Help With My Out Of Network Dentist Costs!

Updated: April 12, 2024 at 9:39 am

It’s common nowadays. Your dentist is out of network. We will explain what that means next. However, you are paying monthly premiums and are paying a lot out of pocket. But, you like your dentist. You don’t want to go through the hassle of switching to another one. You don’t have to. In this article, we discuss options to manage your out of network dentist costs.

In Network Vs Out Of Network Dentist

Let’s first level-set on the difference between an in network and out of network dentist. An in network dentist accepts your dental insurance’s contracted fee schedule. This means he or she likely accepts a reduced fee amount, but in return, has a pipeline of individuals who, like you, have the insurance and need to see the dentist. We’ll show an example in a minute.

An out of network dentist doesn’t accept any contracted fee schedule. Instead, the dentist is free to charge what he or she believes is the right amount for the practice. You see, dentists are business owners. They may not want to accept a lower, contracted fee amount from a carrier. They may want to charge a higher amount depending on their practice.

Truth be told. In speaking with many seniors and families, I think many dentists are going out of network. They want to manage their revenues their own way.

Additionally, many group dental coverage through employers are out of network. More on that in a minute.

There is a lot of lingo that goes with in network and out of network dentist costs. We describe those next with an example. We then discuss solutions and alternatives for your out of network dentist costs.

In Network Dentist Costs Example

As we mentioned, you’ll pay lower costs if you go to an in network dentist. The in network dentist charges are called maximum allowable charges, or MAC. Alternatively, the MAC is sometimes referred as the negotiated network rates.

MAC means you are charged the maximum fee and nothing more. For instance, let’s say you go to an in network dentist for a filling. The dentist’s “retail” fee is $250. However, because the dentist is in your insurance network, the fee is negotiated to $100. This is the MAC.

Next, the carrier applies the corresponding coinsurance. A filling is usually a basic service, covered at 80% of the MAC. This means, using our example, the insurance carrier pays $80 for the filling service ($100 X .8). You pay the difference of $20.

Many carriers have favorable coinsurance rates for in network dentists costs compared to out of network dentist costs. We will show an example in a minute.

In summary, in network dentist costs are usually less than the dentist’s own “retail” fee. This is because the dentist accepts a lower, prenegotiated rate for a procedure or service.

Out Of Network Dentist Costs Example

Same example now, but your dentist goes out of network. What happens?

Well, first the MAC usually doesn’t exist. There is a new concept called the UCR fee. This means usual, customary, and reasonable fee. For out of network dentists, insurance carriers see what dentists are charging in your area. Usually, carriers will charge based on what 8 out of 10 dentists charge or less. For example, if 8 out of 10 dentists charge $250 for the filling, then this is the UCR fee charged.

Using an out of network dentist introduces another concept called balance billing. This means the dentist can charge you the difference between the retail rate and the UCR fee.

If the UCR fee charged is the same or more than what your dentist charges, there is no balance billing. For example, if the coinsurance is 80%, the plan pays $200 ($250 X .8) and you pay the difference of $50 (to the dentist). There is no balance billing in this case. $250 dentist retail fee – $200 paid by insurance – $50 paid by you = $0

If the UCR is less, however, you pay the difference with balance billing.

For example, let’s say the UCR fee for a filling is $200. The dentist’s “retail” fee for a filling is $250. This means the plan pays $160 ($200 X .8) and you pay $40. But, it doesn’t stop there. The dentist can charge you the balance between his or her retail fee and the UCR fee. In this case, the dentist charges another $50 to you ($250 retail – $200 UCR). In total, you pay $90 ($40 UCR portion + $50 balance billing) to the dentist.

Do you see how you pay more going to an out of network dentist?

Why Your Group Dental Insurance Is Usually Out Of Network

Every so often, people tell me that dental insurance is a waste of money. Well, I firmly believe this is the case because they are going to an out of network dentist unbeknownst to them. I would feel the same way, too, if I had to pay an arm and a leg (or a bicuspid and a molar) even if I had a cleaning done!

This situation is very common with group dental employer coverage.

Group employer coverage is simply dental insurance purchased through your employer. Your employer may have a contract with a carrier. By enrolling through the contracted carrier, you may pay less per month in premium than if you purchased your own, individual dental insurance policy.

While you may pay less in monthly premiums, you could pay more out of pocket. Why?

It has to do with the contract.

Let’s say you live and work in Minnesota. Your company has a group dental contract with Delta Dental of Arkansas. Well, your dentist isn’t taking Delta Dental of Arkansas. He or she might be in network with Delta Dental of Minnesota, but not with Arkansas.

You aren’t aware of this, and certainly the office manager doesn’t tell you. When you receive your bill, even for a cleaning, you see all of the weird type of charges we spoke about. This is because your dentist is out of network with Delta Dental of Arkansas.

You are angry and ticked off and think, “This dental insurance is @#%^$*@!!. What a waste of money!“

You think there is nothing you can do, unless you move to Arkansas. But, there are options. We discuss those next.

Options For Out Of Network Dentist Costs

You have a few options when it comes to managing your out of network dentist costs.

You could:

(1) self insure: you could do that and set aside every month a lump amount of money for dental cost use. In theory, this is a great strategy. You can then negotiate with your dentist a cash price and then pay that discounted fee.

However, that generally doesn’t work. When most Americans don’t even save for retirement, do you think you will save money towards your dental costs?

No.

So, let’s remove “self-insuring” as an option.

(2) go with an in-network dentist or dental plan: a more feasible option. You could simply find out from your dentist what plans he or she accepts as “in-network” and then enroll with that plan. It is important to ask your dentists which plans they accept “in network”. Sometimes, dentists only accept group employer dental plans and not individual plans. Additionally, dentists could interpret your question to mean any plans. All dentists can file a claim with an out of network carrier, so you want to make sure what insurance plans they participate in network.

This means dropping your group dental insurance, if needed. Hey, I bet you will save a lot more in total costs this way. If you want to go with an in network dentist (and you will save more money that way), you’ll want to contact us.

(3) go with a true PPO plan friendly to out of network dentist costs: let’s say you like your dentist. You don’t want to switch. I hear you. That can be a hassle.

There are true PPO plans and “friendly” out of pocket plans available. We discuss these next.

True PPO Plans To Help With Out Of Network Dentist Costs

There are some plans that we call “true” PPO plans. They don’t have networks. They will pay a benefit if you go to any dentist. Really.

Remember we talked about UCR fee? These plans usually pay at the 80th percentile of dental fees in your area. That means the plan pays a fee based on 8 out of 10 dentists in your area. Our filling example above is a good example.

These plans make a good secondary dental insurance because they don’t coordinate with primary dental insurance. If you want to keep your group dental insurance, let’s say, but want to minimize costs, these plans work well. Moreover, they also cover vision care and hearing care as well.

As we said all along, expect to pay, though, more out of pocket than if you went to an in network dentist.

However, you have a lot of flexibility with these plans. You can negotiate a cash price with your dentist – hopefully lower than the dentist’s “retail” fee. Yes, that likely means you have to pay in full at the time of service. Then, you file the claim with the carrier and they send the reimbursement back to you.

A disadvantage: well, as we said all along, you will have out of pocket costs. Additionally, these plans don’t usually cover intense services like implants. If you think you will need intense, major services, you could be better off with the type of insurance we discuss next.

Depending on the state you live in, benefit amount, and age, you could spend anywhere from $30 to $50 per month in premiums.

Friendly Out Of Network Dental Plans

Here is a secret (well, not really). Any time a plan is a PPO plan, it means you can go to any dentist. However, not all plans treat out of pocket dentist costs the same. Some plans have a lower coinsurance on out of pocket dentist expenses. Others may cover at 70th or 80th percentile of the UCR fee. Most do both.

We work with one plan that is a more “friendly” PPO plan for out of pocket dentist costs.

First, it covers at the 90th percentile of UCR. Just FYI, the higher the UCR fee coverage, the better.

Moreover, it covers the same coinsurance rates as an in network dentist.

What does that mean, John, you ask?

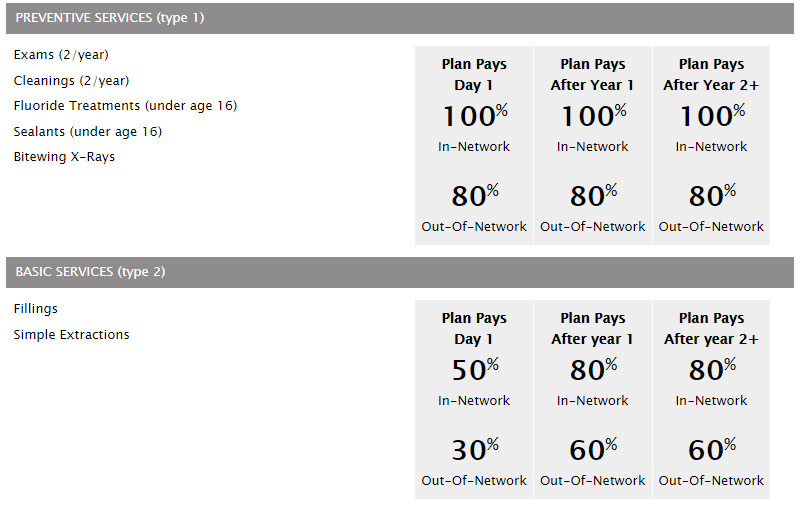

Well, as we mentioned, many PPO plans have in network and out of network dentist coverage. Many plans have higher coinsurance rates for in network dentists versus out of network dentists. An actual snippet from one plan is below. You can see an in-network dentist has a higher coinsurance sharing than going to an out of network dentist

As you can see, if you went to an out of network dentist for a cleaning, you would have a 20% coinsurance to pay (in addition to any balance billing, likely).

We work with one plan that utilize the in network dentist coinsurance, (like 100% in this example)

What is the premium cost of these plans? Well, the monthly cost can be anywhere from $40 to $60 per month.

Geez, John, you exclaim! Talk about breaking the bank!!

We will provide an example next. As we mentioned, you will have out of pocket costs with any dentist, including in and out of network dentists.

Example Of Out Of Network Dentist Costs

First, keep a couple of things in mind. Yes, you will have out of pocket dentist costs. (A recurring theme…) However, the plan:

(1) covers at the 90th percentile of UCR, so hopefully minimal balance billing from your dentist. That saves money

(2) increases in the coinsurance amount to the in network rate. That will also save money.

Here is an example.

Let’s say you go to an out of network dentist for a cleaning. Of course, going to an in network dentist saves you money, but you like this dentist and the care she provides. You credit her with saving your teeth!

She charges $250 for a cleaning.

Let’s say have the “friendly” PPO plan. The UCR fee (covered at 90%) is $250 or even $300. Well, there is no balance billing because her “retail” fee is equal to or less than the UCR fee. And, because the coinsurance cleaning is at 100%, you pay nothing.

Now, let’s say you have a basic dental plan that really is useful for in network coverage, but allows for out of network coverage. You go to your out of network dentist.

With this plan, the UCR fee is $200. Additionally, the coinsurance amount for an out of network dentist at 80%. (Using the chart above.) Well, you will have to pay $40 coinsurance to start. That is $200 X 20%. The insurance pays $160. Moreover, you are exposed to balance billing. That amount is $250 – $200 UCR fee or $50. So, all told, you will pay $90 ($40 coinsurance + $50 balance bill) for the cleaning.

You may have a lower monthly premium in the last example, but you will definitely have higher out of pocket costs than compared to the first example.

Conclusion

We hope you found this article informative. You certainly can stay with your dentist. However, understand that if your dentist is out of network, or does not accept any insurance, you usually will pay higher out of pocket costs.

Do you need assistance? We can help. We can look up and see if your dentist is in any individual dental insurance network. (It helps if you ask the office manager, too.) If so, we can make a switch to a lower cost dental plan. Also, if your dentist does not accept any insurance or you simply don’t want to switch, we can help you find the right plan that will save money on dental costs.

Give us a call, contact us, or use the web form below. We would be very happy to help you with your dental insurance needs.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Help With My Out Of Network Dentist Costs!”

Comments are closed.

Looking for dental insurance for out of network dentists

Thanks for reaching out to us, Brenda.

Give us a call at (800) 645-9841 and we can help.

John