Best Guaranteed Issue Disability Insurance For Small Business Owners

Updated: April 12, 2024 at 9:39 am

Are you a small business owner and looking for disability insurance? Sure, you can buy some individually. However, did you know that guaranteed issue disability insurance exists for small business owners? Moreover, you as a small business owner can buy it yourself.

Are you a small business owner and looking for disability insurance? Sure, you can buy some individually. However, did you know that guaranteed issue disability insurance exists for small business owners? Moreover, you as a small business owner can buy it yourself.

No, John. I did not!

Most small business owners don’t. Depending on your occupation, age, and health, an individual disability insurance plan can be expensive. However, let me stress that disability insurance is extremely important insurance. A small business owner and other professionals really can’t go without it.

But, small business owners have more options. Small business owners can purchase disability insurance at guaranteed issue. In other words, no underwriting.

Get out of here, John. How?

Let’s discuss this next. Here is what we will discuss:

- Why Do Small Business Owners Need Disability Insurance

- Group/Employer Disability Insurance For Small Business Owners

- The Best Guaranteed Issue Disability Insurance For A Small Business Owner

- Eligibility And Participation For Guaranteed Issue Disability Insurance

- How The Guaranteed Issue Disability Insurance Helps You

- Cost Of Guaranteed Issue Disability Insurance

- Can You Add An Individual Disability Insurance Plan?

- Now You Know How Small Business Owners Can Obtain Guaranteed Issue Disability Insurance

Let’s jump in and quickly discuss why you need disability insurance. You probably already know, but it doesn’t hurt to read another perspective.

Why Do Small Business Owners Need Disability Insurance?

If you are a small business owner, you wear many “hats” (we know). Many people rely on you: your staff, your suppliers, your customers, and most importantly, your family.

What if you could no longer earn a paycheck? Think about that for a minute. Let’s say you paid yourself last Friday. Driving home from work, you think everything is OK in your life right now. Suddenly, a cell-phone texting driver slams his car into yours. You are severely injured and life-flighted to the nearest major hospital. You will live, thankfully, but your road to recovery is a long one.

What if you could no longer earn a paycheck? Think about that for a minute. Let’s say you paid yourself last Friday. Driving home from work, you think everything is OK in your life right now. Suddenly, a cell-phone texting driver slams his car into yours. You are severely injured and life-flighted to the nearest major hospital. You will live, thankfully, but your road to recovery is a long one.

Your injuries are just the start of the pain. Since you are a small business owner, you do it all. Who is going to work with your customers? Who is going to make sure the business runs smoothly? How will your family dynamics change? Moreover, where will you get money to pay for your mortgage and other living expenses? It is an all too real and common situation.

This is where disability insurance comes into play. A proper disability insurance policy pays a percentage of your income in case of disability.

This type of policy keeps your future and dreams alive. If you can’t earn a paycheck because you are sick or injured, and you can’t work, what will you do?

Nevertheless, the thought of not having a paycheck for an extended period of time should make you worried.

Group/Employer Disability Insurance For Small Business Owners

We have written about disability insurance ad nauseam. According to the Council of Disability Awareness, 51 million working Americans are without it. Likely, you are, too. We aren’t going to rehash the discussion of the need here.

As you are likely aware, as a small business owner, you can purchase disability insurance on an individual basis. You can purchase:

- An individual plan that is based on your self-employment earnings/net income.

- A business overhead expense policy that pays for business expenses like rent and employee salaries

Disability insurance underwriting can be stringent. Most people, however, qualify for disability insurance. Some people, however, just can’t. They either have a significant pre-existing condition, lifestyle, or health condition.

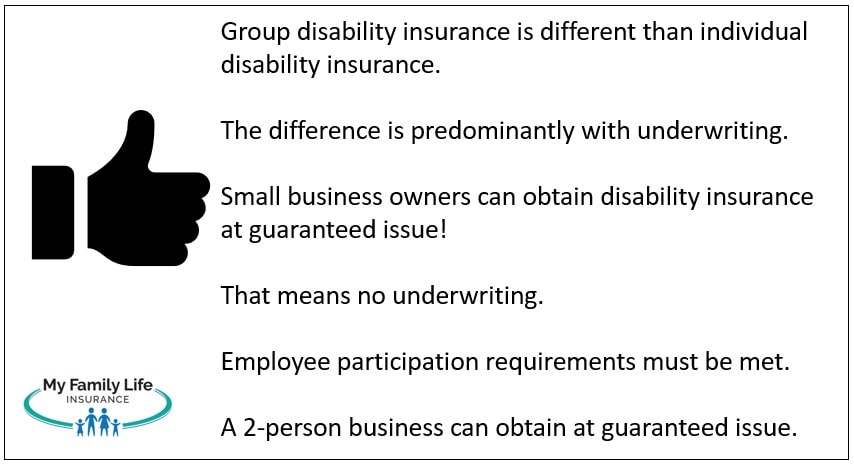

Since you are a small business owner, you have another option: group disability insurance coverage purchased at guaranteed issue.

“Small business owners can purchase disability insurance at guaranteed issue. That means no underwriting!”

What does guaranteed issue mean? It means that you will be given disability insurance no matter what. Coverage is automatic.

Read these questions and answers:

Do you have a severe medical condition? No problem. You will have disability insurance.

Overweight? You will have disability insurance.

Cancer in your health history? You will have disability insurance.

Lifestyle concerns like daily, recreational marijuana use? You will have disability insurance.

How is this possible, John, you ask?

We discuss this next.

Group Disability Insurance Underwriting

It is possible because of the underwriting. Individual disability insurance underwriting is based on you. It is based on your health among other variables such as your occupation and age.

However, group disability insurance underwriting is different. Group underwriting is based on the carrier’s claim experience for an occupation class.

So, the underwriter looks at the group of employees as a whole, rather than a single individual. Of course, they take into account age, gender, and occupation. However, that’s about it.

Your business purchases the disability insurance and then holds the policy. Employees then enroll through your business. Typically, the insured employee fills out a short application with limited health questions asked. Additionally, underwriting does not require a paramedical exam!

Then, coverage for existing employees begins immediately or on a date you specify in the future. New employees, however, have a probation period. Once that is met, they will have disability insurance. In other words, they have to remain with the company for a specified number of days before enrolling.

Depending on the number of participants, coverage could be at guaranteed issue. Why is this important? The number of participants spreads the carrier’s risk. The more participants, the lower the risk. (In theory, of course.)

Compare group underwriting to individual underwriting, which specifically looks at you and your health, job class, income, etc.

With individual disability insurance underwriting, the carrier spreads your risk 100% on you. That is why if you have a health condition, lifestyle situation, or a serious medical condition, your premiums are higher. The insurance company mitigates the higher chance of claim through an increased premium or an exclusion on the policy.

However, with group disability insurance, this type of underwriting usually doesn’t happen.

Disadvantages of Group Disability Insurance

While that sounds great, there are limitations with group disability insurance, though. Most of these limitations pertain to the group policy itself.

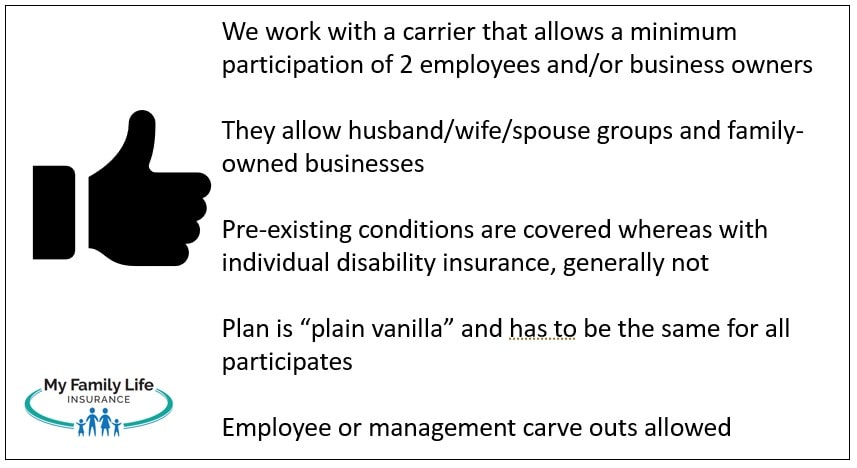

First, group disability insurance policies are usually “plain vanilla”, meaning you can’t customize the policy to meet your specific needs. What you see is what you get.

Second, the definition of disability sometimes is more stringent. Most individual policies offer the beneficial “true” own occupation definition. Many group plans do not offer this. Most do, however, offer a modified own occupation version.

Third, many group policies coordinate with social security or other social insurances.

Fourth, many do not cover certain industries or do not cover husband/wife/spouse owned businesses or family-owned businesses.

Next, the “plain vanilla” plan is for everyone. You can’t change it or modify it to suit your individual needs because it is a “group” plan. (If you want individualized disability insurance, then an individual plan works best.)

Finally, group disability insurance premium rates increase annually or every 5 years.

That doesn’t mean you should not have group disability insurance coverage. You should if it makes sense and if the plan is right.

What do you mean if the plan is right?

That is a good question. There are many group disability insurance plans available. Some, in our opinion, are better than others. Depending on the plan, some plans might have a stringent disability definition. Or, they may require some health underwriting. Additionally, they may exclude your profession.

In the next section, we discuss, in our opinion, the best guaranteed-issue disability insurance for small business owners. We have worked with many carriers in the group disability insurance market. This one stands out above the rest.

The Best Guaranteed-Issue Disability Insurance For Small Business Owners

Many carriers offer disability insurance for small business owners at the group level. In our opinion, some are better than others and only one stands out.

We work with a carrier that offers guaranteed-issue disability insurance starting at 2 eligible employees.

That is right.

Wait, John. My broker said I would have to have a 3-person minimum and then 10 people to qualify for guaranteed issue!

Not here. Only 2 people to start and need to be insured at guaranteed issue. Of course, there are participation requirements that we will discuss later.

The carrier insures up to 19 employees. So, this plan is designed for really small businesses. If your business is larger, contact us.

The carrier insures up to 19 employees. So, this plan is designed for really small businesses. If your business is larger, contact us.

As mentioned earlier, your business owns the policy. You and any other employee receive certificates showing coverage.

Here is an important distinction compared to other carriers. This carrier also covers family-related businesses and husband/wife/spouse businesses. Not many do at all.

So, if you and your spouse own a company together, you both can obtain disability insurance. In other words, you and your spouse would be the 2 people.

Even better: you will have coverage if you are disabled due to a pre-existing condition.

Again, there are no health questions on the application.

What, John? No way! You are crazy! What is the catch?

Pre-Existing Conditions Covered

No, we are not crazy. Additionally, there’s no “catch”, either.

There is a pre-existing condition clause. However, unlike those found in individual policies, the plan covers your condition (per the policy parameters).

Here is how the coverage works.

If you are disabled from a pre-existing condition within the first 12 months of the policy’s effective date, you will receive a partial benefit. The partial/pre-existing benefit is 30% of your basic monthly earnings to a maximum of $3,750 per month for 12 months. If there is a “catch”, I guess that is it.

If you go on disability from a pre-existing condition after 12 months, you have full coverage. (For example, let’s say the effective date of your coverage is January 1, 2021. You go on disability on June 1, 2022. That is 15 months, and you have full coverage.)

Really, it is that simple.

Additional Benefits And Provisions

The policy contains the own occupation definition for 36 months. After that, the “any” occupation definition exists. In this case, any occupation means if you cannot perform the material duties of any occupation that you are reasonably qualified for based on education, experience, or training.

If you read our previous articles on disability insurance, you know how important partial disability benefits are. This policy contains partial disability benefits without the total disability requirement that many policies have. Essentially, the benefit is 50% of your total monthly disability benefit. All you need to do is satisfy the elimination or waiting period.

That brings us to the waiting period. You have a choice of 60, 90, or 180 days. As we discussed before, your first disability benefit payment won’t occur until 30 days after the satisfaction of the elimination period.

You can insure up to 60% of your basic salary (excludes OT and bonuses, just like an individual policy) up to $7,500 monthly maximum. Some occupations qualify for up to $10,000. Contact us if you have any questions.

The benefit period is to normal retirement age as defined by the Social Security Administration.

There is a rate guarantee of 36 months. In other words, your premiums won’t go up for 3 years. If there is a disadvantage to this plan, it is that rates do go up every 5 years as participants enter new age bands. However, in looking at rates for many occupations, they are competitive.

The employee can pay up to 100% of the premium. If you as the business owner pay 100% of the premiums, then ALL employees must participate.

Additionally, you can even carve out a class of employees, if you wish. So, if you have office staff who wants coverage, you can do that.

Eligibility And Participation For Guaranteed Issue Disability Insurance For Small Business Owners

You need to follow eligibility requirements. They include the following.

Firms in business for less than 1 year, not participating in social security, and with employees living on the employer’s premise are ineligible.

Home-based businesses are also ineligible. An easy workaround for this, however, is to establish an official shared office or virtual office space.

Employees need to work full time more than 30 per week. You can include part-time employees working 30 hours or less (min of 20) as long as the number of part-time employees is less than 25% of your workforce.

Many industries qualify for this insurance. Here are some who we have helped, including:

Law firms

Doctor Offices

Cleaning, Janitorial, and Maintenance Companies

Musician Studios

Massage Therapy Studios

Some Construction Companies (more below)

Truck Drivers – yes, especially husband/wife teams

Accountants

Insurance agencies – especially husband/wife and family businesses

Property Managers

Real Estate Agents/Brokers

Funeral Homes

Food Service Managers

Chiropractic offices – yes! Especially, husband/wife and family businesses

Architects

Home Inspectors

Landscapers

Mechanics/Auto Shops

Restaurants and Bars (yes, many!)

And the list goes on.

The plan covers 90% of industries. However, some industries just don’t qualify because of the large disability risk. These industries include, but are not limited to, heavy construction, liquor stores, farmers, fishermen, gas stations, and some specialized physician practices. If you think your occupation does not qualify, contact us. We will help you out.

Participation Requirements

As we mentioned, there are participation requirements IF your employees pay a part of the premiums. (If you as the owner pay 100% of premiums, ALL employees are insured.) These participation requirements are as follows:

2 eligible employees (for example, you and your spouse) – both must be insured

3 to 5 eligible employees – all but one must be insured

6 to 9 eligible employees – all but 2 must be insured

10 to 19 eligible employees – 75% must be insured

Application Process For Guaranteed Issue Disability Insurance For Small Business Owners

It’s easy to apply and enroll. Here are the steps:

(1) Confirm your firm’s eligibility and industry classification

(2) Confirm eligible employees

(3) Determine how many need to be insured per the participation chart above

(4) Decide if you, as the employer want to pay all, some, or none of the employee’s premiums

(5) Fill out a very short application that contains no health questions. That is right. As we said, there are no health questions. Guaranteed-issue coverage with a favorable pre-existing benefit clause.

(6) Establish a start-date/effective date

(7) Pay the premium to start the coverage

That is it.

Other Insurance You Can Add With The Carrier

The carrier also allows Life/AD&D, short-term disability, and dental/vision plans on the same application. The application is really simple.

Again, all of this is guaranteed-issue coverage, but participation requirements apply, just like with the long-term disability coverage.

Their short-term disability allows maternity coverage. This is a great and affordable benefit for female employees. While we generally believe short-term disability insurance is a waste of money, it can make sense if purchased through a business.

Contact us to learn more and tell us what information you need.

How The Guaranteed Issue Disability Insurance Helps Small Business Owners

You may be wondering how this all helps you as a small business owner.

First, as we mentioned earlier, the carrier accepts businesses with 2 employees.

So, let’s say you own a business with one other employee. If you decide to pay for that employee’s disability insurance, you then have disability insurance. Or, you can have the employee pay part of the premium, too.

We recently helped an insurance agency owner this way.

Recently, he applied for individual disability insurance. Unfortunately, he has a health condition that the carrier rated and excluded from his policy.

He gave us a call. He has one employee assistant. So, he purchased group disability insurance for himself through his agency. Moreover, he pays the premium for his assistant. He and his assistant qualify as 2 employees.

Additionally, the carrier allows “carve-outs”. Let’s say you are a dentist and your hygienist approaches you about obtaining disability insurance. You have 3, full-time hygienists. You have plenty of disability insurance yourself, but your hygienists don’t. They said they will all gladly pay (in other words, the participation rate is met).

All you do is coordinate the premium draft through payroll, and then they all have disability insurance.

Additionally, you can “carve-out” for yourself and other members of management, as long as you have a minimum of 2 people and the participation requirements are met.

We’ve helped many husband/wife businesses, family-owned businesses, management-only carve-outs, and worker-only carve-outs obtain disability insurance this way.

Administration Of The Plan

Sounds good, John. But, how do I manage this? I am really busy.

Of course. The good news is the carrier makes administration easy. The carrier provides an online dashboard where you can make changes to the plan. Your plan is loaded in the dashboard. You can add and remove employees easily. You can also make changes to salaries. If you make salary changes, the premiums correspondingly change.

You can assign an office manager to do this work or you can manage it yourself.

Even the busiest of professionals have not had a problem managing this.

Cost Of Guaranteed Issue Disability Insurance For Small Business Owners

Sounds good, John, you say. But, I know from life insurance, guaranteed issue means “really expensive”. How much does this all cost?

Good question. Guaranteed issue life insurance can be expensive. However, guaranteed issue disability insurance through your business likely is not.

As we discussed earlier, the carrier bases its premium costs on:

- Genders of the enrollees

- Ages

- Salary/income

That is really it.

Remember, the premiums increase as employee-enrollees enter new age bands. However, even the rate increases are reasonable.

Premium Cost Example

Here is an example cost, subject to change, of course. A self-employed male architect age 38, making $120,000 came to us recently. He has an employee assistant, female, age 27, making $30,000.

architect age 38, making $120,000 came to us recently. He has an employee assistant, female, age 27, making $30,000.

He applied for individual disability insurance, but the carrier rated him rather expensively for a pre-existing health condition. This health condition is also excluded from the policy.

With us, we were able to offer him a 90-day waiting period, to age 65 coverage, with a $6,000 monthly benefit, for $48.00 per month.

Of course, the premium steps up as he enters the 5-year age bands. Additionally, the own-occupation definition lasts 3 years. However, if he is still disabled after 3 years, there is a significant likelihood he can’t do any job.

Because the plan has to be the same for all employees, unless there is a carve-out (discussed earlier), his assistant will have a similar plan. She will also have a 90-day waiting period with to age 65 coverage. However, her monthly benefit is $1,500. Her premium is $7.75 per month. Our architect gladly pays it as she does a nice job. Moreover, it is relatively inexpensive.

Do you see how this is one way the guaranteed issue disability insurance helps small business owners?

Remember Who Can Qualify For The Guaranteed Issue Disability Insurance For Small Business Owners

It bears repeating. Remember, we can help just about any industry and occupation:

Truck drivers

Restaturants and bars

Engineering groups

Dentists and doctor practices

Massage therapists

Manufacturing facilities

Insurance agencies

Real estate groups

And on and on.

There is a small group of industries we can’t work with. These include:

Oil and gas businesses

Heavy construction

Liquor stores

Gas Stations

Really, any industry with heavy labor as well as a dangerous disability risk

If you work in these industries, contact us. We can likely get you some type of coverage.

Most importantly, remember, we can insure:

Husband/wife/spouse owned companies, even if you are the only two employees

Family-owned businesses

Management carve-outs

Worker carve-outs

The carrier makes this plan extremely flexible for small businesses.

Can You Add An Individual Disability Insurance Plan?

Many small business owners ask us if they can purchase an individual disability insurance plan in addition to the guaranteed issue disability insurance plan through their company.

The answer is yes, you can! Moreover, I recommend that!

Depending on carrier income and benefit limits, you can stack an individual plan to your group disability insurance plan.

For example, let’s you have a $3,000 monthly benefit through your group plan. Your income is such that carrier XYZ provides up to $5,000 monthly benefit. Carrier XYZ looks at the group coverage and offers you $2,000 per month.

Why do you want more coverage? Well, you want to be fully insured in case you are disabled and can’t work.

There are no coordination issues like there are with social security as well as worker’s compensation.

However, a larger benefit is the fact that you can purchase business overhead expense insurance.

Many small business owners overlook this insurance, but it is very important.

Contrary to an individual plan, a BOE insurance plan pays your business expenses when you are disabled.

So, it will pay for rent, utilities, employee salaries, and even taxes among other covered expenses.

The good news is this type of plan is relatively inexpensive. Moreover, you can deduct the premiums on your tax return.

Let us know if you have any questions here.

Now You Know How Small Business Owners Obtain Guaranteed Issue Disability Insurance

Small business owners have disability insurance options. However, many small business owners can easily obtain disability insurance at guaranteed issue. Again, this means no underwriting.

As we discussed, we work with a carrier that has a great plan for small business owners. Applying is very simple.

Are you interested in learning more? Do you need assistance? Feel free to contact us or fill out the form below. As with everything we do, we work in your best interest first and foremost. If we feel this is not the right plan for you, we will tell you and help you find one that is. That is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".