Here Is Why You Need Affordable Gap Health Insurance Now | We Give You All The Details Why This Insurance Is Critical To Peace-Of-Mind

Updated: April 12, 2024 at 9:39 am

What is gap health insurance?

Nope. It is not clothing for health insurance carriers.

It is insurance that will help pay for your out-of-pocket medical costs.

Why is paying for your out-of-pocket expenses important?

If you have an ACA health insurance plan, or even a plan from your employer, you may realize that your out-of-pocket costs have risen dramatically in the last few years.

These costs have made a severe financial impact on families.

How can you manage?

Luckily, gap health insurance helps. Big time.

In this article, we discuss:

- Why you need gap insurance now

- What is gap insurance?

- How does it work?

- Underwriting of gap insurance?

- How much does gap health insurance cost?

- Who is it NOT good for?

- Now you know why you need gap insurance now

Let’s start the discussion off by describing why you need gap health insurance now.

Why You Need Gap Health Insurance Now

It is simple.

Have you seen your health insurance lately?

Do you gingerly open any mail that comes from your insurance carrier? Afraid to see what they have inside?

Do you gingerly open any mail that comes from your insurance carrier? Afraid to see what they have inside?

Do you avoid going to the doctor because of the associated costs?

Even this CNBC article states that the higher health care costs aren’t associated with your medical visits (that is, your doctor and hospital visits), but are associated with the insurance plans themselves.

In other words, your higher health insurance costs are due to higher deductibles, copays, coinsurance, etc…

Moreover, if you have read some of our previous articles, medical debt is the #1 cause of personal bankruptcies here in the US. And, yes, that goes for people WITH health insurance.

What do you do?

This is where gap health insurance comes in.

What Is Gap Health Insurance?

Also known as medical gap insurance, hospital indemnity insurance, gap medical insurance, or simply gap insurance, gap health insurance pays for your out-of-pocket costs attributed to deductibles, copays, and coinsurance.

It does not pay your health insurance premiums.

Why is gap health insurance important? As we just pointed above, your health  care costs are going up. That is a given. Ben Franklin should have said, “nothing can be said to be certain, except death and taxes and increasing medical costs.”

care costs are going up. That is a given. Ben Franklin should have said, “nothing can be said to be certain, except death and taxes and increasing medical costs.”

The graph in this Time-Money article illustrates why. Deductibles and coinsurance have risen dramatically over the last decade.

Let me ask you this, “Has your income risen that much, too?”

No, it has not.

Right. Today, with everything else going on, families are feeling the squeeze paying medical bills.

That sounds great, John. But this sounds like an insurance for my health insurance, you say.

Yes, you can look at it that way. And, that is how we look at it. However, gap insurance comes at a fraction of the cost compared to paying these out-of-pocket costs outright or for a more robust health insurance plan. I share a personal story below and example below. We will discuss costs later, too.

It is important to note that gap health insurance is not major medical or complies with the Affordable Care Act. Gap insurance is a supplemental policy.

How Does Gap Health Insurance Work?

Generally speaking, when you have a covered event, you’ll file a claim directly with the gap insurance carrier.

For example, let’s say you had a 2-day hospital stay. The hospital files a claim with your underlying health insurance. However, you take a copy of the records and file a claim with the gap insurance carrier. You then receive the money from the gap insurance carrier. You use that money to pay your hospital bill.

That’s how gap health insurance, in a nutshell, works.

It’s the same process if you have a doctor’s visit or outpatient surgery. It is a rather simple process. Fill out a claim form and provide supporting documents of the service completed.

Types Of Gap Health Insurance

There are two main types of gap health insurance. We discuss them below.

The first option gives you a pot of money, say $5,000, annually. You would then draw on this money to pay for any deductibles, copays, and coinsurance.

The first option gives you a pot of money, say $5,000, annually. You would then draw on this money to pay for any deductibles, copays, and coinsurance.

The next type pays per a scheduled, fixed benefit. It is similar to a hospital indemnity plan as we have discussed before. It pays out for any covered accident, critical illness, or hospital confinement. For example, if you have a lump-sum $5,000 hospital admission benefit, you receive this amount.

As we mentioned earlier, you submit your out-of-pocket costs to the carrier, typically via an online portal. Alternatively, you can fax or mail your information. The carrier then pays your benefit.

The first type, the “bucket-of-money”, is usually the most expensive as it will pay whenever you have an eligible out-of-pocket cost. How great is that?

The second is usually the least expensive as it is just like any hospital indemnity plan.

The premium cost really depends on the number of people in your family, age, and health.

A Personal Story

While you may think you don’t need a gap health insurance plan, you can look no further to the rising deductibles and out-of-pocket costs. My family and I have a gap health insurance plan. We have a benefit amount that matches our family deductible. Over the last few years, we exceeded this deductible amount. By selecting a gap health insurance plan, we paid a fraction of the cost to reimburse us for our out-of-pocket costs.

These plans make a lot of sense if you reach or exceed your deductible every year. Moreover, these plans make sense because, as we mentioned earlier and will again further in the article, your insurance cost-sharing is much higher. There’s no chance of that ever coming down.

If you want peace of mind, gap insurance provides that.

How To Determine How Much Coverage You Need

There is some legwork needed on your part. As I did for my family, you need to review your out-of-pocket costs over the last few years. You can easily do this by reviewing your out-of-pocket costs through your carrier’s online member portal.

Additionally, you can match your total out-of-pocket exposure on your underlying health insurance to the gap insurance benefit.

For example, if you have health insurance that contains a $5,000 deductible with 20% coinsurance, you’ll want your gap health insurance to cover more than $5,000, say $7,000.

These plans can work well with your bronze and silver plans. You may, overall, save a significant amount of money while having “gold” coverage. Let’s compare using an example.

The example below shows you can potentially save serious money on your health insurance premiums by utilizing a gap insurance plan.

Example Of How Gap Health Insurance Works

You have a choice of an ACA compliant Gold plan versus a Bronze plan. The Gold plan costs $2,500 per month with a $2,000 family deductible and the Bronze Plan costs $1,300 with a $6,000 family deductible.

You groan about these costs, but someone tells you about a gap insurance plan.

Right off the bat, by choosing the Bronze plan, you will save $1,200 per month or $14,400 per year versus the Gold plan. Of course, this amount is offset by the $4,000 in extra deductible costs, not to mention higher cost sharing for the Bronze plan.

Your net savings are $10,400 excluding any copay and coinsurance costs.

That is good, but you can potentially save more. Let’s say a $6,000 gap health insurance plan costs $200 per month for your family (depending on the state). That will bring your total premiums to $1,500 per month. You’ll save $1,000 per month or $12,000 on premiums alone. If you exceed your deductible, you will save an additional $6,000 for a total of $18,000.

Additionally, your out-of-pocket costs on your underlying health insurance are pretty much covered. How great is that? And, you are saving $1,000 each month.

Underwriting Gap Health Insurance

Generally speaking, you need a compliant ACA plan to purchase a gap health insurance plan. The reason why is that carriers do not want you to use this as your primary insurance. It is not solely health insurance; it supplements your health insurance policy by minimizing your out-of-pocket costs.

Remember, gap insurance does not fall under the Affordable Care Act.

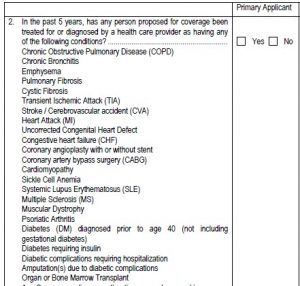

The application process is usually easy. Carriers use simplified underwriting, which consists of a “yes/no” questionnaire, an MIB check, and a prescription drug history check. Additionally, carriers may require a phone interview.

Yes, you need to go through underwriting. As we mentioned, usually, the underwriting is health-based questions. You can’t have any significant health conditions such as COPD, insulin-dependent diabetes, cancer, or drug use. Moreover, you can’t be pregnant. A few gap health insurance plans do cover the out-of-pocket exposure of childbirth.

What this means is that you’ll want to apply when you are still healthy with low severity health conditions if any.

Applying for gap insurance is relatively easy. Most carriers have an online application portal where you can apply. Or, we can assist you in the application process. Contact us if you would like our help.

Additionally, you can enroll in a gap insurance plan year-round.

How Much Does Gap Health Insurance Cost?

Of course, everyone wants to know how much it is.

And, I did say in the title, affordable.

Fact is, gap health insurance can be affordable, especially when one considers the alternative…paying a lot of money out-of-pocket.

You don’t need to spend an arm and a leg on gap health insurance.

I mentioned earlier that the “bucket of money” will be more expensive. However, you will ALWAYS receive a benefit. And, yes, even if you go to the doctor for a checkup!

A $10,000 “bucket” for a family of 4 (every member has $10,000 each) will cost about $190 per month at the time of this writing. This is for 2 people age 30 with 2 children under the age of 16.

The scheduled benefit plans might be a tad cheaper. You could be looking at $160 per month.

I know what you are thinking.

John, I can save that money…

True. You can. Will you? Probably not.

Moreover, what if you have a severe accident and hit with a $10,000 medical bill. It happens…

The best way to look at this coverage is that it is part of your overall protection strategy. Knowing that you’ll spend an extra $200 per month for peace-of-mind should be paramount.

Who Is It Not Good For

Frankly, not everyone needs this type of insurance. These plans work well for many families who want to save money, but may not work for the following. You:

- self insure

- have significant savings

- are eligible for subsidies

- will cancel right after receiving a benefit or after issue

If you fall into these categories, then a gap insurance plan probably isn’t right for you.

Now You Know You Need Affordable Gap Health Insurance Now

With the rising deductibles, copays, and coinsurance on nearly all ACA health insurance, we feel a gap health insurance plan helps families save money. Are these plans right for you? Contact us or use the form below for our help. We only work in your best interest for you and your family. With your help, we will analyze your situation and determine if a gap health insurance plan is right for you. If not, then we will offer alternatives. It is that simple. There is no risk to using our services or asking us for assistance.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".