Understanding Dental Insurance: Your Guide To Learning | And Saving Money!

Updated: April 12, 2024 at 9:39 am

I think you’ll agree with me that understanding dental insurance is like understanding a black box.

I think you’ll agree with me that understanding dental insurance is like understanding a black box.

Here’s what I mean. You pay a premium, sometimes hefty, and you don’t know what you get.

Until you receive your bill.

Sure. dentists create smiles, right? On the one hand, yes. I bet, however, you aren’t smiling after you receive your dentist’s bill. You probably wonder why dental services cost co much.

And, why you are spending money on dental insurance.

Questions About Dental Insurance?

Have you asked yourself these questions about dental insurance?

- Is dental insurance even worth the money I spend?

- Why can’t I know beforehand what to expect from my dental insurance?

- Why doesn’t my dental insurance cover my care and needs while minimizing my out-of-pocket costs?

That’s why we created this guide about understanding dental insurance. We will answer those questions and then some.

I learned first-hand about the unexpected costs of dental insurance. I was one of those people who thought it was a waste of money! Honestly, dental insurance isn’t a waste of money, if you know and understand it. It’s really worth every penny.

In this guide, I educate you on the basics as well as the details of dental insurance. The result: you’ll know how dental insurance works. It is that simple. You will know so much more about dental insurance that you can make an educated decision on the type of plan, premium, and coverage for you and your family. Isn’t that what you want?

I’ve been helping young adults, families, and seniors select the right dental insurance for their needs. There are so many options. Which one do you choose? Easy. The “right” one is the one that covers your needs, minimizes your out-of-pocket expenses, and keeps you happy!

“#1 priority is one that minimizes your out-of-pocket costs and keeps you happy!”

Table Of Contents

So, let’s get started on your understanding dental insurance journey. The first thing I start off is describing the #1 problem people have with dental insurance. Understand this problem, and how to fix it, and you could potentially save yourself thousands every year.

This is a long, comprehensive guide on understanding dental insurance. Use the table of contents to click through and jump ahead to different sections.

- The Problem People Have With Dental Insurance

- Types of Dental Insurance

- How Does Dental Insurance Work?

- How Money Talks?

- Exclusions And Limitations

- FAQs About Dental Insurance

- Now You Know Dental Insurance

As this is a long article, designed to maneuver you through the intertwining of dental insurance, click on a link to jump to a section.

Again, the purpose of this guide is for you to understand how dental insurance works, so you can save significant money.

Let’s start off with the #1 problem with dental insurance. Get this right, and you’ll save yourself thousands of dollars over your lifetime.

# 1 Problem People Have With Dental Insurance

What do you think is the #1 problem people have with dental insurance?

I’ll answer that question with an example.

Picture this. You have group dental insurance through your employer. You work and live in Illinois. The dental insurance carrier is Blue Cross Blue Shield of Arkansas. You think, no problem. I’ll let my dentist know and schedule an appointment. You think nothing of it. Why should you? You have your appointment. A typical cleaning and exam.

About 2 weeks later, you receive your invoice from the dentist. It shows you owe $200. You think, What the heck? This is just a cleaning! I thought cleanings were covered 100%? Why am I spending so much? You then think dental insurance is a waste of money. Heck, this experience changed your attitude about dental insurance.

About 2 weeks later, you receive your invoice from the dentist. It shows you owe $200. You think, What the heck? This is just a cleaning! I thought cleanings were covered 100%? Why am I spending so much? You then think dental insurance is a waste of money. Heck, this experience changed your attitude about dental insurance.

What’s The Problem?

In this case, the reason for the high out-of-pocket cost is your dentist is out-of-network. It is highly unlikely your Illinois dentist takes Blue Cross Blue Shield of Arkansas. Based on my experience in working with young professionals, families, and seniors this is the #1 problem people have with their dental insurance. Your dentist does not take the insurance you have. Again, do you think the dentist in Illinois takes Blue Cross Blue Shield of Arkansas? Likely not.

“#1 problem with your coverage is that your dentist is out of network”

We’ll get to this later with many examples, but out-of-network dentists charge much more than in-network dentists! Before you think it is the dentist, it is not. It’s because the dentist doesn’t take your insurance.

In general, you will save much more money by going to an in-network dentist than an out-of-network dentist. Carriers require their in-network dentists to charge the contracted insurance fee, which typically is much less than their “retail” fee.

Again, we discuss this scenario throughout the guide.

How Do I Know If My Dentist Is Out Of Network?

How do you know if your dentist is in the insurance network or out of network?

You have a couple of options. They are simple. You could:

(1) go online to your dental insurance website to see if your dentist is in their network, and/or

(2) call your dentist’s office and see which plans they accept

Number 2 is the simplest option. I am amazed by the number of people who don’t call their dentist’s office and ask the office manager what plans they take. It is the easiest phone call to make.

“call your dentist office and see what insurances they accept”

What To Do With The Information?

Once you have the information, you should confirm their participation by going on the dental insurance carrier’s website. Nearly all the dental insurance carriers have a “provider lookup” link. All you need to do is enter your zip code and maybe other pieces of information. You should see your dentist listed there. If you don’t, there is a problem. Don’t hesitate to call them back for clarification.

It’s important to note that many dental insurance carriers have many types of dental insurance. For example, and we will get into this more, some carriers have group employer coverage in which the employer/company holds the insurance contract. On the contrary, you own individual coverage. There are different contracts between the two. Office managers may not know this. For example, a dentist may accept the Aetna dental employer plan, but they do not accept the Aetna dental individual plan. If you purchase an individual Aetna plan when the dentist accepts the Aetna employer plan, you’ll have a not-so-nice surprise bill.

So, have the office manager clarify the insurance. Additionally, verify the dentist is on the provider network website.

What If My Dentist Takes No Insurance?

What if your dentist does not take insurance? It happens. Some dentists simply want to control their revenues and bill all insurance out of network. As you will see, that doesn’t mean you should stop seeing them. Personally, my dentist does not take any dental insurance. He bills out of network. Why don’t I take my own advice and find an in network dentist? Well, I could. But, I like my dentist. My teeth are not bad by any means, but he and his staff have kept my teeth healthy. They are also very good educators, too. I like that. To me, that educational piece is worth it.

If your dentist does not take insurance, you have several options. You can

(1) always “self-insure” and pay out of pocket. Some dentists give a discount for this. Self-insuring, however, could prove costly in the long-run.

(2) purchase a favorable PPO plan designed for out-of-network dentists. We discuss these options in more detail in this guide.

(3) switch dentists to an in-network dentist, provided you are lukewarm about the treatment your dentist gives.

Again, we explain the in-network versus out-of-network situation throughout this guide. You will have much more understanding of this and how the difference affects your dental insurance and out-of-pocket costs.

Summary of In-Network vs Out-of-Network Dentists

We went through a lot. But, you are hanging in there! Here’s a review of this section:

(1) If you think your dental insurance stinks, it could be that you are going to an out-of-network dentist

(2) In general, in-network dentists charge less. You will save more money this way.

(3) check with your dentist’s office to see which insurances they accept

(4) if your dentist does not accept insurance, you have options

Next, let’s discuss the types of dental insurance there is. That matters, too.

Understanding The Types Of Dental Insurance

Understanding the types of dental insurance will help you make educated decisions, which ultimately saves you money.

There are VARIOUS types of dental insurance. We mentioned in the previous section there are group employer and individual insurance plans. We won’t discuss group employer plans in this guide. Of course, we will discuss individual dental insurance. And, within the individual dental insurance realm, there are many types of dental insurance.

In the last section, we mentioned that going to an in-network dentist will generally save you money. Well, the type of dental insurance can save you money, too! The type of dental insurance you select matters with your out-of-pocket costs. Remember, minimizing your out-of-pocket costs is your number 1 priority.

“the type of dental insurance affects your out-of-pocket costs”

There are 4 common dental insurance plans and 1 option that is not insurance. We include it here because it is an option. So, you have 5 options to select from. The types of dental insurance include:

(1) In-network insurance plans

(2) PPO insurance plans

(3) Dental indemnity plans

(4) DVH “Combination” insurance plans

(5) Discount dental plans (not insurance)

Let’s talk about them next, starting with in-network dental insurance plans.

In-Network Dental Insurance Plans

The first type of dental insurance is called in-network dental plans. These dental insurance plans contain a comprehensive list of dentists and other dental providers. Dentists and dental providers that accept a dental insurance must accept the carrier’s insurance fee schedule.

Why is accepting the fee schedule a big deal?

I alluded to this earlier. Dentists are business owners. Like any business owner, they want to maximize their income. They can, and do, charge their own rate for services and procedures. But, in order to grow their income, they (like other business owners) have to market themselves and establish a patient base.

That can be tough.

How The Carrier Helps Save You Money

Enter the insurance carrier. Dentists who agree to participate in a dental insurance network, especially with a good carrier, know they will have a patient base. The dentists agree to the contracted insurance fees, but in return, receive a patient base among other benefits.

Enter the insurance carrier. Dentists who agree to participate in a dental insurance network, especially with a good carrier, know they will have a patient base. The dentists agree to the contracted insurance fees, but in return, receive a patient base among other benefits.

This contracted insurance rate is also known as the maximum allowable charge (MAC). This is the most the dentist can charge. Of course, the dentist can charge less if he or she wishes.

We’ll discuss the MAC and ramifications later.

Most in-network plans offer better coinsurance as well for covered services. Coinsurance is the same as health insurance. Expressed as a percentage of cost, coinsurance represents the amount you pay for a service and the insurer pays for a service. For example, if a carrier covers a root canal at 50%, that means it will pay 50% of the MAC and you pay 50% of the MAC.

You’ll see coinsurance in action when we go over cost.

There are some very stringent in-network plans. Some require a “PCP” for a dentist. Moreover, if you accidentally go out of network, you are charged the full amount. These plans are called Dental-HMOs or “DHMOs” for short. Only a few carriers offer these, and these plans are not available in every state.

Then, there are those with in-network dentists, but allow some out-of-network coverage.

Understanding PPO Dental Insurance

The second type is the more common PPO dental insurance. A PPO plan allows you to go to any dentist. The plan pays the dentist a fee based on the average fee charged by dentists in that area. This average fee is known as the UCR fee, which stands for Usual Customary Reasonable.

We’ll talk about the UCR in a minute.

What is nice about these plans is you can go anywhere. Many of these plans offer a dental network as well.

I know what you are thinking. John, if there are some in-network dental insurance plans that have networks and there are PPO insurance plans with provider networks, what is the difference?

The difference is the MAC versus the UCR fee. Also, premiums, too.

This might be a good time to discuss the MAC versus the UCR with some examples. This is a key understanding between in-network and out-of-network dentists.

Understanding MAC Fee Versus UCR Fee In Dental Insurance

The MAC is the contracted insurance fee by the carrier. An in-network dentist can’t charge more than this. Moreover, this is the limit the insurance carrier pays. The UCR fee is the fee the carrier pays that is based on the average fee for the dentist’s area. UCR is common with PPO plans.

Dental insurance carriers pay UCR based on a percentile. For example, some carriers pay their UCR on the 80th percentile. Others at the 75th. The higher the percentile, the better.

An example will make this clear.

Let’s say you go to Dr. Miller. He doesn’t accept your insurance, but will gladly bill out of network. You have a filling done. Dr. Miller’s “retail” price on fillings is $300. The MAC fee on a filling is $125. The UCR fee, at the 80th percentile, is $250. Let’s not assume coinsurance at this point.

Your costs with an in-network plan: Your out-of-pocket expense is $175. The carrier pays Dr. Miller $150, which is the MAC. Dr. Miller, because he is out of network, charges you the difference (known as balance billing) between $300 retail fee and the $125 insurance payment, which is $175.

Your costs with a PPO plan: Your out of pocket cost is $50. The carrier pays Dr. Miller $250, which is the UCR fee. Dr. Miller charges you the difference between $300 and $250.

What If Dr. Miller Accepted Your Insurance And In-Network?

What is your cost if Dr. Miller was in-network? In this example, if you said $0, you are right. The carrier pays Dr. Miller the contracted fee and he can’t charge you more.

This is an easy example; however, you can see how the MAC and UCR fees affect an in-network and PPO dental insurance plan.

Indemnity Dental Insurance

The third type is called indemnity dental insurance. With this type of dental insurance, the carrier pays a fixed dollar benefit to the dentist or to you. You can go to any dentist. However, you or the dentist receives the fixed dollar and nothing more. For example, the carrier may pay a $150 flat amount to the dentist for any cleanings.

Similar to PPO plans, the dentists can balance bill if they are out of network.

These indemnity plans aren’t as common as traditional dental insurance, but a few carriers have them.

If you want to be more “in-control”, an indemnity dental plan might be good for you. You can negotiate the cash price from your dentist.

For example, a dentist might charge $300 for cleaning and office exam. The cash price, though, is $150 if paid on the spot. Your indemnity plan pays $150 for a cleaning. You receive your cleaning, pay your dentist, and then submit the claim to your dental carrier. You receive $150. Your net expense is $0.

DVH “Combination” Insurance Plans

DVH stands for “Dental, Vision, and Hearing”. These are, what I like to call, “combination” plans.

These DVH plans are becoming more common and geared more towards seniors, although young adults and families use them, too.

Why are they becoming more common? People like simplicity. One insurance plan covers your dental, vision, and hearing. Picture a bucket of money that is used to pay for your dental, vision, and hearing expenses.

At the beginning of the year, the “bucket” replenishes.

While that seems good, there are drawbacks.

On the dental side, the plans are true PPO, but a few of these plans have networks. We’ve already discussed the benefits of using a dental network.

Most of the drawbacks come from the vision and hearing side. Carriers that offer these DVH insurance plans often limit the annual benefit for vision and hearing care. For example, they might limit the vision benefit to $300 annually.

Moreover, coverage for vision and hearing is not as extensive compared with a stand-alone insurance plan. You may be better served with an individual policy.

Nevertheless, they are useful, especially if you need secondary or supplemental dental insurance.

Understanding Discount Dental Plans – Not Dental Insurance!

Discount dental plans aren’t insurance at all. Their name is just how they sound. They offer a discount on services. Think of it as having a membership card to Costco, except you get a discount on dental services.

Does that sound good to you? Before you start thinking it is, everything has advantages and disadvantages. Let’s talk about them here.

The advantages include:

(1) low premiums – around $10 per month

(2) additional benefits – many plans offer vision discounts, telemedicine, and a host of others

(3) unlimited use – you can get cleanings 12 times per year if you wanted to, Dental insurance usually covers only 2

(4) no deductible or copays to pay

While That Sounds Good…

Before you say, “sign me up!”, let’s talk about the drawbacks:

(1) you pay for everything. That means you’ll pay for cleanings, etc. Granted, these are at a discount, but you pay for everything nonetheless

(2) payment in full usually required at time of service

(3) these plans usually have limited dental networks, although those with well-known names like Aetna and Cigna generally have more dentists accepting the plan

(4) It can be very hard to find dentists in your area that takes these plans

But, these plans can work if you find the right combination of plan and dentist. Moreover, if your teeth are in pretty good shape, you probably can get by on these plans, assuming you have a good dentist and plan, of course.

We wrote about the benefits of discount dental plans in more detail if you would like to check that out.

You can also search many discount dental plans on our partner discount dental website.

Understanding How Dental Insurance Works

Before we get you understanding how dental insurance works, Let’s review what you’ve learned so far.

You learned that going to an in-network dentist will generally save you more money than going to an out-of-network dentist.

You also learned the types of dental insurance available. Additionally, you learned how dentists are paid by the carrier, depending on the plan you have. (We will go into more detail on cost as this is a rather pain point with many consumers.)

Now, let’s go into more detail about how dental insurance works. What we discuss is common to many types of dental insurance. Your understanding with these dental insurance concepts will save you money and help you make better decisions. As we said, that’s your #1 goal.

The Annual Benefit

The annual benefit is the amount of money at your disposal for your dental needs. Think of it as a bucket of money that is refilled each year by the carrier. As the carrier pays dental costs on your behalf, the amount of money in the bucket decreases. If you reach zero before the end of the year, you have to pay any remaining costs out of pocket.

The more common annual benefits are $1,000 and $1,500 annual benefits. You’ll see these amounts with nearly all carriers.

How does the annual benefit work? Let’s say you have a tooth filled. The total bill is $250. The carrier pays $125 and you pay $125. The carrier pays the $125 out of the “bucket of money”. You have $875 remaining in the year for your needs.

Some carriers offer higher amounts: $2,000; $3,500, and even $5,000 annual benefits. However, in order to achieve those, you have to hold onto the policy for 3 years or more, typically.

So, all you need to remember here is the annual benefit is the “bucket of money” that is available to you each year for your dental needs.

Covered Dental Services

Dental insurance covers three main areas:

(1) preventative care, which includes cleanings

(2) basic services, which is usually tooth fillings and simple extractions (i.e. tooth removal)

(3) major services, like root canals and periodontal services

(4) orthodontia, in other words, braces

See the images below. You can see what is usually covered for each area.

It is important to compare policies to see what is covered. Some policies have bitewings as a preventative care service, while others have them as a basic service.

Orthodontia is an interesting option. Many carriers exclude braces and orthodontia from coverage – that is right. However, there are some plans that do. Those that do, however, usually have a lifetime dollar cap on orthodontia like $1,000 or $2,000. Moreover, carriers usually limit coverage to young adults ages 19 and less.

Now that we discussed the insurance services, it might be a good time to introduce your out-of-pocket costs. This is the “big” item. There are several parts to determining your out-of-pocket costs. Let’s start with coinsurance.

Dental Insurance Coinsurance

As you continue with your “understanding dental insurance” journey, the next several relate to costs.

The next item relates to coinsurance. Just like in health insurance, coinsurance applies to dental insurance.

Preventative care is usually covered at 100%. In other words, the carrier pays for the entire cost IF you go to an in-network dentist. The keyword: IF. See the image below taken from a real carrier brochure.

You can see the plan pays 100% if in-network, but only 80% out-of-network. Moreover, if you are out of network, you’ll face a potential balance billing situation, as we described earlier.

Basic services are usually covered up to 80%. Some plans cover up to 70%. Other plans start out lower, like 60%, and then increase the longer you hold on to the policy. If the carrier pays 80%, for instance, that means you pay 20%.

Major services are usually covered up to 50%, although some plans pay higher coinsurance. As we mentioned, some plans start low coinsurance and increase each year the longer you keep the policy.

Percent Of What???

I bet you are thinking, “John, I understand what you are saying. But, what is the coinsurance off of? For example, the carrier pays 80% of what?”

Yes, that is right. The answer is: it depends. We actually introduced it previously. If you go to an in-network dentist, the “what” is the MAC.

For example, if you have a filling in which the dental insurance MAC is $100, the carrier pays $80 (80% X $100) and you pay $20 (20% X $100).

If you go to an out-of-network dentist, then the coinsurance is off of the UCR. This could mean a higher out-of-pocket cost for you. We will go into further detail on this later.

Understanding Deductibles In Dental Insurance

You should know what a deductible is. You see deductibles with your health insurance, auto insurance, and homeowner’s insurance. The deductible in dental insurance is really no different. It is the amount that you pay in full before the dental insurance covers the service or procedure.

Deductibles are different across carriers. One carrier may have a $100 annual deductible applied to preventative, basic, and major services. Another carrier may have a $100 lifetime or one-time deductible. Additionally, some carriers may have a $50 annual deductible on basic and major services.

Deductibles are one piece of the dental insurance puzzle. One recommendation: don’t make your ultimate dental insurance decision on the deductible. You need to look at the overall picture of each carrier.

Remember that deductibles are paid first before insurance covers. Here’s an example that illustrates a deductible.

Example Of A Deductible

You go to the dentist for a filling. The dentist is in your network, so you are happy about that. You have a $50 deductible on basic and major services (combined). The network fee is $100. The coinsurance is 80%/20%.

How much do you think you’ll pay?

If you said, $20, you are wrong.

The right answer is $60.

You pay the deductible first, so that takes your $100 charge to $50. Of the $50, the carrier pays 80%, or $40. You pay the remaining 20%, or $10.

So, $50 (the deductible) + $10 (coinsurances) = $60 total out of pocket cost.

Wait: What’s A Waiting Period?

Wait: What’s A Waiting Period?

A common element of dental insurance is a waiting period. A waiting period is just how it sounds. It is the period of time you must wait before a procedure or service is covered.

You may be thinking, why? The answer is straightforward when you see it from the carrier’s perspective.

Many Americans wait. That is human nature. We wait. Why spend money on something you won’t need? That is the notion of many Americans for anything. Of course, you will always need dental insurance, provided you go to the dentist and want to take care of your teeth! That’s why you don’t want to wait on dental insurance.

If there was no waiting period, a person with tooth pain could purchase dental insurance, get the treatment done, and have the carrier pays its share. Then, the person could cancel the policy without repercussions. Spending money on a major service costs dental insurance carriers a ton of money.

You may think this is no big deal. However, this scenario really hurts everyone. Carriers will have to raise rates to support these claims and early cancelations. The other policyholders absorb these premium increases. If it’s too great, policyholders will cancel. Then, the carrier will not have enough premium money to support its claims and operations.

This is why carriers implement waiting periods. The waiting period prevents early cancelations and protects all parties involved: the carrier, you, and the dentist, too.

Lengths Of Common Waiting Periods

Most plans allow immediate coverage for preventative services, 6 months for basic services, and 12 months for major services.

However, some carriers buck this trend. Some carriers allow immediate coverage for basic and major services, provided you currently have qualified dental insurance.

Additionally, some carriers allow an immediate benefit, but if you need basic or major care in the first year of the plan, you will pay a higher coinsurance amount.

Nevertheless, all the carriers offer different dental options with or without waiting periods.

Understanding How Money (Out-Of-Pocket Costs) “Talks” In Dental Insurance

In your journey on understanding dental insurance, what did we say is your #1 priority?

That’s right! Your #1 priority of dental insurance is to minimize your out-of-pocket costs given your specific situation.

By now, you can understand there are numerous factors involved when selecting a dental insurance plan. The right plan for you includes:

(1) in-network versus out-of-network dentists

(2) the type of dental insurance

(3) the annual benefit

(4) any deductibles

(5) covered services

(6) coinsurance amounts

The final step is a concept we introduced earlier: the MAC for in-network dentists versus the UCR fee for out-of-network. We can estimate these.

We will provide several examples of estimated out-of-pocket costs, for both in-network and out-of-network dentists. Let’s provide the information for the examples.

*You have a $1,500 annual benefit

*annual deductible is $50 on basic and major services

*Preventative covered at 100%, basic 80%, and coinsurance 50% (of either the MAC or UCR fee)

*the UCR fee is paid at the 80th percentile of the average cost in your area

Preventative Care Example For In-Network And Out-Of-Network Dentist

You go to the dentist for a cleaning and office visit. The deductible does not apply in this case. Preventative care is covered at 100%, but that depends if you go to an in-network or out-of-network dentist. Let’s say the MAC for the cleaning and office visit is $150. The dentist’s retail fee is $250, and the UCR fee is $200.

If you go to an in-network dentist, your out-of-pocket cost is $0. The carrier covers preventative care at 100% and pays the $150 MAC. Your annual benefit drops from $1,500 to $1,350. However, if your dentist is out-of-network, the math is a little more involved.

The carrier pays your dentist 100% of the UCR fee, which in this example is $200. You think, “Great. I am all set. I don’t need to pay anymore.” Unfortunately, you probably will have to pay. The dentist, because she is out of network, wants her “retail fee”, so she will bill you $50, which is the difference between $250 retail fee and the insurance payment.

If you think a $50 out-of-pocket isn’t too bad, remember this is preventative services. Your out-of-pocket expenses increase with basic and major services. Let’s see one example next.

Basic Service Example For In-Network And Out-Of-network Dentist

You have a cavity and need it filled. The MAC for a cavity is $150. The dentist’s retail fee is $400. The UCR is $300. As you can tell, your dentist charges a lot more than what she receives from the carrier.

If you go to an in-network dentist, you’ll pay $30 and that is it. How did we determine that? The MAC is $150. There is 80% coinsurance on the MAC. This means the carrier pays $120 ($150 X 80%) and you’ll pay $30 ($150 X 20%).

If you go to an out-of-network dentist, that’s a different story. You’ll pay more. The UCR fee is $300. Remember, the carrier pays 80% of this amount. You are responsible for the remaining 20% of this amount. So, The carrier pays $240 ($300 X 80%). If you think you’ll pay $60 ($300 X 20%), you are incorrect. But, you pay more, too. Remember, your dentist is out-of-network. Therefore, she can bill you the difference between her retail price and the UCR portion she received. Therefore, you pay $160, which is $400 – $240.

Wow, $30 versus $160! Now you see why we promote going to an in-network dentist whenever possible!

Now, let’s show an example of a major service.

Major Service Example For In-Network And Out-Of-Network Dentist

You need a crown. The dentist’s retail cost is $2,000. The MAC is $1,250. The UCR fee is $1,700.

If you go to an in-network dentist, your out-of-pocket cost is $625 which is $1,250 X 50%. The carrier pays half and you pay half.

As you can guess now, an out-of-network dentist is much more expensive.

If you go to an out-of-network dentist, your cost is $1,375. Yikes! Here is how that works. The carrier pays your dentist $625. Again, though, the dentist will balance bill you the difference, which is $2,000 – $625. So, you end up paying $1,375!

Now you see how important an in-network dentist can be, all things being equal, of course. Seeing an out-of-network dentist is not the end of the world provided you understand the financial impact.

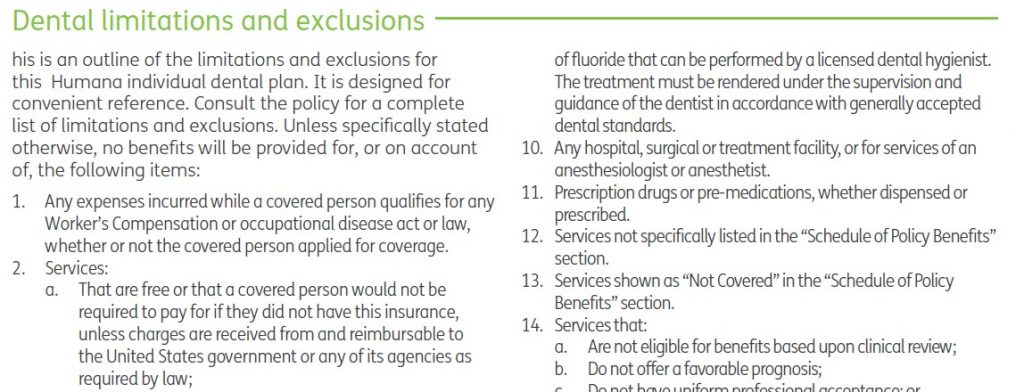

Understanding Exclusions and Limitations In Dental Insurance

Dental insurance has many exclusions and limitations. Most of them, however, are common. Nevertheless, there are a few that are surprises. We talk about some of the exclusions to make you aware.

Where To Find The Exclusions And Limitations

It’s simple to find the exclusions and limitations of your dental insurance plan. All you need to do is look at the brochure or the outline of coverage. Read the exclusions and limitations carefully. If you don’t understand something, ask questions to your agent or a customer service representative with the dental insurance carrier.

Check out the snippet of exclusions and limitations from a Humana plan.

There are typical exclusions like acts of war, cosmetic work, etc.

However, there are other not-so apparent ones.

One common exclusion is orthodontia. Yes, we indicated earlier that it is a service, but many carriers do not cover orthodontia.

Additionally, fluoride treatments are usually excluded.

One surprising exclusion is implants. Yes, they are common nowadays, but several carriers do not include them in coverage.

And, finally, one very common exclusion is the replacement of any pre-existing missing teeth. Let’s say you don’t have dental insurance and your tooth falls out. You decide now is the time to purchase dental insurance. This missing tooth bothers you. So, you purchase a plan, only to find out that it does not cover any repair to fill that missing tooth. This is known as the missing tooth clause.

Moral of the story is you need to read and understand the limitations and exclusions in your dental insurance

FAQs About Dental Insurance

We compile the most frequently asked questions to advance your understanding of dental insurance.

Does Dental Insurance Cover Invisalign?

Sometimes. Invisalign is a very popular alternative to traditional braces. If covered, it is usually covered as orthodontia/braces. However, you need to look at your plan and see if it is covered. Many carriers cover orthodontia. Then again, many don’t.

Keep in mind, too, that there is usually an age limit. Plans that do offer Invisalign and orthodontic treatment usually limit coverage to 19-year-olds and less.

Can I Use My FSA To Pay For My Dental Insurance Premiums?

FSAs, also known as a Flexible Spending Account, are tax-advantaged ways to pay for your out-of-pocket medical costs. This includes any out of pocket expenses associated with your dental services.

So, if you have any out-of-pocket costs related to any dental service, you can submit a copy of your invoice to the third-party administrator and receive reimbursement.

However, the rules with FSAs make it explicitly clear that an FSA will not pay for dental insurance premiums.

Does Dental Insurance Cover Veneers?

Often, veneers are considered an elective, cosmetic procedure. As we stated earlier, man dental insurance carriers do not cover cosmetic procedures. However, there are a few carriers that will cover cosmetic needs.

However, if you need veneers for restorative needs, then the insurance carrier likely covers or covers a portion of the veneer cost.

Again, whether the carrier covers your veneer costs really depends on what is going on with your tooth. Additionally, consider the dental insurance limitations and exclusions we talked about earlier.

We wrote about dental insurance and veneers in more detail if you would like to read more. We also list options for you.

Is Dental Insurance Worth It?

This is a common question we get from people. Yes, your money is spent in many places. In our opinion, however, yes, dental insurance is worth the premiums you spend.

We outlined how to make dental insurance worth it for you. The main reason is to find a dentist who accepts your dental insurance. Moreover, with dental issues creeping as you age, your dental needs could become more frequent and expensive.

Look at it this way. You might spend $35 per month or $420 annually on dental insurance. Most plans cover cleanings and preventative care at 100%. So, ideally, you’ll want these preventative services to cover your premiums. In our experience, they do. Now, if you have a procedure, say a root canal or a cavity filled, you’ve locked yourself into a discounted rate.

That is the benefit and makes dental insurance worth it.

However, if you aren’t convinced, your option is to:

(1) save your money

(2) work with your dentist on providing a discount since you are a cash-payer. Many dentists will discount services. If this sounds like your own discount dental plan, it is. Honestly, you can create your own by just talking and negotiating with your dentist.

(3) and hope that you don’t have any expensive problems in the future.

Remember, if structured right, your cleanings and preventative care essentially cover your premiums.

Can I Get A Dental Insurance Plan I Can Use Immediately With No Waiting Periods?

As we discussed earlier, many dental insurance plans have waiting periods. However, there are many plans that allow you to reap benefits immediately, right away, with no waiting periods. These plans and situations include:

(1) plans that allow for immediate benefit while you pay a higher coinsurance in the first year

(2) DHMO plans that are “copay plans”. You pay a flat amount for service, need to select a PCP dentist and go in-network. Not many carriers offer this and not available in every state

(3) carriers that allow immediate coverage as long as you can show prior proof of coverage, usually look back of prior 12 months

We work with all of these types of plans. If you would like to know more, contact us.

If I Already Have Dental Insurance, Can I get Another Dental Insurance Plan To Expand My Coverage?

Yes, you can. This is called secondary or supplemental dental insurance. However, you can’t just get any old dental insurance plan, or you’ll honestly waste your money.

You’ll need to get a secondary policy that does NOT coordinate with your current policy. In other words, the secondary policy stands alone and does not care what the other policy pays.

However, you will need to check with your primary carrier and see how they treat secondary dental insurance. Some primary dental insurance will coordinate with your secondary dental insurance. Others won’t.

We like the plans that both treat your benefits as stand-alone. In other words, they don’t coordinate.

Of course, you might save money by moving to a plan with a larger benefit than paying 2 policies. Nevertheless, this is an option. We can help you out. Feel free to contact us to learn more.

Now You Should Understand Dental Insurance A Lot Better!

Congratulations on completing our “Understanding Dental Insurance” article. I know it was a lot of information. To summarize, here are the major points in understanding dental insurance and saving you money:

- going to an in-network dentist saves you money. If you have an out-of-network dentist or a dentist that does not accept insurance, there are more “friendly” out-of-network plans that help

- the type of dental insurance matters, too, with your costs

- need to know how deductibles and coinsurance interacts. We provided many examples

- we discussed, too, that your dental insurance premiums should cover your cleanings and preventative care. This shows how dental insurance is worth the money

I know there’s a lot of information here. How can we help you out? We can find you the best and affordable dental insurance for your needs. Contact us or use the form below. We always work in your best interest, and we work with many carriers and discount dental plans. I am certain we can find a plan that meets your needs, situation, and budget.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".