3 Ways Stay-At-Home Moms And Homemakers Can Easily Get Disability Insurance | We Discuss Plan Options, Underwriting, And Costs

Updated: April 12, 2024 at 9:39 am

Let’s talk about disability insurance for stay-at-home moms and homemakers.

It doesn’t exist, you say.

Says who?

My finance guy. Plus, I’ve read that elsewhere. Stay-at-home parents don’t earn an income, so they can’t obtain disability insurance.

That’s not true. I am here to tell you that stay-at-home moms and homemakers can obtain disability insurance.

In fact, there are 3 ways stay-at-home moms and homemakers obtain disability insurance.

How great is that? We all know stay-at-home moms and homemakers are the unsung heroes of a family’s life.

If you are a stay-at-home parent, have you ever thought about what would happen if you became sick, ill, injured, and disabled?

Who could look after the kids or help around the house if you can’t get out of bed?

What would happen if you are sick or hurt for 6 months, a year, or longer?

How does that affect your spouse?

Disability quickly affects your future plans and the lifestyle your family together worked so hard for. In this article, we discuss disability insurance and the best disability insurance for stay-at-home moms and homemakers.

Here’s what we will discuss:

- Some Basics About Disability Insurance

- Important Policy Characteristics For Stay-At-Home Parents

- 3 Ways To Obtain Disability Insurance

- Brief Overview Of Underwriting

- Estimated Costs

- FAQs About Disability Insurance

- Final Thoughts About Disability Insurance

Let’s jump in and discuss some basics about disability insurance.

Basics About Disability Insurance For Stay-At-Home Moms And Homemakers

We’ve written about disability ad nauseum. A disability happens more than you think. Contrary to popular belief, a disability isn’t just someone in a wheelchair. For a stay-at-home parent, a disability could be:

- Cancer

- Torn ACL

- Lower back issues

- Severe accident

- Mental breakdown

- Multiple Sclerosis

- Early onset Alzheimer’s

The list goes on and on…

The possible disabling situations are almost infinite. In fact, the SSA says that 1 out of 4 20-year-olds will be disabled before retirement age. Other websites state that 1 out of 5 workers will be disabled for longer than a year. Additionally, 30% of workers between the ages of 25 and 65 will be disabled for longer than 3 months.

Disabilities Can Last A While

Disabilities Can Last A While

Disabilities can last a long time. The claims departments I speak with say that, generally, most disabilities are under a year. However, some last longer. In fact, I have spoken to some people who were on a claim for 5 years!

You have to answer some serious questions. If you are disabled…

Do you have the money to hire help?

Who can take the kids to appointments, school, etc.?

If you look after an older parent or sibling, who can take care of him or her?

What is the strain like on your spouse?

The questions go on and on…

Disability insurance solves all this. Disability insurance pays a dollar benefit if you are sick, hurt, or ill and can’t do your job.

“As a stay-at-home parent, your job, in this case, is your ability to maintain your homestead. If you can’t do that, the disability insurance pays you a benefit. It is that simple. “

You can use this dollar benefit to hire help, housekeeping, childcare, a cook, or whatever you want.

Contrary to what others say, stay-at-home moms and homemakers can obtain disability insurance.

At one point, even Dave Ramsey, via his website, said that stay-at-home parents can’t obtain disability insurance. (Note the link now redirects to information about the importance of disability insurance.)

Let’s discuss some important policy attributes next.

Important Disability Insurance Policy Characteristics For Stay-At-Home Moms And Homemakers

So, we now know stay-at-home moms and homemakers can obtain disability insurance. But, what kind of policy can you get?

Before we discuss those options, let’s first discuss some policy characteristics. It’s important to level set so you know what to expect.

It’s important to note that the policies available to stay-at-home moms and homemakers won’t have all the “bells and whistles” compared to policies designed for working spouses.

However, as I tell these stay-at-home parents, you don’t need all these “bells and whistles”. You just need a policy that pays a benefit if you are sick or hurt and can’t maintain your household.

Definition Of Disability

The first, and important characteristic, is the definition of disability. Most of the plans we work with for stay-at-home parents contain the modified own occupation definition.

This definition is important. It means if you can’t do your job (in your case, as a homemaker), the plan pays a benefit. You just can’t be receiving an earned income from another job. This shouldn’t be an issue for stay-at-home moms and homemakers unless they are working part-time somewhere (more on that in a minute).

Portability

The plans we work with are portable. So, what happens if years down the road, you are now working and then disabled?

The plan still pays you a benefit based on your inability to do your own occupation. In this case, it is based on your current occupation, not the stay-at-home mom or homemaker status when you applied.

Let’s say you are now a vet tech and disabled from a dog bite. Since your own occupation now is a veterinary technician, the plan pays you a benefit, even though years prior, you applied and were approved as a stay-at-home parent.

This portability is an important aspect of obtaining disability insurance now.

Many stay-at-home parents don’t consider working down the road, but this portability proves invaluable.

Partial Disability Benefits

Most plans we work with also contain valuable partial disability benefits. A partial benefit is when you are still working, but not full-time.

This important attribute likely won’t affect stay-at-home moms right off the bat. Plans require a proven income loss for the disbursement of partial benefits. So, if a disability occurs for a stay-at-home spouse, it likely has to be a total disability in nature.

However, what happens if the stay-at-home spouse returns to work? This attribute then proves invaluable.

Many disability insurance plans for stay-at-home moms and homemakers offer partial benefits. However, you have to read the fine print. They state that partial benefits will be paid only after a total disability. This can be a troubling situation. Let’s say you are back at work and you develop carpal tunnel. This is a potentially disabling situation that may start out as a partial disability. However, you won’t receive a benefit until the carpal tunnel forces you to completely miss work.

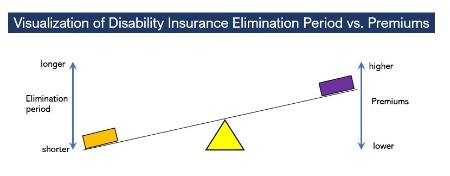

Elimination Period And Benefit Period

The benefit period is one difference between plans for stay-at-home moms and plans for working spouses.

Most plans limit the benefit period for stay-at-home moms and homemakers to 2 years. This means when you file a claim, you have up to 2 years to receive a benefit for that claim.

Two years may seem like a short time. However, 2 years is a long time to be disabled.

However, you don’t receive your benefit on day 1 of an approved claim. First, you have to get through the elimination period or waiting period. Just as it sounds, upon an approved claim, you wait a fixed number of days before being eligible to receive disability benefits. You don’t receive any benefit during this time period. The purpose of the waiting period is to eliminate really, really short-duration claims. (Note: short-term disability insurance does exist for stay-at-home moms and homemakers. We talk about this option later in the article.)

Stay-at-home moms and homemakers can select a 30, 60, or 90-day waiting period. Many of our stay-at-home clients select a waiting period in this range. Higher waiting periods exist, but I don’t recommend those unless your family has significant savings. Think about it, can your homestead continue like normal if you are disabled? Probably not. So, why wait any longer to receive a benefit?

3 Ways Stay-At-Home Moms And Homemakers Obtain Disability Insurance

Stay-at-home moms and homemakers have 3 disability insurance options.

But, John. I don’t earn an income. I spoke to a carrier that told me I am not eligible because I don’t earn money.

That’s true. Nearly all carriers decline applications for stay-at-home spouses because of that very reason.

However, we work with several carriers that do not require an income for stay-at-home spouses.

How great is that?

We discussed these next.

#1 Social Security Disability Insurance

One option is social security disability insurance. This is the disability insurance through the Federal government, Social Security Administration.

If you’ve worked 40 quarters (essentially 10 years) and have paid taxes into the SSA, you are likely eligible for disability benefits from the Social Security Administration.

However, don’t jump for joy.

Receiving disability benefits from the SSA is extremely difficult. Here’s why:

- They use a much stricter definition of disability. Essentially, if your case manager feels you can do any job, you won’t receive any benefits. See this story.

- About 65% to 70% of applicants are denied the first time. I spoke to one woman who said it took her 5 years to qualify for disability benefits from the SSA. At that point, her disability became so great that she could not work at all.

- There is a 5-month waiting period before receiving benefits.

- They only cover total disabilities. They do not cover short-term or partial disabilities. Maybe rather moot, but if you go back to work, you want partial disabilities on your plan. We just discussed the importance of partial disability benefits.

Imagine not receiving a benefit for 1, 3, or 5 years because the SSA feels you can work, even though your disability precludes you from doing most jobs.

I do not recommend SSDI as your only option. We will discuss SSDI more later in this article.

#2 Disability Insurance Tied To Your Working Spouse

Some carriers offer disability insurance for stay-at-home moms and homemakers, but only as an “attachment” to a working spouse’s plan.

In other words, the working spouse needs to apply for his or her own individual disability insurance plan. Then, the carrier will accept an application from the stay-at-home parent.

Some carriers are rather restrictive in their requirements for the working spouse. For example, one carrier states that the working spouse must apply for a minimum $4,000 monthly benefit.

Well, if the working spouse has disability insurance through work, then a supplemental disability insurance plan may not yield the $4,000 to qualify the stay-at-home spouse.

We At My Family Life Insurance Have Options

However, we at My Family Life Insurance have options.

First, we work with a plan that will allow any amount of monthly benefit on the working spouse. The monthly benefit could be $500 for the working spouse, and the stay-at-home spouse qualifies for a disability plan.

The plan offered is a solid one. The stay-at-home parent can purchase up to $1,000 monthly benefit. The definition of disability is the modified own occupation as we discussed earlier. Moreover, there are important partial disability benefits in this plan if the stay-at-home parent decides to return to work.

You may not think $1,000 ($12,000 annually) is a lot, but when a stay-at-home mom or homemaker is hurt or sick, $1,000 goes a long way.

We also have access to a short-term disability insurance plan that offers a stay-at-home spouse benefit.

John, you said short-term disability insurance is a waste of money.

Yes, I did. I did write that short-term disability insurance is a waste of money. I made the point that emergency savings are a “short-term disability insurance plan”. It still is the most efficient, cost-effective way.

Moreover, the plan that was offered at the time of my article was incredibly expensive. As I say, there was no “juice” (i.e. benefits) with that “squeeze” (i.e. premiums).

However, a new plan is available. Premiums are much, much more reasonable for the benefit.

The stay-at-home parent can enroll up to $250 in weekly benefits. The waiting period and benefit period follow those that the working spouse enrolled. For example, if the working spouse enrolled in a 6-month benefit period, the stay-at-home spouse has a 6-month benefit period.

The plan offers the own occupation definition, but no partial disability benefits.

#3 Stand-alone Disability Insurance Plans For Stay-At-Home Moms And Homemakers

Finally, we have stand-alone disability insurance plans for stay-at-home moms and homemakers. Carriers that offer these plans don’t require the working spouse to apply. The stay-at-home parent applies him or herself.

There are not many options available. However, we work with a couple of solid options.

The first carrier offers up to a $2,000 monthly benefit with the modified own occupation definition. It also offers partial benefits and is portable.

This carrier is a Christian carrier, so if you are not Christian, we have other options.

I think you’ll agree with me that $2,000 a month can go a long way.

We also are one of the few brokers that offer a “lump sum” disability insurance plan for stay-at-home moms and homemakers.

That is right. Here are the parameters:

The definition of disability is the “any” occupation definition. While I generally tell people to stay clear of “any” occupation policies, this one is different. It pays a lump sum if your doctor (overseeing your illness or injury) expects the disability to last longer than a year.

If so, the plan pays a lump sum benefit that you use for whatever you want.

Once you receive the benefit, the plan terminates.

Stay-at-home parents are eligible for a benefit equal to ½ X (working spouse’s income), not to exceed $50,000.

I think you’ll agree with me that $20,000; $50,000; or whatever the amount goes a very long way when the stay-at-home spouse is hurt or sick.

The best part, you can have this lump sum disability plan in addition to other disability insurance plans.

Disability Insurance Underwriting For Stay At Home Moms And Homemakers

Stay-at-home spouses will still have to go through an underwriting process.

Disability insurance underwriting consists of the following:

- your age

- gender

- your health

- occupation (stay-at-home parent)

- lifestyle

- motor vehicle records

- any public records

The older you are, the more you will pay, all things being equal.

Same if you are a woman. There is nothing to prejudge here. Women make up more disability insurance claims than men, and carriers adjust their rates as such.

Obviously, your health matters. If you have a health condition or chronic injury, carriers typically exclude that condition from coverage.

Your occupation matters, too. Carriers classify occupations based on disability risk. They use a scale from 1 to 5, usually, with 1 being the riskiest and 5 being the least. A construction worker will have an occupation class of 1 whereas an accountant will have a class 5. Stay-at-home moms and homemakers usually are a class 2.

Lifestyle, motor vehicle records, and public records matter, too. If you use marijuana or smoke, that will have an impact on the policy decision. If you go to the chiropractor, expect a possible back or neck exclusion.

Once the underwriter examines all these factors, he or she will approve or decline the application.

Estimated Disability Insurance Premiums For Stay-At-Home Moms And Homemakers

For Stay-At-Home Moms And Homemakers

Everyone wants to know how much this will cost.

Disability insurance for stay-at-home moms and homemakers is not going to cost a lot of money.

Unless the stay-at-home spouse smokes, uses marijuana, or has some serious ailments as outlined in our disability underwriting article.

We are talking $30 to $45 per month, maybe more or maybe less, depending on the age, benefit amount, and waiting period.

All of this costs about a cup of coffee per day, right?

Here is an example cost of the lump sum disability insurance plan. Let’s assume a 30-year-old woman with a $50,000 benefit. That will cost $29.92 per month or less than $1 per day.

It would take someone 139 years to save $50,000 at $29.92 per month.

I think you’ll agree with me that $30 to $40 per month won’t break the bank. Disability insurance on your stay-at-home spouse gives you some peace of mind all for around $1 per day.

FAQs About Disability Insurance For Stay-At-Home Moms And Homemakers

Here are some frequent questions receive about disability insurance for stay-at-home moms and homemakers.

We will continually update this section.

Can Stay-At-Home Moms And Homemakers Obtain Disability Insurance?

Yes, stay-at-home moms and homemakers can obtain disability insurance, without the earned income requirement.

We outlined 2 viable options in this article. The 3rd (social security disability insurance) is a last resort if you qualify.

Can I Apply For SSDI Anytime?

You can. My recommendation would be to select a tandem plan with your working spouse or a stand-alone plan. Then, if you are disabled, you can apply for SSDI if you wish and you qualify.

Contrary to what other people might say, as long as you don’t have an offset provision in your private, individual disability insurance plan, carriers don’t force you to apply for SSDI.

What Can I Do With The Disability Insurance Money?

As we mentioned, you can use the insurance money for childcare, household help, medical bills, babysitters and nannies. Really, anything you want. Remember that $2,000 per month can go a very long way, especially in times of need and stress.

What If I Go Back To Work?

Great! The plans we like to work with have the own-occupation definition. This means if you go back to work, and disabled, then your disability is based on that occupation. For example, let’s say you go back to work as a teacher. Disability strikes. Your disability is based on your own-occupation as a teacher, not as a homemaker.

Moreover, these contain valuable partial disability benefits as well.

And, what if you currently work part-time? Contact us as there are other coverage provisions.

Now You Know Stay-At-Home Moms And Homemakers Can Obtain Disability Insurance

We hope now you have a solid idea why stay-at-home moms and homemakers need disability insurance.

In this article, we outlined 2 viable disability insurance options. The 3rd, Social Security Disability Insurance, really should be a last resort.

While stay-at-home spouses have to go through underwriting, the monthly cost for coverage is usually inexpensive.

Confused? Don’t feel that way. We’re here to help educate you and protect your future. Don’t know where to start? Use this disability insurance needs analysis worksheet. Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy).

Next, feel free to reach out to us for our assistance or a quote. Or, fill out the form below. We only work for you, your family, and your best interests only. We have helped many stay-at-home moms and homemakers secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".