Best Disability Insurance Options For Chiropractors | Your Guide To Understanding This Important Insurance

Updated: April 12, 2024 at 9:38 am

Chiropractors don’t have a lot of time thinking about disability insurance, am I right?

I think you will likely agree with me on that.

Yeah, John. I am pretty busy, but I am interested in learning more about disability insurance.

Great. However, what if you could no longer do your job?

Have you ever thought about what would happen if you became sick, ill, injured, and disabled?

How would you pay the bills if you could not work because of an injury or illness?

How long could you stretch your savings to make ends meet?

Disability quickly affects your plans, family, and the lifestyle you worked so hard for.

You’ve come to the right place. We have helped many medical professionals including chiropractors obtain disability insurance.

For faster navigation, feel free to click on a link below:

- What Is Disability Insurance?

- Why Chiropractors Need Disability Insurance?

- How Carriers Underwrite Chiropractors

- The Best Disability Insurance Options For Chiropractors

- Is An Association Plan Right For You?

- Other Important Disability Insurance Options For Chiropractors

- Now You Know The Best Disability Insurance To Protect Your Income Now

Let’s jump in and give a quick overview of disability insurance.

What Is Disability Insurance?

Disability insurance pays you a benefit if you can’t work due to illness or injury. It is that simple.

Essentially, if you:

- Make money, and

- You and your family rely on that money to live, and if

- You and your family would be in financial disarray if you were sick or hurt and could not work, then

How much do you receive if you can’t work? That depends on your income. If you are an employee or a self-employed chiropractor, carriers pay between 60% and 80% of your income.

Why don’t they pay 100%? Well, the reasons are simple:

Why don’t they pay 100%? Well, the reasons are simple:

- The disability benefit isn’t taxable, so that saves a ton of money, and

- To incent you to get back to work

Human nature tells us if we receive 100% of our income, we might as well stay home, right?

Think of disability insurance as the spare tire in your car or AAA. If your battery dies or you have a flat tire, you are really happy to have the spare tire of AAA. Except, disability insurance is the spare tire for your life.

Why Chiropractors Need Disability Insurance?

That sounds great, John, you say. But, I am not going to need disability insurance.

That’s an interesting comment. I hear it all the time. Tell me about some of your patients.

Well, some are healthy and some are not.

OK, about those who are not. Why do they see you?

They have injuries or chronic problems they need help with.

Did they expect to have these problems? These likely were or are disabilities.

Well…

You don’t need to answer that. I can see you know what I am getting at. The answer is no one does. A disability happens anytime. Disabilities do not discriminate. They don’t care about your ethnicity, income, or situation.

answer is no one does. A disability happens anytime. Disabilities do not discriminate. They don’t care about your ethnicity, income, or situation.

In fact, the SSA says that 1 in 4 working adults will be disabled before they turn 65.

Tiger Woods knows this. Do you remember his car accident? He entered his car at 7AM. By 7:10, he was disabled. Golfing is his job. At the time, he can’t do that. (As of this writing, he still struggles to get back to his pre-disability shape.) I can bet with certainty that at 7AM, he did not expect a disability. No one does.

The difference is Tiger Woods has millions to fall back on. Do you if you are sick or hurt and can’t work?

What if you faced a situation where you could no longer practice? That is a disability.

However, a disability isn’t only a severe accident. It can be a cancer diagnosis, an ALS diagnosis, or weird nerve pain shooting through your arms that prevents you from using your hands.

What would you do if you could not bring in an income to support your family?

Now, do you see the importance of disability insurance for chiropractors?

More Important People Rely On You

So, now we know a disability happens anytime. Before this discussion, I bet you valued your patients quite a bit. Am I right?

Well, yes. They bring in my income. Without them, I am nothing.

Yes, your patients are very important. However, there is also a group of more important people. Who can be more important than my patients, you think? They pay my income. Without them, I wouldn’t have an income.

True. They do pay your income, which keeps your business going. However, they don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything.

If you are faced with a disability, without disability insurance, there are tough questions that need answering.

- Would you and your family be able to continue your standard of living without your income? If not, what changes would need to be made?

- Would your spouse have to work or work more?

- Would you need to sell your home to make ends meet? (just happened to a prospect I spoke to.)

- Who could be flexible with the children?

- Would you have the money to hire someone to take care of the kids?

The tough questions can go on and on.

Disabilities potentially place families in tough financial situations. They don’t have to, though. With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

OK, John. You have made your point. I need this insurance. How do I get it?

Well, before we discuss the disability insurance policies available to chiropractors, let’s first discuss disability insurance underwriting.

How Disability Insurance Carriers Underwrite Chiropractors

Hopefully, we have made a great case showing that chiropractors need disability insurance.

Before you apply, however, you need to know how carriers underwrite occupations.

For chiropractors, disability insurance underwriting is rather stringent.

Let’s start at the beginning.

When it comes to underwriting, carriers look at your:

- Age

- Health – medical records review or phone interview

- Income / Salary

- Occupation

- Other hazards and lifestyle situations

Most of the chiropractors we insure are healthy, so that usually is not an issue.

Age is age. The older you are when you apply, the more expensive the policy. That happens to everyone. This is why we recommend applying as soon as possible to lock in relatively lower premiums.

happens to everyone. This is why we recommend applying as soon as possible to lock in relatively lower premiums.

However, the issue with chiropractors is occupation.

All the disability insurance carriers classify occupations based on disability risk.

Disability Insurance Occupation Risk

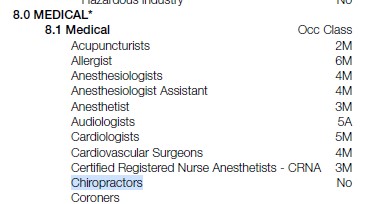

Carriers classify this risk on a numerical scale, usually from a 1 to a 5 or a 6. A 5/6 occupation class is the lowest disability risk. Conversely, an occupation with a 1 has the highest disability risk.

For example, two people have the same birthday, height/weight, health status, and income. One is a construction worker and the other is an accountant. The construction worker pays more simply due to occupational risk compared to the accountant (all things being equal, of course).

For chiropractors, disability insurance carriers classify the occupation at a 1.

Sometimes, we can usually get an upgrade to a class 2, depending on the situation.

What, you exclaim? So, I am just as risky as a construction worker?

You have to admit your occupation is rather laborious. There’s a lot of potential disability risk.

But, it’s nothing to be upset about. Income protection is extremely important. You do the best you can in your current situation.

Let’s briefly go over some important policy basics for chiropractors.

Disability Insurance Policy Basics For Chiropractors

While every carrier is different, here are the important policy basics for chiropractors.

You generally can cover up to 70% of your gross salary. Every carrier is different, though. Some have 60% coverage maximums. For example, if you have a gross monthly salary of $5,000, you can cover up to $3,500 (70%).

If you are self-employed, carriers insure your net income, which is your gross income less any business expenses. This is typically found on Schedule C of your tax return.

What Are The Elimination / Waiting Period And Benefit Period?

There is an elimination period, which is like a deductible. It is the length of time – a waiting period – that elapses before disability benefits begin upon an approved claim. For example, a 90-day elimination period means your benefit period will begin after 90 days of disability. On the 91st, you are eligible for long-term disability benefits. You typically won’t get paid until 30 days later, until day 120 or so. This means you need to have adequate savings to carry you and your family until benefits begin.

You can usually have a waiting period as low as 30 days, but you will pay a higher premium.

We find that many individuals and families can “get by” for a few months of disability; however, it is after 90 days that they feel a negative financial impact.

The maximum benefit period is 5 years. This means you will have up to 5 years to receive a disability benefit for one claim. A “to age 65” benefit period is possible through group employer or association plans. More on that later.

Many chiropractors have told us they just can’t get individual disability insurance. Carriers preclude their profession, or they say it is just too expensive. We will get more on that in a minute, but you CAN get disability insurance and it is likely less expensive than you think.

Maybe you searched for the wrong carrier or insurance agent?

The Disability Definition Matters…

The definition of disability matters. You generally want some type of own occupation period. This could be “true” or “modified” own-occupation definition.

What is “true own-occupation”? Simply, it means you can continue to work in another occupation while receiving disability benefits for your own occupation as a chiropractor. So, if you can’t use your hands and do your job as a chiropractor, but you can greet people at Walmart, you will receive disability benefits in addition to your earnings as a Walmart greeter.

Modified own-occupation is a bit different. You will still receive a disability benefit based on your occupation as a chiropractor. However, you can’t work in another job. So, if you work as a Walmart greeter, you won’t receive disability benefits under the modified own-occupation definition (because you are working as a Walmart greeter. You’ll have to quit your Walmart job to receive disability benefits.)

Finally, there is the stringent “any occupation” definition. This means, simply, if you can work in any other gainful occupation (for which you are reasonably suited, considering your education, training, and experience), the carrier will deny disability benefits. So, under this definition, you won’t receive a disability benefit because the insurance carrier says you can work as a Walmart greeter.

The plans we work with contain the favorable true own-occupation or modified own-occupation definition for chiropractors.

Optional Disability Insurance Riders For Chiropractors

You can add optional riders (link) at an additional cost to your policy to best fit your needs and budget.

Some important rider options for chiropractors include:

Guaranteed Insurability Option Rider: Also known as a future increase option, this rider allows you to purchase additional coverage in the future without evidence of good health. In other words, you don’t have to go through health underwriting again. How great is that? You just need to show evidence that your income increased.

Residual Disability Rider: This rider will pay a benefit if you are partially disabled. Partial disabilities happen all the time. If you are diagnosed with an illness or injury, and you are still working, that generally is a partial disability. Here is an example of how it works.

For example, you are diagnosed with carpal tunnel in your left wrist. Your doctor wants you to go to physical therapy and rest before considering surgery. Sounds great, but your doctor says you can only work 2 days a week, not 5. That’s a disability. It’s a partial disability, but a disability nonetheless. Let’s say you experience a 40% income loss. If your monthly disability benefit is $4,000, you will receive $1,600 ($4,000 X 40%). Easy math.

Additionally, the residual disability rider provides residual benefits if you return back to work from a total disability. (Essentially, you are partially disabled.)

Importance Of Proper Partial Disability Benefits

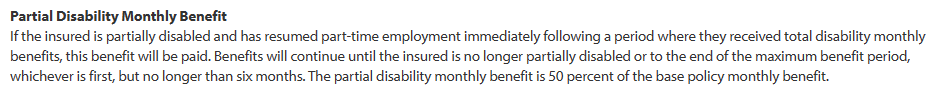

It’s important that you select partial disability / residual disability benefits that do not require a total disability first. Many carriers have this negative provision, and insureds are not fully aware until they file a claim. See this excerpt from a real disability insurance company.

Let’s use the example above. If your policy said that partial disability benefits are only paid AFTER a total disability, then you would not receive any partial benefits during your physical therapy/rest. That stinks, doesn’t it? You’d have to wait until your doctor said you were totally disabled and unable to 100% work as a chiropractor.

Let’s use the example above. If your policy said that partial disability benefits are only paid AFTER a total disability, then you would not receive any partial benefits during your physical therapy/rest. That stinks, doesn’t it? You’d have to wait until your doctor said you were totally disabled and unable to 100% work as a chiropractor.

There are other riders available. Of course, additional riders come with an additional cost. However, these may be important to you:

- Retroactive injury benefit

- Catastrophic disability benefit

- Mental illness/drug use option

- Critical illness option

We discuss all of these in our disability insurance rider guide. Contact us if you have any questions.

The Best Disability Insurance For Chiropractors

If you’ve started some research on disability insurance for chiropractors, you know that disability insurance options are limited. For one, some carriers simply do not insure the occupation. Second, if they do, it is usually at an occupation class 1.

That doesn’t mean disability insurance is out of reach. It’s not. You’ll just have to change your perspective.

Let’s discuss the best disability insurance options available for chiropractors.

Individual Disability Insurance

A common option for chiropractors is individual disability insurance. You apply on your own and go through the underwriting process (as we discussed). The carriers will either approve or decline your application. If you are generally healthy with no significant ailments or lifestyle situations, then carriers should approve your application.

As we discussed, not many disability insurance companies will cover the chiropractor occupation. However, many do, including:

- Illinois Mutual

- Assurity

- Guardian

- Thrivent

- Mutual of Omaha

- Petersen International

One thing to keep in mind, except for Petersen, these carriers will force you to coordinate your disability benefits with any disability benefits from the Social Security Administration. If you’ve read my article about disability insurance riders, you know I generally recommend avoiding any coordination with the government. (I mean, it is the government…) However, for chiropractors, the coordination is really unavoidable. Basically, if you make a long-term disability insurance claim, the disability insurance company will require you to make a subsequent claim to the Social Security Administration disability benefits. If Social Security approves your application, then the disability insurance company reduces its monthly benefit by the Social Security disability benefits. For example. If your social security offset provision is $1,500, and you receive $1,000 from Social Security, the disability insurance company reduces its benefit to you by $1,000 and pays you $500 instead of $1,500.

I know other websites place the potential rates on their website. I wouldn’t put too much faith in the rates you see elsewhere online. They may not be updated or exclude certain provisions. Moreover, they do not include the specific attributes about…you! Contact us to learn more, and we can give you a quote.

This takes us to premiums…

The Math Works…

We receive a lot of responses from chiropractors about cost. They think individual disability insurance is too much. Let’s test that theory. A 35 year-old male chiropractor, non-smoker, with a $3,000 monthly benefit, 2-year benefit period could expect to pay around $60 to $70 per month for a base policy. That averages about $2.00 to $2.50 per day.

Is it worth $2.50 per day to protect your income and what you have worked so hard for? We insure our homes, cars, and other material things, but we overlook protecting our ability to earn an income. How can you afford your car or your material things if you don’t have your income?

Is it worth $2.50 per day to protect your income and what you have worked so hard for? We insure our homes, cars, and other material things, but we overlook protecting our ability to earn an income. How can you afford your car or your material things if you don’t have your income?

Depending on your health and riders, the premiums could run anywhere from $2.50/day to $4.00/day. Think that is expensive? I bet you buy coffee almost every day or your lunch. What is more important? Insuring your income or buying a cup of coffee?

There are many ways to afford individual disability insurance.

Group Disability Insurance For Chiropractors

This is an often overlooked solution because many group disability insurance carriers do not insure chiropractors or chiropractic practices. What is group disability insurance? It is disability insurance that is placed through your company. Differences exist between group plans and individual plans. One large difference is that your company is the policyholder and employees enroll in the plan.

You are right, John. I tried to get disability insurance through my practice, but the carrier declined. They said they do not insure chiropractic practices.

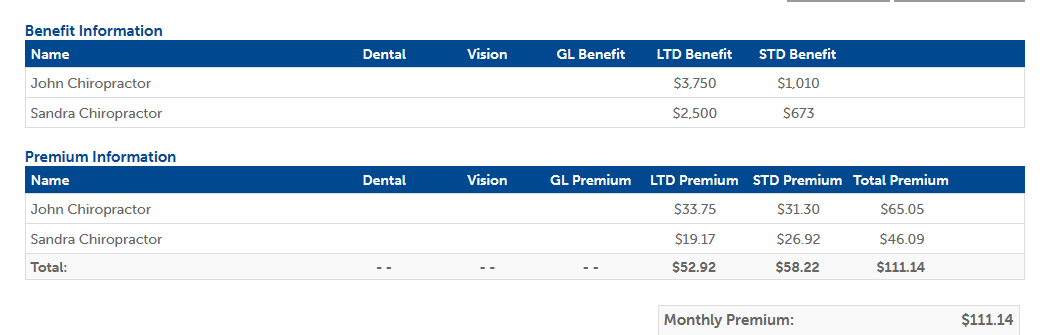

That is common, but we work with one that does. Moreover, it will cover husband and wife and/or family-owned chiropractic clinics.

What!

That is right. Additionally, the carrier provides guaranteed issue underwriting starting at 2 employees or business partners. That means you don’t need to answer any of the health questions or go through an underwriting process like an individual plan. It also means you and a fellow employee or chiropractor can be covered.

Moreover, the carrier covers pre-existing conditions after a waiting period. Non-pre-existing conditions are covered immediately.

Some Plan Specifics

The plan provides a modified own occupation definition for 3 years and then reverts to the “any” occupation definition after 3 years, to age 65. This is a common definition for group disability insurance plans. Additionally, the plan does force you to coordinate your benefits with social security. However, again, the plan is guaranteed issue starting at 2 people, including chiropractors, family-owned businesses, and spouse-owned businesses

Rates are reasonable, too. Here is a real quote we did for a 2-person, husband and wife chiropractic office. I changed the names, but everything else is real.

Additionally, this carrier allows for short-term disability insurance which covers maternity leave / childbirth as an illness.

Additionally, this carrier allows for short-term disability insurance which covers maternity leave / childbirth as an illness.

Contact us if you would like to learn more.

John, quick question. Does my employer have to pay?

No, the employer doesn’t. This can be set up for employees to pay only, and the employees can pay 100% of the premiums if the employer wants that. Or, if the employer wants to pay, say 20% of the premiums as a nice gesture, it can do that, too.

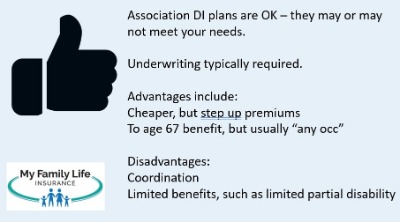

Is An Association Plan Right For You?

Many chiropractic associations offer disability insurance. Are these plans right for you? Maybe. Maybe not, though.

Disability insurance plans through associations are usually limited and “plain vanilla”. It doesn’t mean they are bad. It just means they contain a basic structure to meet the needs of everyone.

Disability insurance plans through associations are usually limited and “plain vanilla”. It doesn’t mean they are bad. It just means they contain a basic structure to meet the needs of everyone.

Some chiropractors think association plans are guaranteed issue (like our small business option above). Nope.

You still have to go through underwriting. There’s no avoiding that.

Here are some advantages of association plans:

- Some coverage for pre-existing conditions including wellness chiropractic treatment (which is an exclusion with other carriers)

- To age 65 benefit period, but with the “any” occupation definition usually after 2 years own-occupation

- Might be cheaper, initially, but then premiums might “step up” every year or 5 years

And some disadvantages:

- Other benefit coordination, including group coverage

- Limited waiting periods

- 2 year modified own occupation definition

- Partial disability after total disability only (likely)

- Premiums could “step up” (i.e. increase) as you age

Like anything, there are advantages and disadvantages. Feel free to contact us about any specifics. We are happy to explain, compare, and contrast so you can make an educated decision.

Popular carriers that underwrite association plans include The Hartford, Prudential Insurance Company of America, and New York Life.

Let’s discuss other disability insurance options for chiropractors.

Other Important Disability Insurance Options For Chiropractors

So far, we have discussed individual long-term disability insurance.

Other disability insurance options exist for chiropractors. We define and discuss them below.

Business Overhead Expense Insurance

Business overhead expense insurance is an important type of policy for business-owner chiropractors. This type of policy pays your business expenses if you are disabled.

Sounds great, John, you say. But, I already have this policy.

You actually don’t. Many people think that, but what they really have is business interruption insurance. That is part of your professional liability insurance or commercial insurance. It pays you for lost income if your business doesn’t operate due to damage, like a fire, or some other type of covered interruption.

interruption insurance. That is part of your professional liability insurance or commercial insurance. It pays you for lost income if your business doesn’t operate due to damage, like a fire, or some other type of covered interruption.

Business overhead expense insurance pays for your business expenses if you can’t work due to a disability. It will help pay for your:

- Rent

- Employee salaries

- Liability, commercial, and other insurances

- Property taxes

- and more

As I say, business overhead expense insurance keeps the lights on, rent paid, and employees happy.

Additionally, the premiums are tax-deductible. If you use the policy to pay for your business expenses, then the benefit is income tax-free.

Most of the time, the cost of business overhead expense insurance is very inexpensive compared to an individual policy. Contact us to learn more.

Disability Insurance For Business Loans

Paying back a loan is a serious matter.

You pay a promissory note that says you will pay back the loan…

…no matter what.

What if you get disabled? What do you think happens to those payments?

Oh, John, you say. I’ll just work with the bank or the lender on managing the payments.

You will?

How sure are you about that?

That promissory note essentially says you will pay  no matter what.

no matter what.

What if you invest in new equipment – or even a loan to purchase a new practice – and suddenly you are disabled?

Do you think the bank will let you off scot-free?

No, you say.

Right. This underscores how disability insurance for business loans protects you. It will continue your loan payments – right to the lender – with no involvement from you.

But, John, what about the individual disability insurance?

That’s for your everyday needs. That pays your mortgage and groceries. It keeps your personal lifestyle afloat while you get better.

If you assign your individual disability benefit to pay your loans, you’ll ultimately be stuck between a rock and a hard place. You will have to use your monthly benefit to pay your loan, and then will potentially have nothing to cover your everyday costs.

A disability insurance plan designed to cover your business loans does the trick. It’s generally affordable, too, because your monthly loan amount should be lower than your income.

Feel free to contact us if you have any questions. We are happy to help.

Now You Know The Best Disability Insurance To Protect Your Income Now

We hope now you have a solid idea of why chiropractors need disability insurance. In this article, we discussed underwriting, costs, and the best options for chiropractors.

Depending on your situation, you have options. We discussed individual disability insurance as well as disability insurance through your business. The plan we like provides guaranteed issue at 2 lives. That is unheard of.

We also discussed business overhead expense policies and disability insurance for business loans. These options also protect chiropractors.

Confused? Don’t feel that way. We’re here to help educate you and protect your income and future. Don’t know where to start? Use this disability insurance needs analysis worksheet. Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy).

Next, feel free to reach out to us for our assistance or a quote. Or, use the form below. We only work for you, your family, and your best interests only. We have helped many chiropractors secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Best Disability Insurance Options For Chiropractors | Your Guide To Understanding This Important Insurance”

Comments are closed.

Hey! Looking for a quote. Thanks!

On its way. Thanks for reaching out.

John