2 Reasons Why The Disability Insurance Elimination Period Is Important To Understand | Knowing This Could Potentially Save You Thousands In the Long Run

Updated: April 12, 2024 at 9:38 am

An agent talks to you about disability insurance, but then mentions the “elimination period” or waiting period.

Your eyes glaze over and that stops you from proceeding. Or, you briefly discuss it, and then you have a wrong impression of how it works.

Then, you will have a misstep down the road if you ever file a claim.

I already know what it is, John. It’s a probationary period.

Nope.

In this article, we discuss the disability insurance elimination period, but more importantly, why it is important for you to understand. (Note: we use the words “elimination period” and “waiting period” interchangeably as they mean the same thing.)

If you understand how the elimination period works with disability insurance, I guarantee you will likely save money.

Moreover, you’ll know what to expect when you make a claim.

That’s pretty important to understand, right?

At a minimum, however, you will have a better understanding to make an educated decision on the right plan structure for you.

Here are the section links for easy navigation:

- What Is The Disability Insurance Elimination Period?

- How Does The Disability Insurance Elimination Period Work?

- 2 Reasons Why The Disability Insurance Elimination Period Is Important To Understand

- Common Disability Insurance Elimination Periods

- How Does 90-Day Elimination Period Work?

- Now You Know Why The Elimination Period Is Important To Understand

Let’s jump in and clearly define the elimination period.

What Is The Disability Insurance Elimination Period?

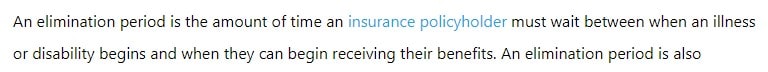

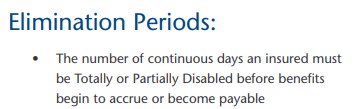

The disability insurance elimination period, or waiting period, is simply the time period (i.e. number of days) you wait between an approved injury or illness and when you are eligible for your disability benefit.

That is it.

Be aware. Many websites and other agencies state that the disability insurance elimination period is the length of time you wait before you receive disability benefits. Like this popular one:

See the difference?’

See the difference?’

Actually, many popular websites on the first page of Google incorrectly state the disability insurance elimination period this way.

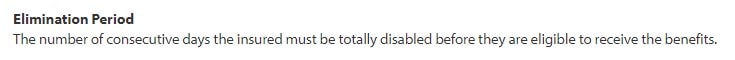

Here is a correct elimination period definition straight out of a popular disability insurance carrier’s contract:

See how different that is?

See how different that is?

It’s also not a probationary period as some people may think. A probationary period happens through your employer when you become eligible for any group plans like health insurance. It is the specifed timeframe you need to wait before you are eligible to be covered by group insurance plans.

Now is a good time to show how the disability insurance elimination period works.

How The Disability Insurance Elimination Period Works

It is easy to show how the disability insurance elimination period works with an example.

Let’s say you have a 60-day waiting period. This means you have to wait 60 days before being eligible for disability benefits (the date of an approved injury or illness and when you are eligible for disability benefits).

You are an auto mechanic. On weekends, you like to work on your lawn and garden. Neighbors say you have the best curb appeal on the block!

One day you are walking in your yard, examining your grass. Unexpectedly, you step into a hole and turn your knee awkwardly. There’s shooting pain, but then the pain goes away. You get up and walk it off. You have some pain throughout the day, but you take ibuprofen and don’t think much about it.

Until the next morning.

You are in pain. You can’t move your leg. Your wife drives you to urgent care when they take an MRI. You tore your MCL and ACL. The doctor is surprised you didn’t have much more pain.

You can’t work. That’ll be hard to do your own occupation as an auto mechanic.

You wonder what you will do. Then, you remember the disability insurance policy you have. It will pay a $3,000 monthly benefit. Your primary doctor fills out the disability paperwork and you submit the claim.

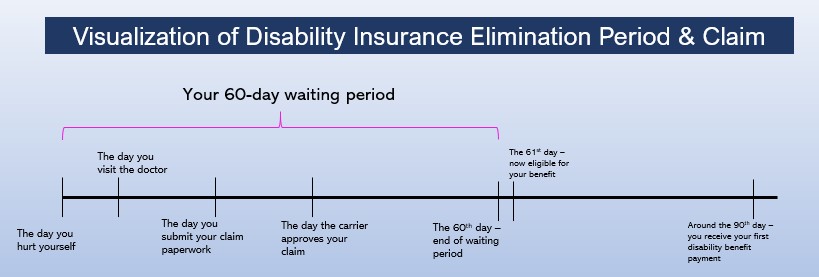

The carrier approves your claim. Here is what the timeline looks like:

So, What Is Going On Here?

So, let’s discuss what is going on with our example. First, your elimination period begins with the date of your approved disability. Most often, that is when you are diagnosed with an illness or when you hurt yourself.

Do you see all the steps above? You file the claim. Then, it is approved. Additionally, it is retroactive to the date of your injury or illness.

But, you still have to wait. You have to wait, in this case, 60 days. Again, on the 61st day of disability, you become eligible for disability benefits. If you are receiving long-term disability benefits, you will receive your first disability payment about 30 days after that. The reason is that on long term disability insurance policies, insurance companies pay every month.

This is how the claims timeline works. As mentioned, with a long-term disability policy, in this example, you will receive your first payment about 30 days after eligibility. In other words, for long-term disability policies, if you have a 30-day waiting period, expect your first payment on or around day 60 of disability. A 60-day waiting period, then is 90 days. A 90-day elimination period is 120 days. And, so on.

So, what do you do during this waiting period? Well, you aren’t working and receiving $0 disability benefits yet. So, you’d better have an emergency fund, a spouse working, or money saved during this time period.

Different types of disability insurance exist. With differences in disability insurance types come differences in the elimination period / waiting period. For example, short term disability insurance has a shorter elimination period compared to long-term disability insurance policies. (Don’t worry. We discuss short-term disability insurance and long-term disability insurance in more detail later in the article.)

You also need to know how your insurance carrier defines the elimination period. We discuss this next.

Not All Disability Insurance Waiting Periods Are Created Equal

Another source of confusion is that people assume the elimination periods on disability insurance are all the same. They are not. Moreover, they vary by insurance carrier.

Tell me. All things being equal, which carrier below would you want?

Would you want this one, on the left?

Would you want this one, on the left?

Or.

Would you select the insurance company below?

Do you see the difference?

All things being equal, you want the first one. Why? Because the insurance company counts a partial disability towards your elimination period. However, the second carrier does not.

This distinction is important as many disabilities start out as partial, which means you can work, but not full-time.

How disappointed would you be if you developed carpal tunnel, a back problem, or a debilitating illness like multiple sclerosis? You could still work, but only a few days per week. The first carrier will pay a partial benefit (after you meet the waiting period) for your disability. However, the second carrier won’t until you are totally disabled, which could be months or years away depending on your circumstances.

(Also, see how the carriers state you are eligible to receive benefits…)

Contact us if you would like to learn more. This underscores, again, why it is important to understand the disability insurance elimination period.

2 Reasons Why It’s Important To Understand The Disability Insurance Elimination Period

So far in this article, we discussed what the disability insurance elimination period is and how it works. We also provided an example that illustrates how it works.

Two reasons exist why the disability insurance elimination period is important to understand.

We discuss these 2 reasons next.

Reason #1 – It Is Very Easy To Make A Mistake

This is the first reason. We’ve spoken to many people about disability insurance. When I ask them to tell me what the waiting period is (so I know they understand), they usually say this: It’s the period of time you wait before the policy takes effect.

With most insurances, that is generally right. For example, some hospital indemnity plans, for instance, have a 30-day or 60-day waiting period upon policy issue. Or, a pre-existing condition waiting period of 12 months. This waiting period eliminates the concept of adverse selection: those who need the insurance (let’s say a recent cancer diagnosis) get it. Then, these same people might cancel shortly thereafter once they receive benefits. This then drives up the premiums for current policyholders.

But, that’s not the waiting period in this case with disability insurance.

As we said before, it is the amount of time you wait, from the date of disability, before you become eligible for disability benefits.

As I mentioned earlier, there are other websites and agencies that state it is the time you wait before you receive disability benefits.

And, unfortunately, that is not true.

Why is it important you understand the disability insurance elimination period? So, you know how your plan works. How awful would it be if you filed a claim and thought you’d receive benefits the next day?

Moreover, you can make a better, informed decision when selecting the right plan for you.

Reason #2: You Can Save Money

Who wants to save money?

If you understand the disability insurance waiting period, you can save money.

How?

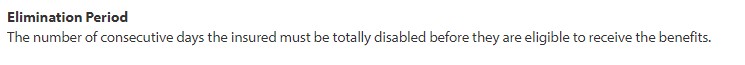

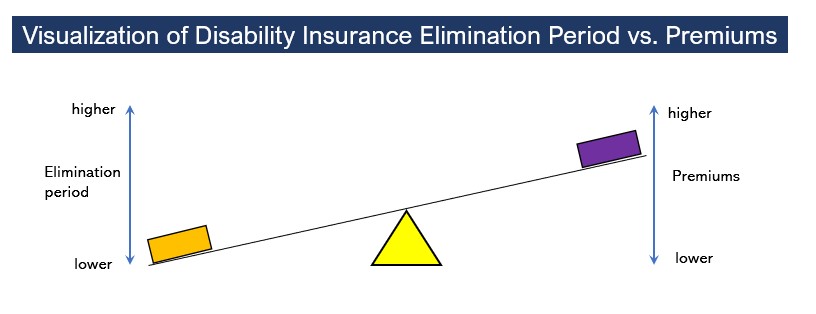

Think of the elimination period and the monthly premiums as a see-saw. The shorter or lower the waiting period, the higher the premium, and vice-versa. A longer elimination period yields a lower monthly premium, all things being equal. See below for an illustration.

See that? All things being equal, a lower or shorter waiting period yields a more expensive or higher premium. Why? Because you are receiving your benefit quicker. Conversely, a higher or longer elimination period yields lower premiums because you are delaying your disability benefits.

With most carriers, the most economical price point on a long-term disability insurance policy is a 90-day elimination period (more on that in a minute).

But, John. I need a shorter waiting period. I need my money fast.

Is a shorter elimination period right for you? Well, that depends. And, it depends on how much money you have saved.

How To View Short-Term Disability Insurance

You see, if you have a disability in the short term, ideally that disability should be covered by your savings. Remember the emergency fund I mentioned earlier?

Families run into serious financial trouble after 3 or 4 months of no income. That is why long-term disability insurance makes sense. Moreover, long-term disability insurance usually is pretty affordable.

However, short-term disability insurance – which typically has a 3 or 6-month benefit period – does not. It can be incredibly expensive, which is why we believe short-term disability insurance is a waste of money. (Note: Plans through your employer may be worth the cost. Not only are they typically cheaper, but also they usually cover maternity leave for women.). Short-term disability insurance is more expensive because it has a shorter period of time when you receive benefits.

If an agent or agency is telling you that you need short-term disability insurance, you have to question why. What you really need to do is buckle down on your spending and save that money.

Here’s an example of comparing the premium costs on a long-term disability insurance policy with different waiting periods. You’ll see what I mean.

Savings Example Of Disability Insurance Waiting Period

You can see how much short-term disability insurance costs.

Below are two example premiums for a disability insurance plan with a 30-day elimination period and a 90-day elimination period.

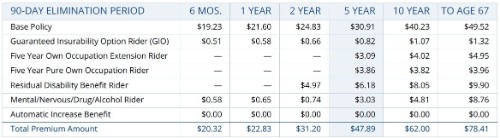

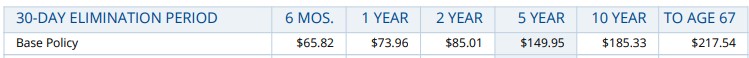

I assume a 30-year-old woman, accountant, in good health, making $100,000. Here is a 30-day elimination period:

You can see a 5-year benefit period costs almost $150 per month.

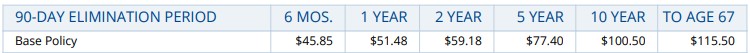

What about a 90-day elimination period?

Wow. The same 5-year benefit period on a 90-day-waiting period costs $77.40 per month. Almost half!

So, you have to determine if it is worth spending an extra $72.55 per month to get your money 60 days sooner.

Look at it this way. In 35 years, she will have spent an extra $30,000 or so for the 30-day elimination period.

That is no big deal, John, you say.

What if I told you, that if you invested that same $72.55 each month, over 35 years, you will have potentially saved $170,000 by age 65?

That’s the point I am making. I wouldn’t recommend a waiting period of greater than 90 days unless you have significant savings. However, you are giving up a lot of potential savings if you want a 30-day waiting period.

This also underscores the point about short-term disability insurance. You really don’t need it. You need to have 3 months of household expenses covered through adequate emergency savings.

Common Disability Insurance Elimination Periods

Here are some common disability insurance elimination periods you will see with short-term disability insurance and long-term disability insurance.

As we said, we believe short-term disability insurance isn’t worth the money. But, we address its elimination periods here should you decide to purchase a plan yourself or through your employer, if available.

The main differences between short-term and long-term disability insurance are many, including the waiting period.

Common Short-Term Disability Insurance Waiting Periods

Here are the most common short-term disability insurance elimination periods:

- 0/7 – the “0” refers to the waiting period for an accident and the “7” means the waiting period for an illness. In other words, you will have an immediate benefit upon a disability via an accident and eligibility on the 8th day due to an illness.

- 0/14 – 14 day waiting period on illness

- 14/14

- 30 days

The “see-saw” example applies here as well. The shorter the waiting periods, the higher the premiums, all things being equal However, you’ll receive your short-term disability benefits sooner.

With short-term disability insurance, you typically receive the benefits weekly.

Common Long-Term Disability Insurance Elimination Periods

With long-term disability insurance, the waiting periods are (subject to state law):

- 30 days

- 60 days

- 90 days

- 180 days

- 365 days

- 730 days

As mentioned before, I generally don’t recommend a 30-day waiting period. Moreover, I usually don’t recommend a 180, 365, or 730-day waiting period, either. While the “see-saw” example holds true, the savings (generally speaking) by going from a 90-day waiting period to 180, 365, or 730 are immaterial (usually).

How Does The 90-Day Elimination Period Work?

The 90-day waiting period is the most common elimination period on a long-term disability insurance policy. The reason is that it is usually the most economical price point insurance companies offer.

With a 90-day elimination period, you basically don’t receive any disability benefits until about 120 days after the date of disability (upon approval of the long-term disability claim).

So, you have to make sure you have adequate emergency savings for this time period (hence, the waiting period).

John, I have enough money saved up for a 180-day elimination period. I’ll just get that.

Sure, that, is great.

However, there usually is no material premium difference between a 90-day waiting period and a 180-day elimination period.

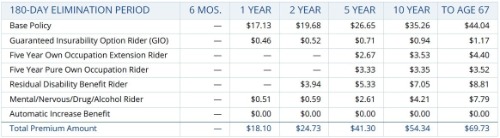

Check out this example for a 30-year-old woman.

You can see the 180-day elimination period is only a few dollars less per month. Unless you are subject to any state disability insurance plan (outside the scope of this article), then a 180-day elimination period usually doesn’t make financial sense, even if you have significant emergency savings.

Now You Know How The Disability Insurance Elimination Period Works And Why It Is Important To Understand

We hope you learned what the disability insurance elimination period is, how it works, and why it is important to understand. To recap:

- Most people mix up the definition with waiting periods on other types of insurance. The waiting period on disability insurance is completely different compared to other types of insurance.

- Carriers have different definitions themselves.

- You can save money if you know how the disability insurance elimination period works.

Would you like our assistance or have questions? Feel free to contact us or use the form below. We are happy to review any policies you have or discuss your situation.

Unlike other agencies, we have your best interests first. There is no risk of contacting us. If we can’t help you, we will point you in the right direction as best we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".