Life Insurance For People Without A Social Security Number | We Discuss The Steps And Options

Updated: April 12, 2024 at 9:39 am

You understand that you need life insurance. However, you don’t have a social security number. Maybe you’ve applied elsewhere, and the carrier declines your application because you don’t have a social security number. You are concerned about your family and loved ones if something were to happen to you. You know you need life insurance. However, you need the right documentation. Is that holding you back? Luckily, we have options. In this article, we discuss life insurance for people without a social security number.

security number. Maybe you’ve applied elsewhere, and the carrier declines your application because you don’t have a social security number. You are concerned about your family and loved ones if something were to happen to you. You know you need life insurance. However, you need the right documentation. Is that holding you back? Luckily, we have options. In this article, we discuss life insurance for people without a social security number.

In our experience, there are a couple of reasons why people don’t have a social security number. We’ll talk about those situations next.

Is It Possible For People To Obtain Life Insurance Without A Social Security Number?

The answer to this question is, yes. Yes, you can obtain life insurance even if you don’t have a social security number.

However, life insurance options will be limited. You see, many carriers require a social security number on the application.

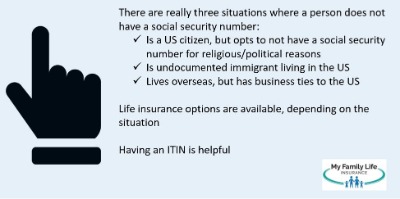

In our experience, three situations lead to no social security numbers. You:

- are a US citizen (born here) and have religious or political beliefs not to have a

social security number

social security number - are living in this country with undocumented status

- have ties to the US (for example, business ties), but live overseas

The amount and type of life insurance depend on your situation. Additionally, it also depends if you have a taxpayer ID number.

Let’s discuss these three scenarios, first with those with VISAs and undocumented status.

Life Insurance For People Without A Social Security Number

If you don’t have a social security number, you may feel at a stand-still. You don’t have to anymore. We at My Family Life Insurance have options for you. The amount of life insurance and the type depends upon what kind of documentation you have. In this section, we discuss people who are here in the US on business VISAs and those living with undocumented status.

Life Insurance For People With Business VISAs

Many foreign nationals have business ties to the United States. If you don’t have a social security number, but have a valid business VISA, you can obtain life insurance.

There are some requirements, though. While these are not “set in stone”, they are generally the same among carriers:

- Need an ITIN

- Must have demonstrated business ties in the US

- Home country citizenship allowed for coverage

- Application, paramedical testing, and policy delivery takes place in the US

- Premiums are drawn from a US bank account

This is life insurance for foreign nationals.

As we mentioned, your country of citizenship matters, too. The United States has laws for life insurance on people from other countries. Some countries don’t allow their citizens to purchase life insurance outside their citizenship country. France is one, for example.

Relations matter, too. The US has a list of countries it prohibits the sale of life insurance due to poor or unsettling relations. If you are a business person on a B-VISA here from England, that alone qualifies you. However, if you are a business person on a B-VISA here from Iran or another country prohibited by the US, you, unfortunately, won’t qualify.

Relations matter, too. The US has a list of countries it prohibits the sale of life insurance due to poor or unsettling relations. If you are a business person on a B-VISA here from England, that alone qualifies you. However, if you are a business person on a B-VISA here from Iran or another country prohibited by the US, you, unfortunately, won’t qualify.

If you have any questions or would like to find out if you qualify, don’t hesitate to contact us.

Life Insurance For Undocumented Immigrants With ITINs

Let’s say you are an undocumented immigrant and have lived here for a number of years. You have no intention of going back to your birth country. Can you obtain life insurance? Yes, you can. Even if you don’t have a social security number, you can obtain life insurance. You do, however, need an important document.

That document, as we mentioned before, is an Individual Taxpayer Identification Number (ITIN). You can obtain an ITIN through the IRS. There are some requirements. Generally, the requirements are that you pay federal income tax. If you do, then you can apply for an ITIN.

If you have an ITIN, we work with several carriers that accept ITINs as the identifying document. No social security number required. There is one carrier in particular that whose application is quick and easy. The application is online and takes 10 minutes to apply. We can help you over the phone or send you the link directly. Applying for life insurance, in this case, is very easy. Honestly, it has to be the easiest life insurance application I work with. However, the death benefit is limited to $250,000.

We also work with many other carriers if you are in need of a death benefit greater than $250,000. The underwriting is a little more involved; however, if you are healthy with no health conditions, we likely can help you obtain life insurance in a week. Even those looking for death benefits below $250,000 might consider this option because the premiums are more affordable.

Let’s go back to the business person whose citizenship is Iran. If she has lived here a long time, with no intention of going back to Iran, and has an ITIN, we likely could get her some level of life insurance.

What If I Can’t Get An ITIN?

If you don’t have an ITIN, there is potentially another option. We work with one carrier that allows term life insurance, but only up to $100,000 death benefit. It is not a perfect way of obtaining life insurance, but it is possible. However, I must stress, that I do recommend obtaining an ITIN because that document makes applying for a life insurance policy much easier. Contact us if you would like to learn more.

What If I Am A US Citizen, But Without A Social Security Number? Can I Obtain Life Insurance?

We receive phone calls every now and then from US citizens wanting life insurance, but they are without a social security number. The reason (they tell us), usually, is either religious or political reasons.

It is possible for these US citizens to obtain life insurance. We have worked with a few carriers that allow these citizens life insurance. They are still US citizens. A birth certificate is usually required.

I still recommend obtaining an ITIN. The carriers we use in these situations offer life insurance on a case-by-case basis. There is no guarantee the carriers will allow this practice in the future. They currently allow it now at the time of this writing.

It’s important you contact us, and we can discuss your situation in greater detail.

What Do I Need To Do To Obtain Life Insurance?

We would need to discuss your situation in more detail. We at My Family Life Insurance have helped many non-citizens, undocumented immigrants, and VISA-holders obtain life insurance. Every situation is different, however, and we would need to learn more about you. Here are some questions that need answering:

(1) What country are you a citizen of?

(2) How long have you been in the US?

(3) Date of entry (month/year) to the US?

(4) What specific form of VISA are you here on?

(5) Have you applied for permanent residency?

(a) If so how far along in the process are you?

(6) Are you married to a US citizen?

(a) Or do you have children, born here in the US?

(7) Do you own any property or business here in the US?

(8) What are your occupation and income?

(9) What is your plan to stay here permanently?

(a) Any foreign travel planned, back home?…or to anywhere else of possible concern?

(10) Face amount and plan type you’re considering?

(11) Do you have an ITIN?

(12) Any health conditions diagnosed or treated by a physician in the last 5 years? Any hospitalizations in the last 5 years as well?

(13) What medication do you take?

(14) What is your height and weight?

These are some of the questions that need answering. We would go over your situation in detail to make sure you qualify and, if so, we then match the right carrier to your situation.

After that, we can describe the underwriting process. The underwriting process depends on your situation.

Now You Know People Without Social Security Numbers Can Obtain Life Insurance

We hope you enjoyed our article on life insurance for people without a social security number. Do you have any questions? Contact us. Or, use the form below.

We are happy to discuss your situation and answer any questions you have. Even if you don’t have a social security number, you generally can obtain life insurance!

Feel free to reach out to us. We have helped many people with ITINs, or without, obtain life insurance. What makes us different? We truly care about your situation and have your best interest. It is the only way we know how to work. You can contact us or use the form below to reach us.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".