How Supplemental SSI Benefits Affect Life Insurance? | Yes, You Can Obtain Life Insurance If You Receive SSI – The Policy Needs To Be Structured The Right Way

Updated: March 3, 2025 at 12:52 pm

If you are on SSI, you might wonder if you can obtain life insurance.

Am I right?

No, John. Another agent told me not to worry, and I purchased a whole life insurance policy.

I hear that alot. Unfortunately, that agent is wrong. The life insurance policy you just purchased can negatively impact your Medicaid/SSI.

Do you want that to happen?

No! But, I need life insurance. What should I do?

However, life insurance options are available. You just need to be careful on how you structure the life insurance policy.

(Note: I am not a Medicaid or Elder Law attorney. If you have specific questions, I recommend you speak to a qualified attorney in your state.)

Here is what we will discuss:

- What is SSI – Supplemental Security Income?

- What are Resources for SSI?

- How Receiving SSI Supplemental Security Income Affects Life Insurance

- How to Structure a Life Insurance Policy

- Other Options for SSI Recipients

- Cost of Life Insurance for SSI Recipients

- What Happens If An SSI Recipient Receives Life Insurance Proceeds?

- FAQs about Life Insurance and SSI

- Final Thoughts about Life Insurance and SSI

Let’s jump in and discuss SSI.

What Is SSI – Supplemental Security Income?

SSI stands for supplemental security income. It is income for people with limited income and resources. SSI eligibility includes people who are:

- blind,

- over the age of 65, or

- have a qualifying disability (including young adults and children)

The Social Security Administration manages the supplemental security income program (SSI). Many SSI recipients receive Medicaid as well. Moreover, they may receive other types of assistance such as food stamps.

The Social Security Administration manages the supplemental security income program (SSI). Many SSI recipients receive Medicaid as well. Moreover, they may receive other types of assistance such as food stamps.

Many people – even those receiving SSI benefits – confuse SSI payments with SSDI payments (social security disability insurance). Moreover, many life insurance agents mess this up, much to the detriment of their clients (more on that in a minute).

SSI payments are nowhere near what Social Security disability benefits are. While there is overlap on qualifying for both (and some people do recieve SSI payments and SSDI payments), SSI recipients receive SSI if they have limited resources (i.e., assets) and income (essentially, poverty) AND if they are blind, over the age of 65, or have a qualifying disability (any age, including young adults and children). SSDI recipients receive SSDI payments if they have a qualifying disability. Social Security disability benefits do not consider income and financial resources.

One way to remember this: if you receive Medicaid or any state assistance, such as food stamps, WIC, etc., you will likely receive SSI benefits. If you are on Medicare and maintain many financial resources, then you likely receive SSDI benefits.

However, if you are looking for life insurance, you need to know what type of payment you receive – supplemental security income (SSI), social security disability insurance (SSDI) income, or both.

What Are the Resources for SSI?

You need to be poor to receive SSI payments. You won’t qualify for supplemental security income if you have many assets, such as a 401k, stocks, bonds, mutual funds, rental properties, etc., unless you want to spend down those assets.

The Social Security Administration calls these assets resources. The SSA works with individual states on SSI/Medicaid eligibility. Most states allow only $2,000 or $3,000 of assets / resources in your name. That’s not much, right? That is what I mean. You have to be destitute to qualify for SSI benefits.

You may hear this $2,000 limit as the resource limit, SSI’s asset limit, or the Medicaid allowable limit.

However, not every asset disqualifies you from receiving SSI. Here is a list of resources (also known as assets) the Social Security Administration allows an SSI recipient to have. (In other words, an SSI recipient won’t be disqualified or lose benefits if he or she has these assets. They don’t count against the SSI resource limit.)

Non-Countable Assets for SSI Eligibility

Here is a list of assets that do not count toward SSI’s asset limit / resource limit.

- your home and land

- 1 vehicle

- household goods, personal effects, and personal property

- the cash surrender value of life insurance policies you own with a combined face value of $1,500 or less (a very small death benefit – more on this soon)

- burial plots

- burial funds (not burial insurance). These are pre-need burial funds

- $100,000 or less in your state’s ABLE program

So, to reiterate, you can have all of these, and they don’t count against the $2,000 asset limit. For example, let’s say you have $1,000,000 in value with all of the above (and these are the only assets you have), you will still qualify for SSI (generally speaking).

Now, let’s discuss the countable assets.

Countable Assets for SSI

It’s easy to say that countable resources and assets are the opposite of non-countable assets. However, let’s be more specific. Here are assets that, if you have them in your name and own more than $2,000 of them (or, whatever your state’s limit is), will disqualify you from receiving supplemental security income.

- Cash

- Bank accounts

- Stocks, Mutual Funds, IRAs, 401(k)s, etc.

- Vacation homes and property

- Cash value in life insurance with combined face values over $1,500 (yes! However, not a term life insurance policy. A permanent life insurance policy like whole life will disqualify.)

- More vehicles

So, if you have any of these assets above $2,000 in value, you won’t qualify for SSI.

But, John. How does life insurance play into all this?

Yes, let’s discuss how receiving SSI affects life insurance.

How Does Receiving SSI Supplemental Security Income Affect Life Insurance?

Having or purchasing life insurance can affect SSI and vice versa. However, not just any life insurance. Permanent types of life insurance, such as whole life and indexed universal life, negatively impact your supplemental security income.

In other words, if you hold any permanent policies, the SSA may disqualify or prevent SSI payments to you.

Why? Because permanent policies contain cash value. What is cash value? Think of cash value as a savings account (but it is not). As you pay premiums into your policy, part of the premiums go to fees, some to the cost of insuring you, and some to cash value.

Over time, the cash value grows over $2,000 (unless your face value is $1,500 or less, which is nearly impossible). Once that happens, you may have disqualified yourself from SSI benefits.

Many other agents and brokers say not to worry about this. Just look at other articles online. However, there is cause to worry. While it can take time for cash value to grow, it will. And, if it grows over $2,000 (assuming you are living), then you potentially have disqualified yourself from SSI.

Is this what you want?

No!

Of course not!

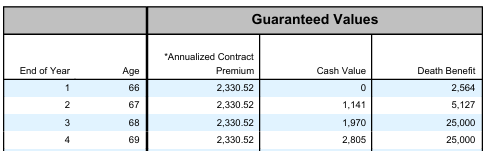

Just to be clear on how fast cash value can grow, look at the illustration of this guaranteed issue whole life policy. This is a 65 year old man. As you can see, even with a guaranteed issue whole life insurance policy, this man will have $2,000 in cash value around year 3 of holding the policy.

So, what do you do? We discuss this next.

How to Structure a Life Insurance Policy the Right Way to Keep Your SSI

So, a couple of things:

- we have helped many people on SSI / Medicaid obtain life insurance

- I recommend you speak to a qualified attorney in your state for specific questions

- the information below is general and does not consider your situation

However, there are a few ways to structure a life insurance policy so it doesn’t affect your SSI / Medicaid.

Don’t Own The Life Insurance Policy

First, it is not to own the policy. This really pertains to whole life insurance. You can still be on Medicaid / SSI and have a life insurance policy on your life as long as you are not the owner. As I mentioned before, the countable assets depend on ownership. If you do not own an asset, the SSI asset limit doesn’t exist. Again, please consult an attorney in your state to determine specific state laws.

You just can’t have anyone own the policy. The person:

- should be a close member of your family, such as a spouse or an adult child. The person needs to have an insurable interest, demonstrating that your death will negatively impact him or her

- should not be on Medicaid / receiving SSI. If so, he or she will have the same issue and potentially disqualify himself or herself.

Purchase Term Life Insurance

Another option is to purchase a term life insurance policy. Contrary to whole life insurance, term life does not contain cash value. It is death benefit coverage only with no inherent value. Therefore, an SSI recipient can purchase a term life insurance policy in his or her name. Again, please contact a qualified lawyer in your state for specific rules.

A couple of disadvantages, however, of term life:

- it lasts only a fixed number of years (i.e., the term period), like 20 years, for example. It pays a benefit if you pass away during the term period. If you live beyond the term period, your beneficiaries receive nothing from the policy.

- it is an uncommon option for SSI recipients. Term life can be hard to qualify for. The reason is that many life insurance companies have minimum death benefits like $100,000 or $250,000. Life insurance companies won’t insure someone with practically no assets at those death benefit levels. Additionally, carriers generally have more rigorous underwriting for term life.

However, we do have some term life insurance options that are beneficial for SSI recipients. Note: life insurance options change regularly, so contact us to find out the current options.

Other Options For SSI Recipients

A couple of other options exist for SSI recipients. These aren’t necessarily life insurance, but they will help pay for funeral and burial expenses upon death of the SSI recipient.

Funeral Trust

A funeral trust is a great option. It is an irrevocable trust designed to pay money to a funeral home of your choice upon your death. One of the greatest advantages of a funeral trust is that it allows you to move assets into the trust without impacting the 36-month look-back rule. Contrary to what you think – and many people say – transferring assets you own to someone else can impact your SSI benefits.

to a funeral home of your choice upon your death. One of the greatest advantages of a funeral trust is that it allows you to move assets into the trust without impacting the 36-month look-back rule. Contrary to what you think – and many people say – transferring assets you own to someone else can impact your SSI benefits.

The Funeral Trust avoids that. We have used it in “crisis” situations where a person needs to quickly qualify for SSI, Medicaid, or a nursing home paid by Medicaid.

There are a couple of points to make, however. The Funeral Trust:

- is irrevocable, so you can’t access the assets once it is set up. The value in the trust pays your funeral and final expenses upon your death

- has a low contribution limit. Many states allow only up to $15,000 of assets transferred to the trust

In terms of whole life, you would transfer your policy’s cash value to the trust.

John, not the death benefit?

No. The cash value is the asset value of the policy. That is what you own and what is transferable.

For example, let’s say you own a $10,000 whole life insurance policy with $7,000 of cash value. In order to qualify for SSI, you need to remove this. A great way to do this is to transfer the cash value to the Funeral Trust. You avoid the 36-month lookback rule. The $7,000 is available for your funeral. It grows at a nominal interest rate.

ABLE Account

Another option is an ABLE account. ABLE accounts are savings vehicles for disabled children and adults. Money inside the account grows tax-deferred. If the money is used for qualified expenses, including funeral expenses, it is tax-free.

As long as the value in the account is less than $100,000, ABLE accounts won’t affect your SSI eligibility.

This is another option available to SSI recipients. If you are interested in an ABLE account, you can search online for plans available in your state.

Cost of Life Insurance for SSI Recipients

The cost of life insurance on SSI recipients depends on:

- the age of the insured / SSI recipient

- gender

- tobacco status

- health status – height and weight, disabilities, etc.

- the resident state

- death benefit amount

Feel free to research costs yourself using the quoter below.

If you are an adult child of a parent or grandparent on SSI, you can still purchase a life insurance policy on them. We have helped many adult children purchase life insurance on grandparents and parents on SSI.

What Happens if an SSI Recipient Receives Life Insurance Proceeds?

This topic is subject to some gray area, and I recommend that you speak to a qualified attorney in your state. Life insurance proceeds are currently not taxable. This is one of the most important, if not the most important, benefits of life insurance. If you are a beneficiary and receive a life insurance payout, you don’t need to report that money on your income taxes.

Remember we went over what countable and non-countable resources are for SSI? Although beneficiaries don’t have to report life insurance proceeds on their taxes, SSI recipients would have to acknowledge, somehow, that they are in receipt of income. This income will put SSI recipients over the asset limit and potentially disqualify themselves.

I generally recommend having a trust or a trusted family member as the beneficiary.

However, there seems to be a gray area. I have had people tell me that life insurance proceeds will affect SSI and others say they won’t. That is why I recommend you speak to a qualified attorney in your state.

Frequently Asked Questions About Life Insurance and SSI

Let’s discuss frequently asked questions about life insurance and SSI.

Can SSI Recipients Obtain Life Insurance?

Yes, SSI recipients can obtain life insurance. However, it’s crucial to choose a policy type and ownership structure that complies with SSI eligibility rules to avoid affecting your benefits.

Will Owning Life Insurance Affect My SSI Benefits?

Owning a whole life insurance policy with a cash value exceeding $2,000 may count as a resource and could affect your SSI eligibility. Term life insurance policies, which do not have a cash value component, typically do not impact SSI benefits.

If you are in the market for a whole life insurance policy, I recommend having an immediate family member, like a spouse or adult child, (who is not receiving SSI) be the owner and beneficiary of the policy.

What Types of Life Insurance Are Best for SSI Recipients?

Term life insurance is often suitable for SSI recipients because it doesn’t accumulate cash value, thus not affecting resource limits. However, term policies last for a fixed number of years (i.e., the term period). Alternatively, whole life insurance with a carefully managed cash value might be considered, but it’s essential to monitor the policy’s cash value to ensure it stays within allowable limits.

How Can I Structure a Life Insurance Policy to Protect My SSI Benefits?

One approach is to have the policy owned by a trusted family member or placed within an irrevocable trust. This arrangement can help ensure the policy doesn’t count as your resource, thereby protecting your SSI benefits.

Can I Use Life Insurance to Provide for a Disabled Dependent Without Affecting Their SSI?

Yes, by setting up a special needs trust funded by a life insurance policy, you can provide for a disabled dependent without jeopardizing his or her SSI benefits. The trust manages the funds for the beneficiary’s benefit without directly providing them with resources that could affect their eligibility.

Are There Specific Life Insurance Policies Designed for Individuals on SSI?

While there aren’t policies exclusively for SSI recipients, certain policies like final expense or burial insurance offer lower face amounts, are easier to qualify for, and may be structured to comply with SSI resource limits. Final expense and burial insurance are whole life insurance policies, so you want to be mindful of cash value levels and/or have an immediate member of your household (again, not on SSI) own the policy.

What Should I Consider When Naming Beneficiaries to Protect SSI Benefits?

This is a gray area. In my opinion, it’s advisable to avoid directly naming the SSI recipient as a beneficiary. Instead, naming a special needs trust as the beneficiary can help manage the proceeds in a way that doesn’t affect SSI eligibility. Or, have close family members named as beneficiaries.

How Does Cash Value in Life Insurance Impact SSI?

The cash surrender value of a life insurance policy is considered a resource for SSI purposes. If the total death benefit amount of all life insurance policies exceeds $1,500, the cash value counts toward the SSI resource limit of $2,000 for individuals. Of course, this assumes the SSI recipient owns the policy.

Can Burial Insurance Policies Affect My SSI Benefits?

Burial insurance policies with a face value up to $1,500 are generally excluded from being counted as a resource for SSI. However, any amount exceeding this may count toward your resource limit.

Final Thoughts About Life Insurance and SSI

If you receive SSI, you can obtain life insurance. However, you will want to be mindful of a few things:

- the type of policy

- if it is a permanent policy, like whole life, how much cash value is in the policy

- ownership considerations

Are you interested in learning more? Contact us or use the form below.

We have helped many people on SSI obtain life insurance. There is no risk to contacting us. We are beholden to helping you in your situation and nothing else. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".