5 Types of Long-Term Care Insurance | Know Your Best Options

Updated: October 11, 2024 at 1:44 pm

As we age, the possibility of needing long-term care becomes more likely. In recent years, the insurance industry developed various types of long-term care insurance to help cover these potential costs.

As we age, the possibility of needing long-term care becomes more likely. In recent years, the insurance industry developed various types of long-term care insurance to help cover these potential costs.

Gone are the limited options from 30 years ago. Today, more types of long-term care insurance exist, and even some great options for the younger generation!

Moreover, many options nowadays are affordable.

Remember, long-term care insurance covers custodial care such as bathing, eating, dressing, using the bathroom, etc. An easy way to think about activities of daily living is when you wake up in the morning. Getting around, eating, showering, using the toilet, etc., are all activities of daily living.

This is a complete guide on the types of long-term care insurance available in the US. Here is what we will discuss. Feel free to jump around the guide.

- What is Long-Term Care Insurance?

- Why You Need Long-Term Care Insurance

- 5 Types of Long-Term Care Insurance

- 5 Types of People Who Need Long-Term Care Insurance

- Typical Costs of Long-Term Care Insurance

- Long-Term Care and Medicaid

- FAQs about the Long-Term Care Insurance

- Final Thoughts About the Types of Long-Term Care Insurance

Let’s first define long-term care insurance. Many people get this wrong from the start. When they realize what it does and need it, it’s usually too late for them to purchase it.

What is Long-Term Care Insurance?

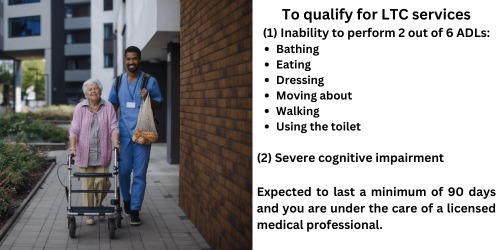

Long-term care insurance is a type of insurance specifically designed to cover the costs of care for individuals who need assistance with daily activities over an extended period, typically due to illness, disability, or aging. Activities of daily living relate to personal care (i.e., taking care of oneself) and include six functions:

- bathing

- eating

- dressing

- getting into/out of a chair (i.e., moving about)

- walking

- using the toilet

Moreover, the insurance pays a benefit if someone develops a cognitive impairment.

For example, if someone develops Alzheimer’s disease and requires in-home care or moves into a nursing home, their long-term care insurance would help pay for these services, alleviating the financial burden on the individual and their family.

Here is another example. Joe had a stroke and is no longer able to dress, walk, or use the toilet without substantial supervision. Assuming he is under the care of a doctor, he would qualify for long-term care services.

A couple of requirements must be present in order to receive a benefit payout from the long-term care insurance policy. The requirements include:

- inability to perform 2 out of the six activities of daily living and needing substantial assistance for a minimum of 90 days

- you need significant supervision because of a severe cognitive impairment (like Alzheimer’s disease)

- you are under the care of a licensed healthcare provider who prescribes a treatment plan that includes long-term care services

Why Do You Need Long-Term Care Insurance?

Government statistics routinely demonstrate that 70% of adults at age 65 will need some type of long-term care in their future.

That isn’t fake statistics. Think about it. Who do you know who needed long-term care?

My aunts and uncles. My grandparents, too.

Did any of them have long-term care insurance?

I don’t think so. I remember their going into nursing homes, but we had to drive far away to visit them.

It sounds like your relatives qualified for long-term care through Medicaid, which honestly is not a good option at all. (Moreover, it is outside the scope of this article, but if you want to read more, you can read our articles about Medicaid below.)

It sounds like your relatives qualified for long-term care through Medicaid, which honestly is not a good option at all. (Moreover, it is outside the scope of this article, but if you want to read more, you can read our articles about Medicaid below.)

However, you see you had three family members with long-term care events. I can almost guarantee that many other family members had long-term care events. Multiply these events by the number of families in the United States, and one can see the plausibility of the 70% statistic.

However, long-term care insurance isn’t for older adults. Did you know that about 16% of long-term care claims in 2018 (last data) were from people younger than age 64? You may think 64 is old, but it’s not. Sixteen percent may seem low until you yourself experience a long-term care event.

That, unfortunately, happened to a person I know. I explain that more later.

Long-Term Care Costs Keep Rising and Not Stopping

It may be no secret. Long-term care costs keep rising, and there is no end in sight.

The reason is three-fold:

(1) the obvious one: people are living longer thanks to advancements in pharmaceuticals and technology

(2) the not-so-obvious: younger people are needing long-term care

(3) long-term care inflation is much higher than the general inflation

Currently, the average daily cost of a nursing home stay is $330 (private room) and just under $300 for a semi-private room. This daily cost depends on where in the US you live. People living in New York face high costs, whereas people in Alabama have lower costs. The average daily cost of a nursing home stay (semi-private room) where I live is $465!

It is widely noted that long-term care costs rise much faster than the cost of inflation. Yes, even during our high inflationary environment, long-term care costs were even higher.

Do you remember COVID and the aftermath? Long-term care facilities, including assisted living and home health companies, found keeping and retaining employees hard. In order to obtain qualified individuals, they had to pay a higher-than-normal salary and benefits to retain these employees.

This brings me to 2 final points. I know a 40-year-old woman who needed long-term care services. She had a brain aneurysm which required skilled nursing care. However, she still couldn’t perform her activities of daily living, making her eligible for a long-term care benefit (if she had insurance). She basically had to re-learn everything.

Young People Could Need Long-Term Care Services

My first point is that young people can develop a need for long-term care. Unfortunately, her family learned the hard way. Because of her age and working ability, a disability insurance policy would have worked, too.

Second, her personal health insurance didn’t cover long-term care services. Health insurance policies don’t cover long-term care services. Moreover, contrary to what many people believe, Medicare does not cover long-term care services, either.

Because her family had no type of long-term care (or disability insurance), they had to establish a “gofundme” fund to defray the cost of the custodial care.

Before you say, “No way, I heard long-term care insurance is way too expensive,” many affordable plans exist today compared to those expensive plans in the past.

Let’s now discuss the 5 types of long-term care insurance.

5 Types of Long-Term Care Insurance

Before we discuss the 5 types of long-term care insurance, let’s review some basic definitions. The definitions could differ depending on the long-term care insurance company. Many of these definitions are found on traditional long-term care policies.

Tax Qualified Plans: long-term care plans must meet IRS tax guidelines (meet section 7702(b)) to have favorable tax status.

Waiting Period / Elimination Period: the time you wait until the long-term care policy pays a benefit for your custodial and long-term care needs.

Policy Limit: The maximum amount a long-term care policy pays out.

Partnership Plan: a traditional long-term care plan that coordinates with the state’s Medicaid. This is outside the scope of this article. However, if you like a traditional long-term care plan, you want to make sure your plan is a partnership plan.

Hospice Care Benefit: People who are terminally ill can receive benefits with no waiting period.

Respite Care Benefit: Allows an unpaid caregiver a break in care; will pay for temporary services or a facility

Inflation Benefit: allows benefits to grow and assist with the potential rising cost of long-term care services

Let’s now discuss the five long-term care insurance options.

1. Traditional Long-Term Care Insurance

When you think of “long-term care insurance,” you probably think of traditional policies created 30 years ago. These policies rose in demand and popularity. Of course, they would! People need custodial care!

However, by the 1990s and 2000s, cracks in the dams appeared. Many long-term care insurance companies mispriced the insurance. A couple of things happened:

- Too many people held on to underpriced policies.

- Claims surpassed premiums.

When claims surpass premiums…you don’t have to be a rocket scientist to understand bad things happen. Many carriers had to raise premiums and/or limit/scale back benefits. Many long-term care insurance companies went out of business or suspended their traditional long-term care insurance business.

(I won’t go into all the details, but if you want to read more, the American Prospect has a good article about the historical problems and future of long-term care insurance.)

I only say this because I don’t believe traditional long-term care insurance is dead at all. While a handful of companies exist in this market today, these companies have stabilized premiums and have solid plans.

How it works:

- You pay regular premiums, usually monthly or annually.

- If you need long-term care, the policy pays for services up to a certain amount per day or month.

- You fund up to a maximum benefit amount.

- Most plans have a shared care option where you can share benefits with your spouse.

- The inflation protection option allows your benefit to grow

What it covers:

- Home health care

- Assisted living facilities

- Nursing homes

- Adult day care services

Advantages:

- Protects your savings and assets

- Covers a wide range of care services

- Can be customized to your needs

- These are tax-advantaged plans and are great for small business owners

- Many of these plans are partnership plans and protect recapture of assets if you need your state’s Medicaid to help pay for care.

Disadvantages:

- Can be expensive

- You might pay for years without using it (use it or lose it, but I personally think many people will use it)

- Policies can be complex and hard to understand (unless you work with us 🙂 )

2. Short-Term Care Insurance

Short-term care insurance is like long-term care insurance, except it lasts a short time, with benefits paid up to a year. Since 50% of long-term care claims are 1 year and less, a short-term care insurance plan can work.

Short-term care insurance has existed for about 5 to 10 years. Although it is relatively new, it offers robust benefits at an affordable cost.

Key features:

- Covers care for up to one year

- Generally less expensive than long-term care insurance

- Easier to qualify for, even if you have health issues. This is very true.

- Flexible: will pay benefits for nursing home care, assisted living care, at-home/in-home care (home health aide), and money towards a family caregiver (not all plans)

Who might benefit:

- People who want affordable coverage for short-term needs

- Those who can’t qualify for traditional long-term care insurance

- People who want some custodial care protection

Pros:

- Lower premiums

- Immediate coverage without long waiting periods

- Easier to qualify for and generally liberal health status and pre-existing conditions

Cons:

- Limited coverage duration

- May not be enough for extended care needs

Compared to traditional long-term care insurance, short-term care insurance is like buying an umbrella instead of a full raincoat. It’s cheaper and works for rain showers, but it might not be enough for a long, heavy downpour.

3. Asset-Based Long-Term Care Insurance (Hybrid Long-Term Care Insurance)

Asset-based long-term care insurance is like planting a money tree that can bear two types of fruit: long-term care benefits or a life insurance payout.

These are known as “hybrid policies” because they contain two types of life insurance – long-term care insurance and life insurance – packaged into one policy.

The life insurance policy is usually a permanent life insurance policy like whole life insurance.

How it works:

You invest a lump sum or make payments over time. This money can then be used for:

- Long-term care expenses, if needed

- A life insurance payout to your beneficiaries if you don’t use the long-term care benefits

- long-term income (from the cash value) if you want income from the policy

Who it’s suitable for:

- People who want long-term care coverage but don’t want the “lose it or use it” if they never need care

- Those who can afford higher upfront costs for potential long-term benefits

- Great for the younger generation who want to lock in some long-term care coverage now.

Benefits:

- Money isn’t “wasted” if you don’t need long-term care – no “lose it or use it”

- Provides both long-term care coverage and life insurance coverage in one policy

- Can potentially access funds for other needs

- Some plans offer a “multiplier” for the long-term care coverage

Drawbacks:

- Higher initial costs

- More complex than traditional insurance

- May provide less long-term care coverage than a standalone policy

- Possibly tax-advantaged LTC rider premium (usually)

- Not partnership eligible

- Not as flexible as compared to a traditional LTC plan

Real-life scenario: Sarah buys a hybrid policy with a $200,000 benefit. If she needs long-term care, she can use up to $200,000 for care expenses. If she never needs care, her beneficiaries receive $200,000 as a life insurance payout. Additionally, she can withdraw income from the cash value.

4. Annuity Long-Term Care Insurance

Annuity long-term care insurance is like a special savings account that grows over time and can be tapped into for long-term care needs. It is another form of long-term care insurance. It is part annuity and part long-term care insurance.

How it works:

- You make a large upfront, lump sum payment or series of payments

- The money grows tax-deferred

- If you need long-term care, you can withdraw more than your account balance to cover costs

- Long-term care benefit is based on a multiple of the base investment (usually 2X or 3X)

- If you don’t need care, you can use the annuity for retirement income or leave it to beneficiaries

Benefits:

- Guaranteed income for long-term care needs

- Tax advantages on growth

- Money isn’t lost if long-term care isn’t needed

- Very useful for people who can’t qualify for other types of long-term care insurance (due to a pre-existing condition or some other type of limitation)

Limitations:

- High upfront costs

- Complex terms and conditions

- May have limits on long-term care coverage

Key considerations:

- Understand all terms and conditions before purchasing

- Consider your personal health and financial situation

- Consult with a qualified insurance agent or advisor to see if it fits your overall plan

Example: Jane used $100,000 of savings and purchased an annuity long-term care insurance plan with a benefit multiple of 3X. If she needs long-term care, she has a $300,000 “bucket” of money. If not, she can use the income from the annuity.

5. Life Insurance with Custodial Care

This is similar to a hybrid policy with an LTC rider, except the LTC rider does not meet the tax-qualified definition under 7702(b). Hence, life insurance carriers can’t call this “long-term care coverage.” They call it custodial care or chronic illness care, which is really what long-term care insurance covers. (Note: chronic illness and custodial care riders meet section 101(g) of the IRS code.)

However, these plans operate similarly to long-term care insurance. These plans usually have the same benefit triggers (unable to perform 2 out of 6 activities of daily living or have cognitive impairment).

It works similarly to a hybrid life insurance plan with a long-term care insurance rider.

These plans are also known as life insurance with living benefits.

How it operates:

- You buy a life insurance policy with custodial care / chronic illness

- If you need custodial care, you can use a portion of the death benefit to pay for it. It pays out a monthly benefit that you can use for your long-term care needs

- Any unused portion remains as a death benefit for your beneficiaries

Benefits over regular life insurance:

- Serves dual purposes: life insurance and custodial care coverage

- Often more affordable than separate policies

- Premiums are generally more stable than standalone long-term care insurance

Potential disadvantages:

- Limited amount available for long-term care

- Can be more expensive than basic life insurance

- May have strict criteria for accessing long-term care benefits

Example: John has a $400,000 life insurance policy with a long-term care rider. If he needs long-term care, he could use up to $320,000 for his care (for example). The life insurance company pays this out as a monthly benefit to John. If he doesn’t use it all, the remainder goes to his beneficiaries as a death benefit.

5 Types of People Who Need Long-Term Care Insurance

Almost everyone will need some long-term care services in the future. We just discussed five types of long-term care insurance available.

You may think you won’t need it or you’ll be in the approximately 30% who don’t use it.

As I mentioned, think about people close to you (family, friends, neighbors). Did they experience a long-term care event themselves? Probably. Moreover, more people than you think,

When we think about who needs long-term care coverage, the answer is: all of us. However, let’s get to the specifics. I know many of you reading this article will say, “Nope. Not me, John.” We can’t tell our future; otherwise, if we did, we would be very rich, right?

Here are five types of people who need long-term care insurance.

1. Your Parents

Most parents don’t want to burden their children with the task of caretaking. Think about it. How would your parents receive care if they had no long-term care insurance? Likely from you! So, have the long-term care conversation today. Just ask them, “Mom and Dad, what is your plan if you need help with long-term care services like eating and getting around?”

Many also want to avoid depleting their entire life savings on custodial care costs. They want to protect their legacy and guarantee an inheritance for their children. That is you!

It’s worth it today to start the long-term care conversation.

2. People with No Children

Conversely, many individuals without children may also need long-term care coverage. Their informal support system, which typically includes friends and relatives, is usually limited.

3. Married Couples

3. Married Couples

For married couples, purchasing a long-term care policy helps ensure they have enough financial resources available for the healthy spouse in the event one spouse requires care. It also alleviates the caregiving burden, which would probably fall on their spouse.

Remember, traditional long-term care insurance offers shared care. This is an important advantage for married couples. Moreover, many traditional long-term care insurance companies offer premium discounts for married couples who apply and are accepted at the same time.

4. Single People

Like individuals with no children, single people are more likely to have limited support for informal caregiving. For many single people, having a long-term care insurance policy is their only way to receive care from the comfort of their home.

5. Women

It’s no secret that women have a longer life expectancy. However, did you know that women account for two-thirds of all long-term care claims? It’s true! Moreover, they are also more likely to be a caregiver for someone else, which means they may be looking to plan for their own future care needs.

Typical Costs of Long-Term Care Insurance

OK, John. You make convincing points about long-term care insurance. How much does this all cost?

I receive many inquiries about the costs of long-term care insurance. The costs really depend on the underwriting of long-term care, specifically:

- your age and gender

- where you live

- your health status and any medical conditions (people in poor health when applying won’t qualify for long-term care insurance)

Here are estimates for a 55-year-old man.

Traditional long-term care insurance: $2,200 annual premium

Short-term care insurance: $948 annual premium

Life insurance with living benefits: $4,320 annual premium (paying for both custodial care and life insurance)

Long-Term Care and Medicaid

Obtaining long-term care coverage through your state’s Medicaid program is an option. However, it is not an option that I recommend.

The reasons are as follows:

(1) you have to essentially be poor to obtain long-term care through Medicaid. This is done through the spend-down process and ridding your assets more than 5 years before applying for Medicaid. Do you really want to do this? Do you really want to spend away all of your assets and become destitute to qualify for Medicaid? Of course not!

(2) Not many facilities accept Medicaid beneficiaries. It can be hard to find a bed, and if you do, you will likely face a lower quality of care. Medicaid reimburses these facilities at a lower rate compared to private long-term care insurance.

(3) Medicaid generally does not reimburse/cover assisted living facilities. So, if you need or want to go to an assisted living facility, you are out of luck.

Your private insurance policy is much more valuable and flexible. Long-term care insurance policies cover way more and are more robust, giving you peace of mind.

If you want to learn more about long-term care and Medicaid, feel free to consult our articles here:

- Does Life Insurance Affect Your Medicaid Eligibility?

- How a Funeral Trust Helps With Medicaid Eligibility?

- Term Life Insurance That Doesn’ Affect Your Medicaid Eligibility

- How Massachusetts Long-Term Care Insurance Works and With Home Asset?

- How to Protect Assets from Nursing Home Costs?

We have helped many people navigate the long-term care / Medicaid conundrum and are happy to answer any questions you may have.

Frequently Asked Questions About Long-Term Care Insurance

Here are 10 frequently asked questions (FAQs) about long-term care insurance, along with answers:

1. What is long-term care insurance?

Long-term care insurance is a type of insurance policy designed to cover the costs associated with extended care needs due to chronic illnesses, disabilities, or aging-related conditions. It provides financial support for individuals who require assistance with daily activities such as bathing, dressing, and eating or who need specialized care in facilities like nursing homes or assisted living centers. Long-term care insurance policies typically begin coverage after a waiting period and can last for a specified number of years or a lifetime, depending on the terms of the policy.

2. Who should consider buying long-term care insurance?

Everyone. However, long-term care insurance is particularly relevant for:

- Individuals in their mid-50s to early 60s, as they are typically healthier and can secure more favorable premiums

- Those who wish to protect their savings from potentially high long-term care costs

- Individuals with a family history of chronic conditions that may require long-term care

- People who want to maintain their independence and have choices about their care in the future

- Those who want to avoid burdening family members with caregiving responsibilities

- People who want to avoid Medicaid (trust me; you want to avoid this if you can help it)

When deciding which type of long-term care insurance is right for you, consider your personal health, financial situation, and family history.

3. What does long-term care insurance cover?

Long-term care insurance generally covers a range of services in various settings, including:

- Home health care

- Assisted living facilities

- Nursing homes

- Adult day care centers

- Hospice care

The specific coverage can vary by policy, so it’s crucial to carefully review the terms to understand what is included and any possible exclusions. Exclusions are usually related to health conditions. Some policies may also cover modifications to your home to accommodate disabilities or the cost of training for family caregivers.

4. Doesn’t Medicare cover long-term care services?

No. Medicare does not cover long-term care services. This is a very common misconception and one that many people find out until it is too late (and they can’t enroll in a policy due to health reasons).

Medicare will only cover a set number of days for skilled nursing care. Certain types of Medicare supplement insurance policies extend these days. However, skilled nursing care is not necessarily custodial care. Medicare will pay for custodial care during these days as long as it is attached to a skilled nursing need.

Your best option is to obtain one of the types of long-term care insurance we discussed.

5. When can I start using long-term care insurance benefits?

Most long-term care insurance policies have an “elimination period,” which is like a waiting period before benefits begin. This period typically lasts 30 to 90 days after you need care, during which you must pay for your own care costs.

Some plans have 0 waiting days. A waiting period of 0 is a common waiting period for many short-term care policies.

Please contact us if you have any questions.

6. Is long-term care insurance tax-deductible?

Yes, there can be tax benefits associated with long-term care insurance:

- Premium deductions: Traditional long-term care insurance premiums may qualify for tax deductions as part of itemized medical expenses on federal tax returns. The amount that can be deducted increases with age. Business owners can write off 100% of the premium on the 1040.

- Tax-free benefits: Benefits received from long-term care insurance are often tax-free, depending on the policy and local regulations

- Health Savings Account (HSA) use: Premiums for qualified long-term care insurance policies can be paid using funds from an HSA, which offers tax advantages.

It’s important to consult with a tax professional or financial advisor for specific advice on how these tax benefits may apply to your situation, as tax laws can change, and benefits may vary based on individual circumstances.

Other types of long-term care insurance are not tax deductible. However, some hybrid plans may allow a tax deduction on the long-term care rider portion as long as the company identifies the corresponding long-term care premium.

7. Can I be denied long-term care insurance coverage?

Yes, insurers can deny coverage based on medical history. Pre-existing conditions such as Alzheimer’s disease or other chronic illnesses may disqualify you. This is why many people apply for coverage when they are younger and healthier.

People in poor health likely won’t qualify for long-term care insurance. However, an annuity / long-term care insurance policy could be available, as these plans are more lenient with underwriting. The applicant must have a large sum of money to deposit into the annuity.

8. What is the benefit period in a long-term care insurance policy?

The benefit period is the length of time the policy will pay for covered services, usually ranging from two to five years. Some policies offer lifetime benefits, although these are much more expensive.

9. What is the inflation protection option in long-term care insurance?

Inflation protection is an optional feature that increases your benefits over time to keep up with the rising cost of care. This can be crucial since long-term care costs tend to rise over the years. I generally recommend obtaining some type of inflation protection on your long-term care insurance policy. Note: traditional long-term care insurance usually has this option.

10. What happens if I never use my long-term care insurance?

If you never use your long-term care insurance:

The premiums paid are generally considered a sunk cost, similar to other types of insurance you may not use, such as home or auto insurance.

Unlike some life insurance policies, LTCI typically does not offer a return of premium or cash value if the policy isn’t utilized.

Some policies may offer a “return of premium” rider at an additional cost, which can refund a portion of premiums if benefits are not used.

The peace of mind and financial protection provided by the policy throughout its duration can be considered a benefit, even if care is never needed.

Note: hybird policies and those with custodial care don’t have the “use it or lose it”. If you never use the long-term care potion, you can access the cash value in the life insurance policy or allow the death benefit to pass to your beneficiaries.

While it may seem financially disappointing to pay for insurance that isn’t used, the primary purpose of LTCI is to provide protection against potentially catastrophic costs that could arise from needing long-term care.

Now You Know The 5 Types of Long-Term Care Insurance Available to You

In this article, we discussed the 5 types of long-term care insurance available to you.

Choosing the right long-term care insurance depends on your personal situation, health, and financial goals. Traditional long-term care insurance policies offer comprehensive coverage but have a “use it or lose it” identity, although many plans offer a refund option. Moreover, the probability that you will need care is very high. Carriers offering traditional long-term care insurance nowadays have stabilized premiums, although rate increases can happen.

Short-term care insurance is more affordable but limited in duration, with a maximum benefit period of up to a year.

Asset-based, hybrid, and annuity options provide flexibility but require larger upfront investments. Life insurance with a long-term care rider offers dual benefits but may have limitations on care coverage and benefits. The same goes for life insurance with custodial care (i.e., living benefits).

Consider your age, health, financial situation, and family history when deciding.

It’s always wise to consult with a reputable financial advisor or insurance agent (i.e., us 🙂 ) to help you navigate these options and choose the best fit for your needs and budget.

Do you have any questions or would like to get started? Would you like to see a quote or illustration of costs?

Contact us or use the form below.

We are happy to discuss the types of long-term care insurance available to you and answer any questions you may have.

Are you afraid of constant phone calls and someone trying to sell you something? That is not us. When working with us, we have your and your family’s best interests at heart. If we can’t help you, we will point you in the right direction as best we can. This is the only way we know how to work with our clients and their families.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".