High Benefit Dental Insurance For Seniors And Families

Updated: April 12, 2024 at 9:39 am

You feel you need a lot of dental work. Maybe you went to the dentist, and he or she indicated several recommended, expensive procedures. Or, many of your friends have had dental work done recently. They described the high-out-pocket costs. Hearing this nearly made your jaw drop! They mentioned they “max’d out” or went over their carrier’s annual benefit limit. Whatever the case may be, you want high benefit dental insurance. You want protection.

You feel you need a lot of dental work. Maybe you went to the dentist, and he or she indicated several recommended, expensive procedures. Or, many of your friends have had dental work done recently. They described the high-out-pocket costs. Hearing this nearly made your jaw drop! They mentioned they “max’d out” or went over their carrier’s annual benefit limit. Whatever the case may be, you want high benefit dental insurance. You want protection.

In this article, we discuss dental insurance options that provide a high annual benefit – like $3,500 or $5,000 annually. Unlike other agencies or carriers, we provide an unbiased view with the advantages and disadvantages of each. We also describe an option of expanding your annual benefit from your underlying dental insurance.

Before we do this, however, we give a basic overview of dental insurance.

Some Basics About Dental Insurance

Would you get in your car and drive off to a new place without first mapping how you will get there? Likely not! The same goes for dental insurance. I find that people who don’t “look under the hood” of their dental insurance are setting themselves up for pain (in the wallet or purse) and anger. Here are some basic concepts of dental insurance. Understanding these terms will help as we discuss high benefit dental insurance in more detail.

You’ll always have out of pocket dental costs. You have to understand that. The magnitude depends on if you go to an in network dentist of out of network dentist. Going to an in network dentist will save you much more money. If your dentist does not accept insurance or is not in network, you will want a more “friendly” dental insurance that is designed to pay a higher cost share.

The annual benefit (what we are talking about here) is how much the carrier pays on your behalf. If you have a $1,000 annual benefit, this is how much the carrier pays. It does not include any coinsurance you pay.

Preventative, Basic, and Major services are the categories for dental services and procedures.

In network dentists agree to your carrier’s fee. These dentists can’t charge you any higher amount. This fee is sometimes known as the maximum allowable charge (MAC).

Out of network dentists agree to submit their costs through your insurance, but the dentist’s reimbursement will be lower (usually). This means your costs are higher, and higher in 2 ways. Out of network dentists can “balance bill” and send you an invoice for the difference between their “retail” fee and the insurance reimbursement.

The UCR Fee

The other way is the insurance reimbursement itself. On every procedure, carriers will pay 100% of the cost or cost share with you through coinsurance. For example, a filling might be 80/20 coinsurance where the carrier pays 80% and you pay 20% of the cost. For in network dentists, the cost is the contracted rate that we described above. (The MAC.) The carrier reimburses its 80% to the dentist.

Reimbursements to out of network dentists are much different. The cost is based on the UCR fee. What is the UCR fee? It means usual, customary, and reasonable. Without going into the weeds, to determine the UCR, the carrier looks at what the area dentists charge for a certain procedure. The most common benchmark for the UCR fee is the 80th percentile. What this means is the charge the carrier pays is equal to the 80th percentile of charges billed by dentists in your area. The lower, the worse. The higher, the better. The higher the UCR, the less chance for a large “balance bill”, or none at all.

In my opinion, not understanding the UCR fee and balance billing are the reasons many people think dental insurance is a waste of money. If your dentist is out of network, unbeknownst to you, certainly you are paying an arm and a leg (or a bicuspid and molar) for your dental needs.

OK, on to why you came here. Let’s talk about high benefit dental insurance.

Types Of High Benefit Dental Insurance

Scour the internet for dental insurance, and you will find many $1,000 and $1,500 annual benefit dental insurance plans. In fact, there are very few dental insurance plans offer a high annual benefit. But, we have them.

There are really 2 types of high annual benefit dental insurance. One that has a consistent, relatively high benefit amount. The other one is what I call a “step-up” benefit plan. In year one, the plan starts with a low annual benefit amount, like $750 or $1,000. Each year, the annual benefit increases to its ultimate amount.

Both plans offer in-network and out-of-network dental coverage. As we continue to say, you will save much more money going to an in-network dentist. The carrier offers friendlier insurance plans for out of network dentists.

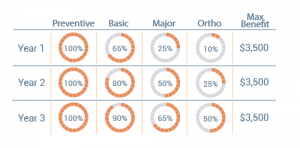

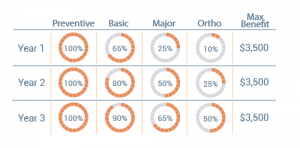

The plans also offer immediate or “day 1” coverage on basic (fillings) and major services (like root canals, crowns, etc). However, if you need to use these services within the first year, your coinsurance is higher. (In other words, how much you pay.) Check out the diagram below to see what we mean. Look at the coverage in year 1.

Both plans have a lifetime deductible of $100 on all services. Once you pay this, you pay no more.

Their Out Of Network Insurance Plan

One of the key features is their favorable out of network insurance plan. If you go to an out of network dentist or your dentist does not accept insurance, their plan will generally save you more money than a traditional PPO plan. Sure, you may spend more in monthly premiums, but your overall out of pocket costs will probably be less.

How?

Well, if you use their out of network coverage, the plan does not discriminate on the coinsurance share. You see, many PPO dental insurance plans increase your coinsurance if you go to an out of network dentist. For example, you may have to pay 20% (insurance pays 80%) of the UCR fee instead of 100% covered by insurance by going to an in-network dentist for a cleaning. This plan allows the same coinsurance amounts whether you go to an in-network dentist or not.

Additionally, the plan pays at the 90th percentile of what dentist’s charges in your area. Again, this is known as the UCR fee. The higher the UCR fee, the better for you. This minimizes your share of the coinsurance dollar amount. Moreover, it reduces the chance of the dentist balance billing you.

Consistent High Annual Benefit

Instead of a $1,000 annual benefit plan, would you like a $3,500 annual benefit plan?

Wow, you think. That would cover a lot.

Yes, it would. And, if you go to an in-network dentist, at a much lower cost, as we described.

We work with one carrier that has a $3,500 annual benefit. That should be sufficient for cleanings as well as any major services like root canals or bridges.

The carrier has two types of $3,500 annual benefit plans – one that works better with in-network dentists and one that works better with out of network dentists or dentists that do not accept insurance.

There is a difference in cost, too. The in-network plan will be much less than the out of network plan. For example, a person living in the Cleveland suburbs might pay $48/month for the in-network plan and $70/month for the out-of-network plan.

Why the difference?

We explained it earlier. It has to do with dentist options and how the carrier pays for out of network coverage. The out of network insurance plan will pay a higher benefit amount for a covered service. This is due to the UCR fee. Remember, too, that the coinsurance amount is the same, too. Your chance of a dentist “balance billing” you is much lower.

Now, you know why we explained UCR fee and those dental insurance concepts :).

Another benefit as well is the higher carrier coinsurance by year 3. See below: 90% coinsurance coverage for basic and 65% for major services are unheard of in the dental insurance industry.

Step-Up High Benefit Dental Insurance Plan

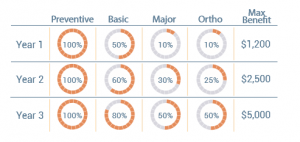

The carrier offers an alternative plan to the consistent $3,500 annual benefit. It is a “step up” insurance plan. You can receive an annual benefit up to $5,000 by year 3.

The plan works the same way as the $3,500 annual benefit plan. Except, it has different coinsurance amounts. The coinsurance amounts are similar to that of traditional dental insurance industry standards.

Moreover, if you have children, the plan has a valuable orthodontia benefit. It will provide up to $1,200 in orthodontic treatment lifetime per child, under age 19, according to the schedule above.

These step up plans can make sense for anyone with good teeth now, but want to protect against the unexpected need in the future for major services.

See the chart below:

Alternatives To High Benefit Dental Insurance

Do you need one of these high benefit dental insurance plans to expand your annual benefit? Do you need to drop your existing dental insurance and enroll in one of these high benefit plans?

You could, for ease, if you wish. You may be able to save more money. But, you don’t have to.

You can simply keep your underlying dental insurance and enroll in another plan that does not coordinate with your primary dental insurance.

We talked about secondary dental insurance in a previous article. We work with several insurance plans that do not coordinate with your primary dental insurance. Let’s say you have a $1,000 annual benefit with your underlying dental insurance. You enroll in another plan offering $2,000 annual benefit. All told, you have a $3,000 annual benefit between the two.

You need two root canals and a bridge. Let’s say these procedures, in total, costs $3,000. For sake of simplicity, these are the only dental costs you’ll incur all year. Moreover, let’s exclude the impact of UCR fees or in-network fees.

Major services are at a 50/50 coinsurance amount. You pay half and the carrier pays half.

But, in this case, the carrier for your underlying dental insurance will pay only $1,000 since that is your maximum amount. You have to pay the $2,000 remaining amount out of pocket.

Without secondary dental insurance, you would. With your secondary dental insurance, you file the claim yourself. You receive $1,500 from the carrier to offset your costs.

All told, your out of pocket expenses for these procedures are $500, excluding your monthly insurance premiums.

Again, this is an easy example, but you can see how adding a secondary dental insurance, that does not coordinate, expands your benefits. In effect, you made your own high benefit dental insurance plan.

Conclusion

We hope you understand the different high benefit dental insurance options available. We described a couple of different options that could benefit your situation. Additionally, we described an alternative using an additional dental plan to expand your dental insurance benefit.

What is right for you? It depends on your need and situation. If you would like our assistance, contact us, or use the form below. We would be happy to help you with your dental insurance needs.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".