Indexed Universal Life Insurance: Everything You Need To Know | The 2025 “No Fluff” Guide

Updated: January 26, 2025 at 10:51 am

Here at My Family Life Insurance, we are asked often about indexed universal life insurance (IUL).

Here at My Family Life Insurance, we are asked often about indexed universal life insurance (IUL).

There is good reason. At the end of 2018, indexed universal life insurance sales topped over $2.1 billion! What is indexed universal life insurance, you ask?

Read on for our unbiased opinion on indexed universal life insurance. We caution, though: like many things, IULs are not for everyone. (Even though many agents claim they are.) Below is our expert analysis. We only provide the “meat”. No “fluff” allowed in this article.

Here, we will discuss:

- What Is Indexed Universal Life?

- 4 Characteristics Of IULs

- Crediting Strategies

- Tax Advantages Of Indexed Universal Life

- Who Could Use An IUL?

- Who Should Not Purchase An IUL?

- Disadvantages Of Indexed Universal Life Your Agent Won’t Talk About

- Now You Know What Indexed Universal Life Insurance Is

Let’s get started and discuss indexed universal life insurance.

Indexed Universal Life Insurance – What Is It Really!?!?!?

So, what is indexed universal life insurance?

Well, first we need to learn about universal life insurance. Universal life insurance is, many ways, a parent to an IUL.

You might be thinking, “John, this is universally confusing to me. Just get to the point.” I promise; I will, and in lay terms so you understand.

To back up a bit, you probably know that nearly all common types of life insurance come with level premium and death benefits. We are talking about term life and whole life, specifically. (There are some others, but not to confuse you, these two are the most common).

Universal life, and therefore, indexed universal life, operates much differently than whole life insurance or term life insurance.

What Is Different About Universal Life?

So, what is different about universal life? Like whole life insurance, universal life is permanent insurance. However, there are significant differences.

Universal life’s flexibility is the main difference. For example, assuming appropriate cash value, its premiums can be adjusted. In some cases, an owner of universal life can even skip a payment!

How is this possible?

Well, universal life’s insurance policy costs, cash value, and death benefit are separated, or unbundled. These policy costs include the cost of insurance, which is the cost of your death benefit risk, as well as other fees. Contrast this with whole life, in which the cost of insurance and death benefit are bundled together. This is why whole life insurance, on the other hand, promotes guarantees. Guaranteed premiums, guaranteed cash value, etc.

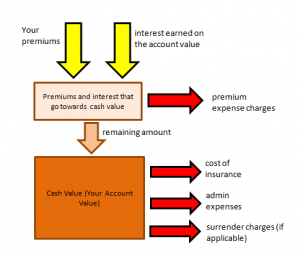

An illustration will make this clear. This is how universal life insurance works:

Your premiums and any interest are accumulated. The carrier then withdraws a premium expense charge. The remaining amount is added to the cash value whereupon the cost of insurance, administrative expenses, and any surrender charges (if applicable) are withdrawn.

As you can see from this diagram, if your expenses are too great (in red), you will need to add more premium money to keep the policy in force (or greater interest). Conversely, if the cash value increases more than expected, you can skip a payment or even add more premium.

Depending on the type of universal life insurance, as the cash value grows, so does the death benefit.

So, Now We Can Discuss Indexed Universal Life

Indexed universal life insurance is just like universal life (see the diagram above) except the cash value / interest is pegged to an index, such as the S&P 500.

“John, am I investing in the stock market?”, you ask.

No. However, you do not invest directly in the index. Instead, the financial performance of the index determines how much is credited to the cash value.

A major benefit of an IUL is the downside (i.e. losing money) protection. In other words, you can’t lose money in an IUL. You may have heard, “zero is your hero” when it comes to IULs. All this means is if the market index your IUL tracks lose value in a given year, you don’t lose money. You have, what they call, a “floor”. The floor for many IULs is 0%.

In other words, if your cash value was $55,000 and the market lost 10%, your cash value does not drop to $49,500. It stays at $55,000.

This is an advantage of an IUL. In fact, it is an advantage of all cash value life insurance (but many agents do not mention that).

“What, John?,” you question. “So, I don’t lose money, and I enjoy all the gains!”

The Hidden Costs Of An Indexed Universal Life Insurance

Nope. The insurance carrier typically caps or buffers the upside growth. It has to. You see, providing a no-risk asset comes at a cost. For example, US Treasuries are essentially no risk. You generally don’t make a lot of money in Treasuries because there is no risk of loss (generally).

The cost for the carrier is the call option it buys on the market index to make this all work. Essentially, the carrier buys an option contract on the market. If the market goes up higher than the value of the option contract, the carrier and you win! The carrier credits your IUL cash value a portion of the gain on the option contract. The carrier keeps the rest to offset its own operating costs.

And, what if the market drops less than the value of the option contract? Then the carrier lets the contract expire and incurs the cost of purchasing the option contract as an expense.

The level of the carrier’s crediting ability is proportional to its investment portfolio and its internal expenses. In other words, the lower the costs, the better the crediting amount – in general.

You’ll want to review these costs. It’s an area many agents gloss over. These costs should be included in any policy illustration.

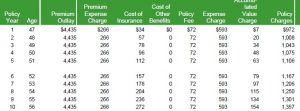

Here’s one from an illustration we ran for a client. It’s very telling, and if your agent doesn’t go over costs, you need to ask (and ask what else he or she isn’t telling you…more on that soon).

Example On How Indexed Universal Life Insurance Works

It’s probably a good time now to present an example. First, let’s recap.

An IUL is a universal life insurance policy that tracks the performance of a stock market index.

The components of an IUL – the policy costs, cash value, and death benefit are all unbundled. This is a double-edged sword. In good times you can skip a payment. In bad times, you may have to pay in more to support the policy.

You do indeed enjoy upside gains if the market goes up with no downside (loss). However, this downside protection comes with a cost. The cost comes in the form of the carrier’s internal expenses, policy fees, and call option strategies.

Example

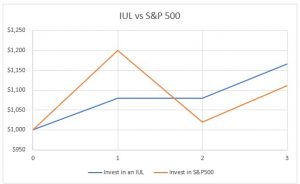

Let’s take a look at an example. You have an IUL that tracks the performance of the S&P 500. You have a cap (more on this in a minute) of 8%. Your cash value is $1,000. Let’s assume policy costs are $0.

In the first year, the S&P 500 rose by 20%. You receive $80 of cash. Your ending cash value is $1,080. Sorry – you don’t receive 20%. That’s because you have downside loss protection.

You are happy about the downside protection. In the second year, the market drops 15%. You, however, don’t lose anything (unless due to policy fees). Your ending cash value remains $1,080.

In the 3rd year, the market rebounds. It rises by 9%. You only receive 8%. So, your ending cash value in the 3rd year is $1,166.

Here’s a graph.

So, in this very simple example, we see the IUL outperforms the S&P500, simply because of the floor of 0%. It doesn’t always work out this way. Over long stretches of market growth (with a pullback thrown in here and there), the market will outperform the IUL. See further in the article for another illustration.

Four Characteristics of Indexed Universal Life Insurance

We’ve talked about indexed universal life insurance quite a bit. If you are still here, you should have a good foundation now. Here are four main characteristics of an indexed universal life insurance policy. Some of it is repetitive, but it bears repeating:

- Utilizes the features and benefits of a traditional universal life policy (i.e. flexibility and death benefit protection), but uses a different method for crediting interest. The index performance and crediting method determine the amount of credit.

- Potential for higher crediting interest, resulting in greater cash value, compared to a traditional universal life policy.

- Interest credited is linked to the performance of a market index like the S&P 500.

- Offers cash value protection against index declines through a guaranteed floor, usually 0%

What you have to keep in mind is indexed universal life insurance is still life insurance, although many people utilize it for retirement savings. I’ve discussed using life insurance for retirement savings and will do so again in this article.

What Is It Not

Depending on whom you speak to, IULs are the best thing since sliced bread.

However, misconceptions about indexed universal life insurance abound. It is not:

- an investment in the stock market or index. It does not participate in any equity or bond investments

- a variable contract, which those allow participation in the market/indexed

- a contract where cash value performance is dependent upon subaccount (i.e. variable) performance

- an investment vehicle. Although, it does offer above-average returns compared to a CD with minimal risk

- cost-free. In fact, there are many costs associated with an IUL, even more so than a mutual fund or ETF

- loss-free. We hear “zero is your hero” all the time. Due to policy fees, however, you can lose money IF the cash value does not grow strong enough to support the policy fees. While I don’t think this will happen, several years of mediocre market returns and a low credit strategy by the carrier is troublesome. You’ll have to pay a higher premium to keep your IUL going.

How Does Crediting Work – Types Of Crediting Strategies

Indexed universal life has a unique parameter. It is the crediting strategy. The crediting strategies have to be one of the most confusing aspects of indexed universal life insurance. Don’t worry; we break it down here.

Generally speaking, the performance of the index as a unit of time determines the amount of credit, if any.

That’s right. A unit of time.

This unit of time is usually one year, but insurers have to implement time units as long as two years and even 5 years!

What is a “unit of time” in the context of indexed universal life insurance? It best described with an example.

For example, let’s say your indexed universal life insurance policy has a register date of 10/1/18. If your credit strategy measures 1 year as the unit of time, your credit is based on the S&P 500 index value on 10/1/19. If the S&P 500 was 1,000 on 10/1/18 and it rose to 1,100 on 10/1/19, the credit you will receive is 10%, less any caps or participation rates (more on that next).

Some carriers offer longer units of time, such as 2 years or even 5 years. This means you won’t receive your credit, if any, until that day. I explain this more in a minute.

Three Main Crediting Strategies

There are 3 types of crediting strategies available (there are a couple more, but these are the most common):

Cap – the maximum interest rate the carrier credits you. Let’s say the cap is 10% for a 1 year time unit (also called “point to point”). The 10% is the maximum cap. For example, if the S&P 500 went up 20%, your credit is 10%. However, if the S&P 500 went up 5.6%, your credit is 5.6%.

Participation rate – a percentage multiplied by the index performance. For example, let’s say the participation rate is 55%. The S&P 500 rose 10%. The credit is 5.5% (10% X .55).

Spread – a percentage subtracted from the index performance. For example, let’s say the spread is 4%. The S&P 500 rose 10%. The credit is 6%.

Then, there is a floor. Although it is not a crediting strategy, your credit can never be less than 0%. For example, if the S&P 500 lost 20% in one time unit (let’s say one year), your credit is 0%.

Except for the floor, do you know what these really are? They are a way for carriers to control their internal costs with the IUL. I will explain more in a minute.

Market Indexes

As I have mentioned through this article, the carrier credits your IUL based on a market index performance.

There are nearly endless market indexes, and even nowadays, carriers create their own for differentiation.

Some of the most common include:

- S&P 500

- S&P 400 Mid Cap

- Russell 2000 index

There are many others. In my opinion, since there is no risk of loss (except for policy fees), you should aim for the index with the highest return potential.

So, if you pick the S&P 500, that index is your tracking index.

The Tax Advantages of Indexed Universal Life

Agents like to point out the tax advantages of IULs. However, all cash-value life insurance has the same advantages. Like all cash value life insurance policies, indexed universal life insurance has the following tax advantages:

- the death benefit is income-tax free

- cash value grows tax-deferred

- the cash value can be withdrawn income tax-free

Yes, income tax free – like all cash-value life insurance.

You may hear that indexed universal life insurance is similar to a Roth IRA.

This is true.

It is true that one can receive the cash value income tax free by borrowing from the policy (like all cash value life insurance).

However, a major benefit of indexed universal life insurance policies is that they allow over-funding (all cash value life insurance do) of premiums, up to a limit. In other words, they also don’t have the contribution limitations as a Roth IRA. The limit for life insurance is much higher than that of Roth IRAs.

So, in summary here, the tax advantages of IULs are the same with any cash-value life insurance, including whole-life insurance.

Do you see a common theme here? If your agent expounds on the tax-advantaged virtues of IULs, these are all common with other types of life insurance.

I will say, however, the ability to overfund an IUL (or any cash-value life insurance) is a major advantage. Moreover, an IUL can mimic the benefits of a Roth IRA.

Who Could Use Indexed Universal Life?

For the everyday person, like you, you probably don’t need an indexed universal life insurance policy.

That is right. We will get to that more in a minute.

Instead, you need an adequate term life insurance coverage, possibly a small whole life policy for burial insurance (and protected from Medicaid spend down rules), and invest your money for retirement savings or for your children’s college.

However, some people could use an indexed universal life insurance policy. You

(1) have permanent insurance needs

(2) are a business owner and need it for buy-sell agreement

(3) have maxed out of your 401k and want an alternative method to fund for retirement

(4) are an above-average, affluent and could use the tax advantages of the cash value

(5) want to diversify your portfolio and use the cash value as a replacement of bonds or marketable securities

(6) you are older, healthy, have a portfolio that you want to convert into potential income tax free income

The reasons are probably endless. The big point here is that you understand the limitations of indexed universal life insurance. We will discuss these more soon.

Who Should Not Purchase An IUL

Not everyone should purchase an indexed universal life insurance policy. Be careful of what you read on the internet. There’s a lot of misinformation about IULs.

You probably don’t need one if:

(1) you have a long-time horizon and can withstand recessions and market pullbacks. Staying the course and contributing during these uneasy times (I am writing this during the Coronavirus epidemic) can potentially bear large fruit well into your future.

(2) it’s hard for you to save money. Let’s admit. A disciplined approach is almost mandatory for any contribution to cash-value life insurance including IULs. In fact, a disciplined approach is mandatory for any type of investing.

(3) you are uninsurable.

(4) simply, you are uncomfortable with all the moving parts about IULs. Hopefully, we have broken down the details. However, people will be uncomfortable. And, you know what, that is OK.

(5) you don’t want to commit to a large premium every month. This potentially can happen, because this is life insurance. We talk about this more next.

Nevertheless, the reasons are endless, too, if you don’t want to purchase an IUL.

Disadvantages Of Indexed Universal Life Insurance That Your Agent Probably Won’t Mention

Let me first say that many life insurance agents aren’t all that bad. Many go through an IUL – or any purchase – like a fine-toothed comb. They are concerned about you and your family rather than the sale. They discuss the advantages, and more importantly, discuss the disadvantages of IULs as well.

Unfortunately, like ANY industry, there are derelicts and bad apples that spoil the good work many agents do.

Here’s a list that I can almost guarantee most agents do not discuss with their clients.

High Fees

IULs have above-average fees compared to similar types of life insurance. Just look at the diagram above. There are at least 3 cash outflows. If all you need is a death benefit for income protection, then term life insurance is the better option.

Even compared to other types of investments like mutual funds and money management, IULs have high fees.

It Is Still Life Insurance

It is still life insurance, and a universal life plan at that!

That means, if your cost of insurance is increasing, but your cash value and your premiums are not sufficient to cover your cost of insurance, you will need to add more premium.

The intention of life insurance is to insure your life, not to create a separate savings account. This could happen with lukewarm returns in the market coupled with increasing expenses. Be aware of this!

Additionally, if you are not healthy, these policy costs are going to be much higher. This means you will have to pay a higher premium than someone healthy, all things being equal.

You’ll Have To Pay More

Compared to other types of investments, the premiums for indexed universal life insurance are much higher than those for other investments.

Look at the policy fees snapshot. You can see those are pretty hefty fees.

You have to pay a lot more.

Have you ever heard of “term and invest the difference”?

It means you buy cheap term life insurance and invest the difference between the cost of the term life insurance and the cost of an IUL.

Check out the cost of term life insurance in our quoter below, and see for yourself.

Where do you invest? Well, in your 401k, your IRA, etc.

Sure, the money may not have the same tax advantages as cash-value life insurance, but there are several factors you need to know.

the cost of the investment is likely much cheaper

taxes are important

if you have a long time horizon, you’ll likely come out ahead.

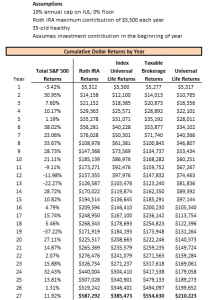

Below is a snapshot I did. True, I ran this well before the coronavirus pandemic, but it has the Great Recession impact as well as the tech bubble burst. This snapshot is no different the carriers run to exploit an IUL performance. In fact, I excluded any policy fees to keep things apples-to-apples.

So, over the long-run, you should come out ahead over an IUL. Again, we are talking about the long-run.

The Carrier Can Change Rates And Caps Anytime

As I write this, carriers have offered favorable cap and participation rates in the last 10 years.

Golly, many of them have offered “multipliers” and so many other options to distinguish themselves from the competition.

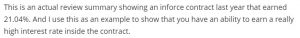

If you had an IUL, you should have had a good return, as evidenced by this comment from a carrier whom I respect:

Yes, when times are good, you should have a good return. But, carriers can change their cap rates and any rate at any time. Think I’m joking? Here is this:

At the time this headline was written in February 2016, National Life had a cap rate of 13.5%. It is now at 8.5%. Same with American National. Prior to the Coronavirus (as I write this), we had a nice stock market run, about 68% cumulative return in the S&P 500 from February 2016 to January 2020.

Beware Of The Unit Of Time: It Is Not Your Friend

I mentioned the “unit of time”. This isn’t your friend.

The industry calls it “point-to-point”.

As I write this, the stock market tanked in March thanks to a self-imposed recession. Sadness goes to the person who had a March contract date.

“Why?”, you ask.

Because the person got a credit of 0% whereas those who had a contract date of February and January had a good return.

This is because of the unit of time (or “point to point”). You see, you can’t receive the interest credit during the year. Only on the contract date…a unit of time.

Did you know that? Likely not. Conceivably, the market could drop in a month, then spike up (as we saw in December 2018). If you had a contract date in December with a 1 yr unit of time, you probably got nothing. A contract date of November or January…well, you were in luck.

Now You Know About Indexed Universal Life

We hope you now understand indexed universal life insurance.

Am I a proponent of indexed universal life insurance? Actually, I am. I think it can work well in the right situations and when you know the limitations. Sure, there are many. I have outlined them here. You should have a good, solid understanding.

Is an IUL right for you? We can help determine that. Feel free to contact us or use the form below. Additionally, you can let us know in the comments section if you would like to learn more about indexed universal life insurance.

What you will receive from us? A phone call, email, and an easy discussion on what you are trying to do. Unlike other agents and agencies, we have the planning, insurance expertise, and duty of care to make a professional recommendation. There is no risk of contacting us. You won’t lose any money. If we can’t help you, you’ve learned a little more, and we will part as friends. That is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".