Does Life Insurance Pay For Funeral Costs? [Yes, Here’s How] | The Ultimate Guide to Paying for Funeral Costs with Life Insurance

Updated: April 12, 2024 at 9:38 am

Does life insurance pay for funeral costs and expenses? Many people ask me this question.

Does life insurance pay for funeral costs and expenses? Many people ask me this question.

The answer is “yes”. Life insurance will pay and cover funeral expenses.

However, like anything, there is a right way to go about having your life insurance cover your funeral costs and a wrong way.

We discuss the right way and how to go about setting up your life insurance to pay for your future funeral expenses and costs.

In this article, we will discuss:

- Does Life Insurance Pay For Funeral Expenses?

- 2 Ways To Structure The Life Insurance Death Benefit

- The Advantage Of Life Insurance

- What Types Of Life Insurance Will Pay For Funeral Expenses?

- How Much Does A Funeral Cost?

- Other Options To Pay For Your Funeral

- How To Enroll In A Life Insurance Policy

- Final Thoughts

Let’s discuss further life insurance paying for funeral costs.

Does Life Insurance Pay For Funeral Expenses?

Yes, life insurance will pay for funeral expenses and costs. The life insurance company pays out a death benefit. Your beneficiaries can use the death benefit amount for anything, including paying for funeral and final expenses such as medical bills and outstanding debts (also known as end-of-life expenses).

Having the life insurance pay for funeral and burial costs takes a huge financial burden off of remaining family members and loved ones. As a CFP® Professional, I generally recommend clients use life insurance to pay for funeral and burial costs.

Why do I recommend life insurance? Life insurance has 3 main advantages that other options don’t have. We discuss these advantages later in the article.

But, John. A friend of mine had a policy that didn’t pay for any funeral costs!

I hear this a lot. This generally isn’t true. However, if this statement is true, the reason is that the insured/owner set up the life insurance policy the wrong way (or had the wrong type of policy).

In order to discuss the right way to pay for a funeral using life insurance, let’s first introduce how life insurance works.

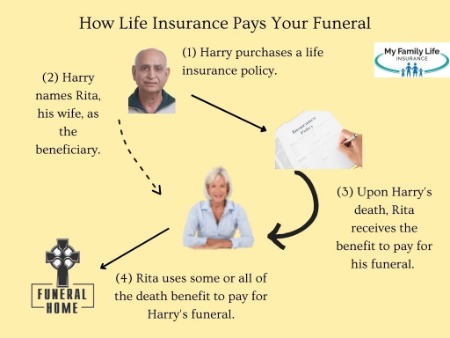

How Life Insurance Works

Life insurance is really a simple mechanism of wealth transfer or money transfer.

The insured is the person whose life is covered. When the insured passes away, the life insurance carrier pays out the death benefit to a named beneficiary. The named beneficiary is the person who receives the life insurance payout. Usually, this payout is paid as a lump sum.

The owner of the life insurance policy controls the policy. He or she can change the beneficiary to someone else and payment methods, for example. Usually, the owner of the policy is either the insured or the beneficiary.

The owner of the life insurance policy controls the policy. He or she can change the beneficiary to someone else and payment methods, for example. Usually, the owner of the policy is either the insured or the beneficiary.

Take a look at this simple example about Harry. Harry buys a life insurance policy on himself (so he is both the insured and owner) and names his wife, Rita, as the named beneficiary. Upon his death, Rita contacts the life insurance company. She submits the claim information along with the death certificate. She receives the life insurance proceeds (i.e. death benefit) a week later.

As the beneficiary, she can use this money however she wants to. She uses part of it to pay for Harry’s funeral.

Now that you understand how life insurance works, let’s discuss the proper ways to pay for funeral costs using life insurance.

2 Proper Ways To Structure The Life Insurance Death Benefit To Pay For Funeral Expenses

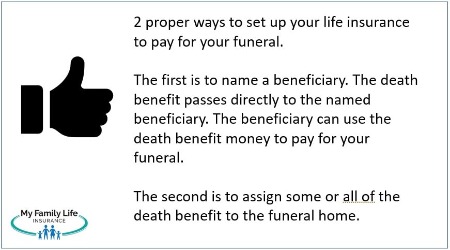

Two main ways exist to pay for funeral expenses. There is a 3rd that exists that we will touch on.

The Named Beneficiary Pays The Funeral Costs

The first, and more common, way to pay for funeral costs is through your named beneficiary. We illustrated this in the example and diagram above with Rita.

The beneficiary, in turn, pays the funeral home the cost of the funeral.

However, the underlying assumption here is you have a responsible beneficiary who will pay the funeral costs. Now, most people do – a beloved spouse or children. However, as I stated earlier, a beneficiary can, technically, do anything with the money. Conceivably, he or she can spend it on a trip and let your remaining loved ones figure out how to pay for your funeral!

who will pay the funeral costs. Now, most people do – a beloved spouse or children. However, as I stated earlier, a beneficiary can, technically, do anything with the money. Conceivably, he or she can spend it on a trip and let your remaining loved ones figure out how to pay for your funeral!

One way around this is to start your funeral planning before you pass away. If you are already covered by a life insurance policy, you essentially have the money for your funeral already.

You can visit your local funeral home and speak with the funeral director. One of the first things the funeral director will want to know is how you will pay for the funeral. I recommend bringing the life insurance policy and your beneficiary to this meeting. The funeral director will likely want a copy of the insurance declarations. He or she will also ask if you could assign the death benefit to the funeral home. We discuss this next.

(Related: see our article on life insurance beneficiary mistakes.)

Assignment Of The Death Benefit To The Funeral Home

Assigning part of the death benefit to the funeral home might be a better option. This means you assign part of the life insurance death benefit to the funeral home.

John, can’t I simply name the funeral home as the beneficiary?

Good question. While some carriers allow entities to be a beneficiary, most do not. The proper way of naming an entity as a beneficiary is through an assignment of the death benefit.

Let’s use Rita from our example above. Let’s say she and Harry went to the funeral home a year before Harry’s death and set up their funerals. Harry has a $50,000 burial insurance policy on his life. His funeral will cost $15,000. For ease, Harry assigns the funeral home $15,000 of the death benefit. The remaining $35,000 goes right to Rita.

The benefit of this process is ease. Rita doesn’t need to coordinate the payment to the funeral home. Harry’s funeral is, essentially, pre-paid by the assignment.

Life insurance companies have assignment forms. The owner of the policy fills out the form and notes the entity (in this case, a funeral home) as the assignee and the death benefit amount assigned.

Note that there are a couple of types of assignments. You will want a collateral assignment. The benefit of the collateral assignment is that it can be rescinded, removed, and/or changed by you, the life insurance policy owner. Let’s say your children move to Arizona, and you want to be closer to them. You can rescind the assignment with the current funeral home and create a new assignment with a different funeral home in Arizona.

How great is that? What an advantage.

This might be a good time to discuss why life insurance is the best way to pay for funeral expenses.

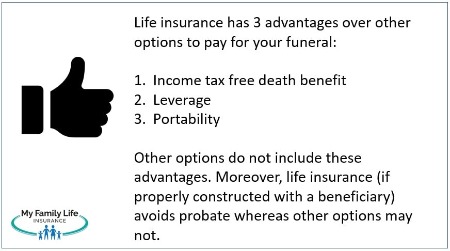

3 Advantages Of Life Insurance To Pay For Your Funeral

Three advantages exist with life insurance, which makes it a perfect conduit to pay for funeral expenses.

We will discuss other options, but life insurance stands out as the best way (in my opinion, and I balance that opinion against other options below) to pay for funeral costs.

#1 Use Of Leverage

I know what you are going to say.

John, I already have my funeral saved in a checking account! I have $15,000 saved.

Good. For reasons I’ll explain later, this can be a bad decision.

With life insurance, you can use a small premium to get that $15,000.

For example, a 65-year-old woman could spend $60 per month on a $15,000 whole life insurance policy.

If she passes away at age 67, her family receives $15,000 and she will have spent $1,440 (24 X $60).

Let’s say she passes at 85.

I call this leverage. You are using a small premium for a larger potential benefit.

You can save that $15,000 for other things in your life.

#2 Income Tax-Free Death Benefit Payout

One overlooked advantage of life insurance is the income tax-free death benefit.

In other words, upon your passing, your beneficiary (or the funeral home if you assigned the death benefit to the funeral home) receives the death benefit and pays no tax on it.

The income tax-free status of the death benefit is a huge advantage over other options.

As we will discuss later in the article, other savings options could subject the beneficiary to tax implications.

#3 You Can Take The Life Insurance Anywhere

Another advantage of life insurance is that it is yours. It doesn’t belong to anyone, but you (assuming you are the owner as well).

You can go to any funeral home and set up your funeral. The “portability” of life insurance is another advantage. As we described earlier, you already have the funds and method (the life insurance) to pay for your funeral services and expenses.

We will discuss this important aspect in more detail later.

What Types Of Life Insurance Will Pay For Funeral Expenses?

All types of life insurance can pay for funeral expenses. These types of life insurance include:

- term life insurance

- permanent life insurance policies such as whole life insurance and universal life insurance

- burial insurance

These types of policies can pay for the cost of your funeral. As we described above, your beneficiaries will have that life insurance death benefit payout to pay for the funeral.

Many people know what term life insurance and whole life are. Burial insurance is a new term. Let’s talk about burial insurance policies in more detail next.

How Do Burial Insurance Policies Pay For Funeral Costs?

I’m sure you heard of burial insurance. But, what is burial insurance?

A burial insurance policy is simply a type of whole life insurance policy with a small death benefit like $10,000; $25,000; or even $50,000. Like a traditional whole life policy, burial insurance contains cash value.

This type of policy is designed to pay for your funeral and burial costs. Hence the name “burial insurance”.

These policies are also called:

- final expense insurance

- funeral insurance

- final expense life insurance

- end-of-life insurance

They all mean the same thing. They are whole life policies designed to pay for your funeral costs (and anything else; money to your loved ones. See my example with Rita and Harry above.)

The advantages of these burial insurance policies include:

- very easy to apply for. Usually, no medical exam is required. Burial insurance policies accept many types of health conditions as well as lifestyle situations.

- designed to pay for your funeral. Most of the life insurance carriers that offer burial insurance policies allow the assignment of the death benefit to a funeral home.

- generally affordable. People who are on a tight budget usually can afford these policies.

This all sounds good, John. But, how much should I be applying for?

Let’s discuss this next.

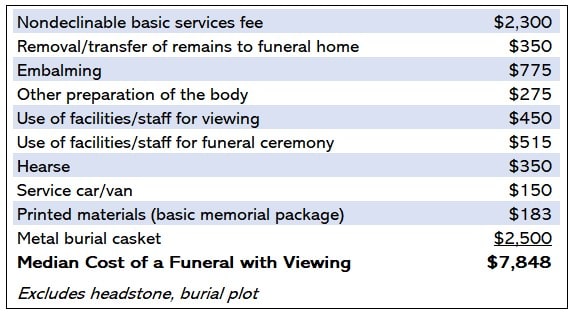

How Much Does A Funeral Cost?

The National Funeral Directors Association states that the average cost of a funeral is $7,848.

However, this average varies across the country as well as your needs and wants.

For example, the cost of a funeral is different in Massachusetts compared to Alabama.

Moreover, the cost of the burial plot and memorial service aren’t factored into these costs.

I always recommend an amount that is the highest you can afford and above this $7,848 average. Did you want to search for preliminary burial insurance costs? Feel free to use the quoter below. Just input some basic information about yourself and search. You can contact us if you have any questions.

Other Options To Pay For Your Funeral

Other options, other than life insurance, exist to pay for your funeral.

I do think life insurance is the best option to pay for your funeral; however, some of these other options can work as well.

Funeral Trust

Funeral trusts work very well in paying for your funeral because that is one of their intentions! One of the advantages of a funeral trust is that the carrier pays the death benefit directly to the funeral home.

Funeral homes like funeral trusts because of the ease and quickness of receiving the funds.

Funeral homes like funeral trusts because of the ease and quickness of receiving the funds.

Great, John. I am going to sign up!

Not so fast. Funeral trusts are really designed for someone to qualify for Medicaid very quickly. If you have spendable assets like retirement accounts, checking accounts, investment accounts, and even permanent life insurance policies like whole life, Medicaid essentially forces you to spend these assets down to qualify for Medicaid.

You transfer the spendable assets into the funeral trust. By doing so, and retitling the assets to the funeral trust, you have just moved spendable assets to a non-spendable status and qualify for Medicaid.

The assets in the trust grow at a nominal interest rate. It’s not life insurance. The funeral trust is more like an annuity.

Upon your death, your loved ones contact the carrier and direct the carrier to mail the check to a specific funeral home.

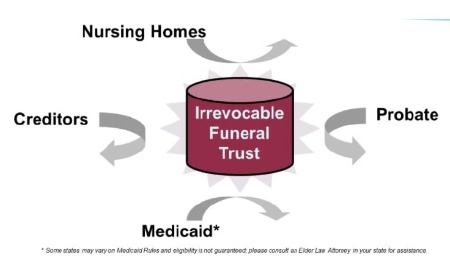

Creditors, Medicaid, the IRS, and even you…no one has access to the money in the funeral trust except for the funeral home. Like life insurance, the money in the funeral trust avoids probate and goes right to the funeral home of your choice.

The funeral trust is portable and easy to set up. No underwriting exists. It is guaranteed issue.

Feel free to contact us if you have questions.

POD Account

Some people select a POD account and think it is related to paying for funeral services.

It isn’t.

However, a POD Account is one way to pay for your funeral, provided you have trusted loved ones. More on that in a minute.

POD stands for “Payable On Death”. This designation is really used by banks and financial institutions. With this designation, your assets transfer to a named beneficiary outside of probate. Avoiding probate is the main reason people use POD account designations.

Just like life insurance and funeral trusts, POD-designated accounts avoid probate; however, these accounts generally do not avoid any tax implications. In other words, your beneficiary will pay some tax on that account. It is important you speak to a qualified tax advisor about any tax implications on POD accounts upon your death.

Recall that life insurance (and funeral trusts) have no income-tax implication to the named beneficiary.

FYI, if you have a stock brokerage account, a Transfer On Death designation works the same way. The designation passes your stock brokerage account to a named beneficiary and allows the account to avoid probate. However, just like a POD account, a TOD account may face tax implications whereas life insurance will not.

Pre-Need Insurance

Pre-need insurance is another option.

What is pre-need insurance? It is a fancy description of purchasing a funeral plan directly from the funeral home. It is typically a whole life insurance policy with specific modes of payments such as:

directly from the funeral home. It is typically a whole life insurance policy with specific modes of payments such as:

- lump sum, single payment

- 3-year payment

- 5-year payment

- 10-year payment

These types of plans are specific to funeral homes, mortuaries, etc.

While a pre-need insurance plan seems like a good choice, there are better choices in my opinion. (Note: I am a CFP® Professional and hold fiduciary duty, which means I place your interests before my own.)

One disadvantage of a pre-need insurance plan is that it is tied directly to a funeral home. What if you want to switch funeral homes? Well, the plan usually doesn’t go with you. It is non-transferable.

Additionally, if the funeral home goes out of business, so goes your pre-need insurance as well.

Life insurance, in my opinion, is the best choice as it provides more flexibility/portability, an income tax-free benefit, and uses leverage.

John, a friend of mine says he is using an annuity for life insurance. What about that?

Good question. Let’s discuss annuities next.

Can Annuities Pay For Funeral Expenses?

Yes, annuities can pay for funeral costs and expenses. Annuities contain a beneficiary designation. As long as you name a beneficiary (and not yourself), the money inside the annuity goes right to the named beneficiary. It will avoid probate.

However, it won’t avoid any tax implications. In other words, your beneficiary will have to pay income tax on the annuity.

The money inside the annuity grows tax-deferred. That means the owner doesn’t pay any tax during this “accumulation phase”.

If the money in the annuity hasn’t been “annuitized” (that is, paid out as an income stream to the owner), then the beneficiary receives the accumulated value. Moreover, the beneficiary will face a possible income tax.

The income tax impact would be on the gain in the policy (the difference between the total value and the investment basis in the annuity). This difference is then taxed at ordinary income tax rates.

For example, Joe receives a $90,000 annuity from his deceased father, who paid $50,000 for the annuity. Joe will likely have to pay income tax on the $40,000 gain.

Moreover, annuities do not receive a “step-up basis” like other investments currently do upon the owner’s death.

The tax implication of annuities shows that life insurance still remains the best option to pay for your funeral.

How To Enroll In A Life Insurance Policy

Nowadays, it is very simple to enroll in a life insurance policy. Many carriers offer a “DIY, instant decision term life insurance“. If you are generally healthy and have no lifestyle issues like skydiving, you can apply here: Integrity4Life

Nowadays, it is very simple to enroll in a life insurance policy. Many carriers offer a “DIY, instant decision term life insurance“. If you are generally healthy and have no lifestyle issues like skydiving, you can apply here: Integrity4Life

Of, you can just contact us.

However, if you are looking for a specific type of life insurance to pay for your funeral expenses, burial insurance works great.

Burial insurance is easy to apply for. You just:

- contact us

- tell us your situation including any medication you are on and health conditions

- we analyze your options

- we go over a recommended plan and prequalify you with the carrier’s health questionnaire

- you apply with us (over the phone)

- typically, as long as you were upfront with your situation, you are approved

It is pretty simple and takes maybe 30 minutes, typically.

As we stated earlier, you can then have a loved one as a beneficiary or assign part (or all) of the death benefit to a funeral home.

Now You Know How Life Insurance Carriers Pay Out Your Funeral Costs And Expenses

Now you know that life insurance can pay your funeral costs and expenses.

We discussed 2 ways to structure your life insurance to pay for your funeral expenses. The first, and most common, way is to have a trusted loved one as the beneficiary. Upon your death, your beneficiary can pay for your funeral expenses from the death benefit he or she receives.

The second is assigning part (or all) of the death benefit to the funeral home. Many burial insurance policies allow assignment.

We also discussed the advantages life insurance has compared to other vehicles that pay for your funeral expenses.

Do you have any questions or need assistance with getting a policy? Contact us or use the form below. We don’t call you a thousand times per day, and you can always tell us to stop contacting you, no problem.

We only work in your best interests. That means we place your needs first, not our own. There is no risk of contacting us.

Moreover, if there is a better option available to you that we can’t offer, we will tell you that and point you in the right direction as best we can.

You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".