How To Get Life Insurance Approved For Autism The Right Way | No Matter Your Situation, We Can Likely Get You Life Insurance

Updated: April 12, 2024 at 9:38 am

If you have family members with autism or have a type of autism spectrum disorder, you may wonder if it’s possible to get life insurance on them.

life insurance on them.

I am here to say it is possible, and we have helped many people with autism obtain life insurance. Children and adults alike.

There is a process, and depending on the situation, some options are more available than others.

But, life insurance is available. How great is that?

Here is what we will discuss:

- The Underwriting Process For People With Autism

- Life Insurance For Children With Autism

- Life Insurance For Adults With Autism

- Watch Out For Medicaid!

- Final Thoughts About Life Insurance And Autism

Let’s discuss underwriting for people with autism. You will see that underwriting is the foundation of the types of life insurance that are available to you.

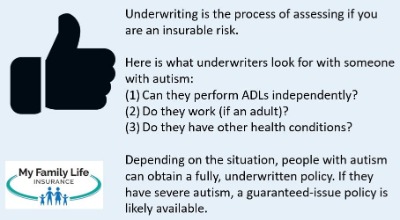

Life Insurance Underwriting For Someone With Autism

Many people blindly apply for life insurance, thinking they can apply anywhere.

You really don’t want to do that if you or a family member has autism. It’s best to do your research beforehand and understand how carriers underwrite your situation. This is where an independent life insurance agent or broker like My Family Life Insurance helps. We know the life insurance companies and types of policies that work well for people with autism.

Once the carrier receives your application, it starts a review process called “underwriting”.

During the underwriting process, the carrier basically assesses if you are an insurable risk.

If you are in good health, with no or minor health conditions, then likely the carrier easily approves you.

However, if you have moderate to severe health conditions, carriers will place a table rating or even decline your application.

The same can be said about people with autism.

It’s important you know your chances of getting approved for life insurance BEFORE you apply. The reason? Not all carriers will insure someone with autism.

I am happy to say we have helped many individuals with autism obtain life insurance. However, the chances of approval really depend on your situation and certain characteristics. We discuss these characteristics next.

How Carriers View People With Autism

Below is a general idea of how life insurance carriers underwrite an individual with autism. If you have specific questions, please contact us.

Here is something to understand. People with autism generally have a lower life expectancy compared to a typical person. Carriers know this. I’ve heard from parents and caregivers that the proposed insured person is healthy every other way, but has autism. They get angry when they, or their child or grandchild, get declined. Unfortunately, if you or your loved one have a moderate to severe autism diagnosis, then life insurance options are fewer (but still available).

Can You Perform Activities of Daily Living Independently?

Activities of daily living are important, everyday functional areas like eating, going to the bathroom, and dressing.

If you can’t perform ADLs or need assistance for 1 or 2 of them, that will hinder your ability to obtain a policy.

Why, John, you ask? I am healthy every other way.

True, you might be. However, performing ADLs is an important, foundational aspect of everyday life. Carriers say that the inability to perform ADLs independently can lower one’s lifespan. It’s true.

If you or your relative can’t perform ADLs independently, then there are fewer life insurance options. In fact, most carriers will likely outright decline the application.

However, life insurance options still exist. We discuss that further in the article.

Additionally, companies may also decline if you, or your loved one, require a primary caregiver or have minimal social interaction with other people. Nevertheless, life insurance options still exist.

Do You Work?

I say this all the time, but carriers like to see people working. It shows that the person can carry on meaningful relationships and conversations and has intelligence. Similar to performing ADLs, working is foundational for everyday life. Carriers do expect you to work in gainful employment (unless you are a stay-at-home parent).

If you don’t work or require financial support from someone else (or the government), then the life insurance options are limited. For an adult with autism, then that might lead to a decline.

As we mentioned earlier, there are still life insurance coverage options available.

What Is The Severity Of The Autism?

The severity of your autism plays a role as well. People with mild autism, who can perform ADLs independently and work have the best life insurance options available to them. For example, generally speaking, people with Asperger’s syndrome should be able to obtain any type of life insurance (provided they are independent and gainfully employed).

Conversely, limited life insurance options exist for people with severe autism.

Do You Have Any Other Health Conditions?

Carriers look at your overall situation, too, specifically at other health conditions or comorbidities.

So, if you are overweight or have a high BMI, that plays a role in the underwriting.

Same with medication like metformin for type 2 diabetes.

Carriers confirm your prescription drug history through a drug database like Milliman Intelliscript. They also look up your medical history in the MIB.

Carriers look at everything. They then assess your risk and make an offer.

Honestly, however, in our experience, if you can’t perform ADLs independently or don’t work, then carriers will likely decline your application.

Nevertheless, there are life insurance options. We discuss them next. First, we discuss life insurance options for autistic children. Then we discuss options for adults.

Life Insurance Options For Children With Autism

I know many parents and grandparents apply for life insurance on their autistic children. Carriers like Globe Life and Gerber Life are very popular. These life insurance companies do a great job marketing to parents. However, they aren’t really good for children with autism. Many of our clients were declined by these carriers.

So, that means, yes, children with autism can obtain life insurance, but usually not with these carriers.

The availability really depends on the severity of the condition (i.e. underwriting, as we discussed) as well as application age.

Generally speaking, most carriers will decline any application for children diagnosed with autism until age 8.

diagnosed with autism until age 8.

In other words, if your child is age 5, for example, diagnosed with autism, the life insurance carrier will decline the application. They will tell you to reapply at age 8.

The reason is carriers underwrite the autism condition much better starting at age 8.

At age 8, there is generally a better understanding of your child’s condition and potential future. However, I recommend even waiting until age 10. The older your child, the better underwriters can assess your child.

What Carriers Look For

Here, in general, are some key aspects underwriters will look at for life insurance on children with autism:

- Is the child in a mainstream classroom – if yes, that is better

- Can the child perform ADLs without assistance – if yes, that is better

- Does the child need any assistive devices like an iPad – if no, that is better

- Can the child speak and communicate in a traditional manner – if yes, that is better

- Can the child carry on a conversation and have social interaction – if yes, that is better

- Does the child have a documented IQ of greater than 70 – if yes, that is better

Additionally, the underwriters may want:

- Any neuropsychological reports

- A copy of an IEP

- Other medical records

- IQ testing

Available Life Insurance For Children With Autism

Generally speaking, if your son or daughter is high functioning, in a mainstream classroom, communicates as a typical child, and has no other health conditions, you can expect the life insurance rates in the standard rate to a table rating.

Most times, carriers will apply a table rating like table 2 to table 4. So, expect a standard to table 2 for a health classification.

Provided they are high functioning, your children can obtain any type of whole life insurance, universal life, and other types of permanent insurance. Because of your child’s age, whole life insurance is usually a good option. Term life insurance on children is also an option.

If your child is high functioning, then you typically can get up to 1/2 the death benefit you have on yourself up to a certain dollar amount. For example, if you have $100,000 of life insurance on yourself (really not much, but that is beside the point), you can get up to $50,000 death benefit on your child.

However, if your child has moderate to severe autism, then guaranteed issue whole life insurance exists. Depending on the state where you live, it is available.

John, I’ve checked, you say. Guaranteed-issued life insurance is only available for people age 50 and older.

No, we do work with a carrier that provides guaranteed-issue whole life insurance for people less than age 40. We even have helped children as young as 1 month get life insurance on a guaranteed-issue policy.

Additionally, you can apply for life insurance for yourself. We work with a few carriers that offer a guaranteed issue child rider. As long as you are approved for life insurance, your son or daughter gets life insurance as well (usually up to $10,000).

Moreover, we work with a carrier that will allow $15,000 of whole life insurance, guaranteed issue, after you apply and are approved for life insurance.

Life insurance is available for your children. Feel free to contact us if you have any questions.

Life Insurance For Adults With Autism

Life insurance options for adults with autism really depends on what we discussed in our underwriting section.

If you or your family member needs assistance for every day activities, then the only option likely is a guaranteed issue life insurance policy. We work with both guaranteed issue whole life insurance and guaranteed issue term life insurance policies.

Feel free to check out the rates here in our quote. Just select “Poor Health” in the dropdown for the health class. (We reserve the right to call, email, or text you, but we don’t contact you 1,000 times per day as other agencies do.)

However, if you are high-functioning, with a normal, typical life, have gainful employment, and have a family then really any life insurance options are available to you. Honestly, if your condition no longer poses an issue in your life, and you no longer see a neuropsychologist or require testing, a standard rate or better should be available. Additionally, depending on how the question is worded, you may be able to answer “no” to any question implying autism.

Feel free to search for rates. I would assume a “standard” rate for an estimate. (Of course, we may reach out to you via phone, text, or email to say hello and thank you for visiting.)

Of course, if you still need assistance with ADLs, but let’s say you are gainfully employed, then the carrier may apply a table rating.

Watch Out For The Impact On Medicaid

Many adults with moderate to severe autism utilize government assistance like Medicaid, supplemental security income (SSI), and other resource programs.

Medicaid, supplemental security income (SSI), and other resource programs.

In order to qualify for these programs, the beneficiary (i.e. the child or adult with autism) must have limited assets and income. Generally speaking, a state’s asset test is $2,000. In other words, the adult with autism must have fewer than $2,000 of assets to qualify for Medicaid and other programs.

A big problem comes into play when family members purchase a whole life insurance policy on this person. Maybe the family purchased the policy when the person was a child or now as an adult.

Regardless, if the autistic family member is the owner of the policy, then the policy will negatively impact your family member’s aid. In fact, it may even disqualify him or her.

The reason is whole life insurance has cash value. (Even guaranteed-issue whole life policies.) The cash value is like a savings account (but, it is not). It accumulates value. At some point, the cash value will be great enough that it will disqualify your family member from his or her Medicaid and other services.

You don’t want that to happen, right?

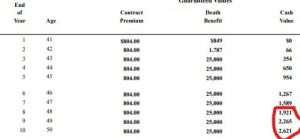

Many agents and other agencies aren’t aware of this. If they are, they will say that the cash value doesn’t grow fast and not to worry! (I have heard other agents say this, and even many websites contain this incorrect advice.) That is incorrect. See the snapshot here of a 40-year-old autistic male with a $25,000 guaranteed-issue whole life policy. This person will likely live a long time. However, if he is the owner of the policy, he potentially loses his Medicaid at age 48-49.

Many agents and other agencies aren’t aware of this. If they are, they will say that the cash value doesn’t grow fast and not to worry! (I have heard other agents say this, and even many websites contain this incorrect advice.) That is incorrect. See the snapshot here of a 40-year-old autistic male with a $25,000 guaranteed-issue whole life policy. This person will likely live a long time. However, if he is the owner of the policy, he potentially loses his Medicaid at age 48-49.

How To Purchase A Life Insurance Policy Someone On Medicaid The Right Way

It is possible for someone on Medicaid to have a life insurance policy. You just need to go about it the right way.

It is all about ownership.

Note: we are not estate planning or elder care lawyers. Please speak to a lawyer in your state about the specifics.

Every state has some nuances about Medicaid and life insurance ownership. However, here are some general options:

- A non-Medicaid family member can own the policy

- A trust can own the policy – even better

Someone else can own the policy. I generally recommend a family member like a brother or sister to own the policy. However, this person can’t be on Medicaid, either. If he or she is, the cash value in the policy will affect their Medicaid, too.

You will also need a power of attorney or guardianship to sign on your family member’s behalf. Generally speaking, you want the powers of estate and property, which allow you to enter into contracts (including insurance contracts). If you have the more common powers of medical care and needs, these powers do not allow you to enter into contracts. As I said before, it is very important you speak to a qualified attorney as every state is different.

A special needs trust usually is a better option. A trust creates a separate entity. You will still need the correct power of attorney or guardianship authority to transfer the policy into the trust and sign on behalf of your loved one.

Again, speak to a qualified attorney as there are several different types of trusts.

Now You Know How People With Autism Can Obtain Life Insurance

We hope you now understand how people with autism can obtain life insurance. As we discussed, the severity of the autism is the main factor during the underwriting process. Additionally, underwriters review other health conditions and comorbidities.

If the autism is severe, the only life insurance option is a guaranteed-issue whole life insurance policy. As we mentioned, we can get you a guaranteed life insurance policy for children with autism. (Essentially, age 0 newborn to age 85 is available).

We also briefly discussed the impact a life insurance policy has on Medicaid.

Do you have any questions or need assistance? We are happy to help in any way we can. Feel free to contact us or use the form below.

There is no risk of contacting us. Unlike other agencies, we only work for you and your situation. If we can’t help you, we will point you in the right direction, and we will part as friends. Seriously. You can always contact us again if your situation changes. This is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".