A Solid And Affordable Disability Insurance Option For Christians

Updated: April 12, 2024 at 9:39 am

There are many disability insurance carriers here in the United States. Did you know that an insurance carrier offers disability insurance for Christians?

There are many disability insurance carriers here in the United States. Did you know that an insurance carrier offers disability insurance for Christians?

It’s true.

While nearly all the carriers don’t require any specific religious denomination, we work with a carrier that caters to Christians.

So, if you are a practicing Christian, you have peace of mind knowing that a carrier supports your beliefs.

Moreover, the plan is pretty solid in my opinion.

We will go through all of that. The plan also has very competitive premiums.

Here’s what we will discuss:

- The Requirements For Disability Insurance

- Advantages & Disadvantages Compared To Other Plans

- Unique Options Available

- Example Costs

- Final Thoughts

Let’s jump in now and discuss the requirements for the disability insurance.

Requirements For The Disability Insurance Plan For Christians

The carrier requires a condition for the disability insurance.

You must be a practicing Christian.

You can’t be halfway. Also, having a Christian upbringing isn’t a qualification. Nope, you have to be a practicing Christian now. Then, you can apply.

The carrier requires a form, completed and signed by you, attesting to such.

John, I’ve heard of this. This is the manna disability insurance sharing program!

Nope. It’s not.

The carrier is a Christian carrier and offers insurance products, including disability insurance, to practicing Christians.

In other words, the carrier accepts any Christian denomination. That means:

- Catholics

- Baptists

- Methodists

- Episcopalians

- and on…

…are all accepted.

Of course, you still need to meet the additional typical requirements for disability insurance. For instance, you need to work, have gainful employment, meet the health underwriting, etc.

Moreover, for approval, you’ll have to meet the carrier’s underwriting requirements.

Nevertheless, you’ll need to be a practicing Christian to apply with this carrier.

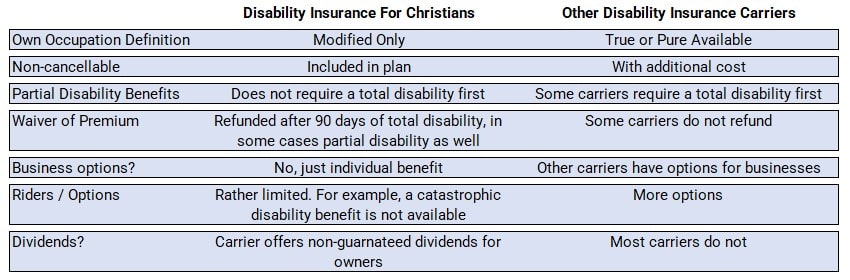

Advantages & Disadvantages Of The Disability Insurance For Christians Compared To Other Plans

I mentioned before that the disability insurance plan for Christians is pretty solid.

However, like any insurance, advantages and disadvantages exist.

Here’s a good comparison chart between the disability insurance plan for Christians and other plans.

(Note: you can enroll in any one of these competitors if the Christian disability insurance isn’t a right fit.)

(Note: you can enroll in any one of these competitors if the Christian disability insurance isn’t a right fit.)

The plan offers the typical 30,60, and 90 elimination periods with up to age 67 benefit period (subject to underwriting, of course).

If you’ve read my other articles about disability insurance, then you know I talk about “non-negotiable” provisions in every plan.

These “non-negotiables” include:

- own-occupation definition

- enhanced partial disability benefits

- future/guaranteed purchase options

The plan offers these valuable and formidable provisions.

However, a drawback is that the plan doesn’t offer any extra benefits for self-employed business owners. For example, occupation class upgrades or enhanced monthly benefits are not available. Other carriers do offer these.

Also, they only offer the modified own occupation definition of disability. That’s not a bad thing. Having the modified own occupation definition is still good.

Additionally, they don’t offer business-specific disability insurance applications like business overhead expense insurance, business loan disability insurance, buy/sell agreements, etc.

The plan is beneficial for occupation classes 3 and above.

However, that doesn’t mean an occupation class 2 (like a plumber) is bad. It just means benefits are a little more limited. Moreover, that limitation is similar to many carriers.

Let’s discuss some of the unique features of this plan next.

Unique Features Of The Disability Insurance For Christians

There are many unique features of the disability insurance plan for Christians.

First, it is favorable to many occupations including, but not limited to:

- Dental hygienists and dental assistants – class 3 whereas other carriers at a class 2

- Bartenders – insurable occupation whereas many other carriers do not insure

- Nannies – insurable occupation at a class 2 whereas other carriers do not insure

- Pawnbrokers – insurable occupation whereas other carriers do not insure

- Oil and gas industry workers – insures many occupations in this industry whereas other carriers do not

- Stay-at-home parents / homemakers – insurable whereas many other carriers will not insure

- Part-time workers – they will insure people who work between 10 and 24 hours per week with a part-time disability insurance plan. Many carriers will only insure individuals who work 30 or more hours per week.

Additionally, the carrier also has some unique plans for individuals.

A mortgage option – is really designed for self-employed professionals who do not qualify based on income or who do not want to provide a tax return. You can apply your monthly mortgage amount + $750, not to exceed a $2,000 monthly benefit. This is like disability insurance mortgage protection.

A clergy compensation plan – will consider a clergy or minister’s compensation as:

- Fixed salary, plus

- Housing allowance, plus

- Utilities allowance

Many other carriers, while they will insure clergy and ministers, will only base their monthly benefit on the clergy’s fixed salary.

Example Costs

As we discussed in previous articles, the premium you pay is dependent on underwriting.

Disability insurance underwriting includes:

- Age

- Health

- Occupation

- Lifestyle choices

- Health Conditions

- Your Income/Salary

The carrier then bases its premium on this risk.

All of the carriers are all different in their underwriting, claims, and premiums.

The disability insurance for Christians typically offers premiums less than that of comparable carriers.

Here’s a recent person we helped. She is a 38-year-old, female non-smoker, and works as a hairstylist (class 2).

We insured her through the Christian carrier with a $2,000 monthly benefit, 90-day waiting period for $56.81 per month. As we discussed, the plan has the modified own occupation definition and partial disability benefits.

A comparable carrier we use, for a similar plan, however, would cost $73.48 per month, with a similar modified own occupation definition and partial benefits.

A comparable carrier we use, for a similar plan, however, would cost $73.48 per month, with a similar modified own occupation definition and partial benefits.

This underscores a couple of points:

- The price competitiveness of the disability insurance plan is for Christians

- How working with My Family Life Insurance gives you the best options for your needs and situation

Remember, too, that the price of disability insurance is about a cup of coffee per day. Sure, your cost could be a little more or less depending on your situation. However, it is still about a cup of coffee per day.

Final Thoughts And How My Family Life Insurance Can Help

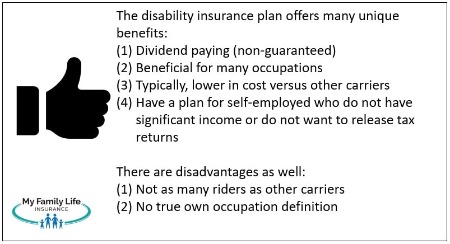

We hoped you enjoyed this article and learned a little more. There is an insurance carrier that offers insurance products, including disability insurance, to Christians.

The plan is very competitive and contains the 3 important provisions needed in every plan:

- own-occupation definition (modified, in this case)

- future/guaranteed purchase options

- enhanced partial benefits

Additionally, the carrier offers unique options for certain occupations.

Do you have questions or want to get started?

Contact us or use the form below.

As we always say, there is no risk in contacting us. We always work in your best interest. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".