3 Reasons Why Hospital Indemnity Insurance Is Worth The Money | We Discuss Why This Insurance Can Be An Important Component To Your Health Insurance

Updated: April 12, 2024 at 9:38 am

Many people wonder what hospital indemnity insurance is and if they need it.

Oh, John, you say. Stop right there. I have health insurance. I’m covered.

Many people think they are. However, did you know your health insurance likely does not cover everything? Here’s what I mean.

Let’s say you are in the hospital for a few days because of an accident. The pre-insurance bill is $50,000. After it is all said and done, you owe $7,500 which includes your $6,000 deductible you will need to pay and $1,500 of coinsurance.

Do you have the money to pay for that? How would you pay for these unexpected medical expenses? A hospital indemnity insurance policy is an option.

Considering the increasingly higher out-of-pocket expenses, people are turning to hospital indemnity insurance for cost assistance and peace of mind.

Is hospital indemnity insurance worth the money, though? In this article, we describe hospital indemnity insurance and 3 reasons why it is worth the money.

Here’s what we will discuss:

- What Are Hospital Indemnity Plans?

- Types That Exist, Depending On Age, Needs, & Wants

- 3 Reasons Why It Is Worth It

- Estimated Costs

- Underwriting Of Hospital Indemnity Plans

- Health Insurance And When You Don’t Need A Hospital Indemnity Plan

- FAQs About Hospital Indemnity Plans

- Final Thoughts

Let’s discuss what hospital indemnity insurance is.

What Are Hospital Indemnity Insurance Policies?

Hospital Indemnity Insurance is a type of supplemental insurance that pays you a fixed, cash benefit for hospital admittance and other in-patient services. Sometimes, these policies are known as “hospital insurance”.

Hospital Indemnity Insurance is a type of supplemental insurance that pays you a fixed, cash benefit for hospital admittance and other in-patient services. Sometimes, these policies are known as “hospital insurance”.

Again, these situations are for in-patient situations. In other words, you are admitted to the hospital for an overnight stay.

Because it is an indemnity plan, hospital indemnity insurance pays on a fixed dollar benefit. You use this money for whatever you want, including paying out-of-pocket hospital expenses such as deductibles and coinsurance on your underlying health insurance.

A hospital indemnity policy works well with major medical insurance and high-deductible health plans. Additionally, many carriers offer hospital indemnity coverage that offsets many out-of-pocket costs associated with Medicare Advantage Plans (more on that later in the article).

Here’s generally how hospital indemnity policies work. Let’s say you have a high-deductible health insurance plan with a $4,000 deductible. Let’s also say you are admitted to the hospital for a sickness. You are in the hospital for 3 days. A hospital indemnity plan may pay:

- $1,000 for the hospital admittance

- $3,000 for each day in the hospital ($9,000)

You receive a lump-sum payment of $10,000 and use the money to pay for your deductible, hospital bills, and anything else.

This, in a nutshell, is hospital indemnity insurance.

Be honest with me…that sounds ideal, doesn’t it? Let’s say you are cleaning your gutter and fall off the ladder. You are seriously hurt. Very likely, you are still in your health insurance’s deductible stage. This means you are faced with a potentially huge medical and hospital bill.

A hospital indemnity insurance plan helps pay those costs.

Many Types Of Hospital Indemnity Insurance Plans Exist

Many types of hospital indemnity plans exist. Plans available are based on your:

- Age and type of health insurance you have

- What kind of preferences and options that you want

There are really 2 kinds of hospital indemnity plans – one type for people under the age of 65 on a group employer plan, a high-deductible health plan, or an ACA plan.

the age of 65 on a group employer plan, a high-deductible health plan, or an ACA plan.

The other is for people over the age of 65 and on a Medicare Advantage plan.

We won’t go into all the details and differences (contact us to learn more); however, here are some highlights.

Hospital Indemnity Insurance Plans For Those Under The Age of 65

If you are under the age of 65 and/or on a group employer plan or an ACA-exchange plan, hospital indemnity insurance offers the following benefits (generally speaking, subject to change by carrier):

- A lump sum hospital confinement benefit

- A daily hospital benefit

If you are admitted to the hospital, you receive these aforementioned benefits based on the benefits contained in the insurance contract.

I’ve talked about this before; carriers always look for an edge. Do you see a problem with the above? That’s right. You only receive a benefit if you are admitted to the hospital. What if you have outpatient surgery? Well, under the aforementioned scenario, you won’t receive a benefit unless you are admitted to the hospital as an inpatient after your surgery.

Some people don’t like that. Nowadays, though, many hospital indemnity insurance plans for the under age 65 market have expanded and provide additional benefits. Some carriers embed these additional benefits into the base plan itself while others make these additional benefits optional.

New Plans Available For The Under 65

These plans are known as gap insurance plans. These are similar to hospital indemnity plans except they cover much more and extra expenses, including (but not limited to):

- emergency room visits – for treatment in the emergency room or urgent care

- rehabilitation – pays for rehab at a qualified facility under a doctor’s order

- intensive care unit coverage – pays an additional payout if you are in the ICU

- physician care – pays for doctor office visits for covered accidents and illnesses

- preventative care – pays for procedures defined under the Affordable Care Act

- labs, x-rays, imaging, diagnostics – pays for these services when connected to a covered illness or accident

- ambulance – for travel in a ground or air ambulance

- outpatient surgery – pays a lump sum, like $3,000, towards an outpatient surgery like an ACL repair, kidney stones, etc.

- prescription drugs – some plans will pay a benefit for prescription drugs (yes, even if you have prescription insurance through your primary health insurance).

- Other medical services

Nowadays, many hospital indemnity plans offer these extra benefits as part of the base contract or you can purchase them for an extra cost.

Remember, these benefits are typically a lump sum or fixed dollar benefit that you can use towards your out-of-pocket medical expenses or anything you want.

Hospital Indemnity Insurance For Medicare Beneficiaries

Medicare beneficiaries have their own hospital indemnity insurance plans available to them. If you enroll in a Medicare Advantage plan, you can purchase an indemnity plan designed to supplement your Medicare Advantage plan.

The discussion of Medicare Advantage plans and the structure of the hospital indemnity plans are beyond the scope of this article. However, the benefits are similar to that of the new indemnity plans on the market today for the under 65 market. In other words, hospital indemnity plans for Medicare Advantage enrollees will typically cover (subject to specific carriers):

- Skilled nursing daily benefits

- Ambulance coverage

- A daily hospital visit benefit

- MRI, diagnostic imaging

- Outpatient surgery benefit

- physician / doctor office visit benefit

- some coverage for a chronic condition or chronic illness

- a lump sum accident benefit for a sudden accident

Hospital indemnity policies that supplement Medicare Advantage plans offer a wide range of options and coverages as well.

Contact us if you would like to learn more about the plans available for Medicare beneficiaries.

3 Reasons Why Hospital Indemnity Insurance Is Worth It

So far, we’ve discussed what a hospital indemnity insurance plan is and what they cover. You may be thinking if a plan is right for you.

John, I don’t want to be insurance poor, you say.

No one does. However, I’m talking about spending prudently on your insurance needs.

Here are the 3 reasons why hospital indemnity insurance is worth the extra cost.

#1 Financial Protection

You are living under a rock if you haven’t noticed that medical costs are increasing at an alarming rate. I am sure you are feeling the financial constraint, even with employer-sponsored health insurance.

How do you adjust your financial situation to save money? Well, there are many ways. You could cut expenses elsewhere such as cutting your cable bill.

How do you adjust your financial situation to save money? Well, there are many ways. You could cut expenses elsewhere such as cutting your cable bill.

Another area people cut is their health insurance itself. Many simply drop coverage or lower their coverage, thereby increasing the potential for higher out-of-pocket costs. Sure, you have a lower premium, but a potentially higher out-of-pocket cost. How does that help you out? When you need health insurance the most, you’ll face a larger bill.

This is one reason why we think hospital indemnity insurance is worth the money.

Additionally, you can simply save the deductible and the out-of-pocket maximum on your plan. It’s true! In other words, you can establish an emergency savings account and hold an appropriate amount of money for health care expenses. Let’s say your deductible is $5,000 and your out-of-pocket maximum is $10,000 (including the deductible). Therefore, you need at minimum, $10,000 saved.

Let’s be honest, can you really do that? Most Americans can’t even cover a $1,000 emergency. Moreover, did you know that medical debt is the #1 reason for personal bankruptcies here in the US? That is right. And, these bankruptcies are from people who HAVE health insurance.

What we said is not to scare you. We don’t believe in scare tactics. However, these situations point out that your primary health insurance won’t totally cover you. You need additional assistance. As we said, this is why we feel hospital indemnity insurance is worth the money spent. We discuss below how much money you can expect to pay on premiums.

#2 Saves You Money

John, you say. Really, you can save money?

Sure you can.

Do you want high deductibles? High coinsurance and copays, I ask?

No, of course not, you say. But, that is all I can afford.

Well, let’s see an example. These are true plans taken off the health exchange for zip code 75001, Dallas, TX.

Example Of How A Hospital Indemnity Insurance Plan Saves You Money

Let’s say you are a healthy 40-year-old, non-smoker. You have a $1,450 deductible with a $6,300 maximum out-of-pocket cost. Your monthly premium is $652.

You see a new plan in your area. It is HSA-eligible, which means it is a high-deductible health insurance plan. You think it would be nice to contribute to an HSA, but you don’t want to face a high medical cost exposure. The new plan has a $6,900 deductible with a 0% coinsurance once the deductible is met. That is really nice, you think, because the maximum out-of-pocket expense is essentially the same as your current plan. And, the cost is $399 per month, which is $253 less than your current plan.

You don’t think you can downgrade as significant out-of-pocket cost exposure ($1,450 versus $6,900). But, you can, with hospital indemnity insurance.

One hospital indemnity plan we work with contains a $6,350 lump sum hospital admission benefit and a daily hospital benefit of $200 per day. Additionally, you can receive a $3,000 lump sum benefit for any surgery. The cost for this is $66 per month.

So, you downgrade. Your total monthly cost is $465 per month (both the new HDHP plan and the hospital indemnity insurance). You still have $187 per month that you can save or use to fund your HSA.

That is right. You still have almost $200 to now invest in your HSA or use for whatever you need. Your deductible is nearly 100% covered.

This is how you can save money with hospital indemnity insurance and another reason why it is worth the money.

#3 Portability

You can take your hospital indemnity insurance anywhere. Well, not in the literal sense. If you change jobs, your hospital indemnity insurance stays with you. Some under-age 65 plans work well with Medicare. So when you transition to Medicare, you’ll have a plan that helps pay for those Medicare out-of-pocket costs.

Many people I speak with think the portability aspect isn’t that important. It is. Many employers offer hospital indemnity-type insurance through their group plans. They are usually cheap (of course, as the employer likely subsidizes a portion of the premium). However, if you lose or change your jobs, that coverage is gone. Unless, of course, you have an individual plan that stays with you.

The portability aspect is another reason why hospital indemnity insurance is worth the cost.

Additionally, no network restrictions exist with hospital indemnity insurance. You can go to any medical provider you wish. The reason is that the hospital indemnity insurance companies typically pay the benefit amount directly to you.

So, what are the costs? Let’s touch on that next.

Estimated Premiums Of Hospital Indemnity Insurance

The premium cost of a hospital indemnity insurance plan varies. These are the variables that play a part in what you pay:

(1) state you reside in

(2) tobacco use status

(3) your age

(4) include family members

(5) underwriting – discussed next

Here’s an example using a 40-year-old single, male living in Illinois. A hospital indemnity insurance plan might cost between $35 and $200 per month depending on the plan. Again, some hospital indemnity insurance plans are “plain vanilla” while others are much more robust.

You may be saying to yourself, “John, forget it. I would rather save the $200.”

Well, let’s test that, and see if the status quo (doing nothing) is feasible. Remember, a majority of Americans can’t even pay for a large medical bill…

Example #1

Looking at available options, a Blue Cross Blue Shield “Gold” plan costs $616 per month and has an out-of-pocket maximum of $8,550. It has a $1,000 deductible and 20% coinsurance. Coinsurance is your share of the costs after you pay the deductible.

In total, your out-of-pocket exposure is $15,950 ($7,400 annual premium + $8,550). Can we do better with a hospital indemnity plan?

There is a Bronze plan available, for $342 per month. It has an $8,100 deductible and an $8,500 out-of-pocket maximum with 50% coinsurance.

There is a hospital indemnity plan available for $50 per month, which provides a lump sum hospital confinement of $6,350. It also provides a $3,000 lump sum outpatient surgical benefit. If you wanted to stay at the $616 budget, you could select the $50 per month hospital indemnity insurance plan and purchase the Bronze plan. Your total cost is under $400 each month, saving you about $200 every month. The hospital indemnity insurance plan wipes out most of the deductible and out-of-pocket costs. You figure you will save that $200 every month into an HSA and use that fund for any out-of-pocket expenses.

Example #2

For example, let’s say you are in a bad car accident and break your leg. You have surgery and are admitted to the hospital for 2 days. The hospital charges $10,000.

Your Gold plan has a $1,000 deductible up to a maximum out-of-pocket of $8,550. So, you need to pay $2,800 ($1,000 deductible + $9,000 X 20%). You don’t have that kind of cash lying around.

Alternatively, a Bronze plan has an $8,100 deductible, 50% coinsurance with an $8,550 maximum out-of-pocket. So, you pay $8,550. Wow! Who has that kind of cash! But, you have a hospital indemnity plan which pays:

(1) $6,350 for the hospital admittance

(2) $200 daily benefit for the 2 days ($400) in the hospital

(3) $3,000 for surgery costs

Total paid: $9,750.

You receive a check for $9,750. You pay off the $8,550 bill from your Bronze plan and use the difference to pay for additional costs related to the injury.

Note: you won’t have a surplus every time (this is insurance), but hospital indemnity insurance will help pay for those out-of-pocket expenses.

This is a simple example that shows why we feel hospital indemnity insurance is worth the money.

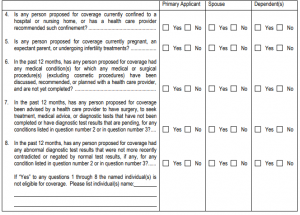

Underwriting of Hospital Indemnity Insurance

You do have to go through underwriting. Underwriting consists of the carrier analyzing your background and health status, ensuring that you meet the insurability requirements.

Underwriting for hospital indemnity insurance usually consists of answering a health questionnaire on the application. Then, possibly having a phone conversation with an underwriter about your application and background.

Carriers will look at any pre-existing conditions. Severe pre-existing conditions, such as cancer or stroke likely proceed as a decline. This means you can’t obtain hospital indemnity insurance. Of course, if you develop these conditions after obtaining hospital indemnity insurance, the policy will pay.

After 12 months on the plan, most carriers will cover any pre-existing conditions (i.e. on the 13th month).

Carriers look up your application history in the MIB and your prescription drug history.

As we always say, best to be honest on these applications.

Below is an excerpt of an actual health underwriting questionnaire from a carrier.

Many carriers offering hospital indemnity plans to Medicare beneficiaries have slightly different underwriting processes. Many offer their hospital indemnity insurance at guaranteed issue (i.e. no underwriting) between the ages of 64 and 68.

Alternative Types Of Hospital Indemnity Insurance

As we mentioned earlier, there are many types of hospital indemnity insurance plans in the US. Some are plain vanillas while others are more robust.

Another popular plan is a gap health insurance plan that pays up to your annual out-of-pocket maximum and nothing more. The benefits are apparent. Have a $3,000 out-of-pocket bill from a hospital stay, the plan pays $3,000. The downside? You receive nothing more, but the premium is again ½ the cost. You just need to select a “bucket of money” that represents your total maximum out-of-pocket on your primary health insurance for the year. The $8,100 out-of-pocket maximum for the 40-year-old Illinois resident costs around $77 per month. However, it just about covers every hospital or outpatient event.

Finally, there are indemnity plans for a specific situation. For example, accident insurance is a popular indemnity plan. These plans are very affordable, but will pay only on a covered accident. Same with a critical illness insurance or a cancer insurance plan. These plans will pay you money based on a diagnosis and/or treatment of a critical illness such as heart disease, cancer, or some other illness such as ALS. These plans are usually affordable as well.

Finally, don’t forget about disability insurance. If you have a severe ailment or injury, disability insurance pays a portion of your paycheck so you can focus on getting better. It is often forgotten, but needed when you need money the most.

New Way To Think About Health Insurance…And When You Don’t Need Hospital Indemnity Insurance

We hear it all the time. “John, this sounds good, but it is too expensive.”

You can’t think about hospital indemnity insurance as an “extra”. You have to change your way of thinking. These hospital indemnity plans need to be added as part of your total health insurance protection plan. We described an example above that illustrates this.

Would you rather spend a relatively lower amount now for extra coverage or a higher amount that you potentially have a hard time paying? In other words, would you spend that extra $70 to $170 per month ($900 to $2,000 annually) or the $8,000? We honestly choose the first option. Moreover, if you can’t afford out-of-pocket medical costs, you really need to rethink your health insurance plan.

While these plans will pay, don’t expect to make a “profit”. This isn’t how insurance works. Insurance protects you from a catastrophic event. Not having $3,000 to pay a medical bill is a catastrophic event for many families. You could go 5 years paying these premiums, only receiving benefits for basic services like doctor visits or lab work. But, that one time you need it, you will be glad you have it.

And, it is true: you really don’t need a hospital indemnity insurance plan IF you have the money saved up to pay the maximum on your out-of-pocket on your health insurance. If you have that amount saved up in an emergency fund, and can replenish the money, then you likely do not need hospital indemnity insurance.

However, we know that most families don’t and hospital indemnity insurance is a great way to create that safety net.

Frequently Asked Questions About Hospital Indemnity Insurance

Frequently Asked Questions About Hospital Indemnity Insurance

Here are some frequently asked questions about hospital indemnity insurance. It is always important to read the limitations and exclusions. If you have questions, ask your agent.

Does Hospital Indemnity Insurance Cover Pregnancy?

Nearly all carriers cover complications of pregnancy. However, only 1 carrier that we know of cover a normal childbirth. They will pay a hospital confinement lump sum benefit and a daily hospital benefit.

One thing to know: The baby needs to be born in a hospital. Additionally, there are waiting periods for childbirth, which is 10 months. This means if the baby is born within the waiting period, the carrier won’t pay a benefit (unless due to pregnancy complications).

Note: many states are limiting this benefit, so contact us to find out.

Speaking Of Waiting Periods, Are There Any?

Yes. Most plans have a 30-day waiting period for illnesses. Typically, accidents are covered day 1. And, as we stated above, those carriers covering normal childbirth have waiting periods ranging from 10 months to 12 months.

Does Hospital Indemnity Insurance Coordinate With My Insurance?

We receive that question a lot. The answer is “no”.

As we said earlier, your health insurance and the hospital indemnity insurance are totally separate and do not coordinate with one another.

Indemnity plans are just that…they pay a fixed dollar benefit and pay this benefit directly to you (typically, unless you assign the benefit to your provider).

If you receive more money from the indemnity plan than what you owe from your insurance, you just keep this and use the money for whatever you want.

What Should I Look For In A Hospital Indemnity Plan?

There are hundreds of hospital indemnity plans in the US. Your final choice depends on:

- Your age

- Health situation

- Where you live

- Your preferences

- Cost

Remember, you have to go through underwriting, which is a simple questionnaire.

Final Thoughts Why Hospital Indemnity Plans Are Worth The Money

We hope you found this article informative. We feel that hospital indemnity insurance is worth the money.

In our opinion, it is a “safety net”, preventing you from experiencing potentially high out-of-pocket costs with your health care. Moreover, the cost is not significantly great. We provided 3 examples illustrating how hospital indemnity insurance can save you money.

Sure, you may need to spend a little more each month, but knowing that your health care deductibles, copays, and coinsurance are completely, or nearly covered, should give you peace of mind.

Don’t know what to do next? Contact us or use the form below. We would be happy to help you out in any way we can with finding the right hospital indemnity insurance for you.

As with anything we do, we operate with your best interests first and foremost. What does this mean? Although we work with many hospital indemnity insurance carriers, we will tell you if there is another carrier that is a better fit for you and your situation. This is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".