There are a lot of insurances out there: health, homeowners, life insurance, etc. There are so many, I am sure your eyes roll. Yet, there is one insurance that is the most important of all: disability insurance.

Also, I bet you don’t even have it.

John, I don’t need this insurance.

OK, sure you don’t. However, I’ll prove in this article that you do. As one of my clients said to me, “John, I don’t want to be insurance poor…” He’s right. No one wants to.

However, I regard disability insurance as the most important insurance (after health insurance) you don’t have.

Everyone needs it. I honestly can’t think of someone who would not.

Even millionaires need it.

And if you get hurt or sick and can’t work…the plan pays you money to survive and pay your bills.

Here’s what we will discuss:

Let’s get right into the article and give a brief overview of disability insurance.

What Is Disability Insurance?

Disability insurance is, simply, a policy that will pay you a percentage of your income upon a disability. It will give you money to pay for your mortgage, rent, groceries, medical bills, utilities, and so on when you have the inability to earn an income.

Disability insurance is, simply, a policy that will pay you a percentage of your income upon a disability. It will give you money to pay for your mortgage, rent, groceries, medical bills, utilities, and so on when you have the inability to earn an income.

Thanks, John. I don’t plan on being disabled or in a wheelchair.

Wow! No one does. But, how do you really know that?

(Crickets chirping…)

Be honest. You don’t. Even the healthiest person can end up in a wheelchair for various reasons.

Look at Tiger Woods. Sure, he is back playing golf. But, at one point, he was disabled due to his car accident.

But, as we will discuss later, the wheelchair isn’t the disability you need to worry about. This is a true and real stat: 90% of long-term disabilities are due to illnesses and sicknesses rather than injuries. That means cancer, heart disease, mental illness, and even drug abuse can and more often set you back than a car accident or an ACL tear.

Disability Insurance Is Inexpensive

In the grand scheme of things, disability insurance is inexpensive.

I bet your phone, streaming, and cable bill run $500 per month or more.

Am I right?

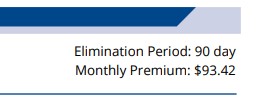

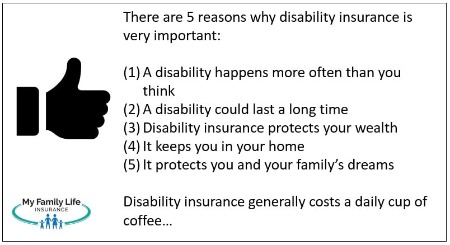

Yet, disability insurance usually costs around a cup of coffee per day.

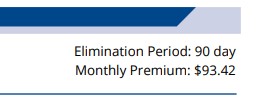

If you don’t believe me, here is a snapshot of a quote we did for a piano teacher. His cost to insure his income of $60,000 is $3.11 per day.

A cup of coffee…

Sure – it can be higher or lower depending on your situation.

Your situation is underwriting. For example, if you make $500,000 annually, you’ll pay more premium to insure that $500,000 compared to someone who makes $50,000.

Yet, the importance of disability insurance is still the same for both individuals.

Keep this cost in mind as we go through the 5 reasons why disability insurance is so important.

5 Solid Reasons Why Disability Insurance Is So Important

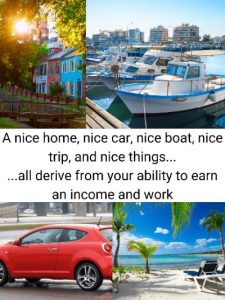

Before we get into the 5 reasons, let me ask a request. Think of your assets. You have a house, right? Do you have things? You rent. You have a car. Likely, you have stuff. Do you have jewelry? Clothes? Do you like video games?

How do you buy all of this stuff?

With money, John.

How do you get this money? It doesn’t come from the sky, right?

Ha. No, I work for the money so I can pay for these things.

That is right. So, what would happen to your financial situation if yesterday was the last day you received your paycheck for 1.5 years? How would your family survive financially? (GoFundMe is not an option, let’s be serious now.)

(More crickets chirping…)

I really don’t know what I would do. I could tap into my retirement.

Really? Do you want to do that? Are you aware of how much that will set you back when you retire and need that money?

No.

Well, in our opinion, you are not unlike most people. I’ll show you an easy-to-understand example later.

Let’s discuss the 5 reasons why disability insurance is so important.

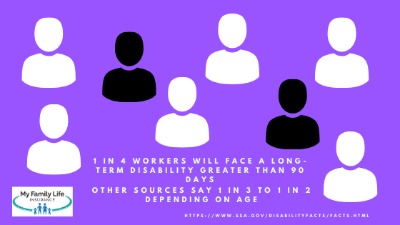

#1 A Disability Happens Way More Often Than You Think

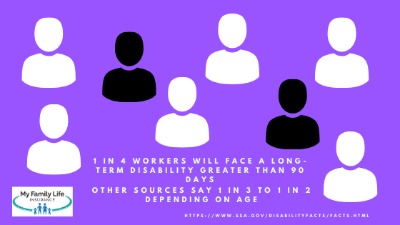

The first reason disability insurance is so important is that a disability happens way more than you think.

A common statistic issued by the social security administration states that 1 in 4 20-year-olds will experience a disability lasting longer than 90 days in their working career.

Moreover, the chances of a disability happening increase with age.

Moreover, the chances of a disability happening increase with age.

So, you have a 1 in 4 chance of not having a paycheck.

Do you like those odds?

The odds of dying are much better. Can you believe that? Even dying from cancer has a 1 in 158 chance.

Even if you aren’t a “statistics” person, I think you’ll agree with me that the 1 in 4 probability is real.

Raise your hand if you know someone diagnosed with cancer before age 55.

Multiple sclerosis?

An injury that prevents a person from working.

A mental breakdown?

These are all disabilities. If you can’t work because of injury or illness, then you essentially meet the definition of a disability.

So, this statistic is as real as it gets.

Now, think about that cup of coffee cost. Doesn’t it make sense to insure that high probability with something that costs a few dollars per day?

#2 A Disability Can Last A Long Time

Here is another reason why disability is so important. A disability can last a long time.

Internet statistics suggest the average claim is 3 years. Possibly.

The claims departments I speak with tell me it’s more like 18 months to 24 months.

Let’s say you make $50,000 gross salary. With disability insurance, carriers typically pay 60% of this or $30,000 (they predominantly do because your benefit is non-taxable.)

is non-taxable.)

Nevertheless, can you be without a paycheck for 18 months, 2 years, 3 years, or longer?

That’s a long time.

If you were out 2 years because of cancer, what could you do with $60,000?

Think about the stress brings to your family without this money.

How will your family adjust for the income loss?

Will your spouse have to work more? Who can look after the children?

There are a million questions that zip through someone’s head when faced with a disability.

With disability insurance, you don’t need to worry as much. You’ll receive that money to help pay for things while you focus on getting better.

Moreover, remember, the average cost of disability insurance is a cup of coffee…

#3 Disability Insurance Protects Your Wealth

It’s pretty obvious how disability insurance protects your income.

If you are hurt or sick and can’t work, then the carrier pays you a benefit.

However, what happens to your wealth if you don’t have disability insurance?

It’s something most agents and financial advisers avoid. However, as a CFP® Professional, I can describe this to you rather easily in an easy example.

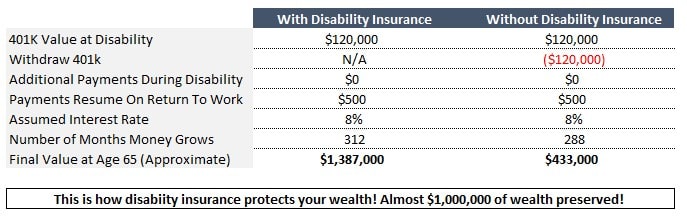

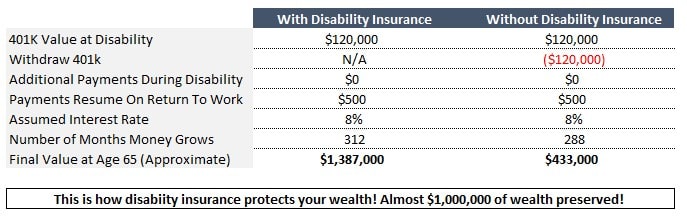

Let’s say you are a 40-year-old, male accountant earning a $100,000 salary. Your net-pay is $60,000 (for easy example).

You have saved $120,000 in a 401(k) and contribute $500 per month.

You are stricken with cancer. It is a serious type, and you are out of work for 2 years. You lose $120,000 of net earnings over that 2-year period.

Where will this money come from if you don’t have disability insurance?

What Happens To Your Wealth If No Disability Insurance

Well, you have retirement savings.

So, you withdraw the $120,000 over the two years. Sure, you have to a penalty on that withdrawal (as an accountant, no one knows that better than you). However, you are able to pay the mortgage and keep food on the table for your family while you go through treatments.

After 2 years, you are back at work. You resume your $500 per month 401(k) contributions.

If you never got disabled, at age 65, you’d have $1,475,000, assuming an 8% annual return.

However, since you had no disability insurance and wiped out your retirement, you’d have only $433,300 at age 65!

Wow. Over a $1,000,000 difference! Why?

Well, mainly, your $120,000 saved is gone. It could not compound for another 25 to 26 years.

What Happens If You Had Disability Insurance

If you had disability insurance, your financial situation and wealth would be a different story.

Keep in mind, that a plan for you, as an accountant, would cost about $85 per month for a $5,000 monthly benefit.

If you had disability insurance, your $120,000 retirement savings stays intact.

You’d suspend the $500 monthly contributions and resume when you are back at work.

So, with disability insurance, at age 65, you’d have about $1,387,000.

In other words, the cost of a cup of coffee protected about $1,000,000 of retirement savings.

In other words, the cost of a cup of coffee protected about $1,000,000 of retirement savings.

This was an easy example, but nonetheless underscores the importance of disability insurance.

#4 Disability Insurance Keeps You In Your Home

One important aspect of disability insurance is that it keeps you in your home.

What do you mean, John?

Well, agents alike are touting “mortgage protection” which is a life insurance policy. It pays a benefit to your lender if you pass away. So, essentially, your loved ones remain in your home.

The problem with that is these policies typically are more expensive than a traditional term life insurance policy. (That’s all you need, really. If you pass away, the death benefit from the term life plan helps pay your mortgage.) Moreover, we just went over the statistics. You are likely to face a disability rather than passing away before your time.

However, you do need life insurance. Yes! If you do pass away, your loved ones have money to pay the mortgage.

But, many families overlook disability insurance as mortgage protection (link).

You see, as we mentioned, a disability happens way more often than you think.

How would you pay the mortgage if you got hurt or sick and can’t work?

It’s an unfortunate situation faced by many homeowners hurt or sick and can’t work.

A Harvard study indicated that half of mortgage foreclosures are due to a disability.

Again, this doesn’t mean life insurance (to insure your mortgage payments) isn’t important. However, disability insurance often goes overlooked in this situation.

How does this work? For example, if your mortgage is $1,000 per month, we can set up a plan that pays a monthly benefit of $1,000.

If you are disabled, you then have the money to pay your mortgage.

And, as we said, the cost is about a daily cup of coffee.

#5 A Proper Disability Insurance Policy Protects You And Your Family’s Dreams

If you’ve read the 4 reasons, then this 5th reason is more of a culmination of why disability insurance is so important.

If you’ve read the 4 reasons, then this 5th reason is more of a culmination of why disability insurance is so important.

Essentially, it protects you and your family’s dreams.

Sure, things are still hard if you are disabled. However, the difficulty is much less when you have disability insurance.

You can still stay in your home.

Your spouse, children, and loved ones can worry a bit less.

You can worry less and focus on getting better.

Decisions aren’t as hard.

Things will still be hard; however, how much harder would life be if you did not have $3,000; $4,000; or $5,000 or more coming in to help you and your family?

That’s the benefit and the importance of disability insurance.

It protects all those things dear to you, which ultimately is your family.

And, I am sounding like a broken record, but all this protection for the cost of a cup of coffee.

No One Has Disability Insurance…Or Enough Of It

Sure, there are people who have disability insurance.

However, there are people who do have disability insurance or are not adequately covered.

One website estimates that 50 million working Americans do not have adequate disability insurance. Or, in other words, 1 in 3 working Americans.

This is further underscored by the fact that between 2.0 million and 2.5 million Americans, or more, apply for social security disability benefits each year.

Roughly 65% each year are denied benefits. I don’t know any other stat that furthers the case of people needing individual disability insurance. That isn’t some made up statistic. It is real people behind those unfortunate numbers. Just go on the social security website and you can read about social security disability applications and award percentages. Why would you put your faith in a program which, generally speaking, denies your application? Moreover, the average social security disability benefit is around $1,200 per month. While some coverage is better than none, do you still want to go through all of that?

Well, John, I have group employer coverage. That should help. Right?

While that is good. It is still likely not enough. Disability benefits from group coverage are taxable income. That means your benefit, in effect, is 30% to 50% of your gross monthly income. Can you live off of, say, 40% of your gross income? Likely not. Put it another way. You are comfortable with $3,500 of income every month. Now, it is reduced to $2,000. What will you do to make ends meet?

But, John, I heard that disability insurance is very expensive. I can’t afford it.

We discussed earlier that the cost of disability is about the cost of a cup of coffee.

Nevertheless, this is a good segue into the truths and myths of disability insurance.

Truths And Myths Of The Most Important Insurance – Disability Insurance

Let’s talk about the truths and myths of this important insurance. Once you realize and understand, this insurance should be at the forefront of your next financial decision. We continually update this article with additional “truths” and “myths”.

Myth: Disability Insurance Is Expensive

We hear this a lot. Anything can be expensive. Disability insurance really isn’t one of them. Here is what drives your monthly premiums:

(1) your gender

(2) age

(3) occupation

(4) income

(5) health conditions

(6) lifestyle situations

(7) rider preferences

Females usually have a higher premium than males because of claim frequency (women have pregnancy risks, more susceptible to autoimmune diseases are some of the reasons).

As you age, premiums increase because predisposed to a greater chance of disability.

Your occupation matters – those in a risky occupation such as carpentry will pay a higher premium than those working in an office.

If you have a higher income, that is more to insure. Of course, if you have any significant health conditions, that could mean a higher premium.

Adding disability insurance riders also increases your policy costs. In our opinion, some riders are worth the additional costs while others really depend on your preference.

While premiums may seem expensive, they usually cost about $0.50 to $5.00 per day. Maybe more depending on your situation. Considering that you are insuring your income (protecting your paycheck), that seems like a good deal to me?

Here is a question for you: do you buy coffee every day? Your lunch? Waste cable channels? I bet you have wasted expenses. All of these expenses are not as important as protecting your income and your family.

The moral of the story: there are many ways to pay for disability insurance. It is not expensive. The best time to purchase it is right now. As someone once told me, “if you feel it is important, you will find a way. If you don’t, you’ll find an excuse.”

Stop making excuses why you can’t afford disability insurance.

Myth: My Friend’s Carrier Never Paid, So They Won’t Pay!

If there is one myth we have heard over and over, it is the “I-have-heard-that-carriers-don’t-pay” myth. As we have said all along, the most important insurance you don’t have is disability insurance. These hearsay-type statements don’t hold water with us, considering many people don’t hold disability insurance at all.

Let’s examine it closer, though. Certainly, there are cases when a carrier doesn’t pay.

It could be an exclusion outlined in black-and-white on the contract.

If you lie on an application, and the carrier finds out, the carrier won’t pay. What you hear about carriers not paying may be from social security disability benefits (which may not pay if it feels you can work in any job).

Or, maybe he has a policy with the “any” occupation definition rather than the desirable “own” occupation definition (link).

Or, if your friend really didn’t receive a benefit, maybe it was from another type of policy. However, there is a reason for a carrier not paying.

Remember this: the carriers in the disability insurance industry would not exist if they did not pay. There would be so many formal complaints against them, that their solvency and reputation would suffer. They would have the state insurance department on their back. Trust me – NO ONE wants that.

I am sorry to say this, but your friend could be wrong.

Myth: I’ll Just Invest My Money

That would be good…if you actually invest. What you may not know is that I am a CFP® Practitioner, and I see the lack of emergency and retirement savings every day. Look in the mirror and be honest. Will you really invest the money? No, chances are very likely you won’t.

Even if you did, the results are poor.

Let’s say you do, and you are 40, making $100,000 gross salary in a class 5 occupation, non-tobacco user. A 5-year benefit plan with a 90 day waiting period might cost $100 per month to insure $5,000 per month ($60,000 annually). Knowing a disability can happen anytime, how long do you think you can save $300,000 to equal your total disability benefit ($5,000 X 12 X 5)?

If you said 5 years, you are wrong.

Nope, not 10 years, either. And, no 15 is not the right answer.

The right answer is around 38 years! So, if you invested the $100 each month in the market which returned 8% each year, you would have your disability insurance fund somewhere around age 78!

Do you think the chances of a disability could occur before then? Yes, could happen according to the statistics.

With disability insurance, once you are covered, you are covered. You could have the policy for a year, get in a serious car accident, and the policy will pay.

Again, this is why disability insurance is the most important insurance. What happens if you are disabled? Would you tap into retirement savings? Put your home on the market? File for your state Medicaid? These are serious questions.

We discussed the impact on wealth earlier.

Truth: You Can Get Injured Doing Something Else And Still Get Paid

Yes, that is right. Let’s say you are working on a farm, and you injure your knee. Your regular occupation is a scientist. Even though you are working on a farm, you have 24/7 coverage. So, yes, if your knee injury is long-term, you will receive a disability benefit. How?

You need the “own occupation” definition. If structured right, your disability payments are based on your occupation as a scientist, rather than a farmer.

Truth: You Can Receive Disability Benefits And Continue To Work

That is right. In order for this to happen, you need the “true” or “pure” own occupation definition. This will allow you to receive disability benefits based on your own occupation while receiving an income from another job. Need an example? Let’s say you are a nurse and developed a long-term problem in your wrists. You are on disability. You want to keep working and teach. With the true own occupation definition, you can do that. Without it, you can’t.

This article is an evolving article. We will continually update our truths and myths of disability insurance.

Now You Know Why Disability Insurance Is The Most Important Insurance

Hands down, disability insurance is likely the most important insurance you don’t have.

Are you one of the 50 million working Americans without this important insurance?

If so, it’s time to protect your income and what you have worked so hard for.

You would be surprised at how affordable disability insurance is. Don’t know what to do next? Contact us or use the form below.

We work with many carriers, and as always, we work with your best interests first and foremost. That means if there is a better policy available than what we can offer, we tell you that and help you in any way we can. We don’t need to promise that; it’s what we do.

As a convenience store owner, your work is hands on. You enjoy owning and operating a store that has impact on many people. (It’s not a “convenience” store for nothing!) No day is the same. You enjoy working with your employees and meeting new customers. What if you could no longer do your job? Have you ever thought what would happen if you became sick, ill, injured, and disabled? How would you pay your bills if you could not work? Disability quickly affects your future plans and the lifestyle you worked so hard for. In this article, we discuss disability insurance and the best disability insurance for convenience store owners.

As a convenience store owner, your work is hands on. You enjoy owning and operating a store that has impact on many people. (It’s not a “convenience” store for nothing!) No day is the same. You enjoy working with your employees and meeting new customers. What if you could no longer do your job? Have you ever thought what would happen if you became sick, ill, injured, and disabled? How would you pay your bills if you could not work? Disability quickly affects your future plans and the lifestyle you worked so hard for. In this article, we discuss disability insurance and the best disability insurance for convenience store owners.

Disability insurance is, simply, a policy that will pay you a percentage of your

Disability insurance is, simply, a policy that will pay you a percentage of your

Moreover, the chances of a disability happening increase with age.

Moreover, the chances of a disability happening increase with age. is non-taxable.)

is non-taxable.) In other words, the cost of a cup of coffee protected about $1,000,000 of retirement savings.

In other words, the cost of a cup of coffee protected about $1,000,000 of retirement savings. If you’ve read the 4 reasons, then this 5th reason is more of a culmination of why disability insurance is so important.

If you’ve read the 4 reasons, then this 5th reason is more of a culmination of why disability insurance is so important.