Best Disability Insurance For Nail Technicians | Your Guide To Understanding This Important Insurance

Updated: April 12, 2024 at 9:39 am

Nail technicians don’t think about disability insurance, but they should.

As a nail technician, your work is hands-on…literally. You rely on your technical skills and style as well as your physical ability to get the job done.

However, have you ever thought about what could happen if you could no longer do your job?

What if you lost the use of your hands and could not work?

Have you ever thought about what would happen if you became sick, ill, injured, and disabled?

How would you pay your bills if you could not work?

Moreover, how this all affects your loved ones and family?

A disability quickly affects your future plans and the lifestyle you worked so hard for.

It doesn’t have to if you have disability insurance.

In this article, we discuss all things disability insurance for nail technicians.

This guide will help you understand this important insurance.

Here’s what we will discuss:

- What Is Disability Insurance?

- #1 Reason You Need Disability Insurance

- Disability Insurance Underwriting

- Strong Elements Needed In Every Disability Insurance Policy

- Disability Insurance Riders

- Best Disability Insurance

- What If You Are An Employer Or An Employee?

- Estimated Premiums For Nail Technicians

- Final Thoughts About Disability Insurance

Let’s jump in and give a quick, but on-point, discussion about disability insurance for nail technicians.

What Is Disability Insurance?

Disability insurance is, simply, a type of insurance that pays you a dollar benefit if you can’t work due to illness or injury.

Do nail technicians need disability insurance?

Many nail technicians tell me, “No”, but if you:

- Make money, and

- You use that money to pay your mortgage, groceries, and other needs, and

- If you and your family would be in a tough financial situation if you could not work, then:

It is really that simple.

Essentially, if you will struggle to pay the bills like your mortgage upon an illness or injury, you probably need disability insurance.

Disability Insurance For Nail Technicians Is Paycheck Protection

Think of disability insurance as “paycheck protection”.

Think of disability insurance as “paycheck protection”.

Think about how you are able to pay for things.

We have our house, cars, vacations, luxury items, and necessities. Think of all that.

How do you get the money to pay for all of that?

From working, you ask?

Yes. All of that is derived from your ability to work and earn an income.

Conversely, all of that is potentially gone with your inability to work and earn an income.

How much benefit do you receive if you can’t work? That depends on how much you make and your income. Depending on your situation as a nail technician, carriers might insure up to 60% of your gross salary. If you are self-employed, carriers will insure maybe 80% of your net income.

Wait, John. Why don’t I get 100% of my income, you ask?

Good question. Carriers rarely insure 100% of your income or salary. Why? Well, there are a couple of reasons:

- If you receive a benefit, your benefit is income tax-free. So, you pay no taxes on your benefit, and

- To incentivize you back to work

Human nature tells us that if we receive 100% of our income, we probably don’t want to go back to work, right?

There are ways to potentially obtain 100% of your income. It is outside the scope of the article. If you want to learn more, feel free to reach out to us.

Disability Insurance Is Your Spare Tire

As a final thought here in this section, think of disability insurance as a “spare tire”. You really don’t think of your spare tire (or AAA) until you really need it. And, when you do, you are thankful you have that spare tire or the AAA membership. A temporary tire replaces your flat. You are back on the road, and you get your other tire repaired.

tire”. You really don’t think of your spare tire (or AAA) until you really need it. And, when you do, you are thankful you have that spare tire or the AAA membership. A temporary tire replaces your flat. You are back on the road, and you get your other tire repaired.

Disability insurance is no different, except it gets you back on the road of your life.

It is arguably the most important insurance you don’t have. (link)

Think about it. If you are sick or hurt, and can’t earn money, what will you do?

Yes, John, but I’m not going to get sick or hurt.

That is a good segue for our next section.

#1 Reason Nail Technicians Need Disability Insurance

There are really 3 reasons why nail technicians need disability insurance. We’ve talked about the first 2 ad nauseum in many other articles. Here are the first 2:

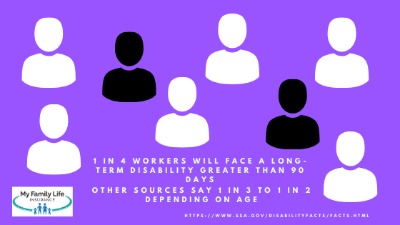

- A disability happens way more than you think – this is true. Government stats

report that a 30-year-old today has a 1 in 3 to 1 in 4 chance of experiencing a disability greater than 90 days.

report that a 30-year-old today has a 1 in 3 to 1 in 4 chance of experiencing a disability greater than 90 days.

Remember that anything injury or illness-related can be a disability if it prevents you from doing your job as a nail technician. It’s not just “wheelchair-related” disabilities. A disability for a social worker could be depression, COVID-19, MS, a severe injury, and on and on…

- A disability can last a long time. There are stats stating that the average disability is 3 years. Maybe. Personally, I think that information is a bit flawed as it probably includes people who don’t want to go back to work. The claims departments I speak with tell me their average claims are around 18 months.

Regardless, can you survive financially without receiving a paycheck or income for 1, 2, or 3 years and more?

That can happen.

Think hard about that. What happens if you can’t pay the mortgage or anything for your children?

This brings us to our #1 reason why nail technicians need disability insurance.

Here’s The #1 Reason Nail Technicians Need Disability Insurance: More Important People Rely On You

Your clients are very important. There is also a group of people who are more important. Who can be more important than my clients, you think? They pay my income. Without them, I wouldn’t have anything.

Your clients are very important. There is also a group of people who are more important. Who can be more important than my clients, you think? They pay my income. Without them, I wouldn’t have anything.

True. But, your clients don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything.

If you are disabled without disability insurance, there will be tough questions that need answering and tough decisions need to be made.

Would you and your family be able to continue your standard of living without your income? If not, what is “plan B”?

Would your spouse have to work or work more? He or she would have to. How?

Would you need to sell your home to make ends meet? (Truthfully, I had a person call me about this. Her husband got disabled and was the breadwinner. This is no joke. With no money coming in, their house was at risk. Sadly, no. It was too late. This is why disability insurance is way more important for “mortgage protection” than life insurance.)

Who could be flexible with the children? Would you have the money to hire someone to take care of the kids? The tough questions can go on and on.

With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

Disability Insurance Underwriting For Nail Technicians

It’s important to understand how disability insurance carriers underwrite your application.

Oh, I just went through the life insurance process. I know how it works, you say.

Great. But, disability insurance underwriting is completely different.

Carriers aren’t insuring your mortality. They are insuring your morbidity. In other words, the risk of a disabling accident or illness and then paying you a percentage of salary/income.

So, carriers look at the following attributes in an application.

When it comes to underwriting, carriers look at your:

- Age

- Health

- Income / Salary

- Occupation

- Other hazards and lifestyle situations

Specifics About Underwriting

Age is a factor. The older you are, the more expensive the policy – all things being equal, of course. This is why you want to start your policy as soon as possible.

Obviously, your health matters. If you have a chronic illness or had a severe injury in the past, likely that illness or injury won’t be covered. Additionally, carriers can limit benefits based on any health conditions. For example, if you take any anxiety or depression medication, nearly all the carriers limit the waiting period to a minimum of 90 days.

As we mentioned before, carriers insure a percentage of your salary. This percentage is usually 60% of your gross salary.

Your occupation matters as well. All the disability insurance carriers classify your occupational disability risk. The classification table is usually a 1 to a 5 (or 6 with some carriers). An occupation with a class 1 is the riskiest while an occupation with a class 5 is the least. For example, carriers classify a construction laborer at a 1 and an accountant at a 5.

Usually, carriers classify the nail technician occupation as a class 2. Sometimes, higher classifications are available.

Finally, carriers also consider other situations and lifestyle choices like hazardous hobbies. Do you like to rock climb? If so, that hobby will be excluded from your policy.

What Do The Carriers Do With The Information?

The underwriters review all this information and make an approval decision or not. They routinely look up your medical background in the MIB, prescription drug databases, driving records, tax records, etc.

As we discussed, certain situations may limit benefits, benefit periods, and/or waiting periods. They may also increase premiums to compensate for an increased disability risk. For example, if you use marijuana, some carriers will rate your policy (i.e. increase the premiums).

Nevertheless, if your benefits are modified in any way, it still makes sense to purchase the policy. We discuss more in our disability underwriting guide.

Strong Elements Needed In Every Disability Insurance Policy For Nail Technicians

Enrolling in disability insurance can be a double-edged sword.

Here’s what I mean.

You have many riders to customize your policy.

However, many of these riders are confusing and expensive.

We’ll discuss those riders later; however, there are provisions we believe should be in every disability insurance plan for nail technicians.

Having these provisions make a strong, formidable plan if you need to make a claim.

We discuss these “non-negotiables” next.

#1 The Definition Matters

The definition of disability matters. You generally want some type of “own occupation” definition.

There are two “degrees” of the own occupation definition: “true” own occupation and the “modified” own occupation definition. (There are other own occupation definitions, but these are the two most common.)

Here’s what they each mean. The “true” own-occupation definition means:

- you will receive a disability benefit based on your inability to do your job (as a nail technician), AND

- also work simultaneously in another job for an earned income (should you decide you can).

In other words, you can continue to work in another occupation while receiving disability benefits for the inability to do your job as a nail technician.

So, if you can’t use your hands, but you can greet people at Walmart, you will receive disability benefits in addition to your earnings as a Walmart greeter.

Modified own occupation is a bit different. You will receive a disability benefit based on your inability to do your job. However, you can’t work in another job. So, if you worked as a Walmart greeter, you won’t receive disability benefits under the modified own occupation definition. This is a good definition, too.

Be Aware Of The Any Occupation Definition

Finally, there is the stringent “any” occupation definition. This means, simply, if you can work in any gainful occupation (for which you are reasonably suited, considering your education, training, and experience), the carrier denies your benefits. So, under this definition, you won’t receive a disability benefit based on your education and experience as a nail technician because the insurance carrier says you can work as a Walmart greeter.

Do you want this definition? As a nail technician, probably not. You probably want some type of own occupation definition.

However, let’s say you have a long-term problem with your left wrist or arm because of work repetition. Can you do another job? If you can, the any occupation won’t pay a benefit.

Personally, I always like to play it safe and have clients’ policies contain, at minimum, the “modified” own occupation definition.

#2 Residual / Partial Disability Benefits

Some disabilities start out as a partial disability. For example, multiple sclerosis can likely start out as a partial disability, which means you can work, but not full-time.

This rider will pay a benefit if you work in your occupation, but you experience an income loss of 20% or more compared to your pre-disability income.

Usually, the amount of disability income you receive is a percentage of your total monthly disability benefit. For example, let’s say you are partially disabled and experience a 40% income loss. If your monthly disability benefit is $4,000, you will receive $1,600 ($4,000 X 40%).

Why would you need this rider? Here’s why:

Most disability insurance policies allow partial disability benefits, but only upon the completion of a total disability first. This means if you are only partially disabled (i.e. you can still work but not full-time), you will not receive any benefits until you have met the carrier’s requirements for total disability first. But, you are partially disabled, not totally disabled. Without this rider, you won’t receive any partial disability benefits until you have met the total disability requirements first. Ugh!

Most disability insurance policies allow partial disability benefits, but only upon the completion of a total disability first. This means if you are only partially disabled (i.e. you can still work but not full-time), you will not receive any benefits until you have met the carrier’s requirements for total disability first. But, you are partially disabled, not totally disabled. Without this rider, you won’t receive any partial disability benefits until you have met the total disability requirements first. Ugh!

Typically, this rider circumvents the total disability requirement and allows you to receive benefits immediately (after you satisfy the elimination period).

Here is a very easy example. You lose feeling in your wrists and fingers. The doctor says you need to rest and limits your work to 2 days per week. Without this rider – or a plan that has a partial benefit without a total disability requirement first – you would not receive any disability benefits because you are still working.

#3 Guaranteed Purchase Option

This option allows you to obtain the coverage you need now with the option to purchase additional coverage in the future without evidence of good health. You just need to show your salary or self-employed income increased (through a W-2 or your tax return).

In other words, you can buy more disability insurance as your salary or income grows (subject to carrier income and coverage limits) with no underwriting?

How great is that?

You can develop type 2 diabietes, develop RA, or get hurt. You can still buy more disability insurance.

Generally speaking, you can purchase additional coverage every 2 years up to age 55. (You do not need to wait 2 years if you had a life change, defined as a marriage the death of a spouse, divorce, or birth or adoption of a child; Instead within 3 months of a life change, you may purchase additional coverage.)

I believe having these 3 provisions creates a formidable plan should you make a claim.

There are other options. Let’s discuss some of those riders next.

Disability Insurance Riders For Nail Technicians

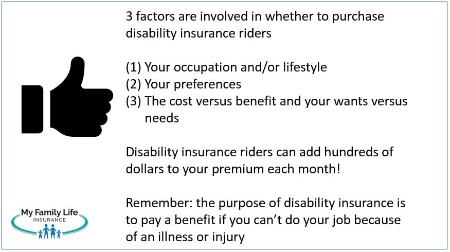

There are plenty of disability insurance riders to customize your policy.

There are plenty of disability insurance riders to customize your policy.

However, some just aren’t worth the extra cost. We are being honest here. The last thing we want is for you to spend your hard-earn money on something you don’t need.

Some riders, though, may be worth it in your situation.

Here are some riders that might be advantageous for nail technicians.

You can read more about them in our disability insurance rider guide. As always, contact us if you have any specific questions.

Catastrophic Disability

The catastrophic disability rider pays an additional benefit, above and beyond, your base monthly benefit. It pays if you:

- Can’t perform 2 out of 6 activities of daily living, or

- Have irreversible cognitive impairment like Alzheimer’s

(Carrier’s requirements may be different.)

You can use this extra benefit to pay for your bills and needs and care.

It’s not a terribly expensive rider as most disabilities are not permanent in nature.

But, they do happen.

Some carriers will pay this extra benefit for up to the benefit period you select.

Others allow to age 65 coverage, provided you meet certain underwriting requirements.

Mental, Nervous, Substance Abuse Rider

Nearly all the disability insurance policies issued in the US have limitations on disabilities due to an emotional or nervous disorder like anxiety or depression.

Additionally, carriers limit claims due to substance abuse like drug and alcohol abuse.

They typically limit these disabilities to 24 months of claims coverage.

Even if I have a longer benefit period, John?

Yes. You can have a 5-year benefit period, for example, and cover only 24 months due to a nervous or emotional disorder.

Unless you purchase this rider. This rider extends disabilities due to a mental or nervous disorder to match the benefit period.

So, using the prior example, if you have a 5-year benefit period and you purchased this rider, then your coverage for nervous and emotional disorders is also 5 years.

Note: a pre-existing condition of a nervous or emotional disorder like anxiety precludes this rider.

These riders are discussed in our disability insurance rider guide. In that guide, we also discuss riders that are a waste of money (in our opinion), so it is worth the read.

Best Disability Insurance For Nail Technicians

You are probably wondering who we like to work with. First, we work with many disability insurance carriers. So, we are sure we can find one that meets your needs and budget.

However, not all carriers insure nail technicians the same. Look at these snapshots out of two underwriting guides of a couple of popular carriers. One blankets the nail technician occupation at a 2. The others at a 1.

As we discussed, all things being equal, the higher your class, the lower your premium.

We like to use the carriers that allow a class 3 for nail technicians.

Additionally, the carriers we like all have the:

- Own-occupation definition

- Partial disability benefits

- Guaranteed purchase options

Moreover, we like carriers that offer additional, value-added options as we discussed. For example, one carrier we like offers value-added benefits like retraining programs into a new career if you can’t do your job as a nail technician.

If you are Christian, we also work with a carrier dedicated to practicing Christians.

Contact us if you would like to learn more. We are happy to chat with you. Since we work with so many disability insurance carriers, I am sure we can find a carrier that meets your needs and budget.

Be careful of blindly applying online without knowing what you are getting yourself into. Buying directly online, currently, is the wrong way to buy disability insurance. Why? As we illustrated earlier, there are so many moving parts with disability insurance. For example, we spoke to one professional who went online and selected a quote for $800 per month! Talk about sticker shock!

With our knowledge and experience, we were able to get her the “formidable” plan for $100 per month.

Group Disability Insurance Available As Well

We also work with a good carrier on the group insurance side. The carrier we like offers both short-term disability insurance and long-term disability insurance at guaranteed issue starting at 2 employees.

Rates are reasonable. The disadvantage? Like all group disability insurance, the plan is “plain vanilla” to meet the needs of everyone.

They also accept husband and wife businesses as well as family businesses. We have insured several family-owned businesses with group insurance. So, if you own a business or are partners with your spouse or another relative, this is an option as well.

Now is a good time to discuss additional options if you own your business.

How Nail Technicians Protect Their Business With Disability Insurance?

So far, we’ve discussed disability insurance that pays a benefit based on your individual needs. In other words, you use that money to pay for your mortgage, utilities, etc.

individual needs. In other words, you use that money to pay for your mortgage, utilities, etc.

What if you are a nail technician and own your business? If so, you have additional options.

You can enroll in a policy that will pay your business expenses upon a disability. The policy is called a business overhead expense policy. Premiums are tax deductible.

If structured properly, benefits are tax-free as well.

This type of policy pays your business expenses (rather than a personal benefit to you). It will ensure your business remains solvent during your inability to work from a disability. This is an additional reason why nail technicians need disability insurance.

Carriers who offer this type of insurance typically offer a discount on an individual disability insurance policy. Additionally, we only work with carriers that offer an occupation upgrade as well, which means lower premium costs, all things being equal.

If you have any business loans, we also have disability insurance for business loans.

What If You Are An Employee?

If you are an employee and your employer offers disability insurance, you can buy more.

We typically can stack an individual policy on your group plan. Why would you want to do this?

In our experience, there are two reasons why:

- Group plans are limited, and/or

- The government taxes your benefit

The great news is that the additional benefit is usually not that expensive.

Speaking of cost, let’s discuss what the cost of disability insurance for nail technicians could be.

Disability Insurance Costs For Nail Technicians

After all of this, how much does disability insurance cost for nail technicians? That’s the $1,000,000 question. Well, the premiums you pay are a function of everything we discussed above.

That’s the $1,000,000 question. Well, the premiums you pay are a function of everything we discussed above.

However, disability insurance is not incredibly expensive.

Depending on your situation, disability insurance costs between $1.00 and $4.00 per day. Sometimes it is more; sometimes it is less.

Here’s another way to look at disability insurance costs. The cost is about the cost of a cup of coffee at your favorite coffee shop. Even in these economic times of rising inflation.

If you can afford a daily cup of coffee, or lunch, you can certainly afford disability insurance.

For example, a female nail technician, business owner, age 35, making $50,000 will cost $3.10 per day with our “formidable” plan.

Think about what you spend each day. You can definitely afford disability insurance.

Final Thoughts About Disability Insurance For Nail Technicians

We hope now you have a solid idea why nail technicians need disability insurance.

We discussed disability insurance options, cost, and underwriting.

Confused? Don’t feel that way. We’re here to help educate you and protect your income and future.

Don’t know where to start? Use this disability insurance needs analysis worksheet. Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy).

Next, feel free to reach out to us for our assistance or a quote. Or, use the form below. We only work for you, your family, and your best interests only. We have helped many nail technicians secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".