Long-Term Care Insurance Tax Deduction | How It Helps & Other Tax Advantages

Updated: April 12, 2024 at 9:40 am

When people think of long-term care insurance, a favorable tax deduction is the last they think of.

When people think of long-term care insurance, a favorable tax deduction is the last they think of.

Why? Well, traditional long-term care insurance has had a bad rap these days. It seems like everyone knows premiums have increased through the roof. (FYI – they have stabilized, though.)

Moreover, people don’t like the “use-it-or-lose-it” stigma associated with traditional long-term care insurance. We understand. As we have discussed, however, you will probably need some type of long-term care in your future.

Did you know that traditional long-term care insurance offers a really nice tax deduction as well as other awesome tax benefits?

Honestly, that makes long-term care insurance really nice. Moreover, business owners or self-employed professionals have additional advantages.

In this article, we discuss the tax deduction for long-term care insurance as well as other benefits.

What Is The Tax Deduction On Traditional Long-Term Care Insurance?

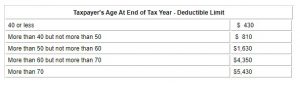

Everyone who purchases a traditional long-term care insurance policy has tax advantages. The largest, and unknown – in my opinion – is the tax deduction on premiums. The IRS allows a person or couple to deduct a certain amount of long-term care insurance premium. This deduction is based on age. The IRS limits this deduction amount, but as you age, the available deduction increases. (See below for the 2020 table).

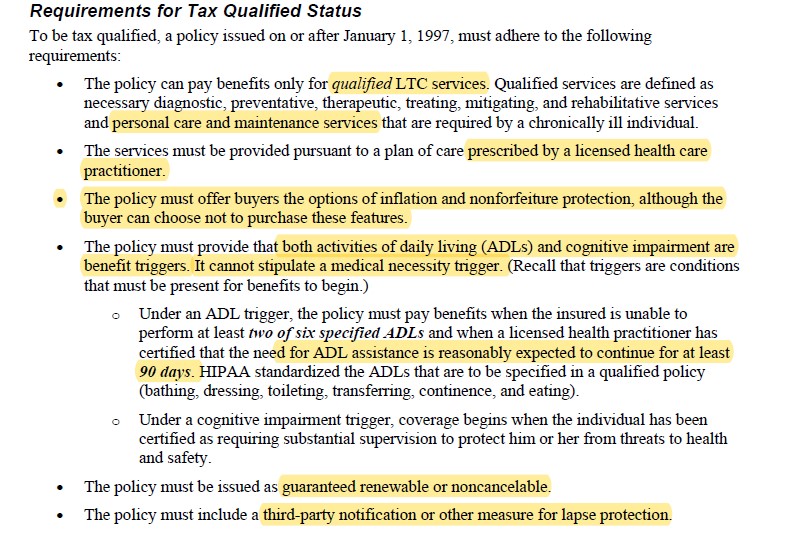

You receive this benefit as long as your long-term care insurance is qualified. No worries. Nearly all traditional long-term care insurance nowadays is tax-qualified. While not the subject of the article, you can see the requirements of a tax-qualified  long-term care insurance policy in the picture (taken right out of my long-term care insurance study guide 🙂 )

long-term care insurance policy in the picture (taken right out of my long-term care insurance study guide 🙂 )

So, as long as your insurance is a tax-qualified plan, you’ll enjoy the tax advantages of long-term care insurance, which includes the tax deduction of premiums.

Examples OF How The Tax Deduction On Long-Term Care Insurance Works

So, you see the chart above. For individuals, the tax deduction is limited to 10% of your AGI per IRS guidelines on health expense deductions. So, it gets lumped into your other out-of-pocket health care expenses you’ve incurred. That kind of stinks. Let’s show how this works.

John and Joan, both age 57, together spend $6,500 per year on their traditional long-term care insurance policy. Their AGI is $100,000: 10% of their AGI is $10,000. They have $500 in additional out of pocket health care costs. Because their total health care costs are less than 10% of their AGI, ($7,000 vs. $10,000) they can’t take a deduction for their long-term care insurance.

John and Joan, both age 57, together spend $6,500 per year on their traditional long-term care insurance policy. Their AGI is $50,000: 10% of their AGI is $5,000. They have $500 in additional out of pocket health care costs. Because their total health care costs are more than 10% of their AGI, ($7,000 vs. $5,000) they CAN take a deduction for their long-term care insurance costs. They are both eligible to deduct $1,630 (2020) or $3,260 in total off their taxes. However, because their total health care costs are only $2,000 above the 10% AGI limit, they can only deduct $2,000 of their $3,060 eligible to them.

See how that works?

Long-Term Care Insurance Tax Deduction For The Self-Employed

However, if you are self-employed, you have a significant advantage. You can deduct the premiums of traditional long-term care insurance at 100%, subject to the long-term care deduction maximums. Instead of 10% of AGI, you would take this deduction 100% on the health insurance line on your 1040 form.

Let’s look at John and Joan again.

John and Joan, both age 57, together spend $6,500 per year on their traditional long-term care insurance policy. Their AGI is $100,000. 10% of their AGI is $10,000. John is a self-employed plumber. They have $500 in additional out of pocket health care costs. Since John is self-employed, the 10% AGI limit doesn’t matter! They are both eligible to deduct $1,630 (the 2020 limit for people aged 50 – 59) or $3,260 in total off their taxes. (For the record, John and Joan can’t deduct the $500 additional out-of-pocket cost because it is less than the 10% AGI limit.)

That is better, isn’t it?

Did you catch something else in the above example? If you mention John’s wife, Joan, you are right. John can deduct Joan’s premiums as well. In fact, he can deduct his children’s premium if his children had a policy. Joan and his children do not have to work in the business with him. What a benefit!

The exception is if your spouse was eligible for a long-term care insurance plan through his or her employer. You can’t take a deduction in this case.

That is another tax advantage of long-term care insurance for the self-employed: you can deduct the premiums for your spouse and children even if they are not self-employed, either.

And, one last advantage. If you hire anyone, you don’t have to pay a long-term care insurance policy on him or her. You can enjoy this benefit to yourself. I know that sounds selfish, but that is the current tax rule.

State Tax Deduction Considerations

Some states also offer tax deductions. Obviously, the reason is to incent you to purchase a qualified long-term care insurance policy. Keep in mind, your policy can be used anywhere. You don’t have to stay in the state that offers you a tax deduction.

You can reach out to us for more information about state tax deduction on long-term care insurance premiums.

Other Tax Advantages Of Long-Term Care Insurance

Everyone who purchases a qualified traditional long-term care policy has some tax advantages. We’ve already talked about the tax deduction on premiums. Did you know the benefits received are not subject to taxation? It’s true.

In 2020, the benefit maximum is $370/day of care. You – or likely your spouse or son/daughter – will receive form 1099-LTC early in the ensuing new year. This shows how much benefits were paid on your behalf from the long-term care insurance to the provider.

Now You Know The Tax Deduction And Advantages Of Long-Term Care Insurance

Now, you know the long-term care insurance tax deduction and advantages. If you are self-employed, consider a traditional long-term care insurance policy. There is a good chance you and/or your spouse would need long-term care services in the future.

While many in the long-term care market disagree, we at My Family Life Insurance believe a traditional long-term care insurance policy is still viable to cover one’s potential long-term care needs. Need help? Contact us or fill out the information below. We can help determine if a traditional long-term care insurance policy is right for you, and if so, an affordable plan that meets your needs and budget.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

photo courtesy of career employer