Rated Or Declined For Disability Insurance Coverage? Here Are Your Options

Updated: April 12, 2024 at 9:39 am

If you’ve been rated, declined, or received a counteroffer for disability insurance coverage, you probably think it is the end of the world.

You better believe it, John, you say.

It is such an important, yet overlooked, insurance policy. It not only protects your family, but also protects YOU, your income-earning ability, and YOUR future.

All things being equal, we opine that disability insurance is more important than term life insurance, your auto insurance, and your homeowners insurance. (We all agree that those are really, really important, too.)

Underwriting for disability insurance is usually stringent. Much more than life insurance. Have you been rated or declined for disability insurance? Or received a counteroffer?

If so, you may think, “Just forget it. I don’t need this $%&# insurance!”

We say, hold on a minute. Let’s analyze this situation in more detail. In this article, we explain the options available for those people rated or declined for disability insurance.

Before we discuss the options, we first discuss disability insurance underwriting, specifically rated or declined reasons. We also discuss why you should accept a carrier counteroffer.

Here’s what we will discuss:

- Why Is Disability Insurance Underwriting Stringent?

- What To Do If You Are Offered A Counteroffer?

- What If I Am Declined?

- Other Options If I Am Declined?

- Now You Know Your Options If You Are Rated Or Declined

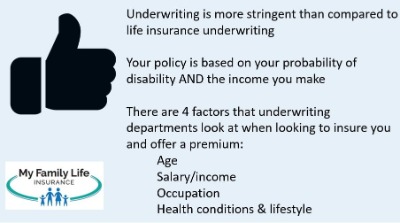

Let’s all level set and discuss disability insurance underwriting. Underwriting is the reason why the carrier offers a counteroffer, rates you, or declines your application.

What’s So Different About Disability Insurance Underwriting?

If you have any form of life insurance, you went through an underwriting process. The underwriter looked at numerous aspects of you – your health, age, and gender, namely. Underwriters review your participation in high-risk lifestyles, hobbies, and occupations as well.

It’s pretty straightforward, right?

Yeah, John. I went through it, and it was simple.

Disability insurance underwriting is similar, but it differs in many ways. It’s more stringent.

The main reason why it is stringent is that the chances of a disability are much higher than that of your unexpected death (life insurance), your house burning down (homeowners), or getting in a total car accident (auto).

higher than that of your unexpected death (life insurance), your house burning down (homeowners), or getting in a total car accident (auto).

Disability insurance underwriting incorporates the higher probability of disability, your occupation, and your income.

Why your occupation? It is a fact that some occupations are more prone to disability than others. Let’s look at a quick example.

Example Of How Occupations Play A Part In Disability Insurance Underwriting

Take the occupation of a construction worker and an accountant.

Traditional life insurance underwriting wouldn’t consider their occupations (probably). But, disability insurance is another story.

Construction workers are prone to injuries and accidents on the job. Contrast this to the accountant who…probably sits all day.

This is why carriers apply a higher risk classification to certain occupations. In this case, carriers apply a higher disability risk classification to construction workers than accountants. In other words, the premium for the construction worker is much higher than that for the accountant, all things being equal.

Carriers are also underwriting your long-term employment because the chance of disability is greater than death. If you have anxiety or depression, that usually doesn’t affect your life insurance rating, but it does for disability. Think about it. You usually won’t die from anxiety, but you could face a disability from it. Smoke marijuana? Many life insurance carriers rate marijuana usage as standard or even preferred health rating. Disability insurance underwriting, on the other hand, usually rates marijuana users at a higher premium. Some carriers even consider usaged as a tobacco user.

We discuss all of this and more in our disability insurance underwriting guide.

What Do You Do If You Receive A Counteroffer?

Before I discuss what is a counteroffer and what to do, let’s put that offer in perspective. Let’s discuss what happens when you are disabled.

A disability can occur at any time. What is a disability? Anything. It could be cancer, a knee injury, or a mental illness. Or, it could be alcohol addiction. It could be from anything. Anything sickness or injury-related that prevents you from working.

What if you received a paycheck today, and tomorrow you were disabled? Let’s say that paycheck…the one you are holding in your hand right now…is the last one you will receive in 1.5 years. Or 3 years? What would you do?

This is a serious question. Likely, you would have to make some extremely drastic decisions. Selling a home or having your spouse overwork (work more) is common. Using your retirement account and using your credit cards are common, but financially devastating, options. People do it, and most do not recover. What would happen to your children, especially if your spouse predominantly cared for them? What would you do?

Why Accepting A Counteroffer Makes Sense

That is why it makes sense to accept a counteroffer. What is a counteroffer? It is when the carrier approves the insurance policy; however, the carrier modifies the policy in some way. This practice is a little more common with disability insurance than with life insurance.

Honestly, nearly all applications will have some type of policy adjustment or counteroffer.

Why? As we discussed, carriers are insuring your risk of disability and insuring your income. They undertake the risk of your disability. If you have any health complications or lifestyle conditions, they will modify the policy to offset your increased risk of disability.

What Leads To A Counteroffer?

The reasons are plentiful. Maybe you were off on your income, or that anxiety diagnosis is a little more severe than you think it is.

The reasons are plentiful. Maybe you were off on your income, or that anxiety diagnosis is a little more severe than you think it is.

Or, you didn’t think the marijuana use or your “few beers an evening” is no big deal.

They are with disability insurance. There is a little more leeway with life insurance than with disability insurance.

Remember…you are being insured based on your ability to earn an income and the probability of a disability. Sometimes the counteroffer results an increase in proposed premium, lower benefit coverage, or both. You don’t have to accept a counteroffer in full. If you have a budget, then you can reduce the maximum benefit or some other provision. While that will leave you potentially underinsured, some coverage is better than none.

The Importance Of Accepting The Counteroffer With An Example

Do you still think accepting a counteroffer is a waste of your money?

Let’s go through a scenario. You applied for $3,000 per month disability insurance on a 5 year benefit period. For health reasons, the carrier increased your premium to $100 per month from $60 and removed two riders from your plan. They also lowered your coverage to $2,200. You are angry. Should you accept or reject the offer? At first, you might think, #@*! yeah! Forget them! However, let’s go through each scenario and see what happens.

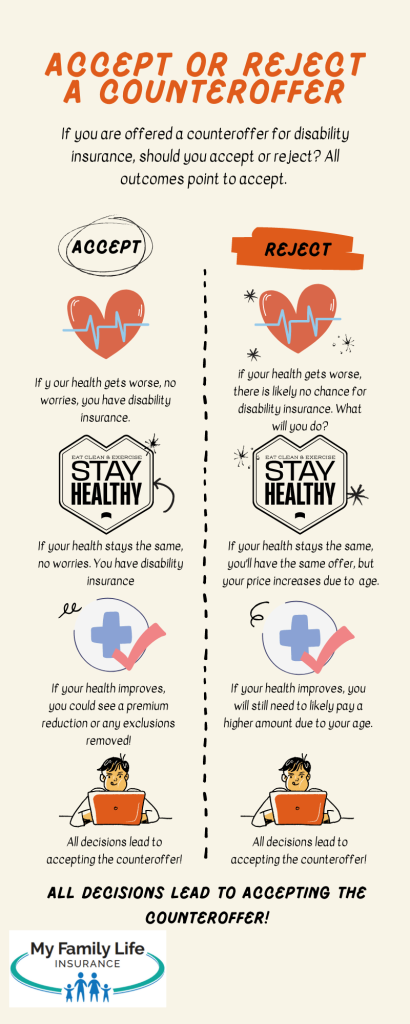

If you reject and over time your health…

…gets worse, there is probably no chance for you to get disability insurance.

…stays the same, the policy would include the same limitations, but the premiums increased due to your increase in age

…gets better, you have to pay a higher amount due to your age if you need disability insurance

However, if you accept and over time your health…

…gets worse, you don’t have to worry. You have disability insurance!

…stays the same, you don’t have to worry. You have disability insurance!

…gets better, you could see a premium reduction depending on the situation. In this case, you could reapply and any rating or exclusions could be removed.

It is clear, though, that selecting a counteroffer likely is in your best interest.

Well, I’ll Just Invest…

You might say, “that is OK, John. I’m just going to invest my money. And, if I am disabled, I will tap into the savings.”

I hear this often from people with counteroffers. Theoretically, it works, but in real life, it does not.

What you may not be aware is that I have extensive experience as a financial planner. I typically figure out opportunity cost/benefit all the time. Investing the difference is no different. Analyzing disability insurance is no different. Certainly, at some point, if you invest wisely, you could replace your income or the expenses you would incur. However, the decision is not as simple as it first appears.

Let’s say you applied for disability insurance. You are 45. The plan was $2,800 monthly benefit for 5 years at a cost of $65 per month. You are eligible for $168,000 in total upon total disability. This $168,000 is your replacement income in case of disability for 5 years.

For a few reasons, let’s say your disability insurance policy proposal came back $100 per month at a $2,000 benefit. That makes you disappointed. Not only did the carrier cut your benefit, but also it increased your premium. You think, “I’m just going to invest. Heck with this!”

Not so fast. Take a look.

The policy will give you $2,000 income tax-free. On a 5 year plan that is $120,000. You need $168,000. Let’s say you do indeed invest the $100 each month at 8% in the market. How many years will it take to accumulate $168,000? Three years you say? No, try again. Ten years? No, longer. OK, 20 years? Nope. Even higher. OK, you give up.

You could accumulate $168,000 in around 32 years! That is right, 32 years…

What happens if a disability occurs in that timeframe?

Declined For Disability Insurance?

So, back to that example. What do you think about that? In 32 years, you are 77.

Here are some things to consider:

(1) investing in the market is an unknown. What if the market tanks, which happens, and then you are on disability, what happens?

(2) a disability can occur anytime, even well before age 77.

This is why it makes sense to take a counteroffer.

OK, John. That makes sense, you say. But, what if I am declined for disability insurance or highly rated? What are my options?

If you’ve been declined for disability insurance, you still have options. First thing is to understand the reason. We have gotten policies approved once we spoke to the carrier and received elaboration from your doctor.

Sometimes, a decline happens, though. Remember, the carrier insures your chance of disability and not working. Not your life for life insurance. This is why life insurance carriers approve significant health conditions, but disability insurance carriers decline.

Maybe this statistic illustrates disability. Accidents aren’t usually the culprit. According to the Council of Disability Awareness, back problems and illnesses are the leading cause of disability.

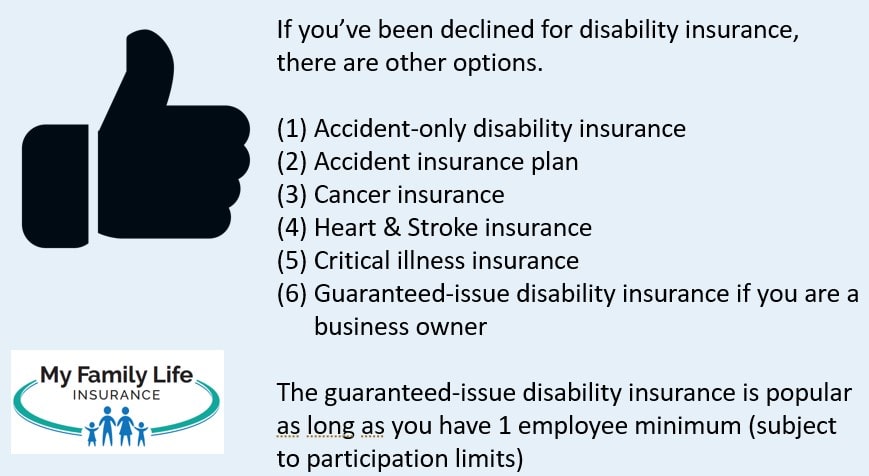

Let’s discuss the options if you are declined for disability insurance.

Options If Declined For Disability Insurance

Think for a moment about what causes disability. A disability could be from:

(1) injury – if accidental

(2) cancer

(3) heart conditions

(4) another major illness

We discuss the options if declined for disability insurance next. It is important to note that these options aren’t as perfect as disability insurance, but they will provide financial benefits to you and your family.

Accident-Only Disability Insurance Policy

These policies are just like a typical disability insurance policy, but will only pay upon an accident. These are also very inexpensive usually, too. Why? Although the probability of getting hurt from an accident is common, getting a disability from an accident is not. If you clicked on the link to the Council of Disability Awareness, you hopefully read that.

These policies are just like a typical disability insurance policy, but will only pay upon an accident. These are also very inexpensive usually, too. Why? Although the probability of getting hurt from an accident is common, getting a disability from an accident is not. If you clicked on the link to the Council of Disability Awareness, you hopefully read that.

Underwriting usually does not consider your health history. They may consider your lifestyle history, bankruptcy history, and any misdemeanor/criminal history.

These will pay just like a typical disability insurance policy, but based on an accident.

Additionally, usually, the carrier limits the payout or benefits. In other words, many accident-only disability policies contain 2 year or 5 year benefit periods.

Accident Insurance Plans

Accident insurance plans are available. What are these? Well, these are not accident-only disability insurance policies.

They are similar to accident-only disability insurance policies, except they pay a fixed-dollar benefit based on an accidental event. An example will make this clear.

Let’s say you slip on ice and break your arm. An accident plan might pay $100 for the ER visit, $500 for the broken arm, $100 for the x-ray, and $50 for the follow-up appointment. These policies help pay for your out-of-pocket medical expenses. Alternatively, you can use the money for anything you want.

These policies are typically inexpensive. A family plan might cost around $50 per month. You can couple the accident plan with an accident-only disability insurance policy if your accidental injury is long-term.

Cancer Insurance Plans

Did you know your chance of developing cancer is around 40%, whether you are a man or a woman? Cancer also is a leading cause of disability.

A cancer plan pays dollar benefits upon your diagnosis of cancer. You have a couple of options:

(1) one that will pay you a lump sum payout, like $50,000, upon diagnosis. You can do what you want with the money

(2) another that will pay a smaller lump sum upon diagnosis, but have ongoing benefits during treatment and recovery

Cancer plans are moderately priced. A family plan might cost around $80 per month. It is really up to you, your budget, and your preference for which option you are comfortable with.

These plans will cover all types of cancer except skin cancer. Some plans cover skin cancer at 25% of the lump sum benefit or some other percentage. While others may only cover malignant melanoma and not the other types of skin cancer.

As long as you never had cancer, there should be no problem enrolling in this plan.

Heart And Stroke Insurance Plans

Very similar to that of a cancer plan, a heart and stroke insurance plan pays if you are diagnosed with a heart condition such as a heart attack or stroke. Just like cancer plans, heart and stroke insurance plans will pay either a lump sum on diagnosis or during recovery.

Just like the cancer plan, as long as you never had a heart attack or stroke, there should be no problem enrolling in this plan.

Critical Illness Insurance

A critical illness insurance policy will pay a benefit, similar to that of cancer and heart insurance plans, upon diagnosis of a specified critical illness. A critical illness could be multiple sclerosis, ALS, or some other disease or condition.

These are usually low-cost, monthly plans. You may think they are useless; however, if you or a family member are ever diagnosed with one of these diseases or conditions, the policy will pay.

Think you don’t need these policies? Diagnosed with cancer or one of these conditions could lead to bankruptcy.

Of course, if you don’t qualify for one policy because of a health condition, it is likely you will qualify for the others. For example, having rheumatoid arthritis won’t prevent you from obtaining a cancer plan.

Business Owner Options

If you are a small business owner with a minimum of 2 employees, you are eligible for guaranteed-issue disability insurance. Yes, even if you are declined for disability insurance.

Seriously?

Yes, even if you’ve been declined, we can still get you disability insurance. However, you need to be a small business owner and have a minimum of 2 employees.

It is group disability insurance. Your company would be the holder of the policy.

It is guaranteed issue, so no underwriting. How great is that? Moreover, it is offered by an A-rated carrier, not some fly-by-night carrier.

We have helped many professionals secure the disability insurance they need from this option.

Now You Know Your Options If You’ve Been Rated Or Declined For Disability Insurance Coverage

Were You declined for disability insurance? You have still have options. We discussed several here.

Of course, as we described in detail, you should seriously consider a counteroffer if presented one.

Need help? Don’t know what to do next? Contact us or use the form below. We can help. We have the knowledge and skill to help you make the right decision for you, that fits your needs and situation. Moreover, we hold your best interests at all times. It is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".