What Are The Best Medicare Supplement Plans In Massachusetts? We Go Into Detail What The “Best” Means

Updated: April 12, 2024 at 9:39 am

I think you’ll agree with me that everyone wants the “best”, and that includes Medicare Supplement plans, even for people in Massachusetts.

I think you’ll agree with me that everyone wants the “best”, and that includes Medicare Supplement plans, even for people in Massachusetts.

To be clear, the “best” is a wicked superlative. What might be the “best” to you can be the “worst” for someone else.

However, when it comes to Medicare Supplement plans (or Medigap plans), the ”best” can boil down to one determining factor: the premium you pay.

Of course, we explain what that means.

We are transparent and nothing to hide or sugarcoat.

In this article, we discuss:

- A quick overview of how Medicare Supplement plans work

- The crazy difference in Massachusetts plans

- The differentiating factor of Medicare Supplement plans

- What we feel are the “best”

- Now you know what are the best Medigap plans in Massachusetts

How Do Medicare Supplement Plans Work?

Medicare can be a maze without a map for most people.

You take a left, only to reach a dead end.

You reverse course, and then take another left. Only to realize you are back where you started.

Then, you try again, but you just keep walking for hours with no end in sight.

As we say, there is a right way and a wrong way to approach your Medicare. If you are not careful, you could make mistakes with your Medicare enrollment and needs.

Most people don’t realize this: when you are Medicare-eligible, you have choices. You can:

- Keep Parts A and B (known as Original Medicare) only, or

- Purchase a Medicare Supplement plan to pay the cost gaps (hence the “Medigap” name), or

- Enroll in a Part C Medicare Advantage plan

A Medicare Supplement plan is completely different than a Part C Medicare Advantage plan. A Medicare Advantage plan packages Parts A and B, a Part D prescription drug plan (usually), and additional coverage. These are usually no premium (yes, $0 premium) or low premium. But, you do have copays. Additionally, there are annual limits, protecting you from unlimited health care costs. So, that is great.

While I think Medicare Advantage plans work great, discussing them here is out of scope for this article. Contact us if you would like to have an easy discussion on Medicare Advantage plans and if they are right for you.

The best way to describe a Medicare Supplement plan is to show an example of how they work. Here’s an example to illustrate how a Medicare Supplement plan works.

Medicare Supplement Plan Example

You go to your doctor for an office visit. When you get to the front desk, you show your Medicare card and your Medicare Supplement card. You then have your office visit.

On the backend, your doctor’s office manager bills original Medicare (i.e. your Medicare card) as primary and your Medicare Supplement card as secondary. In this case, your Medicare Supplement plan pays what original Medicare doesn’t pay. For doctor visits, the share is 20%.

In this example, you don’t pay anything out of pocket.

This is an easy example, and you will have some out of pocket costs even with a Medicare Supplement plan as there are many different types, each covering something different for different premiums.

So, essentially, they pay the “gap”. In other words, they will pay what original Medicare does not pay.

What Is So Different With Massachusetts Medicare Supplement Plans?

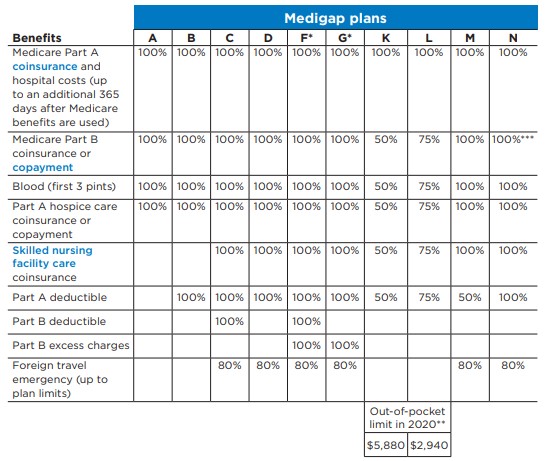

If you have done your homework, you know there are many different types of Medicare Supplement plans.

Many states have Plan C, N, F, G, and others.

All of these plans pay for certain things and they all have different premiums. Check out below.

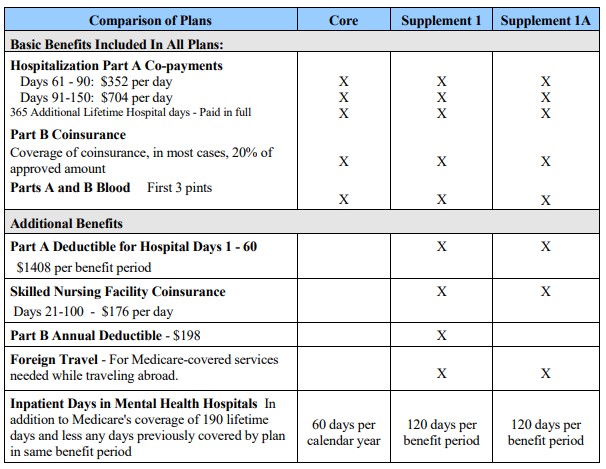

Of course, Massachusetts has to be different. They don’t offer any of these.

Carriers that offer Medicare Supplement plans in Massachusetts must offer three. They are:

- Core

- Supplement 1A

- Supplement 1

Here is an excerpt of the plans here in Massachusetts.

Of course, premiums vary based on the plan you choose. And, that leads to our next discussion.

Of course, premiums vary based on the plan you choose. And, that leads to our next discussion.

The Differentiating Factor Of The Best Medicare Supplement Plans In Massachusetts

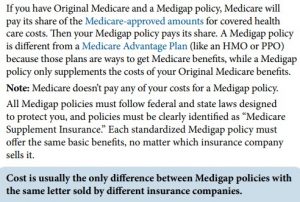

Here’s the thing with Medicare Supplement plans. All carriers who offer Medicare Supplement plans in a state, including Massachusetts, have to pay for covered Medicare services.

Just look at this excerpt from the popular, “Medicare & You” booklet CMS publishes every year.

Do you read what this says?

They can’t dispute. If you go to a doctor that accepts Medicare, have a Medicare-approved surgery, or have a Medicare-covered surgery or hospital stay (very likely), then the supplement plan has to pay its share (of course, subject to the plan provisions).

So, as I tell Medicare beneficiaries, they all have to pay. This means the determining and differentiating factor is usually…the premium.

And, CMS even says it in blue in the excerpt.

Of course, premiums vary based on the plan you choose. And, that leads to our next discussion.

Why Premiums Are The Differentiating Factor

Here’s the thing with Medicare Supplement plans. All carriers who offer Medicare Supplement plans in a state, including Massachusetts, have to pay for covered Medicare services.

In other words, the best Medicare Supplement plans are usually based on cost, even for Massachusetts plans.

It’s in the Medicare & You guide, excerpt above.

Here’s a way to think about cost. Think about 2 cars. Both cars start, drive, and get you from point A to point B.

One car costs $18,000 and the other costs $68,000.

If you just need to get from point A to point B, then the $18,000 car will do just fine.

Same with Medicare Supplement plans. You just need them to pay their share. And they all do. (Unless, of course, you have a service or surgery that is NOT covered by Medicare.)

So, would you pay $68,000 for a Medicare Supplement plan if one that does the job costs $18,000?

No!

See what I mean?

Sure, some plans provide some value-added benefits, but these shouldn’t be deciding factors.

Of course, other factors might prevail in your decision: carrier brand-name, longevity, reputation, etc.

These factors also contribute to “the best” decision.

Maybe, We Should Say “Low-Cost”?

As we introduced earlier in this article, everyone wants the “best”.

However, with Medicare Supplement Plans, even here in Massachusetts, they all pay their share. (Based on the plan you select, of course.)

So, there is no “best” plan. When people say to me they want the “best”, they are really asking, “John, what’s a low-cost Medicare Supplement plan?”

Let’s discuss those next.

The Best “Low-Cost” Medicare Supplement Plans In Massachusetts

There are a handful of carriers that offer Medicare Supplement plans in Massachusetts. These include national carriers such as:

- Transamerica

- Humana

- UnitedHealthcare

However, there are many regional carriers such as:

- Blue Cross Blue Shield of MA

- Tufts

- Harvard Pilgrim

- Fallon Health

- Health New England

Every carrier will have different premiums for the same product. As you can imagine, carriers have different cost structures.

The lowest cost Medicare Supplement in Massachusetts is usually Blue Cross Blue Shield of MA or Health New England. In my experience, Harvard Pilgrim and Fallon usually are next.

I must be clear that all of the carriers are solid, reputable carriers.

However…would you rather pay $68,000 or $18,000 to just get to point A to point B? (Remember, that is all we really ask from a Medigap plan.)

The answer should always be “no” unless there are other factors involved such as brand name awareness.

Moreover, some Medicare Supplement plans offer value-added services, or at an additional cost, like dental coverage or SilverSneakers.

These services should not be the deciding factor.

Now You Know What Are The Best Medicare Supplement Plans In Massachusetts

We hope you found this article informative. Now you know what the “best” Medicare Supplement plan in Massachusetts. As we said, the determining factor is based on premiums. ALL plans, in order to follow CMS rules and regulations, must pay their share for covered Medicare events. Sure, you can go with a carrier with more name recognition, but you will probably pay more.

So, we are really talking about “low cost” or “lowest cost”.

Do you need our help or have questions? We are here to help. Contact us or use the form below. Unlike other agencies, we only work in your best interests. As I always say, there is no risk of contacting us. At the very least, you will learn a little more. If we can’t help you, we will part as friends. Why? Because that is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".