partial disability benefits.

Proper partial disability benefits circumvent the total disability requirement and allow you to receive benefits immediately (after you satisfy the elimination period) if you are partially disabled.

Guaranteed Purchase Option

Let’s say you purchased a disability insurance policy 5 years ago. Your salary is now $25,000 more than what it was when you applied. You are now underinsured if you make a claim.

What do you do?

If you have a guaranteed purchase option, you can purchase more disability insurance with no evidence of health insurability. In other words, you don’t need to go through underwriting again.

That means if you now have type 2 diabetes or Multiple Sclerosis (for example), you can still purchase more disability insurance. How great is that?

You just need to prove your income increased, usually through a tax return or your W-2 stub.

I’ve seen many policies where this option is left off. If you don’t include this option at the time of application, you will then need to reapply for a new policy if you want more disability insurance. If your health changed in any way, you could face benefit limitations, higher premiums, or a decline altogether.

You can see how important this option is.

Optional Disability Insurance Riders For Secretaries And Office Managers

You can add optional riders at an additional cost to your policy to best fit your needs.

Disability insurance is very customizable. If you want more benefits, expect to pay more in premium. Some popular rider options for secretaries and office managers include:

Return of Premium Rider: You will receive the premiums you paid back if you never make a claim.

Retroactive Injury Benefit Rider: Pays additional benefits from the date of total disability due to injury if disability occurs within 30 days of the injury and continues through the elimination period.

Activities of Daily Living Rider: This rider pays an additional benefit if you can’t perform two or more of the activities of daily living. Additionally, it will pay if you are cognitively impaired. This condition is a catastrophic disability. I describe it as needing help with the first 20 minutes of your day. (If you can’t shower, go to the bathroom, dress yourself, etc., then that is a catastrophic disability.)

Accident Plan: pays an indemnity benefit (i.e. fixed dollar benefit) if you are hurt or injured and go to urgent care or ER.

Mental/Nervous/Drug/Alcohol Extension: Most carriers provide a 2 year benefit period only for disabilities caused by mental or emotional disorders (like depression) or by drug/alcohol abuse. This option extends the 2 year benefit period to your contracted benefit period.

Again, you may or may not want these. I am happy to discuss these options in more detail. Just contact us any time.

The Best Disability Insurance For Secretaries And Office Managers

So, we’ve discussed a lot about disability insurance. You are probably wondering which disability insurance carriers we like to use for secretaries, admins, and office managers.

First, we work with many disability insurance carriers. So, we are sure we can find one that meets your needs and budget.

Second, there is no “best” carrier. The “best” is the one that meets your needs, has a good balance of value versus cost, and pays claims.

Having said this, only a handful of carriers properly insure the office manager, secretary, and administrative assistant occupation. These carriers include:

- Illinois Mutual

- Assurity

- Mutual of Omaha

We like these because they will insure your occupation at a class 5. What does this mean? It means that they consider your occupation a low disability-risk occupation. More on that in a minute.

They also offer value-added benefits that enhance your coverage. Additionally, they are on the more affordable side when it comes to premiums. We will talk about the cost later.

However, it is important to level set and understand how disability insurance carriers underwrite your application.

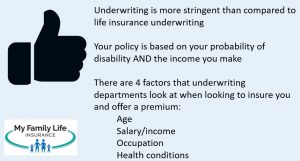

How Disability Insurance Carriers Underwrite Secretaries And Office Managers

It’s important to understand how disability insurance carriers underwrite your application.

Oh, I just went through the life insurance process. I know how it works, you say.

Great. But, disability insurance underwriting is completely different.

Carriers aren’t insuring your mortality. They are insuring your morbidity. In other words, the risk of a disabling accident or illness and paying you a percentage of salary.

Carriers aren’t insuring your mortality. They are insuring your morbidity. In other words, the risk of a disabling accident or illness and paying you a percentage of salary.

So, carriers look at the following attributes in an application.

When it comes to underwriting, carriers look at your:

- Age

- Health

- Income / Salary

- Occupation

- Other hazards and lifestyle situations

Age is a factor. The older you are, the more expensive the policy – all things being equal, of course. This is why you want to start your policy as soon as possible.

Obviously, your health matters. If you have a chronic illness or had a severe injury in the past, likely that illness or injury won’t be covered. Additionally, carriers can limit benefits based on any health conditions.

As we mentioned before, carriers insure a percentage of your salary. This percentage is usually 60% of your gross salary.

Your occupation matters as well. All the disability insurance carriers classify your occupational disability risk. The classification table is usually a 1 to a 5 (or 6 with some carriers). An occupation with a class 1 is most risky while an occupation with a class 5 is least. For example, carriers classify a construction laborer at a 1 and an accountant at a 5.

Carriers classify the office manager, secretary, and administrative assistant occupation at a 5, which is usually the highest classification available.

Finally, carriers also consider other situations and lifestyle choices like hazardous hobbies.

What Do The Carriers Do With The Information?

The underwriters review all this information and make an approval decision or not. They routinely look up your medical background in the MIB, prescription drug databases, driving records, tax records, etc.

As we discussed, certain situations may limit benefits, benefit periods, and/or waiting periods. They may also increase premiums to compensate for an increased disability risk.

Nevertheless, if your benefits are modified in any way, it still makes sense to purchase the policy. We discuss more in our disability insurance underwriting article with a great example.

How Much Does Disability Insurance Cost For Secretaries And Office Managers

That’s the $64,000 question. Well, the premiums you pay are a function of everything we discussed above with underwriting.

However, disability insurance is not incredibly expensive.

Depending on your situation, disability insurance costs between $1.00 and $3.00 per day. Sometimes it is more; sometimes it is less.

The cost is about the cost of a cup of coffee at your favorite coffee shop.

If you can afford a cup of coffee, or lunch, you can certainly afford disability insurance.

For example, a woman aged 40, making $50,000 annually could have a $2,500 monthly benefit, own-occupation definition policy for around $72 per month or $2.40 per day.

Again, the cost could be more or less depending on various factors.

What If My Company Offers Disability Insurance?

We hear this many times.

John, my company offers disability insurance. I’m all set.

That is great they do. However, you aren’t all set.

For one thing, many group disability insurance policies could be limited one way or another. For example, we reviewed the group policy of a woman who makes $100,000 annually. She was astonished to find out her group disability insurance policy provided a maximum $2,000 monthly benefit. That amount is well below full coverage for her.

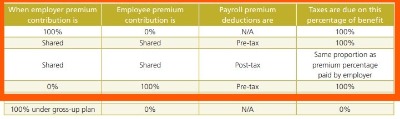

Additionally, that benefit from your group policy is taxable. That means you have to pay income taxes on it. Your employer will note this responsibility on your W-2 in January. Note that if you make a claim against your individual policy, the benefit is not taxable. See the scenarios in the red box.

So, if your employer’s plan pays 60% of your salary as a benefit, that might mean you are netting 40% (or around there) post-tax.

Can you live off of 40% of your salary? Possibly. Most people probably can’t.

That is where an individual plan helps. You can “stack on” an individual plan on top of your group disability plan. Your individual plan will offset any tax impact and bring your overall disability benefits in line with your income.

Is it expensive? Usually, never.

To illustrate, Let’s use the same example previously with the 40-year-old woman, making $50,000 annually. Her employer is nice and offers a group disability insurance plan, in which the employer pays 100%. She receives a $2,500 benefit from her group plan.

If she files a disability claim, that $2,500 is taxable. Based on her situation, she can purchase a supplemental plan. She could purchase up to an additional $1,000 monthly benefit for about $25 per month. That is only $0.75 per day.

Final Thoughts About Disability Insurance For Secretaries And Office Managers

We hope now you have a solid idea why secretaries and office managers need disability insurance. Confused? Don’t feel that way. We’re here to help educate you and protect your income and future. Don’t know where to start? Use this disability insurance needs analysis worksheet. Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy). Next, feel free to reach out to us for our assistance or a quote. You can use the form below, too.

We only work for you, your family, and your best interests only. We have helped many secretaries and office managers secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".