3 Advantages Of Key Person Disability Insurance | We Discuss This Important Insurance And Why Your Business Needs It!

Updated: April 12, 2024 at 9:38 am

In this guide, we discuss key person disability insurance and why, as a business owner, you should purchase such important, valuable coverage.

owner, you should purchase such important, valuable coverage.

John, you say, I already have this. My other agent sold me key person life insurance.

Nope. This is different and arguably more important. Have you ever thought about what would happen if that key employee didn’t pass away, but instead, faced a long-term illness or injury?

No. I haven’t. I think my business would equally suffer.

Yes, the loss of a key person could irreparably harm your business, unless you have insurance protection.

Key person disability insurance is this protection. It is an often overlooked, yet extremely important type of insurance. It is very important for small businesses that rely on an employee or business partner for sales or profit growth.

In this guide, we discuss the “in’s and out’s” of key person disability insurance and 3 advantages such a policy brings to small business owners.

Here is what we will discuss:

- What Is Key Person DI?

- Why Purchase Key Person DI?

- How Does Key Person DI Work?

- Who Is A Key Person?

- 3 Advantages Of Key Person DI

- Policy Provisions And Coverage Options

- Cost Of Key Person DI

- FAQs About Key Person DI

- Other Business Options

- Final Thoughts

Let’s jump in and discuss what is key person disability insurance.

What Is Key Person Disability Insurance?

Key person disability insurance pays you, as a business owner, a lump sum benefit or monthly payments if a key person is sick or hurt and can’t work.

Key person disability insurance pays you, as a business owner, a lump sum benefit or monthly payments if a key person is sick or hurt and can’t work.

You can use this monetary benefit to mitigate the financial impact of losing the key employee and:

- pay for a new hire or replacement employee to replace the activities of the key employee

- pay overtime to current staff

- keep the business open and running

FYI key person disability insurance is also known as key man disability insurance or key person disability coverage. They all mean and do the same thing: to provide a monetary benefit to you upon the disability loss of a key employee.

It is pretty simple. We discuss why you should purchase this important insurance next.

Why Purchase Key Person Disability Insurance?

Many small business owners ask me why they should purchase key person disability insurance.

The reason is simple. If your company will face dire financial loss and consequences with the disability of a key person, then you need key person disability insurance.

The reason is simple. If your company will face dire financial loss and consequences with the disability of a key person, then you need key person disability insurance.

But, John, I have key person life insurance.

Yes, key person life insurance (also known as key man life insurance) is important. However, did you know that the chances of a disability happen way more often than the probability of dying unexpectedly? It is true.

You have to ask yourself, what will happen to my business if this key employee faces a disability?

It is in these types of unfortunate situations where key person disability insurance shines. The benefit money you receive helps mitigate any financial burden faced by the disability of a key employee.

How Will My Business Lose Money If A Key Employee Becomes Disabled?

Many business owners ask me this question. They can’t fathom a disability of a key employee. But, it does happen.

As we have stated in other articles about disability insurance, a 1 in 4 disability chance exists. This comes right from the Social Security Administration. Other industry experts state that this probability increases as we age, which intuitively makes sense.

Having said this, how would you and your business manage if you lose a key person to a disability? Gone are the sales or income this person generates. Moreover, possibly, key sales relationships are on hold or, worse, competitors interfere with your sales.

Or, you lose innate business knowledge that your existing employees just can’t replicate. Your business expenses may increase if you need to pay staff overtime or higher a temporary replacement.

In our next section, let’s discuss how this type of insurance works.

How Does Key Person Disability Insurance Works?

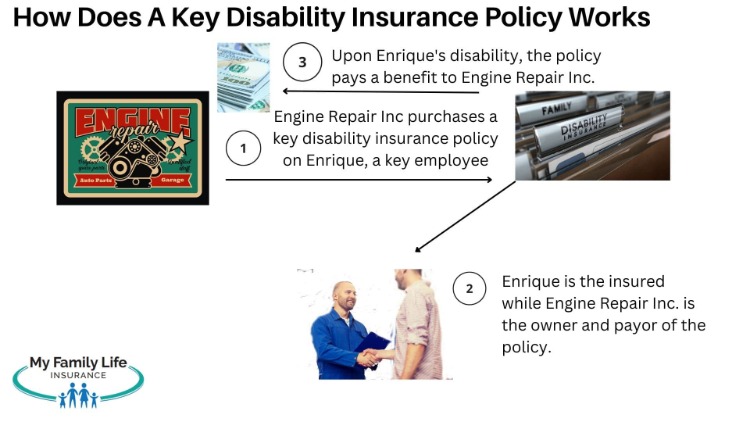

It is rather simple how key person disability insurance works.

(1) you (as the business owner) obtain coverage on a key employee

(2) your company pays premiums to the disability insurance company

(3) if the key employee faces a total disability, your company receives the benefit amount

It is pretty simple.

You use this benefit money any way you want. You can hire a temporary replacement, pay staff overtime, mitigate profit loss, maintain your cash flow, etc.

Who is a key employee in your company? Let’s answer that question next.

Who Is A Key Employee In Your Business?

Every company has key personnel and valuable employees integral to the success of the business.

Think about the employees in your company. Which one, if disabled, would leave your company in a tough financial situation?

(Note: a key person doesn’t have to be someone in sales. A key employee is anyone who makes an immense contribution to your company. They are vital to your company’s success. Without them, your business potentially faces a tough financial situation in the form of lost sales or profit.)

Key people in a business may include:

(1) a top salesperson

(2) a billing and coding manager who has irreplaceable knowledge about her job

(3) an account executive with far-reaching, profitable, unique contacts

(4) an auto repair man who can solve anything, gets the job done quickly, the right way the first time, and brings in a lot of business because of his reputation

(5) a singer who continuously has sold-out shows at your club

It’s simple. If the success or failure of your company rests on this person, then this person is a key person.

Now that you know who a key employee is, let’s discuss 3 advantages of key person disability insurance.

3 Advantages Of Key Person Disability Insurance

Let’s recap what we’ve discussed so far.

Key person disability insurance pays your business a monetary benefit in case a key employee gets hurt or sick and can’t work.

You use this money in any way possible: hire a temporary replacement, pay overtime to staff, etc.

It provides a financial cushion for your business and mitigates any negative financial impact faced by the disability loss of the key employee.

Let’s discuss the 3 advantages that a key person disability insurance policy brings to your business.

#1 Cash Flow

What happens if that key employee is disabled and can’t work? Your business will either face a sales decline, higher expenses, or both.

As we discussed, a key person disability insurance plan provides a monetary benefit that mitigates this financial constraint.

#2 Benefit Is Not Taxable

While this may not seem like a big deal, it is. Any benefit your company receives from a key person disability insurance policy is income tax-free. Why is this an advantage? You can use that benefit to the fullest need. The government will not tax or reduce your benefit.

While this may not seem like a big deal, it is. Any benefit your company receives from a key person disability insurance policy is income tax-free. Why is this an advantage? You can use that benefit to the fullest need. The government will not tax or reduce your benefit.

Of course, your company can’t deduct the premiums paid as a business expense. However, I think you’ll agree with me that having the income tax-free benefit outweighs any business expense deduction.

We will revisit this situation later in the “Other Business Options” section.

#3 Peace Of Mind

One of the greatest advantages of key person disability insurance is the peace of mind it brings to you as the small business owner.

If your key employee is lost due to a disability, you will receive a monetary benefit to mitigate any financial burden your company faces.

Sure, it’s not perfect. Your key employee is away from the business. Nothing is perfect when a disability happens. However, what’s the alternative? Do you want to:

- receive a financial benefit to mitigate the loss of your key employee, or

- receive nothing and face a potentially tough financial situation with your company?

Now that we have outlined the 3 advantages of a key person disability policy, let’s discuss policy provisions and coverage options.

Key Person Disability Insurance Policy Provisions And Coverage Options

A key person disability insurance policy is not the same as an individual disability insurance policy. While similarities exist between the two, notable differences present themselves. In this section, we discuss specific policy provisions and coverage options available on key person disability insurance policies.

Benefit Period

You can select a benefit period of up to 24 months. Contrast with an individual policy in which benefit periods 5 years or “to age 65” are common.

Why do carriers limit the benefit period to 24 months? That should be ample time for you to find a replacement employee or the key employee returns back to work.

All things being equal, you’ll pay a higher premium for a longer waiting period.

Elimination Or Waiting Period

Remember that the elimination period (I call it a waiting period) occurs upon claim. Once the carrier approves your claim, the elimination period / benefit period starts (usually retroactive to the date of disability).

Typical elimination periods on key person disability insurance include 30, 60, 90, and 180 days.

Honestly, unless you have serious cash reserves in your company, I recommend selecting a waiting period of 30 or 60 days. The sooner you receive the benefit money, the better.

All things being equal, you’ll pay a higher premium for a shorter waiting period.

Disability Benefit Amount

Another difference is the available disability benefit. Usually, you can insure up to 100% to 150% of the key person’s salary, subject to carrier restrictions. Contrast this with an individual policy, where carriers usually only insure up to 60% of a person’s gross salary.

Obviously, the higher the disability benefit, the higher your premium, all things being equal.

Occupation

Your key employee’s occupation matters. Most carriers that offer key person disability insurance will accept occupation classes of 3 or greater. As we said in previous articles, the higher the class, the lower your disability risk, and lower premiums you’ll pay (all things being equal).

Definition Of Disability For Key Person Disability Insurance

With key person disability insurance policies, really only one disability definition exists. It is the own occupation definition, which means you will receive a benefit if your key employee can’t perform the normal duties of his or her occupation. Moreover, your key employee must face a total disability. A total disability is such that a person can’t work at his or her occupation at all. So, key person disability insurance plans won’t pay upon a partial disability. That makes sense because key employees can still work if they are partially disabled.

Policy Owner

The policy owner is your company. The insured is the key employee. Upon a total disability of the key employee, your company receives the benefit money.

Disability Benefits

Some carriers only offer a monthly benefit, paid out over the benefit period you specified.

Other carriers offer a lump sum benefit, paid out after satisfying the elimination period (usually 365 days or more).

Additionally, others combine both the monthly benefit and lump sum benefit!

Let’s discuss how this all affects the cost of a key person disability policy.

Cost Of Key Person Disability Insurance

There’s a rule of thumb in the disability insurance industry that individual disability insurance costs about 2% of your gross salary.

That isn’t usually the case when you add age, rider/options, occupation, and preferences. We discuss that in our underwriting guide.

The same holds true for the cost of key person disability insurance.

Nevertheless, no matter the cost, some amount of coverage is better than none. Remember, the viability and solvency of your business are at risk if a key employee faces a long-term disability.

Here are some examples to give you an idea of the cost of key person disability insurance.

Example Cost

Let’s say Eric owns XYZ widget company. Brad is a key employee, 40 years old, and integral to the success of XYZ widget company. Eric wants key person disability coverage on Brad.

and integral to the success of XYZ widget company. Eric wants key person disability coverage on Brad.

Brad makes $150,000 annually. His occupation class is 3.

Eric selects a combination of monthly benefit and lump sum benefit plan.

He selects a 90-day waiting period. If Brad is still disabled (with a total disability) on day 366 of disability, Eric’s company receives a lump sum benefit.

Based on Brad’s annual salary of $150,000, XYZ company would receive $20,000 per month from day 91 to day 365. Remember, Brad would have to be totally disabled during that 90-day waiting period first.

If Brad is still disabled after a year (day 365), then XYZ company receives a lump sum benefit of $270,000.

Eric can use this benefit in any way he needs to keep his business solvent while Brad continues dealing with his disability.

The $20,000 monthly benefit and $270,000 lump sum benefit costs XYZ widget company $235 per month.

If Eric chooses a lump sum benefit only with a 180-day waiting period, the monthly cost is $287 per month.

If Brad is a class 4 occupation, then the costs change. A $20,000 monthly benefit (90-day wait) with a lump sum benefit of $270,000 (365-day waiting period) costs $192 per month.

Moreover, the costs decrease if Brad’s occupation is a class 5. The same plan costs $156 per month.

Let’s answer some frequently asked questions about key person disability insurance next.

FAQs About Key Person Disability Insurance

In this section, we answer frequently asked questions about key person disability insurance.

Can I Have Both Key Person Life Insurance And Key Person Disability Insurance?

Yes! I recommend that. Key person life insurance operates in a similar way, except your business receives a death benefit if the key employee passes away. You can use the money any way you can, same as with the key person disability benefit.

Typically, key person life insurance is a term life insurance policy covering the key employee until retirement age. In other scenarios, outside the scope of this article, permanent life insurance like whole life will make sense.

Contrary to what you may think, key person disability insurance usually doesn’t cover death (unless a carrier offers a rider option that allows a lump sum payment due to death). So, you will want this important coverage as well.

Key person life insurance and key person disability insurance comprise the two needed key employee insurance / key person insurance policies a business needs. However, while many agents focus on key person life insurance, agents should also be recommending key person disability insurance as well. As I indicated earlier, the chance of a disability is much greater than the chance of an unexpected death.

So, Key Person Disability Insurance Does Not Pay Out On Death?

Key person disability insurance won’t pay out upon a key employee’s death unless the carrier offers – and you have purchased – a rider/option to cover an unexpected death.

This situation illustrates a good reason to purchase key person life insurance as well.

If My Key Employee Leaves My Company, What Happens To The Policy?

A couple of options exist. Your policy terminates, probably the most common option.

Additionally, some carriers allow you to transfer the policy to another key employee.

As every policy is different, it is best to review the complete details so you know your options in case your key employee leaves your company.

If I Own A Large Company, Can I Purchase Key Person Disability Insurance?

Possibly; however, key person disability insurance is typically purchased by owners of small to medium-sized businesses. The reason is that large businesses can absorb the loss of a key employee easier than that of a small or medium-sized business. So, many carriers do not offer key person disability insurance to large businesses.

Contact us to determine if your business qualifies.

What Is The Tax Impact Upon Receiving The Disability Benefit?

Any benefit paid to your company is income tax-free. Of course, that means your premium payments are not tax-deductible.

As we indicated earlier, do you want your monthly benefits or lump sum benefit taxed to you?

Of course, you don’t. You want to maximize that amount of money for your business.

That means you can’t deduct the premium payments as a business expense.

There is one business disability insurance plan that allows both the tax deduction of premium payments and income tax-free benefits. (We discuss that next.)

Other Business Disability Insurance Options

Did we get your attention to the importance of key person disability insurance for your business?

Well, other types of disability insurance exist that protect your business in other ways.

And, no, these options don’t cost an arm and a leg.

Business Overhead Expense Insurance

Business overhead expense insurance (BOE) protects your business if you yourself face a disability.

How?

It pays a benefit if you, as a small business owner, face a total or partial disability.

You yourself can’t generate revenue or profit. You are disabled.

So, this type of disability insurance pays your monthly expenses. You use the benefit to pay for:

- rent

- employee salaries

- utilities

- contractual commitments

- and more

The disability benefit is your average monthly expenses.

Additionally, you can deduct the premiums on your tax return. Moreover, if structured the right way, your benefit is income tax-free.

A BOE policy is ideal for small companies relying on the business owner. For example, a 1 or 2 doctor or lawyer practice generates most of the revenue. Having a BOE policy in place allows you to pay rent, employee salaries, etc.

Your personal, individual disability insurance policy pays a benefit for your personal needs and family.

Contact us to learn more.

Buy/Sell Disability Insurance Plan

A buy-sell disability insurance plan protects business partners and their families.

A buy-sell disability insurance plan protects business partners and their families.

How?

If a business partner faces a career-ending disability, a buy-sell disability plan pays a pre-determined benefit to the healthy business partner. The healthy partner uses this benefit to buy out his disabled partner’s ownership share.

John, I already have this.

Likely not. Many business owners have buy-sell life insurance that does the same thing. Except, the benefit pays out upon the death of a business partner.

Here, the benefit pays when your business partner no longer can work due to illness or injury.

Usually, carriers offer a minimum 12-month waiting period on buy-sell disability insurance. Explained differently, buy-sell disability insurance plans really only pay after the business partner can’t work at all. It is clear that the disability has a long-term effect on the work productivity of the business partner.

Contact us if you would like to learn more. Carriers require an established buy-sell agreement.

Business Loan Disability Insurance

Banks that loan money to small business owners typically require business owners to obtain disability insurance. The reason why is simple. Banks still require you to pay the loan upon your disability.

Great, John. I have an individual disability insurance plan already.

Not so fast. Many of my business clients said this. However, using your individual plan to pay for your loan is a big mistake. First, did you incorporate the loan into your monthly benefit?

No.

You can’t because the disability insurance carrier bases your individual monthly benefit on your net income and/or salary. Your business loan isn’t part of that.

If you are disabled and have to pay your business loan first, then you likely won’t have any money left over to pay for your mortgage, food, etc.

This is where business loan disability insurance helps. Upon your disability, the carrier pays the bank your monthly loan payments on your behalf. You keep the full amount of your individual monthly benefit…used for your family and needs.

Everyone is happy. Contact us to learn more.

Group Disability Insurance

Group disability insurance is also an option for small businesses. The small business holds the master contract for disability insurance and offers the plan to eligible employees.

While I believe an individual policy offers better value, group disability insurance advantages include:

(1) simplified underwriting or even guaranteed issue

(2) to age 65 coverage (usually)

(3) can be an important employee retention tool

(4) pays a benefit for disability due to pre-existing conditions

However, disadvantages exist, including:

(1) increase premiums as employee’s age

(2) limited options

(3) usually cap on the monthly benefit

(4) taxed benefit

In any case, offering group disability insurance is a great employee retention tool, especially at simplified or guaranteed issue (which means no underwriting, and employees with moderate health conditions would qualify).

We work with a solid group disability insurance plan that covers employees starting at 2 (most require 3 or more) and at guaranteed issue (others are simplified issue starting at 10 employees, usually).

Now You Know The 3 Advantages Of Key Person Disability Insurance

After reading this article, you should have a solid understanding of key person disability insurance. We discussed the importance, how it works, and 3 advantages.

We also reviewed policy provisions and options. Moreover, we gave real cost examples.

Do you have any questions? Are you ready to learn about the options available to you?

If so, contact us or use the form below.

We only work in your best interests. That means we put you and your business/family first, not our own needs.

Moreover, there really is no risk of contacting us. We aren’t going to call you 1,000 times per day. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".