Discover A Viable Dental Insurance Plan For Massachusetts Residents

Updated: April 12, 2024 at 9:38 am

Are you a Massachusetts resident looking for affordable dental insurance plans, offering good value?

Are you a Massachusetts resident looking for affordable dental insurance plans, offering good value?

Yes. I can’t find anything good.

I know what you mean. I’m a Massachusetts resident, too.

Unfortunately, not as many dental insurance carriers operate in Massachusetts. We will get to why in a minute.

Obviously, that doesn’t leave many options for Massachusetts consumers.

The good news is that we work with a dental insurance company that offers good dental benefits and value.

John, all the dental plans here seem the same. The websites say the best dental insurance, but the dental plans all seem the same.

I know. Not this one. We explain this viable dental insurance option in this article.

Here is what we will discuss:

- Why Aren’t There Many Dental Insurance Companies In Massachusetts?

- Example Of Current Dental Insurance Offerings in Massachusetts

- The Dental Insurance Plan We Like For Massachusetts Residents

- How To Apply

- FAQs About Dental Insurance For Massachusetts Residents

- Final Thoughts About Dental Insurance In Massachusetts

Let’s jump in and discuss what is going on with dental insurance in Massachusetts.

What Happened To The Dental Insurance Companies In Massachusetts?

They are leaving. That’s what is happening.

Companies are leaving because of a new law enacted on January 1, 2024. This law, voted in 2022 as a ballot question, states that dental insurance companies operating in the state of Massachusetts must spend 83% of their premiums on dental care for patients. (In technical terms, this 83% is known as a medical loss ratio.)

In other words, that doesn’t leave much for administrative costs or even a profit for these dental insurance companies.

And, as much as we want to think otherwise, businesses are in business to make money and make a profit.

So, while Massachusetts residents, the American Dental Association, and Massachusetts dentists championed the law, dental insurance companies said they would have to leave Massachusetts if the law passed.

Guess what? That is what some of these dental insurers did.

I mean, they could have raised premiums, but what would that do? Nothing. No one would buy their plans. Companies would not offer them to their employees because of the high cost.

So, dental insurance companies left, including:

- Guardian

- Ameritas (my dental insurance company)

- Humana

- Principal

- Unitedhealth Group

- And others

Sure, some stayed, like Delta Dental of Massachusetts, Altus Dental, Cigna, Blue Cross Blue Shield Association of Massachusetts, and Aetna. Some of them have to because they offer medical plans here. However, their dental plans, in my opinion, are expensive for the value.

How much more? Well, if you are like me, you’ll be scratching your head, wondering if the dental insurance is worth the cost.

Now, in this article, we discuss individual, stand-alone dental plans (i.e. those plans not offered through your employer). Dental insurance through your employer likely costs less because your company pays for part of the premium.

Example Of Dental Insurance Premiums And Plans In Massachusetts

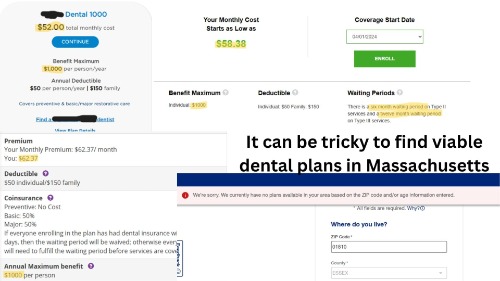

Just to show some example plans and premiums of current dental insurance plans here in Massachusetts.

These are $1,000 annual maximum plans. As you can see, some of these have waiting periods on basic and major services.

These are $1,000 annual maximum plans. As you can see, some of these have waiting periods on basic and major services.

If you don’t understand how dental insurance works – and many people don’t – please consult my understanding dental insurance guide.

Nevertheless, these are all in the $50 to $60 monthly premium range.

Let me ask you this, does it make sense to pay $600 to $700 annually (or more) for a $1,000 annual maximum?

So, you spend $700 annually for a $1,000 annual maximum.

Note: these plans deduct any preventative care from this $1,000 annual maximum.

This is why many people think dental insurance is a waste of money. You see? You can save that $1,000 annually in your savings account.

Additionally, a $1,000 annual maximum isn’t a lot. For example, 2 cleanings each year, paid by the dental insurance company (typically), might cost $700. That only leaves $300 for emergencies or a surprise cavity.

However, I don’t think dental insurance is a waste of money. If you find a viable plan and your dentist is in the network, then dental insurance is worth the money.

The Importance Of Waiting Periods

Additionally, be aware of waiting periods on these dental plans. Basic (like a cavity fill) and major procedures (like root canals) typically have waiting periods of 6 and 12 months, respectively. In other words, you have to “wait” this respective timeframe. If you have a basic or major procedure during this time frame, the dental insurer will not cover the procedure.

That stinks, right? However, companies do this to prevent insureds from getting dental insurance, getting the procedure done, and then canceling the policy. You see, that hurts everyone including current policyholders. Then, dental insurance companies would have to raise their rates to compensate for that loss. (Remember, dental insurance companies are in business to make money.)

Again, I want to stress these companies aren’t bad. However, in light of the offerings here in Massachusetts, it’s hard to justify paying $60 per month for a $1,000 annual benefit.

But, we work with a good plan that offers more value for similar prices. We talk about that next.

The Dental Insurance Plan We Like For Massachusetts Residents

I mentioned that I am a Massachusetts resident. My dental insurance provider, Ameritas, pulled out of Massachusetts. However, they currently still support current insureds. If that were to change, then I would enroll in this dental insurance company.

The company is called National Care Dental. You probably have not heard about them because they don’t market here like Blue Cross Blue Shield of Massachusetts, Delta Dental, Altus, etc.

However, they have some really solid dental insurance plans.

First, they use the MetLife dental network. They have 600,000 dentists in the network nationwide. When I searched, I found over 5,300 local dentists in the network within 25 miles of my zip code.

Second, they have many coverage levels. Here is a list of the annual maximums and corresponding monthly premiums for 1 person:

- $750 $35 per month (good for young adults who have minor teeth issues)

- $1,500 $57 per month

- $2,000 $72 per month

- $3,000 $72 per month

- $5,000 $82 per month

- $10,000 $91 per month (Wow!)

These dental insurance options are all available to Massachusetts residents. Note: member + spouse, member + children, and family plans are available.

So, you will spend $72 per month for a $3,000 annual maximum versus the $60 per month for the $1,000 annual maximum (shown above). In other words, you spend $144 more per year for $2,000 more in available coverage.

No Waiting Periods

Additionally, except for the $750 plan, they all have no waiting periods. If you need a basic service or a major procedure completed, you just pay more out-of-pocket costs in the first couple of years. Preventive care is covered 100% if you go to an in-network dentist. If you don’t, you’ll have to pay more (see my related articles about out-of-network dental costs).

Most of the plans cover implants, up to an annual calendar limit.

Additionally, a few of these plans offer 3 cleanings and basic exams each year (more than the standard 2).

Moreover, there is much value in the annual maximums and the price.

How To Apply

It’s easy to apply. Click on the link below.

National Care Dental Application Page

Just follow these steps:

- enter your zip code

- select dental

- the plans in your area will automatically populate

- select a plan. If you have questions, contact us

- apply when you are ready. It takes 5 minutes

- select vision insurance (optional) if you want vision as well. The vision plans are through VSP

Then, select “begin application”. Just follow the prompts, and you will have dental insurance.

As an aside, I recommend that you select an in-network dentist. You’ll pay lower costs for your dental needs than if you go to an out-of-network dentist. If you don’t, just know you will pay more out-of-pocket costs.

John, what is this association note that I see?

Yes, this plan is offered through an association. The association is called the National Wellness & Fitness Association.

The premiums you see above already include the association fee. The association offers many benefits and discounts including, but not limited to:

- Free televideo medical consults with a board-certified doctor (through Teladoc)

- Travel discounts

- Personal discounts like LifeLock

- Everyday savings programs

- Moving discounts through North American Van Lines

- And more

You should check these benefits out and use them, as they are free with your dental insurance enrollment. Any money you can save in today’s environment helps!

FAQs About Dental Insurance For Massachusetts Residents

We answer frequently asked questions about dental insurance here in Massachusetts.

What Does Dental Insurance Typically Cover?

Dental insurance in Massachusetts covers the following:

- Preventive services / preventive care like cleanings (usually covered at 100%)

- Basic services like cavity treatments (usually covered at 80%)

- Major services like root canals, bridges, and other major dental procedures (usually covered at 50%)

Are There Waiting Periods Before Dental Insurance Coverage Begins?

Except for the $750 annual limit plan, the plans through National Care Dental have no waiting periods.

Can I Choose My Own Dentist with Dental Insurance?

Yes. These plans are PPO plans. A PPO plan allows you to visit any dentist, whether in-network or not.

I always recommend going to an in-network dentist. You’ll want to check if your preferred dentist operates in the network. Dental insurance carriers require in-network dentists to accept the negotiated insurance rate. Typically, the negotiated insurance rate is much less than the dentist’s “retail” rate. If you go to an out-of-network, you’ll generally pay higher dental costs.

Can You Give Me A Cost Example Of Going To An In-Network Dentist Vs. Out-Of-Network Dentist?

Sure. This is just an example only. I am not considering any deductible impact.

Jane goes to the dentist for a root canal. The dentist’s retail price is $900. The negotiated insurance price is $600. The OCR cost is $800. The coinsurance split is 50%/50%. I am just making numbers up.

In-Network Dentist

If Jane goes to an in-network dentist, the cost of the procedure is $600. Per the contract, Jane pays 50% ($300) and the carrier pays 50% ($300). Jane pays $300.

Things change when you go out of network because carriers use something called “Ordinary, Customary, and Reasonable” fee (OCR fee). They analyze what the dentist cost is for a particular procedure in your area and the “contracted fee” is the 80% percentile of that range (this is the OCR fee). Sometimes, carriers refer to this as the MAC fee (maximum allowable charge).

The insured is also subject to balance billing from the dentist.

Out of Network

Jane goes out of network. The dentist submits the claim. The carrier’s OCR fee for this procedure is $800. So, the carrier pays $400 (50%) and Jane pays $400 (50%). The dentist then sends Jane a bill for $100 as shown here: $900 – $400 (from the carrier) – $400 (from Jane) = $100. So, Jane pays $500.

How Do I Know If a Procedure Is Covered by My Dental Insurance?

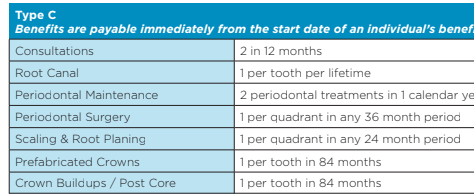

You’ll receive a schedule of benefits. Here is an example.

However, you can call customer service and check. Additionally, your dental office can call and confirm coverage.

Is Orthodontic Treatment Covered by Dental Insurance?

Unfortunately, National Care Dental does not cover orthodontia. However, they do have a discount with Smile Direct Club.

If there is one disadvantage, I would say it is the lack of orthodontic treatments. However, note that dental insurance companies that do offer orthodontia do so with a lifetime limit of $1,000.

What Are Common Exclusions or Limitations in Dental Insurance Policies?

Common exclusions include, but are not limited to:

- missing tooth clause

- bruxism

- services performed before the dental insurance is in place

- dental services caused by an accident (medical plans usually cover this)

- personal supplies like a toothbrush, toothpaste, etc.

Can I Get Dental Insurance if I Already Have Existing Dental Problems?

Yes. However, make sure the dental insurance covers your pre-existing dental problems. Many people call us because they have a pre-existing missing tooth. Nearly all the carriers here in the US do not cover the repair/fix/implant of a pre-existing missing tooth (also known as the missing tooth clause).

Generally speaking, dental insurance companies will not cover services if the work started before the dental insurance is in place.

Are There Annual Maximums or Lifetime Limits on Dental Insurance Coverage?

Yes. The plans with National Care Dental have annual maximums as described above.

How Can I Find Out If My Dentist Accepts My Dental Insurance?

You can look them up in the provider directory or you can call your dentist. Note: if you call your dentist, they may not know “National Care Dental”. You will have to ask them if they are in the MetLife dental network.

Is Dental Insurance Included in Medical Insurance Plans, or Do I Need to Buy It Separately?

Massachusetts requires health plans to offer pediatric dentistry with health insurance plans. So, your health plan likely contains coverage for your children.

However, for adults, you’ll have to obtain a stand-alone dental insurance plan. (Unless, of course, you have access to a dental plan through your employer. As we mentioned earlier, a dental plan offered through your employer may make sense because the dental insurance company typically discounts the rate and your employer pays part of the premium.)

What Happens If I Need Emergency Dental Treatment While Traveling?

Since these plans are PPO plans, you can go to any dentist. You’ll pay more if the dentist is out of network.

Are These Plans Dental Discount Plans?

No. These dental plans mentioned in this article are true dental insurance plans. Dental discount plans, or known as dental savings plans, do exist here in Massachusetts. However, tread carefully if you select a dental discount plan. They can work; however, be aware:

- Not many dentists accept dental discount plans. You need to confirm before purchasing.

- You have to pay for everything, including cleanings, but at a discount.

Some advantages include:

- No annual maximums

- A low monthly premium (but you pay for everything out of pocket – at a discount)

If you think a dental savings plan could work for you, check out the dental savings plans available in your area. Contact us if you have any questions.

Final Thoughts About Dental Insurance In Massachusetts

Although the law has changed here in Massachusetts, residents still have access to affordable and viable dental insurance. The dental insurance plan we like for Massachusetts residents is National Care Dental. They have several plans

- with high annual maximums,

- that offer 3 X annual cleanings,

- that are affordable, and

- contain value-added benefits through the National Health & Wellness Association

Do you have any questions or would like to get started? As mentioned earlier, you can apply directly.

If you have any questions about dental insurance and how it works, please don’t hesitate to contact us or use the form below.

As with anything we do, we always work in your best interest and are transparent. It is the only way we know how to work with our clients. If a better solution exists that we can’t help, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".