Important Reasons Why Whole Life Insurance Is A Good Idea [We Explain The Benefits Of This Product]

Updated: April 12, 2024 at 9:39 am

We wrote an article that described the 3 reasons why whole life insurance is a bad idea. How can we write an article about why whole life insurance is a good idea? Are we talking from both sides of our mouth? No. It is simple: It is your situation that dictates if a whole life insurance policy is needed. Chances are, it is not, but some people and families need whole life insurance.

We wrote an article that described the 3 reasons why whole life insurance is a bad idea. How can we write an article about why whole life insurance is a good idea? Are we talking from both sides of our mouth? No. It is simple: It is your situation that dictates if a whole life insurance policy is needed. Chances are, it is not, but some people and families need whole life insurance.

This article is intended for people who are considering whole life insurance (see our article on why it can be a bad idea, too) and for people who currently have a whole life insurance policy and considering dumping it. Honestly, if you have a current whole life insurance policy, it may not be in your best interest to dump the policy.

We will explain more in a minute.

We are going to discuss the following:

- Why the agents are right

- Why whole life is a good idea to buy

- Now you know whole life can be a good idea to buy

Let’s jump into it and discuss how Dave Ramsey and Suze Orman are wrong.

The Agents Are Right About Something

The Agents Are Right About Something

We know what Suze Orman and Dave Ramsey say about whole life insurance policies. It’s a waste of money, they say. On the one hand, we couldn’t agree more. Nearly all individuals and families need term life insurance. They don’t need whole life. As we mentioned in our other article, if the agent does not present a solid, concrete reason why you need whole life insurance instead of cheap term, then run away.

On the other hand, the agents got something right.

You may have heard that whole life insurance, overall, offers the lowest cost for life insurance. That is true. John, how can you say that when you have said that term is the cheapest, you ask? Easy. Term offers the lowest cost per thousand dollars of coverage. That doesn’t mean it is the lowest overall dollar cost. You have to factor in the cash value to get your true cost of whole life. When you factor in the cash value, you will have paid for your policy, and then some. The problem is it takes a long time for the cash value to grow and to reach that point.

Here is an example. You pay $300 per month for a $250,000 whole life insurance policy which pays up to age 65. In year 12 of the policy, the cash value is $43,200, which equals the total premiums you have paid to date ($300 X 12 X 12). If you were to cancel at that moment, your net cost is $0.

Why Whole Life Insurance Is A Good Idea

Here are the 4 reasons why a whole life insurance policy can be a good idea to buy.

#1 Reason – It Is The Best Asset Transfer Mechanism

If your goal is to transfer your assets in an economical and efficient manner, nothing works better than whole life insurance. (We don’t like using superlatives, but really, there isn’t.) The death benefit is income tax free. This tax advantage makes it beneficial to donate money to a charity, a child or grandchild, and a slew of other reasons. If properly structured, a whole life insurance policy can pay estate taxes and provide liquidity to families who own small businesses.

Why did we not suggest term life insurance? We don’t know when we will die. That is why. Here’s an example to showcase the problem with term life insurance as an asset transfer mechanism.

Example

Here is an example why term life insurance can be detrimental although the cheapest cost per thousand of life insurance. Let’s say you have a small business and purchased a 20 year term policy for estate liquidity needs upon your death. You live through the term and are now 57. At the end of the term, you reapply for a new policy. However, you find out you are highly rated or uninsurable due to heart atrial fibrillation diagnosed 4 years ago. You now can’t get the life insurance you need that will provide liquidity for your estate needs upon your death. Your estate will pay thousands in taxes upon your death.

If your policy was a whole life insurance policy, you would not have this issue.

We expect to live a full and long life. If we need life insurance WHEN we die, whole life is most appropriate.

Even Suze Orman or Dave Ramsey can’t dispute that. They can’t. If they recommend term life insurance in a case like this, they are providing the wrong information.

If you feel you need for a permanent-type of insurance, but don’t want to pay whole life costs, a guaranteed universal life (GUL) insurance policy could work in its place.

#2 Reason – Cash Value Can Increase Rapidly

In our article about the 3 reasons why whole life insurance is a bad idea, we discussed that cash value can take a long time to accumulate. Sometimes as long as 15 years. However, once it does, it generally increases at a rapid rate. It is hard to find cash that increases this rapidly. Your bank interest? No way. The stock market? No. The money is at risk for principal loss.

If you go to a financial planner, CFP® Professionals just like me, I bet many of them discourage whole life insurance.

Many financial planners will simply tell you to terminate your whole life insurance policy without rhyme or reason. Just hearing the words, “whole life insurance” must tell their brain that it was a bad idea to purchase in the first place and you should terminate.

Well, we receive many calls from people wondering if they should cancel their policies. Some we advise them and others we don’t. Why? Their cash is growing at an extremely rapid rate. They were told by a “financial planner” to terminate their policy. Yet, that financial planner never looked at the illustration or did his or her due diligence.

Ways To Look At Cash Value

In this case, the cash value is an emergency fund (which most Americans need).

Moreover, you should view the life insurance as an overall fixed income allocation of a portfolio. You don’t need an MBA or a Phd. to understand that life insurance cash value has really no correlation with the stock market. If the market drops 10,000 points, your whole life insurance still pays its guaranteed rate.

We recently convinced a woman to keep her whole life policy, in which she was paying $1,800 annually. Her “financial planner” told her to terminate it. After reviewing the illustration, we saw that the cash was increasing rapidly. The cash value applied most of her premiums. At this point, the life insurance policy is part emergency fund and part life insurance policy.

True, maybe years ago she did not need a whole life insurance policy. All that she needed was a term life insurance policy. She could have invested the difference in mutual funds and come out ahead most likely. However, that did not happen. She now sits on a policy that is offering increasing cash value, something she can’t get anywhere else with zero risk. She now sees the $150 she spends each month as some going to a life insurance policy, but most of the premium going to an “emergency fund” type account.

At age 65, she can re-evaluate her needs. She can then withdraw the cash value or transfer it to another policy if needed.

#3 Reason – Flexibility With The Cash Value

Sure, you can borrow from the cash value and pay yourself back. In effect, you are acting as your own bank.

We aren’t going to talk about that in this section. If you have a whole life insurance policy (or any permanent type of policy), there are some advantages of the cash value.

The first is that the cash value is not reported as an asset on FAFSA for college planning. That means, you can save for your children’s college through a life insurance policy. All things being equal, you will have more financial aid. You can then use the cash value to pay off some of the financial aid. (Don’t let insurance agents disguised as college planners fool you – college financial aid still comes in the forms of student loans that require pay back.)

As an aside: As a financial planner myself, I don’t like this strategy as a main college savings strategy. There are better ways to save, notably through a 529 plan. While these “college planners” won’t tell you the whole story and the positive benefits of saving through a 529 plan, there are many (and many they won’t tell you). Contact us for our honest perspective.

But, if you already have a whole life insurance policy, know that you don’t have to report the cash value as an asset. Use it to borrow from to then pay back any financial aid.

You can also save for retirement through a whole life policy. If structured correctly, you can withdraw the cash value tax-free. Some policies such as an indexed universal life insurance policy could offer higher potential cash value. Remember, though, this is life insurance. While we don’t promote life insurance to save for retirement, know you could use the cash value to supplement your retirement.

#4 – Living Benefits Allowed On Life Insurance

Personally, I think this an important reason to purchase whole life insurance.

Even for young adults today.

Yes, you heard me right.

You might be young and healthy now, but there are no guarantees…none that you will remain healthy in the future.

In fact, I can bet most of you reading this will:

- face a severe, critical illness,

- need to care for someone,

- need care for yourself to bath, dress yourself, or

- encounter a severe injury or paralysis

We don’t want to think these events won’t happen, but they will for a majority of us.

You can look no further than the cancer statistics. Cancer does not discriminate, and it affects both young and old people alike. Young adults: you can look no further than the passing of actor Chadwick Boseman.

So, anything can happen at any time.

OK, John. You have my attention.

Importance Of Living Benefits

With living benefits, you can advance part of the death benefit anytime upon the diagnosis of a covered illness, injury, or chronic care.

Let’s say you have a $300,000 policy with living benefits. A doctor diagnoses you with stage 2 cancer. You contact the carrier, and they allow advancement of $125,000 for your treatment and care. Your new death benefit is $175,000.

That $125,000 (or whatever amount it is) helps pay for your mortgage, treatments, etc. Most importantly, it gives you and your family flexibility and peace-of-mind.

What if you had the “plain, old” life insurance? Well, you’d have to figure out another way for your needs.

Moreover, I am sure you know someone who had cancer, a heart attack, stroke, or needed custodial care.

Sure, John, you say. You make great points. I’ll just buy term life insurance with living benefits.

That’s good, but here’s a problem with that.

Every term life insurance expires. Why? The premiums after the level period become astronomical. No one can afford those premiums. Well, maybe Bill Gates.

So, when your term expires, so do your living benefits. If your term ends at, say 65, you don’t have any more living benefits. Unless, of course, you purchase a stand-alone critical illness plan or a long-term care policy.

That’s why we say you have to choose life insurance with living benefits carefully.

But, if you purchase permanent life insurance, say whole life, with living benefits, you’ll enjoy having that flexibility for your lifetime. Your family will, too.

The Math Works

I am a big proponent of “buying term and investing the difference”. Many whole-life “haters” fervently announce that option.

However, when it comes to living benefits on whole life insurance, I challenge that argument.

As you read this article, I can guarantee most of you will face a severe illness or a custodial care situation in your lifetime. Maybe not now, but you will.

Additionally, planning for your health care and needs is just as important as saving for your retirement.

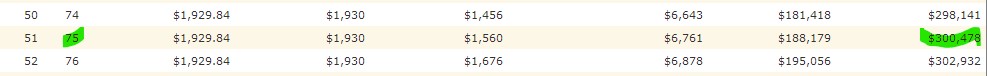

Here’s an excerpt of a whole life illustration with living benefits:

The monthly cost here is about $160 per month. By age 75, as shown above, you would have $300,000 for chronic illness care or a critical illness event. If none of those things happen, or if you want to cash out, you can take the $188,000.

Saving the difference doesn’t make sense because of the future. You don’t know your future. You can be 30 years old and, the next day, diagnosed with cancer. Or, even a stroke (it happens). How much would you have saved at that point for your care and needs? Not much.

However, if these unfortunate events happen, you’ll have peace-of-mind knowing you and your family have a safety net. That is what matters.

Now You Know Whole Life Insurance Can Be A Good Idea To Buy

Now you know the reasons why whole life insurance is a good idea. Is it right for you?

We can help as we have the independent knowledge to assist you in the right decision. We aren’t beholden to any insurance carrier, but we are beholden to you and making sure our recommendations fit your needs and situation. If we feel you need whole life insurance (and some of us do), we will tell you. If something else, we will tell you that, too. Feel free to reach out to us via our contact us page or through the form below.

There’s no risk with contacting us. At the very least, you’ll learn something new, and we will part as friends.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".