An Attractive, Better Gift: Term Life Insurance On Children | A Great And Inexpensive Way To Purchase Life Insurance

Updated: April 12, 2024 at 9:39 am

Did you know you can obtain term life insurance on your children or grandchildren?

Did you know you can obtain term life insurance on your children or grandchildren?

It is true.

Agents abound tell you that it is not available. They say you can only obtain permanent insurance like whole life.

They are misinformed.

There are a few available options for term life insurance for children or grandchildren.

Talk about a great gift. Really! Not only is it inexpensive and cheap (it is term life insurance, of course), but also it provides more value than the toy you bought for their last birthday.

You will see that it is a no-brainer.

I mean, we are talking like $25 or $60…for the entire year!

In this article, we discuss:

- What types of term life insurance are available?

- Who would want term life insurance

- Estimated premiums

- Underwriting on your children

- Now you know you can get term life insurance

Let’s jump right in and discuss what types of term life insurance are available for children and grandchildren.

Types Of Term Life Insurance Available For Children And Grandchildren

As we mentioned, many agents say term life insurance is not available for children. That is not true.

You have two options for term life insurance. Either

- a term life insurance rider, or

- a stand-alone term life insurance plan

We discuss both next.

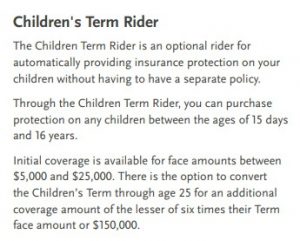

Children’s Term Rider

The first option is a rider attached to your own life insurance policy. Parents can apply for term or permanent insurance themselves and add their child to the policy.

In this case, most carriers offer up to $25,000 of term life insurance until age 25 (depends on the carrier). See the excerpt here from a carrier.

At that point of conversion, the child can convert the policy to a whole life or other type of permanent life insurance with no evidence of insurability. That means if your child develops a health condition (say type 1 diabetes) or has a severe accident, the carrier doesn’t consider all that. Your son or daughter just fills out a form and then they have permanent life insurance.

At that point of conversion, the child can convert the policy to a whole life or other type of permanent life insurance with no evidence of insurability. That means if your child develops a health condition (say type 1 diabetes) or has a severe accident, the carrier doesn’t consider all that. Your son or daughter just fills out a form and then they have permanent life insurance.

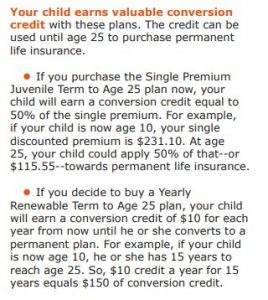

Stand-Alone Term Life Insurance Policy

Another option is for the child to have their own life insurance policy on a stand-alone basis.

Another option is for the child to have their own life insurance policy on a stand-alone basis.

Not many carriers offer this type of juvenile term life insurance. As an independent brokerage, we work with a few carriers that offer term life insurance on children.

Wait, John, you say. How can my child be the owner of the policy?

Good question. Your child is the insured, not the owner. You, as the parent, will be the owner until your child reaches adult age. This age typically 16 or 18, depending on the state.

How old does my child have to be to apply?

Sure, it depends on the carrier, but they usually allow ages between 0 and 18 or 21.

If your child is an adult, you can still be the owner, but he or she needs to sign the application.

Stand-alone juvenile term life insurance is also convertible without evidence of insurability. The conversion option could be different compared to those offering children term life insurance riders (see that option above). Carriers that offer stand-alone term life insurance on children usually offer a “conversion” credit to entice conversion. Here is an excerpt of a carrier.

You can see, this carrier offers a credit towards a permanent life conversion.

So, to recap, carriers that offer stand-alone life insurance usually offer a conversion credit.

Let’s say the conversion credit is $150. Additionally, let’s say the cost of whole life insurance at age 25 is $30 per month or $360 annually.

That means, to convert, you would pay $210 ($360 – $150) in the first year.

In additional years, you pay $360. The conversion credit is a one-time credit.

Why You Should Purchase Term Life Insurance On Your Children

You hear many financial pundits opine that life insurance on children is a waste of money.

They say the probability of death is low and that you can use the money elsewhere.

That is true. However, they are overlooking several aspects.

We discuss these next.

Reasons To Purchase Term Life Insurance

The first is the issue of insurability as an adult. Thankfully, most children are healthy with no major health complications.

So, it should be a breeze to get them through underwriting.

Moreover, the underwriting and decision process is usually pretty quick.

However, their health potentially changes when they get older. Diabetes, high blood pressure, other ailments…

As you are reading this now, think about your (or any love one’s) insurability. Did you have a hard time getting life insurance? Maybe a family member? Do you have to pay more because of any health ailments?

This is what these financial pundits overlook. It amazes me. Locking in that insurability is of utmost importance. Especially when many health conditions like cancer and heart disease are linked to familial traits.

Additionally, even reputable health organizations are seeing an uptick in diagnosed health conditions in young adults.

As I showed above, all term life insurance on children has a convertibility feature that allows you or the child to convert that term policy into a permanent one, without any health underwriting.

Second, it is simply cheap. I’ll get into costs next. But, the expert argument of “investing” that money elsewhere is not a factor. It holds no support.

Finally, you will want term life insurance on your child or grandchild if you want to do something more than the usual birthday gift. You understand the value of life insurance and want to start your child or grandchild on this important financial foundation.

So, to recap here, you should purchase term life insurance on children if you:

- Want to lock in their insurability,

- Don’t want to spend a lot doing so, and

- Want to lock in this important insurance now.

Let’s get into costs next.

How Much Does Term Life Insurance On Children Cost?

As I mentioned earlier, it is cheap.

Carriers that offer term life insurance on children generally have 2 payment options:

- One-time lump sum, or

- Annual pay

Wait, you say. There’s no monthly payment option?

No. Because it is cheap, and the administrative costs of managing monthly payments far outweigh the benefits.

Many carriers offer uni-sex rates. That means the same rate regardless of a boy or a girl.

Plan Options

One plan we work with will cover your child up to age 25 for $20,000.

The cost depends on the age you enroll your child.

For example, if you enroll your child at age 2, the cost is either:

- $25 for the year (that is right), or

- $280 one-time lump sum

I bet the $280 is much less than the Xbox games you purchased for your child or grandchild last year. Moreover, the life insurance policy provides long-term value.

Another plan we work with operates differently.

$25,000 with them will cost $52 annually for that same 2-year-old or $491 lump sum.

This carrier, however, offers a better conversion opportunity.

Then, there are carriers in-between.

Regardless of what you choose, you can see that term life insurance is cheap.

What a great way to guarantee your children’s insurability. As we discussed in our article about life insurance on children, locking in that insurability is the main reason to purchase life insurance on your child.

You might spend $30 per month on whole life insurance versus $25 on term life insurance for the entire year.

There’s (Probably) No Reason Not To Get Term Life Insurance On Children

Many of these financial “experts” say you don’t need life insurance on children. They say it is too expensive, and you are better off investing that money elsewhere. Knowing how much term life insurance costs on children, and what you spend on…let’s face it…junk…do you feel differently now?

If you’ve been on the fence, you shouldn’t be anymore.

While I believe in “investing the difference”, there’s no rebuttal for term life insurance.

Let’s say you spend $25 per month on that $20,000 policy. Your child is 10. If you keep the policy to age 25, you will have spent $375 in premiums in total.

Wow.

Cell phones and clothing cost more.

What if you were to invest that $25 as the experts say?

Ok…but, don’t expect to get rich. It’s not going to fund a 529 college savings plan.

Let’s say you are able to achieve an 8% return in those 15 years. At the end of 15 years, you will have about $680.

Let’s say you are able to achieve an 8% return in those 15 years. At the end of 15 years, you will have about $680.

Don’t forget about the conversion credit. Let’s say it is $150.

So, your net return is $530.

It’s not much of a factor over 15 years. It is immaterial.

However, if you have little life insurance on yourself or none at all, then you should not buy life insurance on your children.

Instead, you need to purchase your own policy. Moreover, carriers won’t approve a policy on your children if you don’t have an adequate amount of life insurance on yourself.

Also, if you don’t want to get life insurance on your child, that is up to you. We are presenting an option here that costs less than many birthday gifts and arguably provides way more value.

Underwriting For Term Life Insurance On Children

The underwriting process for term life insurance on children is pretty easy. First, health questions are usually limited and focus on severe ailments. Below is a sample of ailments that could lead to a decline:

- Cancer

- Heart conditions

- Mental disorders and conditions

- HIV or AIDS

- Kidney issues

- Liver issues

We receive many phone calls about life insurance on children with severe ailments. We do have a solution with guaranteed issue whole life insurance. For example, we have helped many families with sons or daughters with autism or Down Syndrome obtain life insurance. Contact us to learn more.

ailments. We do have a solution with guaranteed issue whole life insurance. For example, we have helped many families with sons or daughters with autism or Down Syndrome obtain life insurance. Contact us to learn more.

Nevertheless, life insurance options are available for your children.

These carriers do not require a paramedical exam or anything like that. The underwriting departments review your child or grandchild’s health history through the MIB and prescription drug databases. If all checks out, then the carrier approves the application.

Now You Know You Can Get Term Life Insurance

Now you know you can get term life insurance on children. I bet you didn’t know that before. And, there is no reason not to. It is cheap. Moreover, you lock in their health insurability, which basically allows them to have life insurance in the future.

Of course, if you don’t want to, that is up to you.

Would you like to learn more? Feel free to contact us or use the form below.

While many people nowadays don’t like to talk to people they don’t know, there is no risk to contacting us. We only work in your best interest. If we can’t help you, no worries. We will try to point you in the right direction and part as friends.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".