Will Life Insurance Pay A Death Benefit From A Drug Overdose? | Yes, Generally Speaking, It Will. But There Are Cases Where Carriers Won’t Pay

Updated: April 12, 2024 at 9:38 am

Practically every day, people ask me if the life insurance policies they are enrolling in will pay out for death due to a drug overdose.

Practically every day, people ask me if the life insurance policies they are enrolling in will pay out for death due to a drug overdose.

It is a valid question. Especially today with the rise of fentanyl deaths and drug overdoses.

The short answer: yes, life insurance companies will pay the death benefit if you or a loved one die from a drug overdose.

However, 2 situations exist where life insurance companies will challenge the death claim on a drug overdose. You need to know these situations. We discuss those later in the article.

In this article, we will educate you on the death benefit payout expectations if you or a family member passes away from a drug overdose. We will discuss:

- Do Life Insurance Companies Cover Overdoses

- 2 Situations When Life Insurance Companies Deny A Claim

- Illegal Drug Versus Prescription Drug Death

- Will An Accidental Death Insurance Plan Cover Me?

- FAQs About Life Insurance And Overdoses

- Final Thoughts

Let’s jump in and discuss how life insurance companies view drug overdoses.

Do Life Insurance Carriers Cover Deaths From Drug Overdoses?

It’s no secret the rise of deaths from drug overdoses. Over 106,000 Americans died from drug overdoses in 2021 Moreover, fentanyl overdoses contributed most of that increase.

The COVID pandemic hasn’t helped. It is a known fact that drug use, alcohol use, anxiety, and depression all increased due to the isolation and distress caused by the pandemic.

Obviously, life insurance companies are aware of all this. In my opinion, they have strengthened their underwriting around drug use, alcohol abuse, and substance abuse. Today. I see more and more questions and review about alcohol and drug use history. (Related: see our article on how people with a substance abuse history obtain life insurance.)

However, life insurance companies will still pay out a death benefit if you die from a drug overdose. That should give you some peace of mind.

I am aware other agencies and brokers may say otherwise. There are indeed 2 situations where the carriers may deny or challenge a life insurance claim. We discuss these 2 situations next.

2 Situations Where The Life Insurance Carriers Will Challenge Or Deny A Drug Overdose Claim

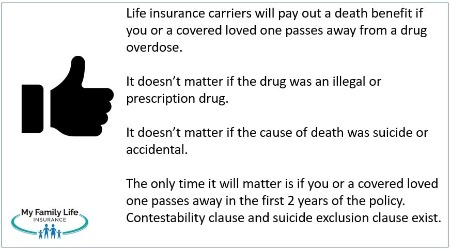

Life insurance carriers will pay out the death benefit if you pass away from a drug overdose.

However, 2 situations exist where the carriers will challenge or deny a life insurance claim.

These situations are somewhat interrelated. Nearly all life insurance policies issued here in the US contain these situations.

The first situation is the contestability period. This is a common clause in a life insurance policy that allows life insurance companies to review your information for any material misrepresentation or fraud. This period lasts for 2 years after your policy is in force.

The first situation is the contestability period. This is a common clause in a life insurance policy that allows life insurance companies to review your information for any material misrepresentation or fraud. This period lasts for 2 years after your policy is in force.

Do you mean, John, carriers can change my policy?

Yes. During this period, carriers will analyze any information that could have been missed during the underwriting process. If the information is significant enough, carriers could alter your life insurance policy or terminate it altogether (a process known as recission).

For example, if you pass away from a drug overdose, carriers will investigate the claim. If they find out you lied on the life insurance application, engaged in illegal activity, or misrepresented a drug usage history, they will deny the claim.

The second situation is a common suicide clause. Every life insurance policy issued in the US contains this clause.

It basically says that if the insured dies by suicide, the beneficiaries receive no death benefit. They will only receive the premiums that were paid. In other words, the carrier refunds the money back.

This suicide clause lasts only 2 years as well. It begins on the start date of the policy and last 2 years after that.

What Happens To Life Insurance Claims After The 2-Year Period?

OK, John. What happens after the contestability period and suicide clause period?

After that 2-year period, life insurance companies will pay the death benefit.

It doesn’t matter if the drug overdose death was accidental or intentional. The life insurance company will pay the death benefit.

People challenge me on this, and I am aware of other websites stating otherwise.

However, here is a real excerpt taken right out of a life insurance contract for one of my clients. You can see that they will pay out the death benefit.

So, life insurance policies will pay if you die from a drug overdose. The cause of death isn’t a factor. It doesn’t matter if the insured’s death was accidental, intentional, or by way of illegal drugs or prescription drugs.

So, life insurance policies will pay if you die from a drug overdose. The cause of death isn’t a factor. It doesn’t matter if the insured’s death was accidental, intentional, or by way of illegal drugs or prescription drugs.

The only cases where carriers will challenge the claim are during the contestability period or during the suicide clause period.

Note: this 2-year period is open to all material situations which could have affected the underwriting decision.

Upon life insurance approval, you will want to review your policy and the fine print for any exclusions. Many life insurance policies do not contain specific exclusions around drug use or drug abuse. Accidental death policies, on the other hand, typically do contain these exclusions. We discuss accidental death insurance later in the article.

Illegal Drug Overdose Versus Prescription Medications Overdose

People think there is a life insurance payout difference if a person passes away from prescription drugs rather than illegal drugs.

Not really. The type of drug, whether an illegal drug or prescription medication, doesn’t really matter. What really matters to the carriers if:

- the person lied during the application process or

- was the cause of death a suicide?

If a person passes away after the contestability period or the suicide clause period, then it doesn’t matter how the insured died.

We just showed some excerpts from life insurance carriers. There are others.

The only time an illegal drug overdose versus a prescription drug overdose matters is during the contestability period or when the suicide clause is in effect.

In both overdose cases, the life insurance companies will investigate and determine if there was a material misrepresentation or misstatement during the underwriting process. If so, then the carrier will deny the life insurance claim.

They will also determine if the cause of death was suicide or accidental.

The coroner’s information and any autopsies will answer many questions if a drug overdose was accidental or not. Carriers will:

- Review the coroner’s information and cause of death,

- Analyze any public information,

- Review police and medical examiner reports, and

- Likely initiate their own private investigation

Many people think that if they pass away from an illicit drug or illegal drug overdose, the life insurance company automatically denies the claim. That isn’t necessarily true. Again, the carrier will have to prove that there was a material misstatement on the life insurance application in order to deny the claim. Or, suicidal intent existed.

An Example To Make Clear

Here’s an extreme, yet plausible example of what could happen.

Joe goes to a party, invited by a friend. Joe purchased life insurance a year ago. He never smoked, used marijuana, or engaged in any risky behavior or illegal activities. He drinks occasionally. Additionally, he has never used any hard or illicit drugs in his lifetime. He doesn’t know many people there. A person at the party pressures Joe to try cocaine. Joe tries it and dies unexpectedly.

What happens here? For sure, the carrier will investigate. It’s within the contestability period. However, Joe never had a drug abuse problem. The carrier completes its investigation and agrees. The cause of death was an accidental overdose from illegal drug use. There was no drug use in his background.

Let’s change the example a bit. Joe did use cocaine 5 years ago. He didn’t use any since, but he did have a small habit back then. The carrier’s investigators find this out. Likely, the carrier will deny his beneficiary’s life insurance claim. While the death was accidental, Joe did have a substance abuse history which he did not disclose.

Do you see the difference here?

Will Accident Death Insurance Cover Me For Drug Overdose?

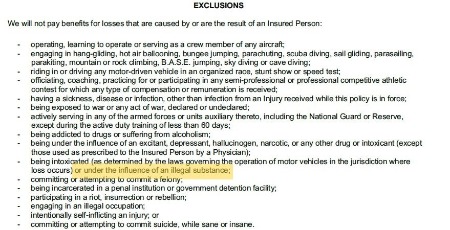

No, accidental death insurance won’t typically pay out for a drug overdose. The short answer is that you really don’t want to purchase accident insurance, also known as accidental death insurance.

Many people think accidental death insurance pays a benefit if you die from an accidental drug overdose. However, in most cases, it doesn’t.

Accidental death policies contain many exclusions. Just look at the exclusions from this real accident insurance policy.

Accidental death policies contain many exclusions. Just look at the exclusions from this real accident insurance policy.

It basically says if you die from an illegal drug overdose, then it won’t pay a benefit.

It also isn’t technically life insurance. That is right. Many other websites talk about these policies as though they are life insurance policies. They technically are not.

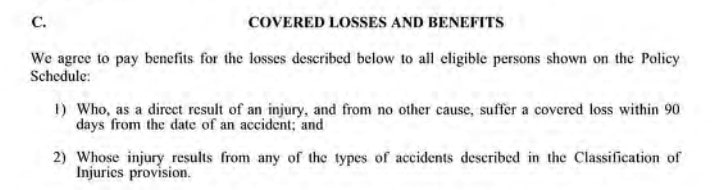

These plans only pay if you die from an accidental injury. However, they typically do not cover accidental ingestion of poison or drugs.

No contestability periods or suicide clauses exist, either. Why? Because, the carrier only pays for accidental death, like this:

People who can’t qualify for traditional life insurance coverage typically purchase accidental death insurance. They might have a significant health condition that prevents them from traditional life insurance policies.

Frequently Asked Questions About Life Insurance And Drug Overdoses

We answer some frequently asked questions about life insurance and drug overdoses.

Does Life Insurance Cover Drug Overdose?

Yes, life insurance companies will pay out the death benefit if you die from a drug overdose. However, if you pass away during the contestability period or during the suicide clause period, the carrier may challenge the death claim.

If I Have A Substance Abuse History, Can I Still Obtain Life Insurance?

Yes, you can obtain life insurance if you have a substance abuse history. We have helped many people with a substance abuse history obtain life insurance.

Is A Drug Overdose Considered An Accidental Death?

It could be. If you pass away within the contestability period and suicide clause period, then the life insurance company will challenge the claim.

Carriers will look at the medical examiner’s report as well as any police investigations. They will also conduct their own investigation.

Will Life Insurance Pay Out For Alcohol-Related Overdose?

Yes, carriers will pay a death benefit if you pass away from an alcohol-related overdose.

Again, if death occurs after the contestability period and suicide clause period, the carrier pays the death benefit.

However, if you pass away during the contestability period or the suicide clause period, the carrier will investigate. If you engaged in any risky activity that was not disclosed, the carrier may deny the death claim.

Can I Appeal A Denied Claim?

Yes, you can appeal a denied life insurance claim if a loved one passed away from a drug overdose. You will have to likely hire a lawyer to do so. The burden of proof likely rests on you to show that your loved one’s death was accidental or that no fraud existed during the application process.

Now You Know That Life Insurance Companies Will Pay Out The Death Benefit If You Die From A Drug Overdose

We hope you found this article informative. As we discussed, life insurance companies will pay out the death benefit if the insured dies from a drug overdose, whether due to illegal drugs or prescription medications.

The only time most carriers may challenge a death claim is in the first 2 years of the policy. The contestability period and the suicide clause allow life insurance companies to analyze your application and see if any material information was missed during the underwriting process. If they find misrepresentation that would have changed the decision, they will rescind the policy and pay back your premiums to your beneficiary.

If the cause of death is a suicide, then the carriers return the premiums to your beneficiary.

Do you have any questions or need assistance? We are here to help. Feel free to contact us or use the form below.

We only work in your best interests and place your needs before our own. We are happy to help and answer any questions you have.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".