Yes, Dental Implants Are Covered By Insurance | The Ultimate Guide To Getting Dental Implants Covered By Dental Insurance

Updated: April 12, 2024 at 9:38 am

You’ve lost a tooth, and now you wonder if dental implants are covered by insurance. Am I right?

You’ve lost a tooth, and now you wonder if dental implants are covered by insurance. Am I right?

Yes, John. I am hearing that dental insurance doesn’t cover dental implants.

That isn’t necessarily true. We work with many dental insurance plans that cover dental implants.

The short answer: it depends on your coverage. It also depends if your plan contains the missing tooth clause. We will get more on that in a minute.

But, even if your dental insurance doesn’t cover dental implants, you can still get coverage.

Yes, that is right.

So, if you need insurance to cover a dental implant, you are in luck.

Here is what we will discuss:

- Are Dental Implants Covered By Insurance?

- How Does Dental Insurance Work?

- How Much Do Dental Implants Cost?

- Dental Insurance Plans That Cover Dental Implants (Enroll Yourself)

- Be Aware Of The Missing Tooth Clause

- FAQs About Dental Implants And Insurance

- Final Thoughts

Let’s jump in and discuss.

Are Dental Implants Covered By Insurance?

Yes, many dental insurance plans cover dental implants and the dental implant procedure (i.e. surgical procedure).

In order to know what is covered, you actually have to read your dental insurance policy. I know that can be boring, but you need to read your policy and the fine print.

Here, for example, is a dental insurance plan that covers dental implants:

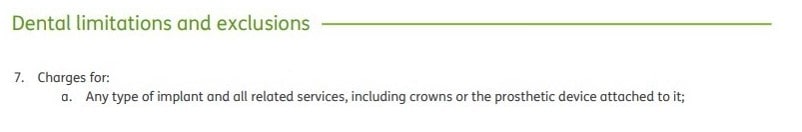

Conversely, some plans do not as seen here:

Conversely, some plans do not as seen here:

Dental plans that don’t cover dental implants treat the procedure as a cosmetic procedure. In other words, the need for a dental implant is a “want”, not a need or out of necessity.

Dental plans that don’t cover dental implants treat the procedure as a cosmetic procedure. In other words, the need for a dental implant is a “want”, not a need or out of necessity.

However, dental implants go beyond just appearance. While, yes, dental implants do restore cosmetic appearance, it also improves your ability to chew. Moreover, it preserves the health of your gums and keeps your jaw bone from shrinking due to bone loss.

So, in most cases, dental implants are a medical need / necessity rather than a cosmetic “want”.

Nevertheless, you want to make sure your dental insurance coverage includes all stages of the dental implant surgery. We briefly discuss this next.

Is The Dental Implant Surgery Covered By Insurance?

As I stated, you should contact your dental insurance provider and find out if they cover dental implants and the dental implant surgery.

In some cases, while the implant itself may not be covered, your dental insurance may cover parts of the surgery.

Here are the general steps of the dental implant procedure:

- tooth extraction

- bone grafting (if required, if your jawbone is not strong enough for an implant)

- insertion of the implant post (the screw that goes into your jawbone)

- bone healing (your jawbone strengthens around the implant post)

- abutment placement (the cap on which the implant replacement tooth sits on)

- artificial tooth placement

An oral surgeon typically performs the dental implant procedure. As such, you will want to make sure your dental plan covers oral surgery. Additionally, make sure your oral surgeon is in your dental plan’s network as that will save you money.

While many other websites also state that dental insurance covers dental implants, they don’t go into the details on just how much dental insurance will cover implants.

For you to learn that, we must discuss how dental insurance works.

How Does Dental Insurance Work?

Many people erroneously assume that dental insurance covers everything. It doesn’t. That is not the main purpose of dental insurance. If dental insurance covered all procedures at 100%, then no one could afford the premiums. They would be sky-high.

The purpose of dental insurance is for you to regularly go to the dentist, and get your teeth cleaned and looked at. If you then need a filling or a root canal, you have dental insurance that will cover these procedures.

Nearly all dental insurance plans have cost-sharing. This means you pay out-of-pocket, part of the dental procedures. You will also pay part of the cost of dental implants (more on that soon). What you pay, and how much, depends on the type of dental procedure, if your dentist is in the dental network, and where you live.

So, while dental implants are covered by dental insurance, you’ll have to pay out-of-pocket for the remaining cost.

(Note: see our ultimate dental insurance guide for more details.)

Dental Insurance Coverage Structure

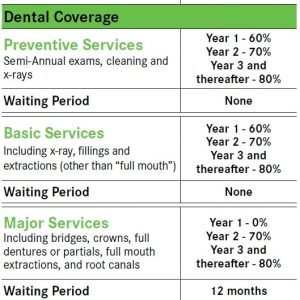

The typical cost and coverage structure of a dental insurance plan is as follows:

- Preventative Care – most plans cover 100% of these procedures, which includes cleanings, basic x-rays, etc. If you go to an out-of-network dentist (link), however, you may have to pay some out-of-pocket expenses.

- Basic Services – these procedures include a cavity fill, simple tooth extraction, etc. Most carriers will pay 80% of the usual and customary fee towards these basic procedures. This means you pay 20% of the fee. If you go to an out-of-network dentist, you may face higher out-of-pocket expenses.

- Major Services – are more complex procedures such as a root canal, dental bridges, etc. Major procedures also include dental implants. Most carriers insure up to 50% of the usual and customary fee, which means you pay the other 50%.

Check out the plan details from this carrier.

So, now you know you will have out-of-pocket expenses with your dental costs. However, the policy’s annual maximum limits how much the dental insurance pays. For example, a $1,500 annual maximum means the dental insurance plan pays up to $1,500 maximum each year towards your dental insurance costs. This amount doesn’t include your share. It is only what the carrier pays on your behalf for your dental treatments.

Dental insurance companies all have an annual maximum on their policies to control costs. The only dental plans that don’t are dental HMO plans (or DMOs – dental maintenance organizations) and discount dental plans.

Here is an example of how the dental insurance annual maximum coordinates with the cost of dental implants.

How The Dental Insurance Annual Maximum Coordinates With Dental Implant Costs

Here are 2 easy examples of how the annual maximum limits dental implant coverage.

Let’s say you need an implant that costs $3,000. Your annual maximum is $1,500. Your dental insurance company has already paid $500 on your behalf, so $1,000 remains available.

The dental insurance covers 50% of the dental implant cost.

This means that you already have to pay $1,500 for the dental implant (50% paid by you and 50% paid by the dental insurance company). However, $1,000 remains available for dental insurance coverage. So, your dental insurance carrier pays $1,000 instead of $1,500. You pay the additional $500. In total, you pay $2,000 for the dental implant cost because you hit your plan’s annual limits.

Let’s change things and you have a $5,000 annual maximum. You still pay $1,500 and your dental insurance plan pays $1,500. Your plan has paid $2,000 toward your dental insurance costs. $3,000 remains for the rest of the year.

How Much Do Dental Implants Cost?

If you want dental implant coverage on your dental insurance, then you will need a plan with a high annual maximum.

The cost of dental implants varies on the type of implant, additional services needed, and where you live (dental implant costs are different in Los Angeles versus Omaha, Nebraska).

However, expect the dental implants to cost between $2,000 and $5,000 depending on everything we discussed.

Then, as we discussed, your dental insurance pays for some of that.

So, out-of-pocket expenses from dental implants may range between $1,000 and $2,500, more or less depending on your situation.

Remember, dental implants are covered by most dental insurance plans, but the plans don’t cover the entire cost.

You can check estimated costs here through fairhealthconsumer.org.

Dental Insurance Plans That Cover Dental Implants

Many dental insurance carriers cover dental implants. Contact us to learn more.

Here, however, are a few popular carriers that do.

I wouldn’t say these are the “best dental insurance plans”; however, they are strong dental insurance carriers that have been in business a long time (Note: the “best” one is the one that meets your needs.) As always, contact us if you have questions. Remember that going to an in-network dentist saves you money. Not all plans are available in all states,

Ameritas contains 2 dental plans (subject to state availability) that cover dental implants – their Access and Total plans. They cover 20% of the cost in the first year of the plan and 50% thereafter. They currently have no lifetime maximum on their dental implant coverage. You can look up Ameritas plans here. Just enter your zip code, follow the prompts, and available plans populate.

Nationwide (National Care Dental) offers three dental plans that all cover dental implants. You can purchase up to a $5,000 annual maximum plan. However, Nationwide implements a 12-month waiting period for major services, which includes dental implants. You can review plans here.

Finally, MetLife covers dental implants, even on plans with a $10,000 annual maximum! Moreover, no waiting period exists, although their plans cover 10% of the cost on major services in the first year. You can review plans here.

Other dental carriers cover implants; however, many have lifetime maximums or low annual maximums on their plans.

Remember, although dental implants are covered by (most) insurance, you could face out-of-pocket expenses ranging from $1,000 to $2,500 or more. How do you pay for this? We discuss other ways to pay.

Other Ways To Pay For Dental Implant Costs

Other ways exist to pay for dental implant costs.

You could utilize a flexible spending account (FSA) or a health savings account (HSA) if you have one. FSAs are traditionally offered through your company / employer. HSAs can be offered through your employer or on an individual basis.

Additionally, many lenders like Care Credit and Lending Club offer dental financing services to pay for your out-of-pocket expenses. Your dental office likely has a relationship with one of these lenders. You just apply through your dental office. The lender pays the money in full to your dentist and then bills you for the loan, which you pay back over a specified timeframe.

Another option that I don’t hear about is discount dental plans. They work similarly to dental insurance; however, many differences exist. One difference is you pay everything at a discounted rate. Additionally, most discount dental plans have no annual maximums. Feel free to check discount dental plans in your area here. If you do decide a discount dental plan is right for you, make sure that the plan covers dental implants and that the dentist in your area accepts the plan.

Beware Of The Missing Tooth Clause

Have you ever heard of the “missing tooth clause”? Don’t worry if you have not; most people haven’t.

Having dental insurance cover implants assume that you have a tooth extraction followed by the dental implant, all while covered by dental insurance.

In other words, if you have a pre-existing missing tooth, then obtain dental insurance later, replacing that missing tooth is not covered by insurance.

This is the missing tooth clause that you can find in just about every dental insurance plan in their exclusions list.

It doesn’t matter if you want a bridge or some other type of treatment. If your tooth is already missing BEFORE you start your dental coverage, the insurance won’t cover the treatment option (i.e. implant, bridge, etc.)

It doesn’t matter if you want a bridge or some other type of treatment. If your tooth is already missing BEFORE you start your dental coverage, the insurance won’t cover the treatment option (i.e. implant, bridge, etc.)

If you do have a pre-existing missing tooth and need an implant, you can review the lenders above. Many discount dental plans do cover dental implants with no waiting period or exclusion. However, you will want to contact and check with the plan first.

Frequently Asked Questions About Insurance And Dental Implants

We answer many questions about dental implants, dental insurance, and what else is covered.

What Is A Dental Implant?

A dental implant is a small titanium post, surgically placed into your gum, and secured into your jawbone. It replaces your tooth root. Your surgeon then places a crown on top of the post.

Dental implants restore proper chewing and tooth alignment. Many dental associations and practitioners agree that dental implants are the best treatment to replace a natural tooth. Many practitioners point out the long-term success of dental implants compared to other treatment options like bridges, dentures, etc.

Are Dental Implants Covered By Health Insurance?

Usually not. Medical insurance plans rarely cover dental implants unless the need for the dental implant is from a covered health event, such as an accident (injury) or an illness.

Is There A Waiting Period For Dental Implants?

Sometimes. Installation of a dental implant is a major service. Many carriers have a 12-month waiting period for a major procedure including dental implants.

Other carriers may cover a major procedure immediately; however, your cost-sharing is much higher in the first year. For example, a carrier may cover a major service at 20% of the cost in the first (i.e. you pay 80%), then 50% in the second year.

Does Dental Implant Insurance Exist?

Not really. Dental implant insurance doesn’t exist on a stand-alone basis. Dental insurance is the best option to cover dental implants.

What If I Go Over My Annual Maximum?

All dental insurance plans (except for dental HMOs – a dental maintenance organization) have annual maximums. Many common annual maximums include $1,000 and $1,500. Additionally, these annual maximums include the cost of preventative care.

So, that traditionally doesn’t work well if you need a dental implant. Even if your insurance covers dental implants, your plan’s annual maximum likely prevents it from covering the dental implant cost adequately. If you go over your plan’s annual maximum, then you will have to cover the remaining cost out of pocket.

We showed an example earlier in the article.

Of course, you can enroll in one of the plans we introduced earlier, all of which have high annual maximums.

What Are Other Tooth Treatment Options?

Dental implants are a good choice for a single tooth replacement. If you have many missing teeth, your dentist may recommend a bridge or denture. Talk to your dentist about the different treatment options available to you.

Are Dental Implants Covered By Medicare Insurance?

Unfortunately, dental implants are not covered by Medicare. Some Medicare Advantage plans may cover dental implants; however, that is unlikely. If the plan does, you can expect minimal coverage.

Enrolling in one of the plans we described above is your best option.

(See related: dental insurance plans for seniors)

Now You Know Insurance Covers Dental Implants

Now you know that dental insurance covers dental implants. We provided 3 dental insurance options above that cover dental implants. They offer high annual maximums and are generally affordable given the value they provide.

Other carriers offer dental implant coverage as well. Note that you want to make sure your annual maximum is large enough to cover your implants. Otherwise, you will pay out-of-pocket for the remaining cost that the insurance doesn’t cover.

Also, note that many carriers have limitations in the first year for major services. Many carriers either lower their cost-sharing participation in the first year (i.e. 20%) or have a 12-month waiting period before covering dental implants.

Do you have any questions or would you like to get started? Contact us or use the form below.

As always, we put your needs and interests first before our own. There is no risk of contacting us. If we can’t help you, we will point you in the right direction as best we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".