Disability Insurance Guide For Dental Hygienists And Dental Assistants | We Discuss Underwriting, Plan Types, Cost, And The Best Options

Updated: October 27, 2024 at 9:28 am

Dental hygienists or dental assistants probably don’t think of the importance of disability insurance. At least not right away.

Dental hygienists or dental assistants probably don’t think of the importance of disability insurance. At least not right away.

If you are a dental hygienist or assistant, you are busy! You spend your day providing important preventative care and other procedures. Moreover, you particularly enjoy how you help your patients maintain and improve their smiles! You rely on your technical skills as well as your physical ability to get the job done.

What if you could no longer do your job? Have you ever thought about that?

Have you ever thought about what would happen if you became sick, ill, injured, and disabled?

How would you pay the bills if you could not work?

What adjustments would you and your family have to make if you don’t have disability insurance?

These are all important questions that require answers. A disability affects the lifestyle you worked so hard for and your future plans.

In this article, we discuss disability insurance and the best disability insurance for dental hygienists and dental assistants.

Navigation And Summary

Here’s what we will talk about. Feel free to jump around as needed. I know time is precious, so here’s a summary of our article for your needs.

If you want to understand a particular topic in more detail, feel free to jump to that section or contact us.

- Why Do Dental Hygienists and Dental Assistants Need Disability Insurance?

- Types Of Disability Insurance for Dental Hygienists and Dental Assistants

- Here’s How Disability Insurance Protects Your Wealth

- Disability Insurance Underwriting for Dental Hygienists and Dental Assistants

- The Makings Of A Strong Disability Insurance Policy

- Disability Insurance Riders for Dental Hygienists and Dental Assistants

- The Best Disability Insurance for Dental Hygienists and Dental Assistants

- Probable Disability Insurance Costs

- Group Disability Insurance for Dental Hygienists and Dental Assistants

- Final Thoughts About Disability Insurance

Let’s start by describing why you need disability insurance.

Why Do Dental Hygienists And Dental Assistants Need Disability Insurance?

Disability insurance (some people call it disability income insurance or income protection insurance – they are the same thing) helps pay your bills if you can’t work due to an illness or injury. Anything illness or injury-related that prevents you from doing your job as a dental hygienist or assistant is a disability.

It pays you a monthly benefit that you can use to pay your mortgage, car payments, health insurance, and other bills while you focus on getting better and getting back to work.

In other words, if you will struggle to pay the bills (your mortgage, groceries, car payments, healthcare, and other living expenses) upon a disability, you probably need disability insurance.

However, there’s more to it. Here’s the real reason you need disability insurance.

I’ll present this in a different way.

Your patients are certainly very important, right?

Yes, John, they are.

However, there is also a group of more important people. Who can be more important than my patients, you think? They pay the bills.

True. They do, but they don’t love you as your family loves you. By far, if you have a family, your spouse and children rely on you more than you think. They love you more than anything. You wouldn’t want anything to happen to you that affects them, right?

Without disability insurance, you’ll have to answer some tough questions:

- Would you and your family be able to continue your standard of living without your income? If not, what changes can you make?

- Would your spouse have to work or work more?

- Who could be flexible with the children? Would you have the money to hire someone to take care of the kids?

- Would you need to sell your home to make ends meet? (No lie; some families have to.)

The tough questions can go on and on.

With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

Yes, But A Disability Won’t Happen To Me

I know. You think it won’t. However, the probability of having a long-term disability is anywhere between 1 in 3 and 1 in 4 workers. Contrast this to unexpected death, say from a motor vehicle accident, which is 1 in 114. Even dying from cancer has better odds: 1 in 7.

But, John, I’m not going to get hurt or be in a wheelchair, you say.

How do you know? You don’t. Moreover, a disability usually isn’t from an accident like a car accident. (Of course, though, it can.) A disability for a dental hygienist could be:

- Broken hand

- Cancer diagnosis

- Cardiovascular diseases

- Back injury

- Heart disease

- Head injury

- Multiple sclerosis diagnosis

- Torn ACL

- Loss of eyesight

- Carpal tunnel

- Neck and back problems from repetitive motion

- A stroke

Naturally, when we think of disability, we think of someone bound in a wheelchair, right? However, according to the Council For Disability Awareness, 90% of disabilities are from illnesses (like cancer) and musculoskeletal issues than from accidents.

That means an illness or condition, such as cancer or a heart condition, has a higher probability of disabling you than a skiing accident.

Moreover, some dental hygienists and dental assistants develop lower arm, shoulder, and back problems. Depending on the severity, these conditions can be long-term disabling situations.

Ok, John, but I have workers’ compensation. I don’t need to worry about money. That’s great, I say. Did you know that work-related disabilities account for 5% of all disabilities? That makes sense since 90% of disabilities are from illnesses.

While worker’s compensation can cover some medical bills and provide some money if you experience an injury at work, it may not totally cover your loss of income.

Again, what is your income plan if you can’t work?

The Types Of Disability Insurance Available For Dental Hygienists and Dental Assistants

There are three types of disability insurance available for dental hygienists and dental assistants.

The three disability insurances include:

- short-term disability insurance

- long-term disability insurance

- accident-only disability insurance

Many people ask us about the difference between short-term and long-term disability insurance. Here’s the difference.

Short-term is for a disability that lasts for a short period. Let’s say you break your hand. Well, working as a hygienist with a broken hand will be hard, right? So, that is a disability – you can’t do your job as a hygienist. How long does a fractured hand heal? Two to 3 weeks? Once you’ve met the waiting period, you’ll be eligible for benefits and receive some disability benefits.

Long-term becomes the lifesaver for those disabilities that last longer than 3 months. Cancer… a catastrophic injury…ALS…Diabetes…you name it. Most families can get by financially when one member has a short-term disability. Sure, it might be tough, but families can get by. Long-term disabilities can financially ruin families.

Both insurances generally use the own-occupation definition of disability. (More on that in a minute.)

Finally, there is accident-only disability insurance. Think of this as a “last resort” disability insurance. It pays a benefit due to an accident. The better carriers offer coverage for both on and off-the-job injuries. Usually, there are no health questions. Most accident-only disability insurance policies are affordable. The reason, as we stated earlier, is that most disabilities do not derive from accidents.

In this article, we focus on long-term disability insurance. However, you can contact us with any questions about short-term disability or accident-only disability insurance.

What About Short-Term Disability Insurance For Dental Hygienists?

We receive many inquiries from dental hygienists and dental assistants wanting short-term disability insurance coverage. They mainly want it as many short-term disability insurance policies through an employer or your state (11 states require employers and employees to cost-share into a disability insurance fund / family paid leave fund) cover childbirth and maternity leave.

However, individual short-term plans do not generally cover maternity or pregnancy.

We only work with one short-term disability insurance carrier of individual contracts. The plan is OK. It is nothing great; however, it has limitations for childbirth and pregnancy.

We used to work with carriers that offer insurance for childbirth, pregnancy, or maternity leave and have helped many hygienists obtain pregnancy or maternity leave insurance through hospital indemnity plans. We no longer do, and if you are interested in that, feel free to contact us. I can email you the information, and you can contact the carrier.

We also offer an excellent group /employer short-term disability insurance plan. We have helped dental hygienists and dental assistants with this short-term plan. Contrary to what you think, your employer dentist does NOT have to pay into the plan. It can be set up as voluntary as long as participation requirements are met. So, if you work with a few more dental hygienists, and you all want to have short-term disability insurance (or even long-term disability insurance) through the dental office, we can make that happen.

How Disability Insurance Protects Dental Hygienists’ And Dental Assistants’ Wealth

Sure, you’ve heard that disability insurance is paycheck protection or income protection insurance. We discussed that earlier in the article.

Additionally, you know how it will pay a monthly benefit to support you and your family if you can’t do your job due to illness or injury.

However, have you ever thought about how disability insurance protects your wealth?

Protecting your wealth is pretty important, right?

No, John. No one has ever discussed this. I’d like to learn more.

As a CFP® Professional, I routinely have discussions about how disability insurance protects your wealth as well.

According to the Bureau of Labor Statistics, dental hygienists earn, on average, about $78,000 gross annually. Let’s average that to $6,500 monthly.

What if you were disabled for two years (24 months)? What would happen financially?

Well, you would lose $156,000 of gross wages over that 2-year period (24 X $6,500).

Where would that money come from to pay $156,000 over those two years?

This is why I asked all those questions at the beginning of the article. In order to replace $156,000, would your spouse have to work more? If so, what gives? (The kids, the house…something has to.)

Now, disability insurance isn’t designed to replace all of your annual income. It’ll replace about 60% of it. Why? For one thing, you aren’t paying tax on that disability benefit.

We know that disability insurance will help pay the bills if you are sick or hurt and can’t work. However, people don’t realize that it has a huge, positive impact on protecting your wealth.

Why?

Well, people tell me they will raid their retirement accounts if faced with a disability. However, they don’t understand the financial consequences.

Doing so will have a substantial negative impact. Let’s illustrate that next.

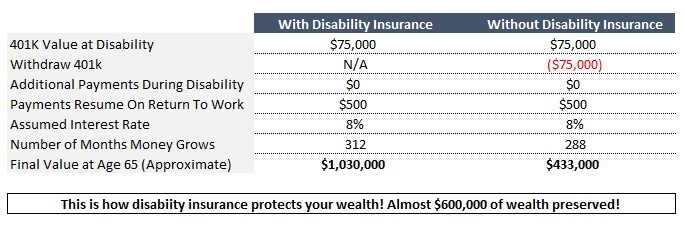

Here Is How Dental Hygienists And Dental Assistants Protect Their Wealth With Disability Insurance

OK, first, let’s assume you saved enough. Let’s also say you are a female dental hygienist, age 40, and make $80,000 gross or $60,000 after taxes and deductions. You have $75,000 saved through your 401k and contribute $500 each month to your 401k. Retirement for you is age 65.

You are suddenly disabled. However, you don’t have disability insurance.

So, gone is your monthly 401k contribution. But, you aren’t worried about that. Your main worry is money. You just need money to help pay the bills.

You turn to your retirement savings and request distributions from your 401k. These distributions are taxable and subject to a penalty.

Let’s compare how your 401k would look with and without a disability.

Assuming an 8% return, without a disability, you would have accumulated about $1,100,000 at age 65.

But, because you are disabled, you exhaust the $75,000. It’s gone. You are still disabled. Additionally, your spouse works more, and your relatives help with the kids. You take out a home equity loan to pay for things, too. Thankfully, your family pays the mortgage. While you are grateful, it is a financial strain and stressful. It makes you worried.

After two years, you are back at work. You’ve used $120,000 ($5,000 per month) between your home equity loan and 401k. However, you are two years older. Moreover, you no longer have retirement savings, so you start over.

You contribute $500 each month. At age 65, you have about $433,000!

Your wealth dropped because the $75,000 you saved could not compound for another 25 years—it was gone.

Don’t forget that you have the home equity loan to pay back, too.

What do you think about this?

What Happens If You Had Disability Insurance?

If you had disability insurance, you would have been much better off. There is no need to raid your 401(k).

Sure, you would not have contributed to your 401(k) for two years ($12,000).

However, your investment still would have compounded those two years.

So, if you had disability insurance, you would have ended up with approximately $1,030,000 at age 65.

That is about $600,000 of wealth preserved.

What, you exclaim!

Yes, and remember…this is a 2-year disability. What if your disability was five years or more?

This is how disability insurance protects your wealth!

Additionally, when you factor in the cost, purchasing disability insurance becomes a “no-brainer.”

Disability Insurance Underwriting For Dental Hygienists And Dental Assistants

Disability insurance underwriting is much more thorough and detailed than other types of personal insurance. In this section, we discuss disability insurance underwriting in more detail.

Disability insurance underwriting for dental hygienists and dental assistants consists of 5 areas:

- your age

- income

- health conditions

- lifestyle situations

- your occupation

Your age is straightforward. The older you are, the more expensive the policy will be. This is why the best time to apply for disability insurance is…now.

The higher your annual income, the higher your monthly benefit available and the higher the premium. Don’t worry about the actual premium. I’ll discuss that more when we discuss premiums below and how we are different from other agencies.

If you were unaware, your income is your W-2 gross salary if you are an employee. So, if your W-2 salary is $60,000, disability insurance companies use that number for underwriting. Underwriters also like to look at the last 2 years or 3 years of salary and average out. So, having the last 2 or 3 years of salary on hand is handy for the application process.

Let’s talk about health conditions and your occupation next.

Why Health Conditions Matter In Underwriting

To get right to the point, carriers usually exclude pre-existing health conditions (link) from coverage. For example, if you have a pin in your right wrist from breakage five years ago, your policy excludes coverage on that right wrist. The reason is that you have a mechanical device helping with your wrist.

If you had complications of pregnancy, then the carrier excludes any complications of future pregnancies.

If you are on medication for anxiety, the company excludes any disability coverage for anxiety and similar conditions.

That’s just how disability insurance works. Remember, the carrier is underwriting your potential disability. So, it will (generally) exclude any health complications or injuries you’ve had in the past.

If you have more serious health conditions, the carrier could place a rating on your policy. A rating is an extra premium the carrier charges for an increased disability risk. Moreover, underwriters may limit options such as waiting periods or reduced benefit periods.

Having an exclusion or a rating is not a reason to ignore a disability insurance policy or decline an offer if approved. There are nearly endless ways for a disability to occur. I always say that while a disability can happen anytime and any type, will your managed pre-existing condition be the source of any future disability claims? It could, but probably not.

We actually discuss many scenarios about disability insurance underwriting. Additionally, we illustrate why it is NOT advantageous to decline a policy with any exclusions.

Your Occupation Matters

So, all the disability insurance carriers classify occupations based on disability risk. In general, the carriers classify from a 1 to a 5 or 6.

An occupation with a class 6 has the lowest occupational disability risk, and class 1 has the highest. All things being equal, you’ll pay a higher premium if you are a class 1.

Disability insurance carriers usually classify dental hygienists and dental assistants as a class two or a 3. In some cases, a higher classification may be available. For example, we have helped many dental hygienists obtain a class 5.

So, what does this have to do with dental hygienists?

Well, you do have the potential for a higher on-the-job disability compared to, say, an office manager. Carriers underwrite this higher risk by assigning a classification number to your occupation.

While there is general alignment among the disability insurance carriers, some carriers elevate your classification higher. All things being equal, carriers with a higher occupation classification save you money with lower premiums.

The Makings of A Solid Disability Insurance Policy For Dental Hygienists and Dental Assistants

Our goal when designing disability insurance plans for dental hygienists and dental assistants is the combination of value and premium. We aim to provide you with the best possible coverage for the lowest premium possible.

However, in our opinion, there are certain “non-negotiable” provisions with disability insurance.

Own-Occupation Definition

The first is the own-occupation coverage definition. Luckily, many carriers make this definition of disability available for the dental hygienist and assistant occupation.

The own-occupation coverage definition means that the carriers pay a disability benefit if you can’t perform your own occupation as a hygienist or assistant. It pays even if your disability doesn’t prevent you from working in another job, say as a security guard. In other words, you can receive your disability benefit as a dental hygienist AND receive your earned income from the other job.

An own-occupation policy provides more flexibility compared to a policy with stringent disability definitions.

Partial Disability Benefits

Another “non-negotiable” feature is partial disability benefits. You’ll want this. I’ve seen far too many policies from other brokers and agents without this important feature.

Some disabilities are partial disabilities. They allow you to work still; however, you are not working full-time (you are only working full-time). You still have an income loss because an illness or injury prevents you from working full-time.

This is where important partial disability benefits help. They will fill the gap because of that income loss.

Now, many carriers offer partial benefits, but they have a stringent definition, one, in which, makes it hard for people to qualify for. We work with carriers that offer an easier partial disability benefit definition for dental hygienists and assistants.

Guaranteed Insurability Option

Of course, you’ll want to insure the most income you can. If you are an employee, most carriers will insure 60% of your salary. For example, if you have a gross monthly salary of $5,000, you can cover up to $3,000 (60%).

But, what If your salary increases? Can you insure that salary increase?

Yes. That is where a guaranteed insurability option helps. This option allows you to purchase more disability insurance in the future as your salary grows. The advantage? You DO NOT have to go through underwriting again. How great is that? Note: some companies call this a future increase option.

I believe these three disability insurance provisions make a formidable plan for dental hygienists and dental assistants.

Disability Insurance Policy Basics For Dental Hygienists And Dental Assistants

There are several definitions and provisions you’ll need to understand about disability insurance to make an informed decision.

First is the elimination period, or waiting period.

It is the length of time that elapses before disability benefits begin. It is based on disability claim. For example, if you select a 90-day elimination period, you’ll be eligible for disability benefits on the 91st day. However, typically with carriers, you won’t receive your benefit until 30 days later (day 120 of disability or so). This means you need to have adequate savings to carry you and your family until benefits begin.

For long-term disability insurance, you can go as low as 30 days for a waiting period.

The second definition is the benefit period. The benefit period is the maximum time you receive your disability benefit for 1 claim. Disability benefit periods can be as low as two years and, with some carriers, as high as to age 67. The average disability lasts around 30 months. Therefore, a 5-year benefit period should be OK.

Optional Disability Insurance Riders For Dental Hygienists and Dental Assistants

Riders customize your policy. Like a car, the more customization, the higher the cost.

You can add optional disability insurance riders at an additional cost to your policy to best fit your needs and budget. I am neither for nor against these riders. However, a few things to remember:

(1) like a car, you just want to get from point A to point B. Disability insurance is the same way. You want it to pay a benefit to you if you are sick or hurt and can’t work.

(2) These riders come with a cost, and sometimes a high one. That doesn’t mean they are not important. The right way to select these riders is if they coincide with your current needs.

(3) like all other types of insurance, disability insurance is a sunk cost. You may never make a claim (but, if you do, you will be thankful to have it). You’ll want to weigh the cost of these riders against other current family needs.

I’ve seen quotes from other brokers/agents that dental hygienists have shared with me. Honestly, these quotes suffer from analysis paralysis. They include all the riders, and the quote shows about $800 per month. Eyeballs start rolling into the back of your head, and then you think there is no way I am buying disability insurance (which is such an important insurance). As I mentioned earlier in this section, you want your disability insurance to pay a benefit. We can then discuss riders if they meet your needs.

Some popular disability insurance rider options for dental hygienists and dental assistants include:

Return of Premium Rider: If you never make a disability claim, the carrier returns the premiums you paid + interest. Note: this can be an expensive rider as it is based on age. (Contact us as I discuss better ways to develop your own return of premium plan.

Retroactive Injury Benefit Rider: This rider benefits from the date of disability due to injury if disability occurs within 30 days of the injury and continues through the elimination period.

Activities of Daily Living Rider: This rider pays an additional benefit if you can’t perform two or more of the activities of daily living. Additionally, it will pay if you are cognitively impaired.

Student Loan Rider: This rider pays an additional benefit that pays your student loans. You will still be able to make your student loan payments while disabled. Honestly, the disability insurance companies that offer this have a low occupation class for dental hygienists. You will have to weigh the cost of the rider plus the increased cost of the disability policy versus a disability policy that is more favorable (and lower cost) for dental hygienists. (Moreover, you can still pay your student loan debt through your monthly benefit.)

COLA Rider: this rider adjusts your monthly benefit if you have received disability benefits for longer than one year (i.e., cost-of-living adjustments).

Residual Disability Rider: This rider will pay a benefit if you return to work in your occupation, and you experience an income loss of 20% or more compared to your pre-disability income. Usually, the amount of disability income you receive is a percentage of your total monthly disability benefit. For example, let’s say you return to work and experience a 40% income loss. If your monthly disability benefit is $4,000, you will receive $1,600 ($4,000 X 40%).

Here’s The Importance Of The Residual Disability Benefit Rider

The residual disability benefit rider is an important one that many overlook. Why would you need this rider? Most disability insurance policies allow partial disability benefits upon total disability first. See the excerpt here. This means if you are only partially disabled (i.e. you can still work but not full-time), you will not receive any benefits until you have met the carrier’s requirements for total disability first. But, you are partially disabled, not totally disabled. Ugh! So, no money for you!

Typically, this rider circumvents the total disability requirement and allows you to receive benefits immediately (after you satisfy the elimination period).

Here is a very easy example. You lose feeling in your wrists and fingers. The doctor says you need to rest and limits your work to 2 days per week. Because of the rider, the carrier pays you for 3 days missed. Without this rider – or a plan that has a partial benefit without a total disability requirement first – you would not receive any disability benefits because you are still working.

Note: this rider is typically called residual disability benefits because it allows you to receive residual benefits from a residual disability (i.e. a partial disability). It is why we consider this one of the important provisions in every disability insurance policy.

The Best Disability Insurance For Dental Hygienists and Dental Assistants

You are probably wondering who we like to work with. First, we work with many disability insurance carriers. So, we are sure we can find one that meets your needs and budget.

However, many carriers insure the dental hygienist occupation at occupational class 2. As we discussed earlier, that proves expensive, all things being equal. Moreover, it also potentially limits your benefits.

The carriers we like classify the dental hygienist and assistant occupation at 3. Additionally, we work with a carrier that insures the occupation at a 5! Specific parameters have to be met. However, we have helped many dental hygienists save money this way.

Additionally, the carriers we like all have the:

- own-occupation definition

- partial / residual disability benefits

- guaranteed purchase options

and additional options as discussed. The carriers we like also have solid, value-added benefits like re-training programs.

If you are Christian, we also work with a carrier dedicated to the Christian community. Even better, they classify the dental hygienist occupation at a class 3.

Contact us if you would like to learn more. We are happy to chat with you.

What About The Disability Insurance Plan From The ADHA?

The American Dental Hygienist Association (ADHA) offers a disability insurance plan to its members. Is it any good? Well, as we always say, some coverage is better than none. However, we feel an individual policy offers better coverage. Why? Let’s discuss more.

The Hartford underwrites the ADHA plan. The Hartford underwrites a majority of association disability insurance plans. These plans are usually “plain vanilla” with no chance to customize to your specific situation.

It’s inexpensive, so that is good. But, peel the onion layers back, and you will see why.

First, it coordinates your monthly benefit with Social Security disability benefits. This means after (generally speaking) 6 months of total disability, the Hartford forces you to apply for Social Security disability benefits. If you receive any benefit from social security, The Hartford reduces your benefit accordingly.

I don’t know about you, but I don’t want the government getting involved with any of my disability payments.

Second, their partial disability benefit pays after total disability first. As we mentioned earlier, that stinks. What if you develop Multiple Sclerosis? That is a long-term partial disability situation. It could be years before you are totally disabled and receive a disability benefit. You might have a serious income loss without an appropriate partial disability benefit provision.

Finally, it has a 2 year own occupation only followed by the any occupation definition. That means the Hartford determines after 2 years (assuming you are still on disability) if you can do any other occupation. If it feels you can, they stop disability benefits.

While any disability coverage is better than no coverage, I feel an individual disability insurance policy provides more flexibility and better coverage.

Premium Cost Of Disability Insurance

Of course, premiums matter. The good news is disability insurance is easily customizable to your needs and budget. Depending on your health and riders, the premiums could run anywhere from $1.00/day to $3.00/day or more. Do you think that it is expensive? I bet you buy coffee or lunch almost every day. What is more important? Insuring your income or buying a cup of coffee? There are many ways to afford disability insurance.

Here’s another way to look at it:

Disability insurance will generally cost 2 cents for every $1 you make. Think about that.

We at My Family Life Insurance try to keep our client’s premiums below $100 per month. Nearly all of the time, we accomplish that. You can easily customize a comprehensive policy for less than $100. Honestly, I think we might be the only agency that aims for that. The reason is we know you have other things to spend and save (like your retirement).

However, there are some characteristics outside one’s control. Remember, that disability insurance is based on fivefactors:

- your age

- occupation

- health and lifestyle

- income insured

You can’t change your age, and you can’t necessarily change your occupation. You can change your health…to a point. If you have type 2 diabetes, for instance, nearly all carriers will increase your premiums to compensate for the increased disability risk. Remember, we discuss that most disabilities are from disease and illness rather than accidents.

Nevertheless, we can structure a plan that protects you and your family, while meeting your needs and budget. We’ve helped many clients this way, and I am sure we can help you, too.

Group Disability Insurance For Dental Hygienists and Dental Assistants

Many employers offer insurance products through their business. Group insurance has become a valuable source of coverage for many employees.

Group disability insurance is an option. However, many group insurance companies have employee participation minimums. These minimums make it difficult for small businesses, like small dental practices, to offer valuable group insurance benefits, including disability insurance, to their employees.

However, we work with a group insurance plan that offers group disability insurance starting at two employees. Moreover, they offer the group disability insurance at guaranteed issue. That means no underwriting, so if you have any pre-existing conditions, you are still covered.

Here are the parameters of the plan:

- starts at two employees (however, participation rates must be met)

- guarantees issue – no underwriting

- offers both short-term disability insurance and long-term disability insurance

- own occupation definition for 3 years

- to age 67 coverage

- covers pre-existing conditions

- the short-term plan covers childbirth / maternity

The best thing about it is that your dentist or employer does not have to contribute to paying the plan’s premiums. This can be set up as a voluntary benefits option where employees pay 100% of the premium. Don’t worry; rates are reasonable.

Keep in mind that group policies do have some disadvantages, including:

- premiums increase as the employee increases in age (very common attribute of group policies)

- own occupation definition for 3 years (but longer than association plans and other group plans)

- coordinates with social security (yes, this is very common)

Nevertheless, this is a solid option for dentists who want to provide for their dental hygienists (especially for maternity leave) or for dental hygienists with moderate health conditions.

Contact us to learn more.

Now You Know Dental Hygienists And Dental Assistants Can Obtain Disability Insurance

We hope now you have a solid idea of why dental hygienists and dental assistants need disability insurance. We went through a lot of information, including:

- why dental hygienists and dental assistants need disability insurance

- disability insurance plans basics and riders

- disability insurance underwriting

- estimated disability insurance cost

- group disability insurance options

Confused? Don’t feel that way. We’re here to help educate you and protect your income and future. Don’t know where to start?

Contact us or use the form below. I am happy to provide you with a quote and answer your questions about disability insurance.

We only work for you, your family, and your best interests only. We have helped many dental hygienists and dental assistants secure the right policy for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Disability Insurance Guide For Dental Hygienists And Dental Assistants | We Discuss Underwriting, Plan Types, Cost, And The Best Options”

Comments are closed.

Hi . I live in California and I am a dental hygienist . I’m curious about your long term true own occupation policy . I have one / but it’s own occupation for only 2 years . Just curious what my cost would be through you guys and see what kind of coverage you offer

Hi Christine,

Yes, we have a plan that offers a “true” own occupation definition through the benefit period, for California residents. I will email you directly with more information.

John