How Do Dental Vision Hearing Insurance Plans Work Approved Now | We Go Into Detail About These “Combination” Plans And If They Are Right For You

Updated: April 12, 2024 at 9:39 am

You’ve heard of dental vision hearing insurance (DVH insurance), and you think it is too good to be true. Am I right?

You’ve heard of dental vision hearing insurance (DVH insurance), and you think it is too good to be true. Am I right?

It sounds good. It is like a “swiss army knife”. You can use any combination of dental, vision, or hearing needs under one insurance.

How great is that?

However, many agencies focus on one popular plan, but we focus on three.

Yes, three.

All three have different attributes. We discuss them here. Why? So you can make the right decision.

In this article, we discuss:

- What are dental vision hearing (DVH) policies?

- What are the attributes these policies have?

- Comparable premiums of dental vision hearing policies

- How to choose the right plan

- FAQs of DVH Insurance plans

- Where these DVH Insurance plans work well

- Now you know how these plans work

Let’s discuss how these dental vision hearing insurance policies work.

What Are Dental Vision Hearing Insurance Plans And How Do They Work?

The easiest way to describe these plans (also known as DVH insurance – for short) is using an analogy.

You know what a swiss army knife is, right?

Yes, you have a million combinations of tools to help you out.

If you need to open a can, you have a can opener!

Additionally, if you need to affix something together, you have a screwdriver!

Of course, you have the main tool…the knife…

A combination dental vision hearing insurance plan works similarly.

You can pick an annual benefit…like any dental insurance option. Remember, annual benefits typically come $1,000 and $1,500, but there are a few carriers that offer $2,000 and more.

Think of the annual benefit as a bucket of money. For example, let’s say you pick a $2,000 annual benefit.

You go to the dentist, and the plan pays $500 to the dentist. Your remaining annual benefit is $1,500.

Next, you have an eye exam. The plan pays the optometrist $50, so your remaining benefit is $1,450.

Your doctor says you need hearing aids. The plan pays $800 towards that. Your remaining amount is $650.

You have a cavity and a cleaning done. That is $600 and your remaining amount is $50.

The “bucket” resets to $1,500 at the new year.

That is pretty much how DVH insurance works.

So, John. I have the chance to maximize my annual benefit every year?

Yes, that is right. These insurances combine your dental, vision, and hearing insurances all into one.

Additionally, they can save you money. However, we discuss further in the article where these plans are useful.

Let’s discuss the attributes of these plans next.

Attributes Of Dental Vision Hearing Insurance

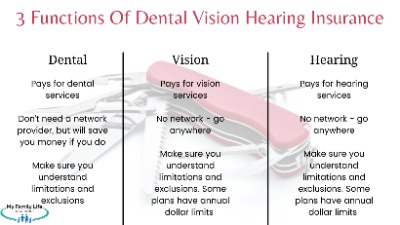

Just as the name sounds, dental vision hearing insurance covers:

- Dental

- Vision

- Hearing

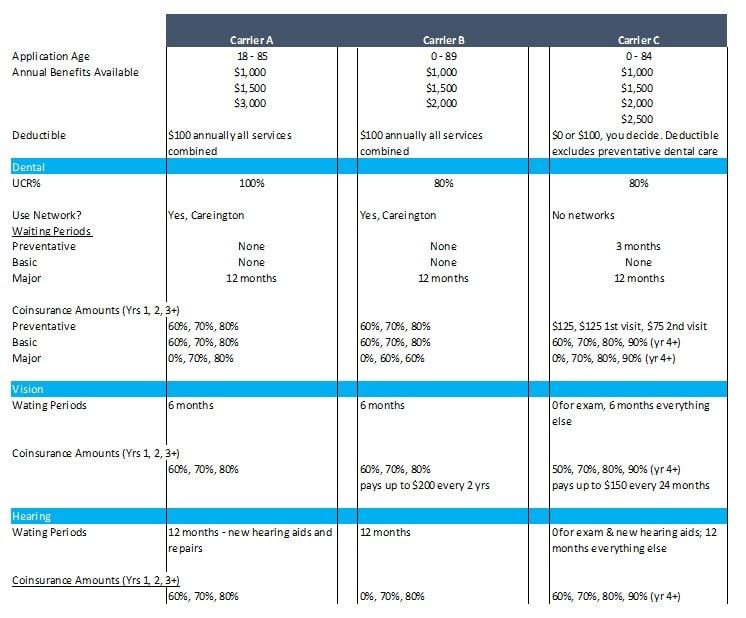

In our estimation, there are 5 carriers that offer DVH insurance. However, we only work with 3 of them. Why? The other two, in our opinion, do not provide as much benefit for the premium. For example, one plan that we don’t use or recommend pays at 75% of UCR. You probably don’t know what that means yet. It’s not good, in our opinion.

The three plans we use have different attributes and limitations.

For one, none of the plans cover serious dental needs, like implants. You need to enroll in a more traditional dental insurance if you want that kind of coverage.

Additionally, these plans all have waiting periods. A stand-alone vision insurance plan, for example, typically does not.

Another important attribute is they are all guaranteed renewable. What does this mean? It means that as long as you pay the premiums, you have the DVH insurance for life. You can have the dental vision hearing insurance until age 96, for instance, as long as you continue to pay the premiums.

Finally, most of these plans allow you to go to any dentist. While that sounds great, that type of freedom comes at a cost. Your cost! You will have to pay more. Thankfully, most of these plans now do utilize a dental network. Using a dental network allows you to save more money. If you do go to an out-of-network dentist, expect to pay more.

Below is a snapshot of the three plans. We do not address them specifically by name because of marketing contact reasons. Contact us if you want to learn more.

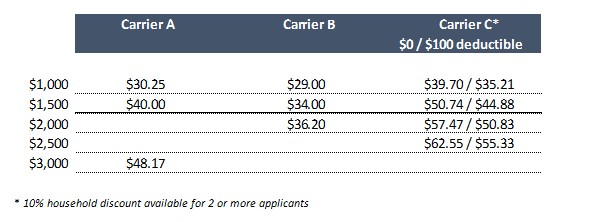

Comparable Costs For The DVH Insurance Plans

Sounds great, John. I am interested, but I’d like to know the costs?

Sure, we can give you an idea. Here is the comparable cost for a 35 year-old person living in Illinois:

As you can see, Carrier B is the least expensive. Carrier C is the most, but they offer a 10% household discount of 2 or more people signing up. Moreover, they also have 90% coinsurance by the carrier come year 4 of the plan. That is unheard of in the dental insurance industry.

Carrier A is the most “middle of the road”.

Contact us if you would like to talk specifics.

How To Choose The Right Dental Vision Hearing Insurance

We arrive at the purpose of our article topic. The decision is really a balance of premiums and coverage. The right choice depends on you and your needs.

The 3 carriers presented in this article offer the best value of premiums and benefits, in our opinion, of course. You can see Carrier A is “middle of the road”. Carrier B is cheaper. Carrier C is more expensive, but has more coverage, especially with basic and major dental services.

We discuss later in the article where these plans fit well. Contact us if you have any questions. Let’s answer some frequently asked questions about dental vision hearing insurance plans.

Frequently Asked Questions About DVH Insurance Plans

Do I need to use an in-network dentist, optometrist, or audiologist to receive a benefit?

No, you don’t. However, you save more money by going to an in-network provider. Note: the insurance does not contain networks for vision or hearing services.

Medicare covers hearing, vision, and dental needs, correct?

Not really. Original Medicare (Parts A and B) does not cover dental, vision, or hearing services. CMS makes that abundantly clear.

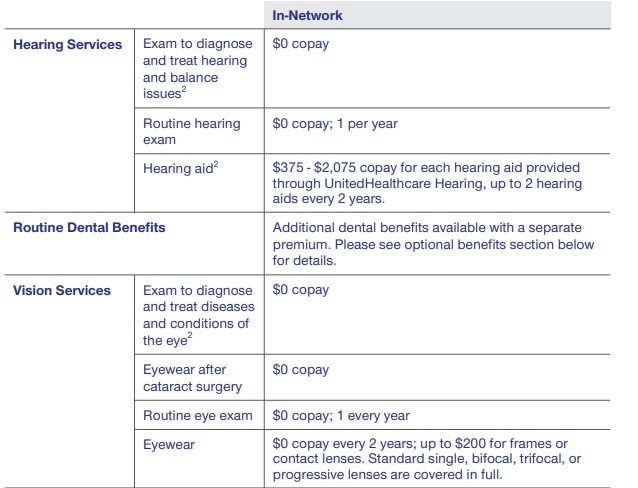

However, some Medicare Advantage plans do provide dental, vision, or hearing services. Stop for a second if you feel that gets you covered. These plans sort of do. Medicare limits coverage dental, vision, and hearing services. See this snapshot of dental, vision, and hearing services attached to a Medicare Advantage plan. It is limited to in-network only. Moreover, the benefits are rather slim. However, in this unique case, they don’t cover dental needs except for a rider, which costs an additional $45 per month.

The same goes for vision and hearing. Most Medicare Advantage plans might cover an annual eye exam, if that. Additionally, many Medicare Advantage plans do not cover hearing aid needs.

The same goes for vision and hearing. Most Medicare Advantage plans might cover an annual eye exam, if that. Additionally, many Medicare Advantage plans do not cover hearing aid needs.

What if I need vision or hearing surgery? Do these DVH insurance plans cover?

No, your underlying health insurance, including Medicare, covers any surgery on your eyes or ears.

What if I need oral or dental surgery? Will these dental vision hearing insurance plans cover that?

Generally speaking, yes. However, your underlying health insurance pays part of the surgery as well, depending on the situation.

Are these robust plans?

Yes, but they do have limitations. Other agencies won’t tell you this. The dental portion usually doesn’t cover implants. Additionally, they all have a missing tooth clause. The vision benefit is rather limited, depending on the carrier you select. Nevertheless, they do cover. Expect to pay / have an out-of-pocket expense. Moreover, definitely review the limitations and exclusions.

Where These DVH Insurance Plans Fit Very Well

Most people purchase dental vision hearing insurance plans as a stand-alone plan. That is fine. However, did you know these plans work great as secondary or supplemental dental coverage? Same for vision and hearing, too. That means you might have an almost “net zero” premium payment and greatly minimize your out-of-pocket expenses.

How is that, John, you ask? I don’t want to pay double.

Let’s show an example. Maybe that will clear things up.

Example On How Dental Vision Hearing Insurance Coordinates With Your Other Insurances

The title of the section is a little misleading because…these DVH insurance plans don’t coordinate with any underlying or primary dental, vision, or hearing insurance you have. Let’s give an example.

Let’s say you have primary dental insurance with a $2,000 annual benefit and costs $37 per month. Your vision insurance costs $11 per month. You don’t have hearing insurance. Hearing insurance really does not exist. Additionally, you are also in year 3 of your DVH insurance plan. We will use carrier A from above for our example. You select the $1,500 for $40 per month.

So, all told, you pay $77 per month for your total dental, vision, and hearing needs.

You have a cleaning and office visit. The dentist’s “retail” cost of the visit is $312. The contracted insurance cost is $192. Since this is preventative care, the carrier pays 100% of the cost, so your primary dental insurance annual benefit decreases from $2,000 to $1,808. You, in turn, file a claim with the DVH insurance plan. Let’s say you receive $240 from carrier A. You keep that money. Your dental vision hearing insurance plan bucket decreases from $1,500 to $1,260.

See how that works?

You then go to your optometrist. You pay the $10 in-network copay. That amount is reimbursed to you, so the remaining benefit in your DVH insurance is $1,250.

You decide to get new frames and glasses. The retail cost of the frames and eyewear is $500, but you end up paying $250 through your primary vision insurance. The dental, vision, hearing insurance pays you back $400.

The remaining amount in your dental vision hearing insurance is $850. If you go to the dentist again for a cleaning, you’ll receive another $240 back.

How Does Hearing Insurance Part Work?

Many people don’t realize that hearing aids aren’t really covered by medical / health insurance. Some states require health insurance to cover hearing aids for children, but not for adults. Regardless, the general consensus is health insurance – even Medicare – does not cover hearing aids.

Let’s say you need one, and you have this dental vision hearing insurance. Your hearing aid cost is $850.

You submit a claim with the DVH insurance carrier and receive $680 back (80% X $850).

So, to summarize:

- You pay $37 per month for dental

- $11 for vision

- $40 for the combination dental vision hearing plan

Or $1,056 annually.

You receive back:

- $240 for the cleaning

- $410 for the eye wear

- $680 for the hearing aids

Or $1,330 in total.

This is an easy example, but you can see how this plan works. Moreover, you won’t always come out ahead. However, it does work well as a secondary insurance plan.

Now You Know How Dental Vision Hearing Insurance Plans Work

Now you know how dental vision hearing insurance plans work. These are nice “combination” plans. The ones we like offer nice benefits for affordable premiums. Moreover, they can work well as a secondary insurance plan.

Do you have any questions? We are happy to answer them. Contact us or use the form below. Unlike other agencies, we aren’t beholden to an insurance carrier. We work for you. Additionally, we always have your best interest. So, when you contact us, there is no risk. If we can’t help you, you’ve learned a little more, and we will part as friends.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".