Affordable Secondary Dental Insurance

Updated: April 12, 2024 at 9:39 am

Dental work is usually expensive and costly. Sometimes, your dental insurance won’t pay as much or very little. Did you know you can purchase secondary dental insurance? Yes, that is true. Secondary dental insurance helps with the payment of services off of your primary dental insurance. And, yes, secondary dental insurance is affordable. In this article, we discuss how secondary dental insurance supplements your overall dental insurance. We also give specific examples and situations that give you a clear idea on how secondary dental insurance works. Additionally, these secondary dental insurance plans are affordable and offer other benefits.

Dental work is usually expensive and costly. Sometimes, your dental insurance won’t pay as much or very little. Did you know you can purchase secondary dental insurance? Yes, that is true. Secondary dental insurance helps with the payment of services off of your primary dental insurance. And, yes, secondary dental insurance is affordable. In this article, we discuss how secondary dental insurance supplements your overall dental insurance. We also give specific examples and situations that give you a clear idea on how secondary dental insurance works. Additionally, these secondary dental insurance plans are affordable and offer other benefits.

What Is Secondary Dental Insurance?

Secondary dental insurance, also known as supplemental dental insurance, pays for gaps in your primary dental insurance coverage. It is similar to that of having secondary health insurance.

For example, let’s say you go to the dentist for a filling. For simplicity, we assume your dentist is in the network of both dental insurance plans. Moreover, both plans pay 80% on basic services such as fillings.

The insurance cost of the filling is $200. Your primary dental insurance pays 80% of this or $160. You are responsible for $40. Your secondary dental insurance pays 80% of the remaining amount or $32. Your final bill is $8.

Larger procedures such as root canals obviously pay a higher amount. While this sounds good, know that many dental insurance carriers do not allow secondary dental insurance. In other words, primary dental insurance plans do not allow coordination with other dental plans.

Wait, John, you just said that having secondary dental insurance is possible? What gives? You ask.

Right. Many traditional dental insurance carriers do not allow coordination with a secondary dental insurance plan. However, there is a type of dental insurance that will supplement and act as secondary dental insurance. We discuss this dental insurance next. The advantages, in our opinion, this secondary dental insurance is affordable, expands your annual benefit, accepts any dentist, and provides additional benefits that save you money.

How Secondary Dental Insurance Works

As we mentioned, there are secondary dental insurance plans that pay. In fact, these plans won’t coordinate with your primary dental insurance. That is right. You can have a Humana or Cigna dental insurance plan and these secondary dental insurance plans pay you a benefit according to their own benefit schedule.

What are these secondary dental insurance plans? These plans are known as indemnity plans. In other words, these plans pay regardless of what your primary dental insurance pays. Let’s look at an example. We will introduce a new term – called UCR fee – and explain how all of this works.

Using the same example above, your insurance cost on that filling is $200 of which your primary dental insurance (let’s say it is Cigna) pays $160. That means your remaining out-of-pocket expense is $40.

In turn, you submit a claim to the secondary dental insurance carrier. The carrier pays 80% of the UCR fee. What is the UCR fee? UCR stands for usual, customary, and reasonable. Carriers determine the average fee for a procedure in your area. This fee is common in out-of-network dentist situations or if the carrier allows any dentist to participate.

Let’s say the carrier’s UCR fee for the filling in your area is $180. You submit a claim to the secondary dental insurance carrier. The carrier pays its share of 80% of the UCR fee ($180). You elect to receive this amount directly (which we always recommend). That means you receive $144.

So, you spent $40 out-of-pocket and then received $144. Your net inflow, in this case, is $104. You may be wondering what do you do with the $104.

You keep it!

We explain why next.

Why Do You Keep The Money?

In our simple example above, you paid $40 to your primary insurance and received $144 back from the secondary dental insurance.

Many people stop us at this point and ask, “John. It doesn’t make sense. Why would I keep any money?”

The reason is the secondary dental insurance is not traditional insurance.

It is an indemnity insurance plan. This means the plan pays per a fixed percentage or a fixed dollar amount based on the service or procedure.

It doesn’t matter what your primary insurance pays. These indemnity plans do not coordinate with your primary dental insurance. Because of that, it is important that you assign the benefits to yourself and not to the dentist. In other words, you receive the benefit money from the secondary dental insurance, not the dentist.

Hopefully, this makes sense. If not, contact us.

There are 4 types of dental indemnity plans we work with that make great choices for secondary dental insurance. We discuss these next.

Secondary Dental Insurance Options

As we mentioned, we work with 4 indemnity insurance plans that we feel make great secondary dental insurance.

These are all very affordable and expand your annual benefit amount. You can have a $1,000 annual benefit on your primary insurance and know that you have an additional benefit through your secondary insurance.

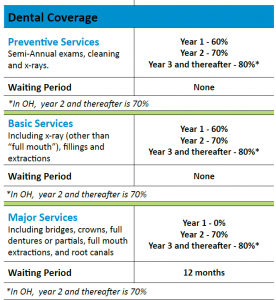

Please note that all of the dental insurance plans have waiting periods. For example, major services may have a 12 month waiting period.

It is also important to note that not all products are available in all states. Contact us to find out if this product is available in your state.

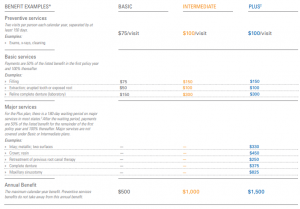

The first one is a fixed dollar amount that you receive, based on the service. For example, you need a filling performed. You submit the claim to the secondary dental carrier, and they mail you a check for the fixed benefit amount. Let’s say it is $100 for your filling. That is what you receive regardless of what your primary insurance pays. You can use the money for whatever you want.

3 Others Offer A Percentage Benefit

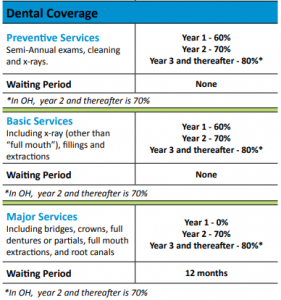

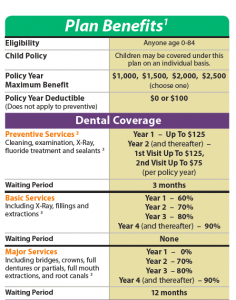

The 3 other plans we work with offer a percentage benefit based on the service. Basic services could start at 60% the first year, 70% the second year, and 80% in the third year and on. For example, here is a snapshot of one plan we work with.

As you can see, the benefit percentages start off low in the first year and then increase each year as you hold on to the policy.

How does this plan work? Let’s say you go to the dentist for a cleaning. Your dentist is in the network of your primary dental insurance. The charges are $250 for the office visit, but you pay $0 since you went to an in-network dentist. You file a claim with the secondary dental insurance carrier. Since this is your first year, you are eligible for a 60% benefit payment. Remember, this benefit payment is based on the UCR. Let’s say the UCR fee in your area is $200 for a cleaning. You receive $120 from the carrier ($200 X .60). You can use the money for whatever you want.

The 3 carriers offer varying benefit percentages in which we illustrate below with premium information (subject to change).

Two of the carriers offer up to $1,500 annual benefits while the other one offers up to a whopping $2,500 annual benefit! These annual benefit amounts are in addition to the benefit amount of your primary dental insurance.

As we mentioned, scroll down below to see these benefits and corresponding premiums. We arbitrarily chose the premium for a 65-year-old. If you would like to know how much your premiums cost, please contact us and let us know which plan you would like to look at.

Larger Dental Service Example

The secondary dental insurance makes a difference for those larger dental services and procedures. Let’s say you need a root canal and the insurance cost is $1,000. You have a $1,000 annual benefit plan with your primary insurance. You already went to the dentist earlier in the year for a cleaning and various other work. So far, the carrier paid $750 in total on your behalf. This means, you will have out-of-pocket expenses for the root canal you pay on your own. In other words, you will have to pay 100% of the cost of the root canal beyond the $250 remaining amount.

However, you have a secondary dental insurance plan with a $1,500 annual benefit. You feel better now. You have had the plan for several years now. Your benefit payment for the root canal is 80% of the UCR fee. Let’s see how this plays out.

Your primary insurance pays 50% of the insurance cost. Because you went to an in-network dentist, the carrier pays $500 and you pay $500. However, $250 of benefit dollars is remaining, That means the carrier pays $250 and you have to pay the remaining amount of $750.

If all you had was the primary dental insurance, this situation would stink!

But you have the secondary dental insurance. You file a claim. The UCR fee for this service in your area is $900. The plan pays 80% of this or $720.

You then use this $720 to pay for the $750 balance for the primary insurance carrier. Your net expense is only $30 in this example.

Hopefully, you see how the secondary dental insurance helps.

Affordable Secondary Dental Insurance

You may be thinking, “This all sounds great, John, but what about premiums? I am on a fixed income”

Thankfully, secondary dental insurance is affordable.

Below are the monthly premiums for a 65-year-old person. Premiums are lower for younger people and more if you want to include your entire family. If you include your entire family, they each receive the respective annual benefit.

Basic $15.50

Intermediate $26.00

Plus $51.00

$1,000 annual plan $34.17

$1,500 annual plan $45.17

$1,000 annual plan $28.56

$1,500 annual plan $33.60

Assume $0 deductible plan

$1,000 annual plan $40.67

$1,500 annual plan $51.41

$2,000 annual plan $57.06

$2,500 annual plan $62.58

The $100 deductible plans less expensive. Two or more people applying within the same household receive 10% discount.

As you can see, we have many options for your secondary dental insurance needs. Remember that not all plans are available in all states. Contact us to find out what is available in your state.

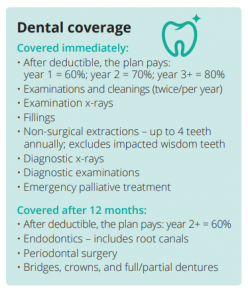

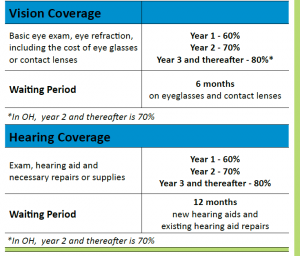

Additional Benefits

These plans offer more than just dental coverage. With the exception of the Fixed Dollar Indemnity carrier, the other 3 carriers (% benefit) offer coverage for vision and hearing costs as well. These services are included in the plan. The premiums above include vision and hearing. Vision and hearing benefit payments work off the same annual benefit amount. Just like the primary dental insurance coverage, the plans act as secondary coverage for your vision and hearing, too.

If you are 65 and older, you are already aware that that dental, vision, and hearing services are not covered by Medicare. If you know how hard it is to afford hearing aids and other services, then the additional benefit provided by the secondary insurance plan could make a positive impact.

Let’s use the root canal example to see how this works. You have a $1,500 annual plan and $720 went towards the cost of your root canal. That means you have $780 remaining to use towards vision and hearing for the year (or any additional dental work as well).

Benefit payments for vision and hearing work the same way as dental. You would file a claim and the secondary dental insurance plan pays you the benefit.

The plans pay a percentage of the insurance cost, increasing each year as you hold the policy.

Below is a snapshot of the benefits of one of the plans we work with.

Vision Example

For example, let’s say your new glasses cost $400 from the optometrist, but with your vision insurance, you paid only $200. Using the plan illustrated above, you are in year 2 of your secondary dental insurance plan. The reimbursement benefit for year 2 is 70%. Therefore, you are eligible for $280 benefit. If the plan has a cap on vision benefit, then you would receive the lower amount.

The same is true for hearing. If you are a senior on Medicare, you are well aware that Medicare does not cover, or has limitations on, hearing aids. This plan will help pay for your hearing aids.

What’s The Benefit?

As you can see, this is a complete dental, vision, and hearing insurance plan. We feel this plan is a great and affordable way to provide for secondary insurance for dental, vision, and hearing.

As a recap, here are the benefits of the secondary dental insurance plan:

(1) expands your dental annual benefit (and your vision and hearing as well)

(2) affordable premiums that don’t break the bank

(3) pays a benefit directly to you (unless you assign it to your provider, which we don’t generally recommend)

(4) does not coordinate with your primary insurance

(5) provides benefits for vision and hearing

Conclusion

We hope you learned from our article about secondary dental insurance. Would you like to learn more? Contact us or use the form below. We would love to help you any way we can and always work with your best interest first.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".