How Seniors Get Inexpensive Vision Insurance The Right Way | We Discuss Process, Plan Options, Costs, And More!

Updated: April 12, 2024 at 9:39 am

Seniors know that Medicare does not include vision insurance. If your plan does, likely your plan limits vision coverage.

Seniors know that Medicare does not include vision insurance. If your plan does, likely your plan limits vision coverage.

Seniors typically have to buy their own vision insurance.

Like anything else, there is a right way and wrong way with buying vision insurance.

In this article, we discuss how seniors buy vision insurance the right way. We also discuss other vision insurance options. Specially, we discuss:

- What Does Medicare Cover For Vision Needs?

- How Does Vision Insurance Work

- How To Purchase Vision Insurance The Right Way

- Plans We Like (With Enrollment Links)

- Now You Know How To Enroll In Vision Insurance The Right Way

First, let’s discuss what Medicare covers for your vision needs. It is important to understand that.

What Does Medicare Cover For Your Vision Needs?

Many seniors think Medicare covers vision needs, including vision insurance.

Well, that is partly right and partly wrong.

Medicare does cover vision needs…but, only what is related to Medicare Parts A and Parts B.

Medicare does cover vision needs…but, only what is related to Medicare Parts A and Parts B.

If you need eye surgery for glaucoma, Medicare covers that.

Moreover, if you need special eyewear due to cataract surgery, Part B will cover that as well.

Anything surgical or hospital-related to your eyes, Medicare usually will cover.

However, that is not the case with general eyewear or routine vision exams.

It’s true, many Medicare Advantage plans do have some level of vision / eyewear coverage.

But, coverage is usually very limited and limited to a small network of optometrists. For example, a Medicare Advantage plan may reimburse $100 of eyewear costs and exams each year.

A stand-alone vision insurance plan may prove beneficial for seniors. We introduce how vision insurance works, next.

How Does Vision Insurance Work?

Sometimes, it’s hard to justify the purchase of insurance.

You spend your hard-earned money, but with the chance of $0 payout.

Well, that’s the purpose of insurance, right? It’s there when you and your family need it the most (car accident, home fire, loved one’s death).

Sometimes, insurance never pays a benefit.

However, that is not the case with vision insurance, typically.

With vision insurance, you may $10 to $15 per month. Or, $120 to $180 annually.

Vision insurance makes sense for seniors if seniors can get more than $180 of value, right? Otherwise, there’s no need for vision insurance.

So, let’s discuss what is covered under vision insurance.

What’s Covered Under Vision Insurance?

First thing, a routine vision exam is covered. Usually, this vision exam costs $5 to $10 copay.

Contact lens exams/fittings usually cost a tad more.

Then, you are usually given an allowance of $100 to $150, sometimes more, for  frame cost. In other words, If a frame you like costs $200, you’ll pay $50 if your allowance is $150.

frame cost. In other words, If a frame you like costs $200, you’ll pay $50 if your allowance is $150.

You typically can purchase eyewear or contact every 12 months or 24 months depending on the plan.

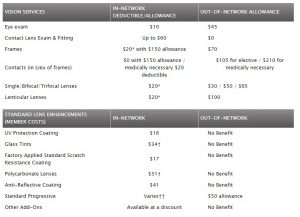

Then, copays apply to the type of lens you need and enhancements. See the snippet of actual vision insurance coverage.

For example, if you want a scratch-resistant coating, that enhancement will cost $17 copay.

You might be thinking, “Does the math work, John? I want to know if I’ll save money?”

We discuss this next.

Does The Math Work?

Insurance makes sense when the math works out. In other words, the amount of premium paid corresponds to the value if you need it. While the chances of a fire in your home are low, you don’t want to pay thousands and thousands if you don’t need to. That’s why you shop around.

Vision insurance is a tad different. If you go every year and you purchase new eyewear, you’ll get value out of it.

With vision insurance, the math tends to work out nicely. You generally can save money by using vision insurance than paying directly out-of-pocket.

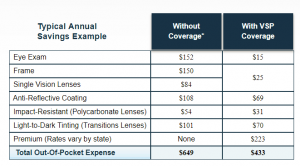

Here is one carrier’s analysis of their savings. It is from VSP. They estimate the average person could save over $200 annually. Your savings may differ from this.

Let’s discuss now how seniors get vision insurance the right way.

How Seniors Get Vision Insurance The Right Way!

It’s rather straightforward, but there can be a right way and a wrong way to getting vision insurance.

First thing you want to do is understand your vision needs. If you are comfortable getting new eyewear every couple of years, then a plan that offers eyeglasses every 24 months should work.

Otherwise, a 12 month plan would work better.

The second step is to find your optometrist in one of the optometry networks. Here in the US, there are 2 main optometry networks:

- VSP

- EyeMed

There are smaller, regional, and secondary optometry networks. VSP and  EyeMed are the two largest here in the US.

EyeMed are the two largest here in the US.

The third step is to determine the right plan for you.

You’ll want to balance your needs (i.e. coverage periods) and benefits against premiums.

Honestly, you should not spend more than $16/month or so on an individual vision plan unless you have moderate to severe optometry needs.

Vision Insurance Plans We Like For Seniors

We don’t like to use superlatives. What is the “best” here may not be the best for you, so you always have to do your homework. However, we like carriers that offer VSP and/or EyeMed because:

- they have the largest vision network in the nation with the most optometrists and doctors in the network

- you actually save money

- there are value-added benefits such as hearing discounts

- possible value-added benefits affords you additional benefits and savings on everyday items

Pay attention to your needs. You don’t want to forgo proper coverage for premium. For example, some plans cover contact lenses better than others. These plans are usually more expensive, but you will have proper coverage.

Enrolling In These Plans

Enrolling in the vision plan is very easy.

Nowadays, carriers have online applications where you can apply yourself.

Here are two, and they both offer VSP and EyeMed.

Direct Vision

You can also look into “combination” plans which include dental, vision, and hearing coverage. You can quote yourself with a popular product we use. It is more expensive, but will offer more coverage.

Not all plans are available in all states. If you need our assistance, please don’t hesitate to contact us.

Now You Know How Seniors Get Vision Insurance The Right Way

We hope you learned more about vision insurance for seniors on Medicare. While Medicare does not include vision coverage, you have affordable options. One of the options we like is VSP. They have the largest vision network and affordable plans. If you would like to learn more, contact us or use the form below. We will send you some additional information on the VSP plans.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

4 thoughts on “How Seniors Get Inexpensive Vision Insurance The Right Way | We Discuss Process, Plan Options, Costs, And More!”

Comments are closed.

I always had good vision but around 50 i started to need glasses to read. I thought it was just old age since so many of my friends required readers. Around the time I was 60 I was having a lot of trouble seeing far away and it was blurry and double but I just kept using the readers since I didn’t have vision coverage. I was on Medicare by this time and was paying for Medicare and supplemental insurance. I had to choose between my teeth and my eyes and I picked my teeth, so now I was paying for Dental Insurance too! I just kept thinking it is only old age, but it wasn’t I had *******! I finally went to the eye doctor and paid out of pocket and they told me I have ******* and need further help. Well I guess I don’t count and people just don’t care about one another like when I was younger. I am supporting my daughter and her two kids and my son lost his job last week. God please help me!

Suzy,

I am sorry to hear all this. The vision plans we work with start at $10/month premium. I would be happy to help or point you in the right direction. Just call us at (800) 645-9841.

John

It’s good to know that vision insurance can help cover the costs of my father’s eyewear. That should be a big help for us since his medicines already cost quite a bit so not having to worry about his vision is a big plus for us. I’ll try to convince him to apply for vision insurance so that he won’t have to worry about the expensive costs of glasses when the time comes. His vision is fine for now, but with his age that is likely to change soon so it’s best to be prepared just in case.

I couldn’t agree more. Thanks for commenting. With the cost of vision insurance being $0.50 per day, he can likely afford that now.

John