3 Important Things Doulas Need To Know About Disability Insurance | Learn About This Important Insurance

Updated: April 12, 2024 at 9:39 am

I think you’ll agree with me that doulas don’t think about disability insurance.

I think you’ll agree with me that doulas don’t think about disability insurance.

I mean, you are busy providing support for and educating your clients about the birthing and labor process. Who has time to think about anything else?

However, have you ever thought about what would happen if you need support?

I’m not talking about your own birth, but if you could no longer do the job you enjoy.

Consider this. Stricken ill, you can no longer work as a doula. Or, you are injured in some way that makes doing your job difficult.

How would you and your family pay the bills? Your mortgage?

That’s where disability insurance steps in and helps, just like how you help the families you care so much about.

In this article, we discuss 3 factors doulas need to know about disability insurance. Additionally, we discuss important parameters in a solid disability insurance policy and costs. For easier navigation, feel free to click on a section below.

- What Is Disability Insurance?

- 3 Important Factors Doulas Need To Know

- The Makings Of A Strong Policy For Doulas

- Now You Know Doulas Need Disability Insurance

Let’s jump in and discuss what is disability insurance.

What Is Disability Insurance?

It is simple, really.

Disability insurance pays you a benefit that you can use to pay your bills, mortgage, etc. Any illness or injury that prevents you from doing your job as a doula is a disability. Stated another way:

If you will struggle to pay your bills (mortgage, food, utilities) upon a disability, you probably need disability insurance.

It’s that simple.

However, there is even a larger reason for disability insurance. I’ll present the case in a different way.

Even though the patients and families are important, there is a group of people who are even more important. Who can be more important than my families, you ask? They pay the bills, and I love working with them.

True. You do. But your patients don’t love you as your own family loves you. I’m serious. If you have a family, your family loves you more than anything. You would not want anything to happen to you that affects them, right?

True. You do. But your patients don’t love you as your own family loves you. I’m serious. If you have a family, your family loves you more than anything. You would not want anything to happen to you that affects them, right?

If you are sick or injured without disability insurance, you may have to make some tough decisions. These decisions include (and are truly questions you’d have to answer if disabled without disability insurance):

- Will my spouse be able to work more?

- How can he or she work more if I need caretaking?

- Who can help around the house and take care of the kids?

- Will we need to sell our home?

- How will we pay these extra medical costs?

Disability is a destroyer of dreams. Your future and family dreams could be destroyed. They don’t have to, though. With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

3 Important Factors Doulas Need To Know About Disability Insurance

Did we make a good point about the need for disability insurance?

Yes, John, you did, you say. However, I still have questions.

Sure. Next, we discuss the 3 important factors doulas need to know about disability insurance. We talk about these next. Moreover, we discuss proper plan structure, probable cost, and the like. Feel free to contact us anytime.

A Disability Happens Way More Than You Think

I know what you are thinking, because I hear it all the time.

John, I am simply not going to be disabled. That happens to other people!

Well, not really. Remember what I said about a disability? Really, it’s anything that stops you from doing your job as a doula.

Any of these situations could mean a disability and prevent you from doing your job as a doula:

- Cancer

- ALS

- Multiple Sclerosis

- An arm injury

- A severe accident

- Fall off a ladder and hurt your back

- Heart Attack

- Stroke

The list goes on and on.

Fact is, 1 out of 4 working adults will face some type of disability before the age of 65. Contrast this fact with the chance of unexpected death, say from a motor vehicle accident which is 1 in 114. Even dying from cancer has better odds: 1 in 7.

Fact is, 1 out of 4 working adults will face some type of disability before the age of 65. Contrast this fact with the chance of unexpected death, say from a motor vehicle accident which is 1 in 114. Even dying from cancer has better odds: 1 in 7.

But, John. I know I won’t get in a wheelchair, you exclaim!

Wow. How do you know that? If you know your future, you should not be a doula. Instead, you should play the lottery if you know your future!

Jokes aside. In all seriousness, when we think of a disability, we usually think of someone in a wheelchair, right?

This is completely untrue. Although the stats vary from carrier-to-carrier, one thing is certain. Illnesses (such as cancer, heart attack, stroke, ALS, etc) and musculoskeletal issues make up a huge proportion of disability insurance claims. These people aren’t in a wheelchair. Moreover, they can’t do their jobs.

In other words, you are more likely to be disabled from a disease or illness rather than a sudden accident.

Why Social Security Disability Is Not The Fallback Plan

OK, John, but I can file for social security disability. Right?

(crickets…)

John?

Do you really want to do that and take your chance on the government? Sure, you are entitled to social security disability benefits. However, as we explain further, no one receives social security disability benefits automatically. Social security disability should be viewed as a last resort.

You have to meet a number of parameters to qualify for social security disability. First, you need to have worked the required number of credits. For social security disability benefits, in general, that means you’ll need at least 20 credits earned in the last 10 years prior to the disability.

Additionally, you must qualify for social security’s definition of disability. Qualifying is extremely hard. The reason why is that social security contains a strict definition. Essentially, you can’t work in any occupation. So, if you are a dental hygienist and hurt your arm, that’s too bad. While you can’t do your job as a dental hygienist, you probably can work as a security guard.

This is why social security denies about 70% of applicants. It can take years before you qualify. Moreover, the average monthly social security disability benefit is around $1,260. Is that something you can live off?

Disability Insurance Underwriting More Stringent

Maybe you have life insurance, and the underwriting was a breeze. That’s not necessarily the case with disability insurance underwriting.

Carriers underwrite your chance of disability and your income/salary.

Specifically, here’s where disability insurance carriers underwrite for doulas. They look at:

- Your age

- Income

- Health conditions and injuries

- The state you live in

- Your Occupation

Your age and income should be straightforward. The older you are, the more expensive the policy. The more money you make, the more you can insure. The more you can insure, the higher the premium you’ll pay. Don’t worry about premiums, though. I’ll discuss more our approach to premiums, and how we are different than other agencies.

In case you are not aware, your income is your W-2 gross salary if you are an employee. If you are self-employed, and many doulas are, your income is your net income as shown on your tax return. It is your gross sales / receipts – business deductions. The resulting number is your net income.

Carriers focus on the net income number or your gross salary because this is the number you pay income tax on. Moreover, this is money you use to pay your mortgage, your utilities, groceries, etc.

Let’s talk about how health conditions play a part in underwriting.

How Health Conditions Play A Part With Disability Insurance Underwriting

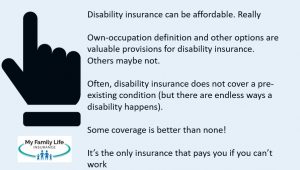

I’ll get right to the point here. Carriers usually exclude pre-existing conditions from coverage. The italicized word, usually, is a keyword. Sometimes carriers do and sometimes they don’t.

Here are situations where carriers exclude a condition from coverage:

- You have a chronic illness such as anxiety or depression. Carriers will exclude disability nervous disorder.

- Several years ago, you broke your right wrist. You don’t think anything of it, but you have a pin in your wrist. Carriers will likely exclude your right wrist from coverage due to the pin.

- You had a miscarriage a few years ago. The carriers exclude complications of pregnancy.

- You really enjoy going to the chiropractor. You go 1 or 2 X per month. That’s too much for carriers so they exclude your spine and back from coverage.

Here are cases where they won’t usually exclude coverage:

- You tore your ACL in your left knee three years ago. You missed several weeks of work. It’s all fine now, and you no longer need to go to a doctor. The carrier likely includes your left knee in coverage.

- That broken right wrist of yours doesn’t have a pin. Not a problem anymore. Probably included in coverage.

Usually, chronic conditions that require doctor’s care are excluded from coverage.

Same with hazardous activities. If you like to ice climb or bungee/cliff jump, carriers likely exclude coverage.

If you have a serious health condition, carriers may place a rating on the policy. A rating is like an extra premium. They may also limit options, such as the benefit period.

Having an exclusion or rating is not a reason to ignore a disability insurance policy. There are endless ways for a disability to occur, even for doulas.

Your Occupation Matters

All the carriers classify occupations based on inherent disability risk. The classification is a numerical digit from 1 to 5 or 6, depending on the carrier. An occupation with a class 1 has the highest occupational disability risk while a class 5 or 6 has the lowest. All things being equal, you’ll pay more if you have an occupation categorized in class 1.

Disability insurance carriers usually classify doulas as a class 3. In some cases, a higher classification might be available. Remember, the higher the classification, the lower your premium – all things being equal.

Where you live could matter, too. States like California and Florida tend to have higher rates than other places in the country. This doesn’t mean you simply avoid disability insurance because you live in, say, California. Where you live has a minor effect, but an effect nonetheless.

Cost Is A Cup Of Coffee

We all worry about cost, right? Far too often, however, most people avoid disability insurance because they feel it is too expensive. That’s not necessarily the case.

Depending on your health and preferences, disability insurance might cost $1.00  to $3.00 per day. Maybe more, maybe less. Do you think spending, say, $2.00 per day on disability insurance is expensive? I bet you purchase coffee or your lunch every day. What is more important? Insuring your income or buying a cup of coffee every day?

to $3.00 per day. Maybe more, maybe less. Do you think spending, say, $2.00 per day on disability insurance is expensive? I bet you purchase coffee or your lunch every day. What is more important? Insuring your income or buying a cup of coffee every day?

There are many ways to afford disability insurance. Here’s another way to look at the cost:

Disability insurance will generally cost 2 cents for every $1 you make. Think about that.

We at My Family Life Insurance try to keep our client’s premiums below $100 per  month. Nearly all the time, we accomplish that. Honestly, I think we might be one of the few agencies that aims for that. The reason is we know you need to spend your money on other things, like retirement. There’s no reason you can’t spend less than $100 per month AND still have a solid, comprehensive plan.

month. Nearly all the time, we accomplish that. Honestly, I think we might be one of the few agencies that aims for that. The reason is we know you need to spend your money on other things, like retirement. There’s no reason you can’t spend less than $100 per month AND still have a solid, comprehensive plan.

However, there are some characteristics outside one’s control. Remember that disability insurance is based on 4 factors (your state might matter, too):

- Your age

- Occupation

- Health

- Your income

You can’t change your age or your occupation. You can change your health…to a point. For instance, if you have type 2 diabetes, for instance, nearly all the carriers will adjust your premiums or plan one way or another to compensate for the increased disability risk (think: potential neuropathy, eye issues, etc.). Remember we said that most disabilities are from disease and illnesses rather than accidents.

Nevertheless, we can structure a plan that protects you and your family while meeting your needs and budget.

The Makings Of A Strong Disability Insurance Policy For Doulas

You now know:

- You need disability insurance,

- That underwriting is more stringent (but not impossible), and

- It is relatively inexpensive

Yes, that is right, John. But what makes a good policy for me?

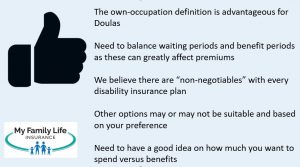

Good question. There are several ways to construct an affordable disability insurance policy. Our goal when constructing a policy is the combination of value and premium. However, we believe there are certain “non-negotiables” that must contain within a policy.

Good question. There are several ways to construct an affordable disability insurance policy. Our goal when constructing a policy is the combination of value and premium. However, we believe there are certain “non-negotiables” that must contain within a policy.

The first is an own-occupation definition. Luckily, many insurance carriers already offer this definition of disability for doulas.

The own-occupation definition means the carrier pays you a benefit if you can’t do your job as a doula. Even if you can do the work of, say, a security guard, the carrier pays you a benefit.

Another “non-negotiable” is partial disability benefits. You’ll want this. All this means is that carriers pay you a benefit if you can work, but not full-time. Many disabilities start out as partial, but watch out! Many carriers say they offer this, but it is a rather stringent definition. That is, a benefit requires a total disability first (i.e. you can’t work at all).

What if you develop MS or ALS? Those conditions start as a partial disability. You may have to wait years before you receive a benefit. The carriers we work with offer a partial disability benefit without the total disability requirement.

Finally, the guarantee or future purchase option is our final “non-negotiable”. It allows you to purchase more disability insurance in the future without any evidence of health insurability. Let’s say your income increases to $80,000. You want to insure that increase. The future purchase option allows you to do that.

Other Optional Riders

A rider on an insurance policy is an add-on. It “rides” with your policy. Riders allow customization. That is really nice! However, as I say, the more customized your plan, the more expensive. That isn’t a big deal if these options are valuable to you.

These options include, but are not limited to:

Return of Premium – if you never take a benefit, you can receive ALL of your premiums back. It sounds good, but there are limitations outside the scope of this article. There may be better options as well. Contact us if you want our honest assessment.

Retroactive Injury Benefit – this option pays you a lump sum benefit if you are disabled due to an accident. It pays you on or around the first day of disability eligibility. It is a rather inexpensive rider because most disabilities are NOT from an accident.

Mental, Nervous, Drug, Alcohol Option – Nearly all the carriers have benefit period limitations if you are on disability for drug or alcohol abuse or for mental/nervous conditions such as depression. Usually, it is for 2 years. This rider extends the benefit period for mental, nervous, or drug abuse disability to your contracted benefit period.

Catastrophic Disability – this will pay out an additional benefit if you can’t meet 2 out of the 6 activities of daily living or irreversible cognitive impairment. Since these conditions usually don’t happen during your working years, the cost of this rider usually inexpensive.

These are some of the more popular options. There are others, such as a critical illness option as well as accident indemnity.

Elimination Period & Benefit Period – Not What You Think

Just to recap, a strong disability insurance policy for doulas include:

- Own occupation definition

- Partial disability benefits

- Future purchase options

- Other riders based on preference

- Not expensive, affordable based on your income

One area that many people mess up is the elimination and benefit period.

These aren’t what you think.

The elimination period, or waiting period, is the period of time you wait until you are eligible for disability benefits. It happens upon a claim, not at the start of the policy.

The benefit period is the length of time you’ll receive a benefit. It is not a renewal period. As long as you pay your premiums, you will always have disability insurance.

An example makes this clear.

In 2017, you purchased a disability insurance policy. Let’s say you have a 90 day waiting period and a 5 year benefit period. You hurt your back severely. Your doctor thinks you will be out of work for a long time. In order to receive disability insurance benefits, you have to “wait” 90 days. On the 91st day, you are eligible for disability benefits. About 30 days later, you receive your first disability payment. You receive your disability benefit every month.

You have 5 years to receive a benefit for your injured back. Did you know most long-term claims are 12 to 15 months?

Several years later, your doctor gives you some unfortunate news. You have cancer. While your prognosis is excellent, you’ll be out of work. You again have to wait 90 days. On the 91st day, you are eligible for benefits. Again, you have 5 years to receive benefits for this claim.

A plan with a lower elimination period and higher benefit period are more expensive than a plan with a higher elimination period and lower benefit period.

Now You Know The 3 Important Factors Doulas Need To Know About Disability Insurance

Now you know the 3 important factors doulas need to know about disability insurance. Moreover, you now know that disability insurance is inexpensive. Additionally, you know what to look for in a disability insurance policy.

Do you have any questions or need assistance?

We have helped many professionals, including doulas, obtain affordable disability insurance.

Contact us or use the form below. We would be happy to answer any questions you have.

I know many people are wary of speaking to strangers on the phone, especially insurance agents. We respect your time and privacy. I always say that there is no risk of contacting us. If we can’t help you, we will part as friends. We are serious about that! At the very least, you’ve learned a little more. You see, we put our client’s interests first, not our interests. It is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".