4 Reasons Why Indexed Universal Life Insurance Is A Good Investment For Children | We Discuss The Advantages, Disadvantages, And Other Options

Updated: April 12, 2024 at 9:39 am

Many parents and grandparents purchase life insurance on their children or grandchildren. Usually, the life insurance is a whole life insurance policy. Did you know that indexed universal life insurance is a great option for children?

grandchildren. Usually, the life insurance is a whole life insurance policy. Did you know that indexed universal life insurance is a great option for children?

John, I heard these have too many moving parts and a waste of money, you say.

Well, yes and no. We have discussed some of the disadvantages of indexed universal life. Additionally, we will dive into some of the details of indexed universal life insurance.

But, indexed universal life insurance might be a solid investment for children and grandchildren.

We will discuss why. Here’s what we will talk about:

- Overview of Indexed Universal Life Insurance

- 4 Reasons Why Indexed Universal Life Insurance Works For Kids

- Other Options For Children

- Final Thoughts About Indexed Universal Life Insurance For Kids

Let’s get right into the article with an overview of indexed universal life insurance.

Overview Of Indexed Universal Life Insurance

I am sure you have heard about indexed universal life insurance (IUL). The life insurance industry generally talks about it like it’s been the best thing since sliced bread.

Here are some common statements about IULs:

- You can receive the cash value income tax-free!!!

- Zero is your hero!!! (In our opinion, this is a misstatement.)

- You don’t have to report the cash value on FAFSA student aid!!

I take a different approach. IULs can work, but you need to know the disadvantages as well as other available options.

You can read about all that in our indexed universal life insurance guide. Additionally, we discuss the disadvantages of indexed universal life insurance. (There are plenty. Every insurance has advantages and disadvantages.)

Indexed Universal Life Insurance Is Life Insurance

At the end of the day, indexed universal life is still life insurance. Moreover, it is a type of universal life insurance.

Universal life, for simplicity’s sake, doesn’t really have guarantees like whole life insurance.

Costs and cash values are all broken out. They are non-guaranteed. (Although, most universal life policies nowadays have some guarantees.)

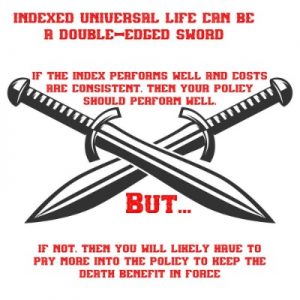

The combination of costs and cash value performance is a double-edged sword that many people don’t understand. First, an IUL can be seen as an investment. (More on that in a minute.)

When times are good, universal life (and IULs) performs well. However, when times are bad…

…universal life policies implode, as we saw with contracts sold in the 1980s.

Indexed universal life insurance is a spin on traditional universal life.

Instead of following the trend of interest rates, indexed universal life policies earn cash value from following the performance of stock market indexes, like the S&P 500.

So, when the index is performing well, generally so is the IUL. However, when times are bad…

In many ways, IULs are like an investment. It’s really important, however, to view IULs as a different investment class that does not fully participate in the stock market.

Now might be a good time to discuss how this all works by discussing how cash value grows in an IUL.

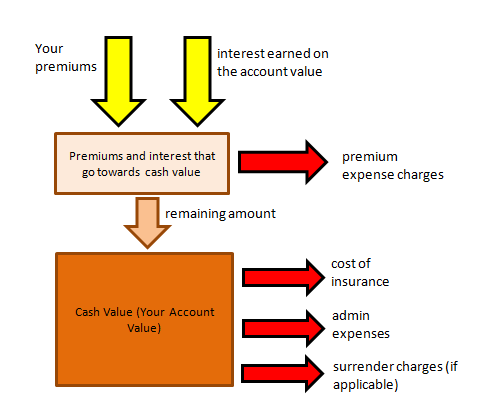

How Indexed Universal Life Insurance Grows Cash Value

So, I just mentioned that the cash value follows the performance of a stock index like the S&P 500.

However, you don’t receive the full gains of the index.

When the index increases, you receive a portion of the gain as a “credit”. There are different credit options: cap rates, participation rates, and spreads.

We won’t go into too much detail as we describe these in more detail in our IUL guide. However, here is a quick example. Let’s say your cap rate is 10% and the index increases 18%. You, therefore, receive a 10% increase in the cash value.

Conversely and favorably, you don’t participate in the index losses. You may have heard, “zero is your hero”, which means if the market index loses money, then you get “0”.

In other words, your cash value doesn’t lose money compared to if you fully invested in the index.

Over time, this cash value can grow higher than traditional universal life or even whole life insurance.

Over time, this cash value can grow higher than traditional universal life or even whole life insurance.

However, you may need to spend higher premiums because expenses generally increase every year.

Moreover, if the policy does not perform as illustrated, then you will have to pay more into the policy.

Here’s an illustration we have used in other articles. This is how IULs work. If your cash value grows higher than projected, then your policy should perform very well.

But if the index doesn’t perform well and costs go up, then your policy may not adequately grow cash value. (Moreover, carriers can cut cap rates as they do now. More on that in our article about disadvantages of IULs.)

But if the index doesn’t perform well and costs go up, then your policy may not adequately grow cash value. (Moreover, carriers can cut cap rates as they do now. More on that in our article about disadvantages of IULs.)

Nevertheless, indexed universal life insurance can work. You just need to understand the disadvantages as well as the advantages.

Let’s now discuss why indexed universal life insurance is a good investment for children.

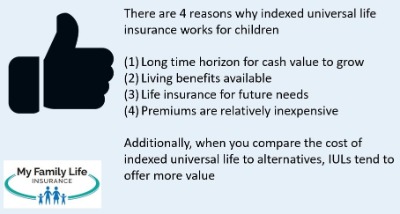

4 Reasons Why Indexed Universal Life Insurance Works For Children And Grandchildren

As a parent or grandparent, you can purchase many types of life insurance on your children or grandchildren.

Life insurance options include term life insurance and, more commonly, whole life insurance.

However, I think an indexed universal life insurance policy is a fantastic option for children.

Here is why:

- Long time for cash value to grow

- Living benefits available

- Still needs life insurance

- Usually cheap premiums

Let’s discuss these one at a time.

#1 Long Time For Cash Value To Grow

One of the benefits of purchasing indexed universal life insurance on children is the cash value.

Actually, that is anecdotally the #1 benefit for all types of cash-value life insurance.

insurance.

If structured properly, you can access the cash value on an income tax-free basis. The details of this benefit is outside the scope of the article. However, it is an advantage of all cash-value life insurance. Obviously, this advantage benefits your child or grandchild when they are way older.

As we stated earlier, IUL’s cash value performance tracks the performance of a stock index like the S&P 500.

If the index goes up, you receive a portion of the growth as a “credit”. Conversely, if the index goes down, your cash value doesn’t go down (except for policy fees paid by the cash value). The carrier credits you nothing or zero.

We really won’t go into detail about crediting options here. We discuss those in our IUL guide and our article about the disadvantages of indexed universal life. However, having a long time horizon, like any investment, allows for potential long-term growth.

Illustration

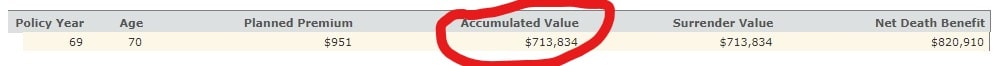

Check out this illustration snippet of a $50,000 IUL on a 2-year old boy.

The cost s about $79 per month. Of course, this is not a guaranteed premium. Moreover, these values are not guaranteed. However, like any projections, if the costs and growth stay approximate, then this 2-year old boy could end up with around $700,000 at age 70 on a $50,000 initial death benefit contract.

How great is that? Moreover, as we said, if structured correctly, he can withdraw the cash value on an income tax-free basis.

Remember, these premiums and cash values are all non-guaranteed. One way to think about this is like investing. Do you invest in a company 401(k)? You invest so much every month in your IRA or 401(k) with hopes of maximizing return.

Indexed universal life, conversely, has lower risk (and, therefore lower return). However, the long-term time horizon of children makes indexed universal life a viable, low-risk alternative.

Again, if structured properly, your children or grandchildren can access (currently) this cash value income tax-free. It can be a good option to supplement for his or he retirement.

#2 Living Benefits Available

A long timeframe for indexed universal life insurance benefits children and grandchildren.

For one, as we discussed, the long timeframe is important so the child or grandchild can adequately grow cash value over the long term.

Second, the child can maximize living benefits over a long timeframe.

John, what are living benefits, you ask? I’ve never heard of them before.

Sure. Life insurance living benefits are options your child or grandchild can maximize if a certain event occurs. Specifically, they can advance the death benefit sooner if they are:

- Terminally ill

- Diagnosed with a critical illness like cancer

- Incapacitated, have a permanent cognitive impairment, or can’t meet 2 out of 6 activities of daily living

In all these cases, your child or grandchild can advance the death benefit sooner (traditionally, with no income tax impact) for his or her needs and care.

But, John, you say. My child is so young. He doesn’t need that now.

Again, it’s not for now. These are for later on. Way later.

Now might be a good time to discuss living benefits in a little more detail.

Advantages Of Living Benefits

Has cancer affected you or someone you know? Probably, because 1 out of 3 men and 1 out of 2 women will have some type of cancer diagnosis in their lifetime. Every day, I speak to someone affected by cancer.

Or, how about a heart attack or a stroke. It happens. A lot.

In these cases, and more, your child advances part of the death benefit sooner for his or her needs and care. The carrier determines the amount to advance based on your prognosis.

Have you ever had to deal with a loved one in a nursing facility or assisted living? Many need some type of long-term care in the future. Living benefits pay for this as well.

Additionally, if your child or grandchild has a terminal illness or situation, he or she can advance the death benefit earlier.

While your children likely don’t need these benefits now, they probably will way down in the future. Look at the illustration excerpt again. Let’s say your son is age 70 and has a heart attack. He has $820,000 at his disposal for his needs and care. And, he paid $79 per month for this. Isn’t that great?

The combination of the long-term cash value growth and living benefits make indexed universal life insurance a viable, long-term financial planning tool for children.

#3 Your Children Still Need Life Insurance

Many financial planners say that children don’t need life insurance. Just search the internet, and you will find the articles.

They say the chance of children passing away early is extremely low (true) and better options exist to save (possible). They also say you should beef up your own life insurance, which is true if you don’t have enough. (Contact us if you’d like to chat or review this easy life insurance needs analysis worksheet).

However, these planners overlook 2 important points:

- Life insurance is cheap on children – just see the illustration above

- Since nearly all children are healthy, you lock in their “health insurability”. More on that in a minute

- Unfortunately, some children do pass away before their time. Having life insurance will help pay some funeral expenses and give the parents some time off to grieve.

Many planners say there are alternatives – and there are (we’ll discuss) – but not for the low premiums you’ll spend. They say there is an “opportunity cost” to life insurance. Let’s discuss this a little more.

What Is The Opportunity Cost For Children?

What Is The Opportunity Cost For Children?

We’ve helped many grandparents and parents obtain term life insurance on their children and grandchildren. That costs about $25 per year.

Per year?

That is right…per year.

What “opportunity cost” is there for that? Nothing.

Additionally, whole life insurance on children is usually inexpensive.

The premiums on indexed universal life insurance are more; however, they are because we are “overfunding” the policy.

This is a little outside the scope of the article. The $79 per month in our example can actually be about $15 per month. Contact us so we can let you know why the $15 isn’t that viable.

Nevertheless, you can see for an inexpensive amount, you can “lock in” your child’s health insurability. This means if your child develops a health condition down the road, even as an adult, he or she will already have some life insurance as a foundation. Moreover, at an inexpensive rate, too.

#4 Premiums Are Usually Cheap

We’ve said this before. Life insurance premiums are usually cheap on children.

The target premium on a 2-year old girl for $100,000 coverage is about $26 per month. You can actually spend up to about $130 per month if you wish. These premium differences are a little outside the scope of this article. However, ultimately, when your child is older, he or she will want to spend the $130 per month as shown in our example (or whatever the maximum premium is).

Nevertheless, in this example, you can see the initial premium is $26 per month. What can you do with $26 per month? Well, you can invest that. Many planners will say that. But, what would you get for $26 per month? Here is the “opportunity cost” option.

What can you do with $26 per month? Well, you can invest that. Many planners will say that. But, what would you get for $26 per month? Here is the “opportunity cost” option.

In a college 529 plan, in 16 years, the $26 per month will be about $10,000.

Sure, 529 plans have no taxable impact if the monies are used for college. However, the $26 per month you spend on life insurance has a death benefit of over $100,000 with long-term living benefits.

When you compare that with the 529 plan, you can see the value of an indexed universal life insurance policy provides for children.

Additionally, what if this girl waited until she was 42 to purchase? Well, then the target premium is $102 per month.

Other Options For Children

We would be remiss if we did not discuss other options. Certainly, there are other options for your children, including other life insurance options.

Nevertheless, indexed universal life remains a solid, viable option for your children.

Here are other options for your children or grandchildren:

- Term life insurance

- Whole life insurance

- Investment accounts such as 529 plans

Let’s discuss term life insurance on children.

Term Life Insurance On Children

Term life insurance is an option for children and grandchildren. Ask other agents or search on the internet, and you will see that they say term life insurance for children does not exist. These agents are wrong. We work with a few carriers that offer term life insurance on children.

The benefit of term life insurance is its simplicity. You are paying for the low probability of unexpected death. Therefore, premiums are low. I’m talking really low. Like $25 annually for $20,000 of coverage! Yes, that low.

Tell me, financial planners, what is the opportunity cost of $25 per year?!

I’ll tell you. It is minuscule.

Moreover, the carriers offering term life contain a guaranteed convertibility option. This option allows your child or grandchild to convert their term plan into a whole life plan.

Contact us if you would like to learn more.

Whole Life Insurance

Speaking of whole life insurance, that is a popular option for children.

Many carriers offering whole life insurance on children offer guaranteed purchase options. These options allow your child to purchase more life insurance in the future with no additional health underwriting. So, if your child has diabetes, had cancer, is diagnosed with MS, etc., he or she can still buy more life insurance. That is a great option and the main reason to buy life insurance on children.

Additionally, a few carriers offer living benefits as well.

If you want to see what whole life could cost on your child, feel free to run the quote below. Note the disclosure. (We will reach out to say hello and see if you need our help. However, if you don’t want our assistance, just tell us that.)

Investment Options

Finally, there are investment options as well. College 529 plans are a great way to save for your child or grandchild’s college. Custodial investment accounts like Stash are options as well. Always speak with a qualified adviser to understand tax implications and your options.

However, investment options take a long time to grow. Moreover, as we showed in our example previously, you have to invest much more for substantial value in your child’s account. I am not, by any means, suggesting that a 529 plan or custodial investment account is inappropriate. They are not, and all my kids have 529 plans. However, you can see that life insurance offers a different value for the money. Moreover, as we have shown, indexed universal life insurance can provide a long-term financial planning tool for your children and grandchildren.

Final Thoughts About Indexed Universal Life Insurance On Children

We thank you for reading our article on indexed universal life insurance on children. Are we totally “all-in” on IULs? No. Unlike other agents, we take a balanced approach to insurance. As with any type of insurance, there are advantages and disadvantages. IULs are no different.

However, indexed universal life insurance provides a viable and fruitful option for children and grandchildren. The reasons include:

- Long time horizon for cash value to grow

- Living benefits available

- Affordable, long-term premiums

- Still provides life insurance protection

Do you have any questions? We are happy to help. Contact us or use the form below. We are happy to go over your options and answer any questions you have.

I am aware people don’t like to speak with agents or people they don’t really know. However, there is no risk of speaking with us. We hold your best interests first and foremost. That’s the only way we know how to work with our clients. Moreover, if an IUL is not right for your child or grandchild, we will tell you that. We will also point you in the right direction as best we can. You can always reach back out to us if your situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".