3 Affordable Burial Insurance Options For Overweight People | No Matter Your Situation, We Can Likely Help You Obtain Burial Insurance

Updated: October 12, 2024 at 12:28 pm

Most people who are overweight or obese think they can’t obtain burial insurance, but that is not true.

Most people who are overweight or obese think they can’t obtain burial insurance, but that is not true.

If you are overweight or obese, you can obtain burial insurance. Moreover, you can obtain burial insurance rather easily and at an affordable price.

In fact, you may have many options available to you.

How great is that?

Many of our overweight or obese clients obtain burial insurance with us, most times with an immediate benefit. No matter your situation, we can likely help you obtain this important insurance.

Here’s what we will discuss:

- What Is Burial Insurance

- Burial Insurance Underwriting For Overweight and Obese People

- The 3 Burial Insurance Options For Overweight and Obese

- Our Burial Insurance Application Process – Easy

- Case Studies

- Frequently Asked Questions About Burial Insurance For Overweight and Obese

- Now You Know The 3 Options Available To You

Let’s jump in and introduce burial insurance.

What Is Burial Insurance?

Do you want to know a secret?

Burial insurance is actually life insurance.

Yes, that is right.

I know people and the industry like to call it “burial insurance.”

However, burial insurance is a whole life insurance policy with a small or low death benefit like $25,000.

It is designed to help pay for funeral expenses and burial needs.

That’s why people and the industry call it “burial insurance.”

Consequently, you may hear burial insurance called other names like:

- Final expense insurance

- Final expense life insurance

- Funeral insurance

- End-of-life insurance

- Cremation insurance

And on and on…

They all mean the same thing. The industry calls it burial insurance because that’s what it is intended to do. It is designed to pay for your funeral and any other end-of-life expenses.

Geez, John. Why don’t I just work with a funeral home directly, then?

Good question. You can. However, we discuss why you may not want to do that next.

Advantage Of Burial Insurance Versus a Funeral Home Plan

However, burial insurance (i.e. the whole life policy with a small death benefit) completes your funeral and burial needs in about 30 minutes (more on that later).

You see, you can go to a funeral home and set up a plan. You pay into their plan. But, what if you die and you still have an outstanding balance?

Then, yes, your loved ones will have to pay the rest.

Do you want that to happen?

No, John, I don’t.

Burial insurance completes your funeral and burial needs, up to the death benefit you select. Moreover, it comes without the worry that your loved ones have to pay. It gives you and your family peace of mind, and really is the best option available to you.

For example, you could pay 3 payments, have a heart attack, and pass away. The carrier then pays the death benefit. (This, unfortunately, happened to a client of ours, but fortunately, he had immediate benefit burial insurance.)

Additionally, most people don’t wake up and say “Honey, it’s such a nice day out. Let’s go to the funeral home to set up our funerals.”

And then spend a few hours at the funeral home.

Alternatively, burial insurance essentially establishes this funding. It creates the maximum amount paid out for your funeral. If your funeral costs less, some money can go to your loved ones.

You can then set up your funeral on your own time.

That’s better, right?

Moreover, burial insurance is easy to qualify for, even for overweight people. Let’s talk about the qualifications next in our underwriting section.

Burial Insurance Underwriting For Overweight And Obese

Burial Insurance Underwriting For Overweight And Obese

Before we get into burial insurance for people who are overweight or obese, let’s talk about burial insurance underwriting.

As we stated earlier, burial insurance is simply a whole life or permanent insurance policy with a small death benefit.

Usually, the available death benefits are between $2,000 to $25,000 and sometimes more (such as $50,000) depending on age.

Underwriting for burial insurance with overweight situations is much different than that for traditional life insurance.

With traditional life insurance, underwriters are going to want to know the severity of your overweight or obesity. They focus on your weight because your weight is a very important indicator of your overall health. Obesity and overweight directly relate to many health issues, including heart disease, sleep apnea, and diabetes.

They will look at your body mass index (BMI, which is a way to categorize your overweight in one number. The industry categorizes a BMI over 25 as overweight and over 30 as obese). Carriers will likely request your medical records, review your health history, require a medical exam, and want to know other health conditions, too. (If you are overweight or obese and need term life or permanent insurance, contact us, and we will discuss the steps and process with you.)

The underwriting process for burial insurance is different. The carrier doesn’t care about all of that.

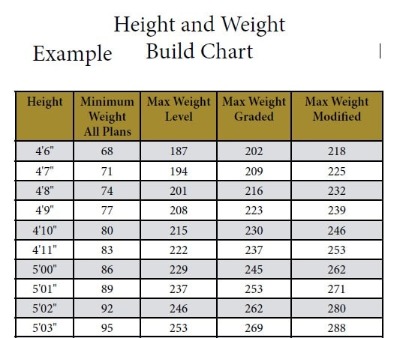

Underwriters don’t want to see your doctor’s records or want a medical exam. They don’t care about that stuff. They simply want to know your height and weight and answer a health questionnaire. Luckily, the height/weight tables are very liberal in burial insurance, so they take into account overweight situations.

If your height and weight fit into the table, you are good to go. If not, no life insurance is available unless you utilize life insurance carriers that do not use a build chart or weight charts.

It is that simple.

Additionally, a handful of carriers don’t utilize a height / weight table. If your situation warrants it, we utilize these carriers.

Yes Or No Questions

So, I just need to be within a height and weight table, and I am good to go?

Not necessarily.

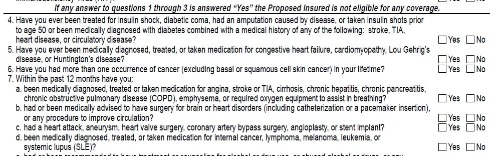

You still have to qualify health-wise. The health questions on a burial insurance application are all “yes or no”. The carrier just wants to know if you have a certain medical condition or not. The question could be as simple as, “in the past 2 years have you been diagnosed or treated for atrial fibrillation?” You would answer “yes” if you have or “no” if not.

If you answer “yes” in this example, then your weight doesn’t matter. You probably won’t obtain burial insurance with that specific carrier.

This brings us to the next point. Every carrier is different in how they underwrite.

Additionally, some carriers don’t even ask about your height or weight. That is right. They don’t care. So, if you are extremely obese, and you have no other significant underlying health conditions, who do you think we will use? That is right – the carrier that doesn’t ask about your weight.

Burial insurance underwriting is a simple “yes/no” application. Some carriers then follow the application with a phone interview. We prefer the ones that don’t when possible. After that, a decision is usually instantaneous or a couple of days thereafter.

Database Check

Carriers will run your background through a few different databases to ensure that what you say on the application matches your records. One database is the MIB which lists your medical claim history as well as your insurance application history.

They will also look at your prescription drug history. Carriers can see all of that. If an answer to an application question does not match a prescription drug you take, that will be a red flag. You don’t want red flags.

It’s really that simple.

Now, let’s discuss your options.

3 Burial Insurance Options For Overweight And Obese People

There are a few types of burial insurance for overweight people. We will help you make sense of them.

Keep in mind that height and weight tables for burial insurance are very liberal, as we indicated earlier.

So, if you are only overweight with no (truthful) health conditions, then we can get you the lowest-cost burial insurance for your situation.

Let’s jump into the burial insurance options for the overweight and obese.

Immediate Benefit Burial Insurance For Overweight and Obese

The first one is called level or immediate benefit. This means the death benefit has “day 1” coverage.

We want immediate benefit coverage. Why? Let’s say Jim applies for $20,000 burial insurance. The carrier approves him with immediate benefit coverage. He is covered on day 1 of the policy’s start date. Unfortunately, Jim dies suddenly six months later. Jim’s beneficiary will receive the $20,000 to help pay for his funeral costs.

It is also, generally, the least expensive burial insurance option.

As I mentioned, if you are only overweight, then you can get immediate benefit burial insurance.

You just need to truthfully say “no” to the health questions.

You can check out the costs below:

Keep in mind that we work with way more carriers than shown on the quoter. The quoter is a nice guide, giving you an idea of what is available.

What if you don’t qualify for an immediate benefit? We discuss that next.

Graded Benefit Burial Insurance

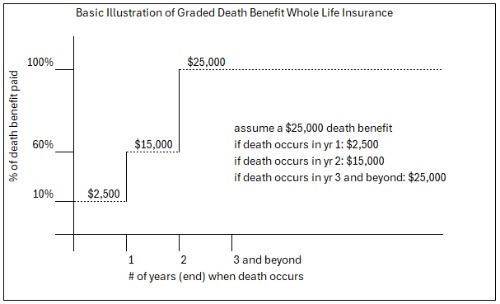

The second option is called graded benefit. It’s a tad different than the immediate benefit.

Essentially, if you answer “yes” to one of the health questions, then you are likely eligible for a graded benefit policy.

Think of graded benefit as a staircase for the death benefit. For example, if you pass away from illness or natural causes:

- In the 1st yr, your beneficiary receives 10% of the death benefit

- In the 2nd yr, 60%, and

- Then if you pass in the 3rd year and beyond, your beneficiary receives 100% of the death benefit.

Notice I used “illness and natural causes.” If you were to pass away from an accident, even in the first two years, the carrier pays 100% of the death benefit. So, the limitation is on illnesses and natural causes only.

Do you think a graded benefit is that bad? Not really.

However, you’ll pay higher premiums compared to immediate benefit plans. That is why we aim for immediate benefit coverage. Remember, too, that every carrier has different underwriting. So, while one carrier may offer a graded benefit for your situation, another may offer an immediate benefit.

Feel free to check out the quoter below.

Just input “decent” health in the health class field.

Guaranteed Issue Life Insurance

If you can’t obtain an immediate benefit or graded benefit, there is guaranteed issue life insurance available. This means just as it sounds: you automatically receive coverage. Just fill out an application and answer a few non-health questions. The carrier does not run your background through the MIB, ask health questions, or review your prescription drug history.

If you can’t obtain an immediate benefit or graded benefit, there is guaranteed issue life insurance available. This means just as it sounds: you automatically receive coverage. Just fill out an application and answer a few non-health questions. The carrier does not run your background through the MIB, ask health questions, or review your prescription drug history.

Guaranteed-issue life insurance coverage contains a “waiting period” death benefit, usually two years.

We work with a few different guaranteed-issue carriers. Sometimes, the cost of the guaranteed-issue insurance coverage is less than that of a traditional graded benefit policy. If that’s the case, it makes sense to apply for the guaranteed-issue coverage.

As we indicated, guaranteed issue life insurance has a “waiting period” for death benefit coverage. Like the graded benefit plan, the waiting period applies to death from illness or natural causes. Accidents are covered 100% on day 1.

Depending on the carrier, the waiting period could be 2 or 3 years. If you pass away within the waiting period, the company usually reimburses your premiums plus interest to your beneficiary.

Feel free to check out the quoter below. Just input “poor” health in the health class field:

As we stated earlier, we work with many other guaranteed issue carriers that are not on the quoter.

For example, we work with a guaranteed issue term plan. It is not available in every state.

We also work with a guaranteed issue whole life plan available to those under the age of 40. Additionally, we work with many inexpensive guaranteed issue plans.

The Burial Insurance Application Process For Overweight and Obese People

If you are overweight or obese, applying for burial insurance is easy. Here are the steps:

- Give us a call, use the form below, or the contact us link

- Tell us you’d like to apply for burial insurance, and that you are overweight

- Tell us other health conditions you have, if any, including tobacco or nicotine use

- We will analyze your options over the phone

- We review the available burial insurance companies and select a carrier. You apply over the phone with us

Depending on your situation, you could have burial insurance in 30 minutes

It is straightforward.

Remember, we work with several carriers that do not utilize a height and weight chart.

Case Studies Of Helping Overweight Individuals Obtain Burial Insurance

As we indicated earlier, nearly all of our overweight clients obtain burial insurance with us. Moreover, most of them are approved for an immediate benefit.

Here are 3 case studies illustrating what is possible. Rates are subject to change.

Case Study #1

Male, non-smoker, age 52.

Height 5’4”, Weight 337 pounds.

No other documented significant health conditions.

He wanted $25,000 of burial insurance.

He was out of the height/weight tables for several carriers, so we used one carrier that has no height/weight tables.

We got him $25,000 for $90.34 per month.

Case Study #2

Female, 47

Height 5’2” Weight 240

She had breast cancer 14 months ago.

In remission, and no follow-ups are required.

It’s not so much the height/weight as the limiting factor, but the cancer.

Because it’s been over a year, a graded benefit is available.

$15,000 burial insurance cost about $70 per month.

However, a $15,000 with a guaranteed issue plan is $49 per month. So, she picked the guaranteed issue option.

Case Study #3

Man 60 years old, 5’11” 345 pounds

He lives in New York.

Takes metformin for type 2 diabetes and has high blood pressure and cholesterol.

These aren’t big deals, and his weight is good with many carriers

Unfortunately, he lives in New York. There aren’t many burial insurance carriers in New York. Those carriers that would accept him are not available in New York.

There is a guaranteed issue option available, so we went with that. $15,000 of burial insurance for $95.38 per month.

Frequently Asked Questions About Burial Insurance For Overweight and Obese

We answer some frequently asked about burial insurance for obese and overweight applicants.

1. How does being overweight affect eligibility for burial insurance?

Being overweight can impact eligibility for burial insurance, but the extent of this impact varies among life insurance providers. Typically, companies use a process called underwriting to assess risk and determine eligibility. For overweight individuals, this process may involve:

- Body Mass Index (BMI) evaluation: Insurers often use BMI (the height-to-weight ratio) to measure health risk. A higher BMI may result in higher premiums or, in some cases, coverage denial.

- Medical questionnaires: Applicants may need to answer detailed questions about their weight, medical history, tobacco use, and lifestyle.

It’s important to note that while being overweight might affect eligibility or rates, it doesn’t automatically disqualify an individual from obtaining burial insurance. Many insurers offer policies specifically designed for individuals with higher BMIs or health concerns.

2. Are there specific burial insurance policies designed for overweight individuals?

Yes, there are burial insurance policies that cater to overweight applicants. These policies are often referred to as “guaranteed issue” or “simplified issue” life insurance. Key features of a burial insurance policy include:

- No medical exams: These policies typically don’t require a medical examination, making them more accessible to overweight applicants.

- Limited health questions: The application process may involve fewer or no health-related questions.

- Guaranteed acceptance: A guaranteed issue policy offers guaranteed acceptance regardless of weight or health status.

- Graded benefits: Many of these policies have a waiting period (usually 2-3 years) before the full death benefit is payable.

- Higher premiums: Due to the increased risk, these policies often have higher premiums than standard policies.

While these policies can be more expensive, they provide an option for overweight individuals who might otherwise struggle to obtain coverage.

The type of policy available to you depends on your specific factors and the underwriting process.

3. How can overweight individuals improve their chances of getting affordable burial insurance?

Overweight individuals can take several steps to improve their chances of obtaining affordable burial insurance:

- Shop around: Different companies have varying underwriting standards, so comparing multiple providers can help find the best rates. (Better yet, let us do the “shopping” for you. It saves you time, and we already know the advantages and disadvantages of carriers)

- Consider lifestyle changes: Demonstrating a healthy lifestyle to improve health through diet and exercise can positively impact insurance applications.

- Manage associated health conditions: Properly controlling conditions like diabetes or hypertension can improve insurability.

- Opt for simplified issue policies: These policies often have less stringent health requirements but may have slightly higher premiums.

- Work with an independent agent: An experienced agent (i.e., us :)) can help navigate options and find insurers more lenient towards overweight applicants.

- Be honest: Providing accurate information during the application process is crucial to avoid future claim denials.

Remember, even small improvements in health metrics can potentially lead to better insurance options and rates.

4. What impact do obesity-related health conditions have on burial insurance rates?

Obesity-related health conditions can significantly impact burial insurance rates. Common conditions associated with obesity that insurers consider include:

- Type 2 diabetes

- Hypertension (high blood pressure)

- Heart disease

- Sleep apnea

- Certain types of cancer

These conditions are viewed as increased risk factors by insurers, potentially leading to:

- Higher premiums: Life insurance rates may be substantially higher compared to those for individuals without these conditions.

- Limited policy options: Some insurers may restrict the types of policies available.

- Longer waiting periods: Policies might include extended graded benefit periods.

- Possible denials: In severe cases, some insurers might deny coverage altogether.

However, the impact varies based on the specific condition, its severity, and how well it’s managed. Demonstrating good control of these conditions through medication, lifestyle changes, and regular medical check-ups can help mitigate some of these effects.

5. Are there any no-medical exam burial insurance options for overweight individuals?

Yes, there are no-medical exam burial insurance options available for overweight individuals. These policies, often called guaranteed issue or simplified issue life insurance, offer several advantages:

- No physical exams required

- Minimal or no health questions

- Guaranteed acceptance in many cases

- Faster approval process

However, these policies also come with some drawbacks:

- Higher premiums: Due to the increased risk for the insurer, these policies are often more expensive.

- Lower coverage amounts: Many no-exam policies have lower maximum death benefit coverage limits.

- Graded death benefits: There’s usually a waiting period (2-3 years) before the full death benefit is payable.

- Age restrictions: Some policies may have upper age limits for applicants.

While non-medical exam options provide accessibility, it’s essential to compare them carefully with traditional policies. In some cases, overweight individuals in relatively good health might find better value in policies that do require a medical exam.

Remember, burial insurance needs vary by individual. It’s advisable to consult with a licensed insurance agent (i.e., us :)) to determine the best option based on your specific health status, financial situation, and coverage needs.

6. Why Do I Pay A Higher Life Insurance Rate As An Overweight Individual?

Good question. It’s all about risk.

Insurance companies use underwriting to measure the chances of risk happening. Homeowner insurance underwriters analyze the chances of your home being damaged (i.e., the risk). Auto insurance underwriters analyze the chances of your getting in a car accident and causing damage to yourself, others, and other property.

Life insurance underwriters are no different. They are analyzing the risk of an unexpected or earlier-than-expected death.

While studies vary, studies show that people who are overweight or obese could lose 6 to 13 years or more of life expectancy.

Moreover, overweight and obesity lead to many medical issues and health complications, including sleep apnea, cancer, diabetes, etc.

To compensate for this higher risk, underwriters have to charge higher rates. (Or they will decline your application if your risk is too high.)

The good news is that, as a reputable independent insurance broker, we can find you the best policy at the best rate based on your needs and situation.

7. OK. What If I Lose Weight? What Happens Then?

That depends on when the weight loss happens.

If you lose weight after you have been approved, your current burial insurance policy does not change. However, if you lose significant weight and have improved vitals, you may be eligible for a new policy. Please contact us if this happens to you. We will advise you if a new policy makes sense in your situation.

Weight loss becomes an issue when you apply (i.e., before you are approved).

Many life insurance companies use, what I call, the “weight loss halving” method.

Here’s how it works: If you lose weight and the weight loss occurred within 12 months of the application, the company takes your weight loss, divides it by 2, and adds it to your current weight.

This number becomes your weight for application purposes.

For example, Joe weighed 400 pounds on July 1. He lost weight, and by December 1, he had dropped 100 pounds to 300. He applied for burial insurance.

Joe enters his weight as 300 pounds on the application. A question on the application asks if Joe has lost weight in the last 12 months. He answers “Yes” and enters his weight loss as 100 pounds.

The burial insurance company comes back and says his weight for the application is 350 pounds.

Underwriters do this as they know people who lose weight within 12 months often gain the weight loss back.

There are a couple of ways to get around this:

- Wait to apply until it has been 12 months since the weight loss

- Use a life insurance company that does not ask a weight loss question

- Use a life insurance company that does not utilize a height-weight table in the underwriting process

Now You Know 3 Burial Insurance Options Available To Those Who Are Overweight Or Obese

We hope you found this article informative. You can obtain burial insurance if you are overweight or obese. We have many burial insurance options available for people who are overweight or obese.

Are you ready to get started? We can help.

Feel free to contact us or use the form below.

We work with many carriers in the burial insurance area and know we can find the right coverage for you. As with everything we do, we work with your best interests at all times. That means if there is a better option for you than what we can provide, we will help put you in touch with someone who can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".