Life Insurance Options for People Living with HIV

Updated: April 7, 2025 at 1:24 pm

Let me guess, you are HIV positive, healthy, and having trouble finding life insurance.

Let me guess, you are HIV positive, healthy, and having trouble finding life insurance.

Am I right?

Yes, John. I have been following my doctor’s plan and am otherwise healthy. Carriers decline me when I disclose I have HIV. Can you help?

Yes, we can. We have helped many people living with HIV obtain life insurance.

The life insurance industry is changing for the better. Some insurers are not only adjusting policy premiums through monitored healthy ways (like Fitbit), but also opening or expanding insurance coverage opportunities to impaired health conditions such as type 1 diabetes. Coverage options are greater today, thanks partly to technology, medical advancements in health care, and people generally living longer with these conditions. Consequently, Americans living with HIV have a great chance of living into their 70s and beyond. Other websites suggest that people living with HIV can have a normal life expectancy.

So, yes, if you have HIV, you can obtain life insurance, even traditional life insurance like term life. Here is what we will discuss.

- Introduction Life Insurance and HIV

- Life Insurance Underwriting for People Living with HIV

- Life Insurance Options for People with HIV

- Other Options

- Application Process

- FAQs Life Insurance and HIV

- Final Thoughts About Life Insurance and HIV

Let’s first introduce life insurance and HIV, followed by a discussion of underwriting. It’s important that you understand how underwriters review your application.

Introduction of Life Insurance and HIV

People living with HIV now are receiving coverage consideration from life insurance carriers. According to the CDC, there are currently 1.2 million Americans living with HIV, with 50,000 new cases each year. Fifteen years ago, these people would never have been able to secure life insurance. With recent medical and technological advancements, several insurers have relaxed their coverage standards for people who have HIV.

People living with HIV now are receiving coverage consideration from life insurance carriers. According to the CDC, there are currently 1.2 million Americans living with HIV, with 50,000 new cases each year. Fifteen years ago, these people would never have been able to secure life insurance. With recent medical and technological advancements, several insurers have relaxed their coverage standards for people who have HIV.

At the time of this writing, there are only a select few carriers offering life insurance to those people living with HIV. Carriers will still issue life insurance coverage at a table rating, however.

However, while you’ll pay higher premiums, the cost and coverage are likely to be much better than applying for a guaranteed issue policy (please read on below).

Our opinion at My Family Life Insurance is that as medicine advances in this area, more carriers will offer and expand life insurance coverage.

There are several carriers offering life insurance to people with HIV. These carriers include:

- Prudential

- John Hancock

- AXA

- Symetra

- Guardian

These carriers offer different types of life insurance and death benefit maximums. For example, Prudential only offers term life insurance to individuals with HIV. On the contrary, Guardian (at the time of this writing) offers both term and permanent life insurance.

The Details Of Life Insurance Underwriting For Someone With HIV

Underwriting falls into a few different buckets for HIV-positive people. These buckets include:

- HIV underwriting

- General health / medical underwriting

- Lifestyle underwriting

Let’s discuss specific HIV underwriting first.

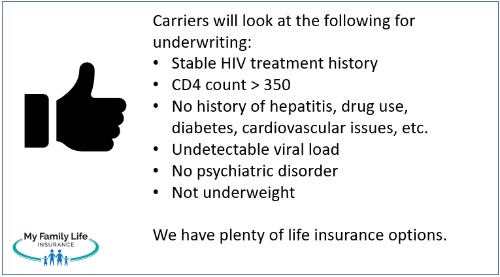

HIV Life Insurance Underwriting

Life insurance companies want to know your HIV status. These are general HIV underwriting guidelines. However, if you are in good health and practice a healthy lifestyle with a stable HIV status, then you should qualify for traditional life insurance. These guidelines include:

- You are aged 30 to 60 years at the time of application submission and in generally good health.

- You must reside in the United States.

- The virus was not acquired via blood transfusion or intravenous drug use.

- It has been more than 1 year since the HIV diagnosis and, if being treated, greater than six months since the current Anti-Retroviral Therapy (ART) was initiated.

- Your medical regimen has been stable for at least 6 months before application with a minimum of 2 recorded, acceptable CD4 counts and viral load results post-medication change.

- Viral load is undetectable (< 200 copies/ml) and stable.

- CD4 count and viral load have been recorded within 6 months from time of application.

- You must consistently comply with your treating physician’s treatment plan and recommendations for follow-up care and routine testing for CD4 counts and viral loads.

- Also, you are free of Hepatitis B / Free of Hepatitis C.

- You are free of Tuberculosis (TB) or Non-TB mycobacterial infection.

Life insurance companies will require a paramedical exam, which is like a medical exam, and also order your medical records to confirm the stability and medical history of your HIV. The paramedical exam includes a blood test and urine sample.

General Health Underwriting

Your overall health status (outside of HIV) matters to life insurance companies. You should qualify for life insurance if you are generally healthy with no other medical conditions. However, if you have other chronic diseases and conditions like sleep apnea or heart issues, for example, then expect a slim chance of approval. Same with these situations:

- psychological conditions like bipolar disorder

- obesity / overweight

- smoking / tobacco use

- substance / drug abuse

- other chronic conditions like diabetes or cardiovascular disease

Lifestyle Underwriting

Your lifestyle (how you conduct your life) matters as well. In addition to understanding your HIV status as well as your overall health, companies also look at your lifestyle, such as:

- your driving history

- felonies and criminal history

- bankruptcy

- hazardous hobbies like skydiving

- recreational use of marijuana

Now that you know what companies look at for underwriting, let’s discuss the life insurance options available to people living with HIV.

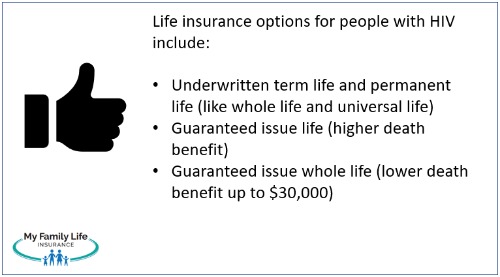

Life Insurance Options for People Living with HIV

As we discussed earlier, with medical advances and technological improvements, many life insurance carriers offer life insurance to HIV individuals. Many life insurance products exist. Here are the life insurance options available for people living with HIV.

Term Life Insurance

HIV individuals have access to term life insurance. Most people purchase term life insurance because it fits their needs and situation: it pays the death benefit only if the insured unexpectedly passes away during the term period (e.g. 20 years, 30 years, etc.). So, it can be good to cover a mortgage or if a parent or spouse unexpectedly passes away.

It is also going to be the least expensive life insurance per coverage.

You can look up monthly premiums here. Note: the cost will be higher because of your HIV. However, the rates will give you an idea of the costs.

If you are interested in term life insurance, please get in touch with us.

Permanent Life Insurance

Permanent life insurance is life insurance that lasts your lifetime. Contrary to term life, permanent life policies have no term period. The life insurance company pays the death benefit no matter when you pass away. That could be 1 year from now or when you are 90.

Two common types of permanent life insurance exist. These are:

- Whole life insurance – has guaranteed premium, dividends (possibly), guaranteed cash value, and guaranteed death benefit

- Universal life insurance – flexible premiums, no dividends, no guarantees of cash value (usually), no guaranteed death benefit (usually)

Permanent life insurance contains cash value. Cash value is like a savings account (but it isn’t). Going into detail about cash value is outside the scope of this article. Contact us if you would like to learn more.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is just as it sounds. Approval is guaranteed. You just apply, and you have life insurance.

We have many options for guaranteed issue life insurance. However, two plans stand out to us that we work with. Both require you to work a minimum of 20 hours in gainful employment. Additionally, both are available through associations. These plans include:

- $50,000 term life to age 80

- Up to $75,000 in whole life insurance

Unlike other types of guaranteed issue life insurance, no waiting period exists on these plans. The reason is that you must be gainfully employed. (I recommend that you print out a copy of your pay stub or some other document that verifies your employment at the time of application.) Rates are very reasonable.

Although $125,000 (combined) doesn’t seem like much, it is some coverage, and some coverage is better than no coverage.

Contact us if you have any questions.

Alternative Life Insurance Options For People With HIV

There are several alternatives if individual life insurance is not possible or viable for you right now. Although these aren’t perfect options, they are options nonetheless.

These alternatives include, but are not limited to:

- Enrolling in your company’s life insurance program, if any. Most life insurance policies issued through your employer underwrite on a group basis. Essentially, that means the coverage is guaranteed, and the rates are better – probably in the standard rating range. Typically, the plan limits your death benefit to 1X to 3X of salary.

- Applying for group life insurance yourself. If you are a business owner, you could apply for group term life insurance. The level of death benefit coverage depends on your company size. However, you will need at least two employees to obtain some level of guaranteed-issue coverage.

- Obtaining guaranteed issue insurance. While guaranteed issue policies have death benefit limitations, they are an option. It is best to consult us so we can direct you to the right policy. We discussed how burial insurance for people with HIV could be a viable option.

- Applying for accident insurance. These policies will pay a benefit upon a covered accident, like a torn rotator cuff while playing baseball. They do provide a death benefit upon accidental death.

Life Insurance Application Process for People with HIV

Here is our life insurance application process.

- Disclose that you have HIV.

- We conduct a pre-qualifying assessment of your HIV history.

- We will also go over your other health and lifestyle situations.

- Based on this, we reach out to favorable life insurance companies for an estimated rate.

- With you, we analyze the options and offer a recommendation.

- You apply.

- We keep you updated throughout the underwriting process (medical exam, medical records, etc., if needed).

- Then, the life insurance company makes a decision, which is usually an approval for our clients.

It is a rather easy process. Contact us if you have any questions.

Frequently Asked Questions About Life Insurance and HIV

We answer frequently asked questions about people with HIV and life insurance.

Can people living with HIV get life insurance?

Yes, absolutely! Thanks to advancements in medical treatments like antiretroviral therapy (ART), many insurers now offer life insurance to people living with HIV. It’s not as challenging as it used to be, and options such as term life, whole life, and guaranteed issue policies are available depending on your health and needs.

What types of life insurance are available for someone with HIV?

You’ve got several options! Traditional term life insurance covers you for a set period, like 10 or 20 years, while whole life provides lifelong coverage with a cash value component. If underwriting is a hurdle, guaranteed issue life insurance is a fallback—it requires no medical exam or health questions. Still, it comes with lower coverage amounts and higher premiums. However, our brokerage works with two guaranteed issue life insurance options with a higher face amount.

Will my premiums be higher if I have HIV?

Yes. Insurers assess risk, and HIV, even when well-managed, is still considered a chronic condition. That said, if you’re healthy, on treatment, and have a stable viral load and CD4 count, most companies will approve your application. It is best to contact us so we can pre-qualify your situation with underwriters. An estimated rate is included in the pre-qualification.

What factors do insurers look at when I apply with HIV?

They’ll dive into your HIV management—your viral load, CD4 count, and how long you’ve been on ART. They’ll also check your overall health, like whether you have other conditions (diabetes, heart disease), your age, lifestyle habits (smoking, for instance), and treatment compliance. The more stable your health, the better your chances for approval.

How long after an HIV diagnosis can I apply for life insurance?

Typically, insurers want to see at least 6 months to a year of treatment history post-diagnosis. They’re looking for stability—proof that your condition is under control. Some might even prefer a few years of medical records, so the longer you’ve managed it well, the stronger your application and your chances of approval.

Do I have to disclose my HIV status when applying?

Yes, full disclosure is a must. Lying or omitting your status is considered non-disclosure, and it could void your policy when your beneficiaries try to claim it. Honesty upfront ensures your loved ones are protected down the line, and insurers keep your info confidential anyway.

Can I get life insurance through my employer if I have HIV?

You bet! Group life insurance through work often doesn’t require medical underwriting, so your HIV status won’t automatically disqualify you. Coverage amounts might be limited—say, one or two times your salary—so you might want to pair it with an individual policy for additional protection.

What if I’m denied traditional life insurance because of HIV?

No worries—there’s still a plan for you! Guaranteed issue life insurance is designed for situations like this. It’s a no-questions-asked policy, perfect for covering final expenses like a funeral. Just know it caps out around $25,000 and premiums are higher, but it’s a solid safety net. Again, we work with two guaranteed issue life insurance options offering a higher death benefit if you are gainfully employed.

How does my HIV treatment plan affect my life insurance eligibility?

Your treatment plan is a big deal. Insurers see you as lower risk if you’re consistently taking ART, have an undetectable viral load, and have a healthy CD4 count (say, above 500). Skipping meds or having an unstable situation could make approval more challenging or push you toward pricier options like guaranteed issue.

What happens if I’m diagnosed with HIV after I already have a policy?

Good news—your policy stays intact! Nothing changes. Once it’s in force, a new HIV diagnosis won’t cancel it or jack up your rates. Your coverage and premiums are locked in based on your health at the time you applied, so your beneficiaries will still get the payout as planned.

Do You Have Any Life Insurance Options for People Living With AIDS?

People living with AIDS have late-stage HIV infection. Therefore, some of the life insurance options we discussed aren’t available.

However, people with AIDS can obtain life insurance. We do have options, and these options include guaranteed issue life insurance.

We work with guaranteed issue whole life insurance options for people aged 0 to 80, depending on the state where you live.

Remember that most guaranteed issue policies contain a two-year waiting period on the death benefit. If you pass away during this two-year timeframe from any illness or natural causes, your beneficiaries receive the premiums you paid + interest. (So, it is a refund of your money + interest.)

If you have AIDS and need some life insurance, don’t hesitate to get in touch with us.

Final Thoughts About Life Insurance and HIV

We hope this article provided education of life insurance coverage options for people with HIV. As we wrote, people with HIV can obtain life insurance, particularly if they live a healthy and stable lifestyle.

At My Family Life, we work doggedly to match the right insurance for you and your situation, even if it takes months to do so. Ensuring you and your family have the right coverage is our first and only priority.

Feel free to call, text, email, or use the form below. We would be happy to help you.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".