How A Bad Driving Record Affects Life Insurance Rates | You Can Still Obtain Life Insurance, But Options Depend On The Severity And Recency Of Your Driving Infractions

Updated: April 12, 2024 at 9:38 am

If you are like most people, you probably don’t think about how your driving record affects your life insurance rates.

If you are like most people, you probably don’t think about how your driving record affects your life insurance rates.

However, a bad driving record can negatively impact your life insurance application and negatively impact your life insurance premiums.

Negatively in the form of higher rates!

Moreover, in some cases, carriers will even decline your application.

What, John? I am completely healthy! Do you mean to tell me the speeding ticket I had 6 months ago could affect my rate or my outcome?

Yes, it could.

However, you have come to the right place. We have helped many people with subpar and bad driving records obtain the life insurance they need.

Moreover, in nearly all cases, we have been able to secure life insurance for people with recent speeding tickets or DUIs.

Here is what we will discuss:

- Why Does Your Driving History Matter In Life Insurance?

- How Does The Life Insurance Carrier Access Your Motor Vehicle Records?

- How Your Driving Record Affect Rates

- 3 Life Insurance Options Available

- How To Improve Your Situation

- Frequently Asked Questions About Driving And Life Insurance

- Final Thoughts About Motor Vehicle Records And Life Insurance

Let’s jump in and discuss the obvious question, “Why does your driving history matter with the life insurance carriers?”

Why Does Your Driving Record Matter In Life Insurance?

Let me ask you something.

If you placed a bet, a risky one, what do you want in return?

More than I paid into it.

Right, you’d want to earn a high return for your likely loss of the bet, right?

Yes.

The life insurance companies want the same thing: a premium commensurate with risk.

with risk.

Underwriters measure your risk. If you are too much of a risk, the carriers charge higher rates by the way of a table rating.

But, I thought table ratings only apply to health situations, you say.

No, they apply to any situation in which the carrier deems you at a higher risk.

Which includes bad driving.

That is right. If you have a poor driving record, that does affect your life insurance rates.

It is rather obvious, right? There is a correlation between speeding and a higher probability of death.

Carriers know this. If they see you are a high-risk driver as evidenced on your motor vehicle record, they will adjust their life insurance rates accordingly and charge higher premiums.

You can be the healthiest person in the world, but those speeding tickets or DWI will play a much higher role in your life insurance rates or application approval.

Now, if you generally have a clean driving record (have no speeding tickets in the last 5 years, no DWIs, and no accidents) then you can skip this whole article.

Other Factors In The Life Insurance Underwriting Process

Many different factors go into life insurance underwriting. Carriers will then look at other underwriting factors including your health, financial history, and lifestyle situations like marijuana use. They will likely use the lexis nexis risk classifer score to assess your risk.

However, if you have speeding tickets, an at-fault accident or two, suspended licenses, or DWIs, please read on.

Again, you can be the healthiest person on earth. That doesn’t matter. If you have a reckless driving history, that plays a much bigger role in the underwriting decision.

How Does The Life Insurance Carriers Access Your Motor Vehicle Report?

Life insurance carriers can access your driving records and motor vehicle report (MVR) in a couple of ways:

- Directly from your state’s motor vehicle registry or

- The lexis nexis group (which compiles all of your data including driving records)

They will review your driving history. A history of:

- excessive speeding,

- multiple moving violations,

- multiple DUIs, and

- other major infractions like reckless, at-fault accidents…

…are a red flag for carriers. Depending on the seriousness of the infraction, the life insurance company may charge you a higher rate to compensate for the higher risk.

How do carriers review your motor vehicle record? Just about every life insurance application contains a section to insert your driver’s license information.

Moreover, the applications contain a disclosure where you agree to let the carrier access your records. Here is one example.

So, by entering your driver’s license information and signing your application, you allow the life insurance carrier to access your driving record.

John, I don’t like that. How do I avoid that?

Don’t worry. We have some life insurance options that don’t look at your motor vehicle records. We discuss this later in the article.

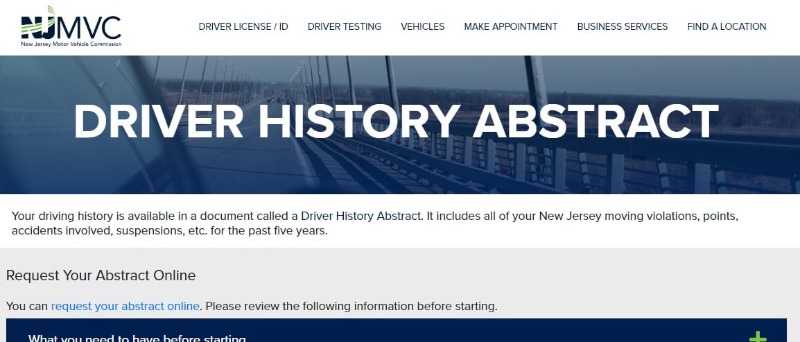

However, did you know you can access your motor vehicle record, too?

You can. You just need to go to your state’s MVR website. Most states charge you a nominal fee to access your records.

If you have a bad driving history, you should access and understand the magnitude of your driving record before applying for any life insurance.

Here Is How Your Bad Driving Record Affects Your Life Insurance Rates?

Here is how a bad driving record affects life insurance rates.

Life insurance carriers are looking at a couple of factors when assessing the risk of your driving history. They look at:

of your driving history. They look at:

(1) The severity of the infraction and

(2) The recency of the infraction

For example, a new speeding ticket (like the one our friend had in the article introduction) for driving 30 miles over the speed limit makes a larger, negative impact on your life insurance rate than the same ticket issued 6 years prior.

The car accident you had last year, in which you were deemed at fault, plays a larger role in the underwriting process than if it occurred 5 years ago.

In these cases, life insurance companies may give our driver a table rating for his recent tickets. Same with the at-fault accident.

Table ratings increase the life insurance rates. However, if his ticket happened 5 years ago with no recurrence or reckless driving events, then likely no table rating.

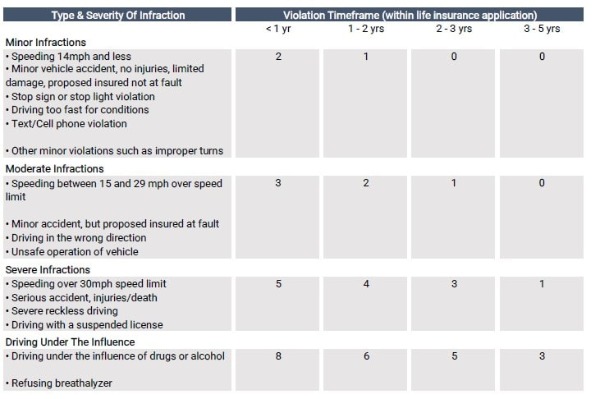

Many carriers assess the magnitude of your driving history on a point system. The amount of points depends on the severity and recency of the driving infractions. Life insurance carriers may give credits for documented good driving behavior. A carrier point system may look something like this:

The larger the points, the higher the potential rating.

The larger the points, the higher the potential rating.

Carriers will assign higher points for major traffic violations and DUI convictions. They could even decline life insurance in these situations.

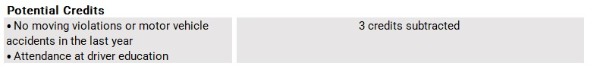

However, carriers do offer credits for good driving behavior. Credits could look something like this:

So, any increase in your life insurance rates depends on:

So, any increase in your life insurance rates depends on:

(1) The severity of the driving infraction and

(2) The recency of the driving infraction

(3) Offset by potential credits

Let’s talk about your life insurance options next.

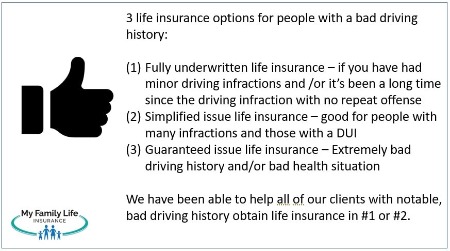

3 Life Insurance Options For People With A Bad Driving Record

You now know how life insurance carriers and adjust your rates accordingly for bad driving records.

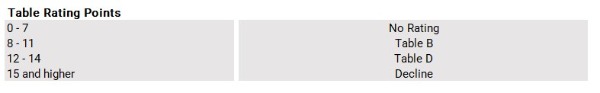

Here is an example table, based on your infractions and any applicable credits:

However, in this section, we will review 3 life insurance options for those people who have a bad driving record.

However, in this section, we will review 3 life insurance options for those people who have a bad driving record.

#1 Fully Underwritten Term And Permanent Life Insurance

If you have recent, but minor driving infractions, fully underwritten term and permanent life insurance is available.

“Fully” underwritten term or permanent life insurance means the carriers:

- Review your health history in full and access your MIB file

- Access your prescription drug history

- Review your financial information

- Review your motor vehicle information

- May require a paramedical exam which includes a blood sample, urine sample, EKG, and other tests

Again, as indicated in the previous section, carriers may charge a higher life insurance rate because of the recency of the driving infraction.

Moreover, if your driving infractions were 3 to 5 years ago or beyond, then the driving infraction likely has a minimal effect on the underwriting decision.

However, if you were in a recent, serious motor vehicle accident or charged with a recent DUI, then fully underwritten term or permanent insurance may not be available.

So, as we described earlier, the:

- Severity of the infraction and

- Recency of the infraction…

…will determine eligibility for a traditional term

Are you sure about that? I mean, ultimately, the decision to go without life insurance is yours.

However, anything can happen anytime, including an unexpected death.

Unless you have a severe driving situation, the right decision is to get some level of coverage now. You can always purchase more life insurance in the future if your situation improves.

If you’d like to see what your life insurance rates could be, feel free to quote. Note the disclosures.

#2 Simplified Issue Life Insurance

If you have many driving infractions, and recent ones, too, then your next (likely) life insurance option is simplified issue life insurance.

Simplified issue means the carrier has “simplified” the underwriting process.

With these insurance plans, carriers usually omit several variables from the underwriting process, including driving history.

Basically, you just answer some health questions and the carrier looks up your health history through the MIB and your prescription drug history. That is it.

Again, carriers usually don’t look up your driving records.

We have helped many people with bad driving records obtain simplified issue life insurance. Additionally, we have successfully used simplified issue life insurance for those people with DWIs or vehicular felonies.

The advantage of these policies is that they provide a “bridge” until you can qualify for something better.

We work with both simplified issue term and simplified issue whole life. Feel free to look up potential pricing here. Note the disclosures:

#3 Guaranteed Issue Life Insurance

Guaranteed issue life insurance is an option for people with bad driving records. You can look up rates here. Just select “poor” in the health status field.

Honestly, not many of our clients with bad driving records qualify for guaranteed issue life insurance. The reason? We can either place them in fully underwritten life insurance or simplified issue life insurance.

The only case where you would qualify for guaranteed issue life insurance is if you do not qualify medically for a fully underwritten or simplified issue plan (in addition to your bad driving record).

So, if you have a severe health condition like schizophrenia (for example) AND have a bad driving record, then likely a guaranteed issue life insurance plan is your only option.

We work with several types of guaranteed issue plans including a guaranteed issue term life insurance plan. You can self-enroll here.

You can always contact us about your specific situation. We are here to help.

How Do People With A Bad Driving Record Improve Their Life Insurance Rates?

There is only one way that people with a bad driving record can improve their life insurance rates. That is:

(1) Drive safely and

(2) Wait

Regarding #1, you should drive safely anyway. Here are real statistics about reckless driving and life expectancy:

- Drunk driving and death: https://www.nhtsa.gov/risky-driving/drunk-driving

- Speeding and increase in accidents: https://www.drive-safely.net/driving-statistics/

- Young men age 30 and below comprise most deaths caused by speeding: https://injuryfacts.nsc.org/motor-vehicle/motor-vehicle-safety-issues/speeding/

This is why your driving record matters to life insurance carriers. There is a correlation between your driving record and life expectancy (i.e. an early death from reckless driving).

Regarding #2, as I have shown, recency matters.

The longer the timeframe from your driving infraction, the better your life insurance rate (all things being equal).

That sounds good, John. I am going to wait.

Not so fast (no pun intended). You may have to wait 5 years for a better rate.

Anything unexpected can happen in a short timeframe. We all went through the COVID pandemic, and no one expected that to happen.

An illness, an injury, more driving infractions, or worse, an unexpected death, happens. Moreover, they happen often.

So, the best thing to do is not wait. Contact us, and let us know your situation. We can find you the right policy until you qualify for something better.

Frequently Asked Questions About Life Insurance And Driving Records

We answer some frequently asked questions about life insurance and driving records.

Can I Get Life Insurance If I Have Multiple Speeding Tickets?

Yes, generally, you can obtain life insurance even with multiple speeding tickets.

However, expect to pay a higher rate with a table 2 to table 4 rating.

As we discussed earlier, your life insurance rate will depend on:

(1) The severity of the speeding and

(2) How recently they occurred

However, if you had a minor speeding ticket or a moving violation that occurred over 5 years ago, then underwriters will likely ignore those violations, assuming no other offenses have occurred since.

Will Multiple Driving Violations Affect My Life Insurance Rate?

Yes, multiple driving violations on your MVR could affect your life insurance rate.

However, life insurance is still likely available. Available life insurance options depend on:

(1) The severity of the violations and

(2) How recently they occurred

Severe situations like DUI/DWI, property damage, and even vehicular homicide could limit life insurance options. However, as we stated earlier, we can likely help you obtain life insurance even in these situations.

I Am A Bad Driver. Can I Improve My Life Insurance Rate?

Yes, you can improve your life insurance rate. In order to improve your life insurance rate, you will have to drive safely and wait. Unfortunately, no magic bullet exists except for practicing safe driving and waiting.

The longer the wait, the better the rate, assuming no additional driving infractions.

However, as I wrote earlier, do you really want to wait?

Anything can happen at any time. You shouldn’t wait. We can help you obtain some life insurance in the short term. Assuming no additional driving infractions, we can then help you apply for a new policy in the future.

If I Have Life Insurance Already, Will My Rate Increase At All Because Of My Driving Record?

No. Once you apply and have life insurance coverage, your rate stays the same for term life and whole life insurance.

In other words, carriers can’t go back and re-underwrite you under your current policy. However, life insurance companies will consider any new information in your MVR if you decide to apply for a NEW policy.

Do Parking Tickets Affect My Life Insurance Rate?

Generally, no, parking tickets do not affect your life insurance rate as they are not moving violations.

However, multiple, unpaid parking tickets could lead to more serious violations such as license suspension.

Now You Know Your Bad Driving Record Affects Your Life Insurance Rates

We discussed how your bad driving record affects your life insurance rates. As we discussed, your life insurance rate depends on the:

- Severity of the driving infraction and

- Recency of the driving infraction

As we mentioned, all of our clients with bad driving records have been able to obtain a fully underwritten life insurance plan or simplified issue life insurance plan.

Are you ready to get started and work with us? We can help. Feel free to contact us or use the form below.

As always, we always work in your best interest. That means if there is a better option available than what we can offer, we will point you in that direction. Why do we do this? Because we have a duty of care to you, not to our needs.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".